Oregon Employee News Form

Description

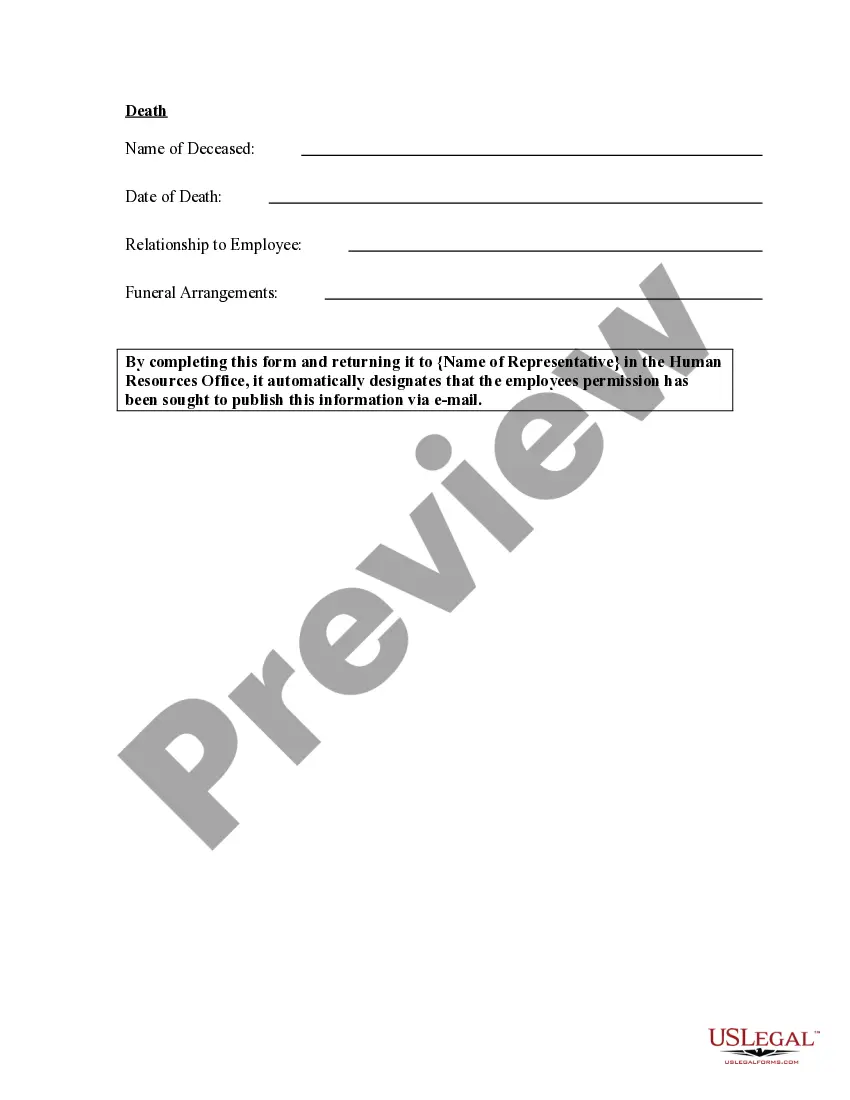

How to fill out Employee News Form?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Oregon Employee News Form within moments.

If you already have an account, Log In and download the Oregon Employee News Form from your US Legal Forms library. The Download option will be visible on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the payment. Use a credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make edits. Complete, modify, print, and sign the downloaded Oregon Employee News Form. Each template you save to your account has no expiration date and is yours permanently. So, if you want to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Oregon Employee News Form with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Make sure you have selected the correct form for your city/state.

- Click on the Preview button to examine the form's content.

- Check the form description to ensure you have picked the right form.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, select your preferred payment plan and provide your credentials to register for an account.

Form popularity

FAQ

The kicker law is unique to Oregon. To calculate the amount of your credit, multiply your 2020 tax liability before any credits line 22 on the 2020 Form OR-40 by 17.341%, a percentage determined by OEA.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Mail Form WR and payment to:Oregon Department of Revenue. PO Box 14800. Salem OR 97309-0920.Oregon Department of Revenue. PO Box 14260. Salem OR 97309-5060. IMPORTANT Mail your Form WR separately from your 2010 4th quarter Form OQ. Make a copy for your records.

One document of ID - passport or driving licence. One document showing proof of address utility bill, bank statement, credit card statement, driving licence (only if driving licence shows the applicant's current address and has not also been used as ID document)

Required Employment Forms in OregonSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.Company Health Insurance Policy Forms.More items...?23-Feb-2018

Newly hired employees must complete and sign Section 1 of Form I-9 no later than the first day of employment. Generally, only unexpired, original documentation is acceptable (i.e., driver license or passport). The only exception is that an employee may present a certified copy of a birth certification.

File Form OR-WR on Revenue Online at . Mail your Form OR-WR separately from your 2018 4th quarter Form OQ and 4th quarter statewide transit tax form. If you amend Form OR-WR, you will also need to amend Form OQ and 4th quarter statewide transit tax form. Make a copy for your records.