Oregon Notification of Workers' Compensation Injury - Illness

Description

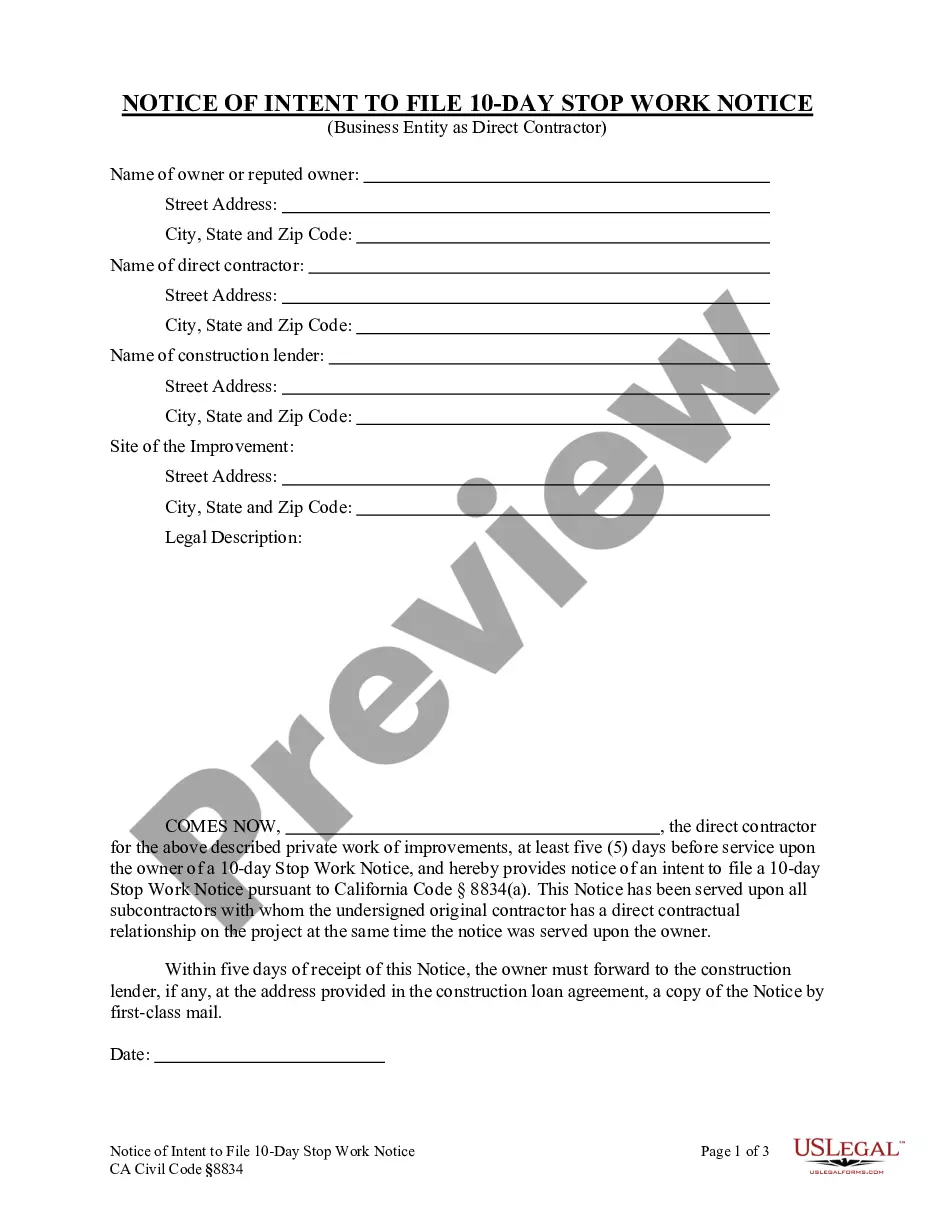

How to fill out Notification Of Workers' Compensation Injury - Illness?

Selecting the correct official document template can be a challenge. Naturally, there are numerous designs accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. This service offers thousands of templates, including the Oregon Notification of Workers' Compensation Injury - Illness, that can be used for both business and personal purposes.

All forms are reviewed by experts and comply with federal and state regulations. If you are already a member, Log In to your account and click on the Download button to access the Oregon Notification of Workers' Compensation Injury - Illness. Use your account to browse through the legal forms you have previously purchased. Go to the My documents section of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the appropriate form for your city or county. You can review the document using the Review button and read the form summary to confirm it is suitable for you.

US Legal Forms is the largest collection of legal documents where you can find various paper templates. Use this service to download professionally crafted documents that adhere to state regulations.

- If the form does not meet your requirements, use the Search field to find the correct document.

- Once you are confident that the form is appropriate, click the Purchase now button to get the form.

- Choose the payment plan you prefer and enter the required information.

- Create your account and pay for your order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Oregon Notification of Workers' Compensation Injury - Illness.

Form popularity

FAQ

An Injured worker's wage paid is 66 2/3 percent of the workers wage. The weekly payment minimum is $50 or 90 percent of the employees actual wage if it is less. The weekly maximum is $790.38, 100% of the Oregon state average weekly wage. Maximum period of payments is the length of the disability.

Workers' compensation insurance pays for workers' medical treatment and lost wages on accepted claims when workers suffer work- related injuries and illnesses. By law, Oregon employers that have one or more employees, full or part time, must carry workers' compensation insurance or be self-insured.

Is Oregon a monopolistic state for Workers' Compensation? No. Workers' Compensation coverage in Oregon can be purchased through agents or brokers licensed to sell business insurance within the state, or through online portals such as CoverWallet.

This article explains how to set up or change the OR WBF in QuickBooks Desktop....DetailsIn the Employee Center, double-click on the employee's name.Click the Payroll Info tab.Click the Taxes button to display the Federal, State and Other tabs.Click the Other tab and click the OR WBF tax.More items...

The length of time such benefits can be paid while enrolled in a vocational retraining program is limited to 16 months, although can be extended in special circumstances to 21 months. Jodie Anne Phillips Polich, P.C.

The Workers' Benefit Fund (WBF) assessment funds return-to-work programs, provides increased benefits over time for workers who are permanently and totally disabled, and gives benefits to families of workers who die from workplace injuries or diseases. In 2021, this assessment is 2.2 cents per hour worked.

The Oregon Workers´ Benefit Fund (WBF) assessment is a payroll tax calculated on the number of hours worked by all paid workers, owners, and officers covered by workersA´ compensation insurance in Oregon, and by all workers subject to Oregon's WorkersA´ Compensation Laws (whether or not covered by workersA´ compensation

The 2022 Workers Benefit Fund (WBF) assessment rate is 2.2 cents per hour.

(2) Employer reporting time frame. An employer, except a self-insured employer, must report a claim to its insurer no later than five days after the date the employer has notice or knowledge of any claim or accident that may result in a compensable injury.

Injured Workers are Protected from Retaliation in Oregon In Oregon, it is unlawful for an employer to fire an employee in retaliation for an on-the-job injury.