Oregon Purchase Order for Car

Description

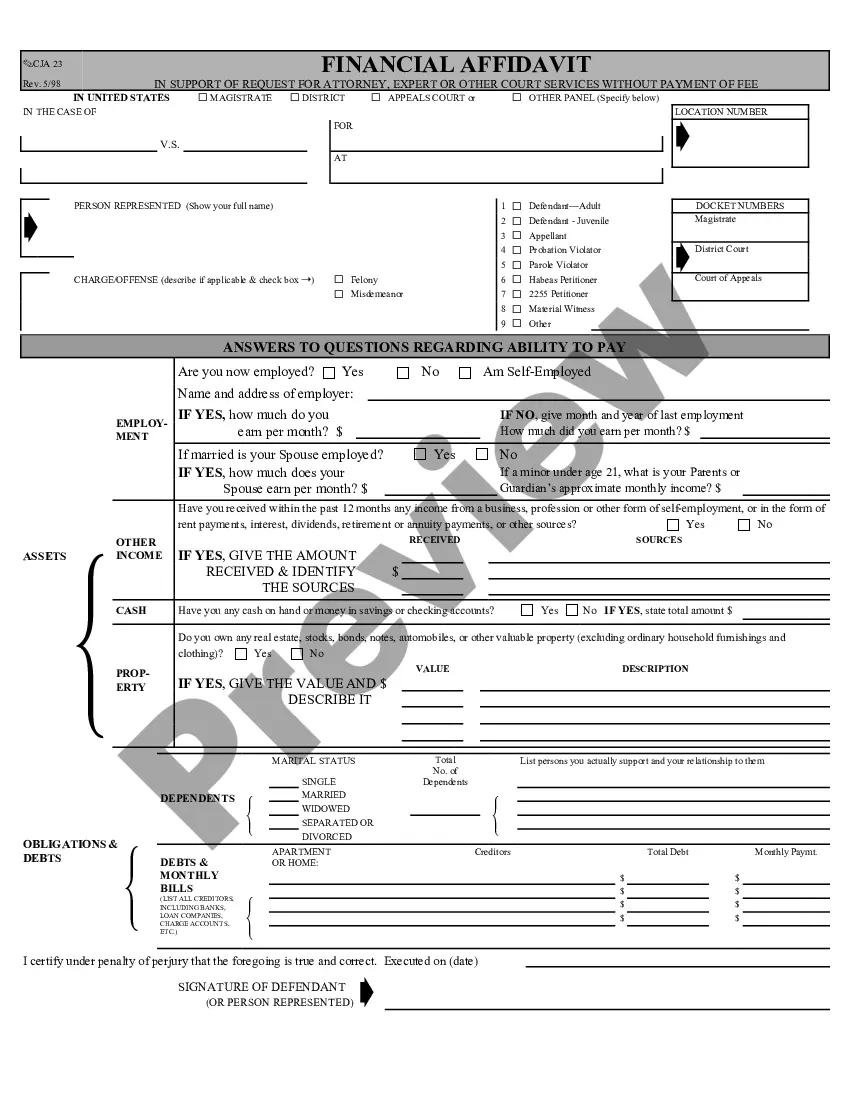

How to fill out Purchase Order For Car?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a broad selection of legal document templates that you can acquire or print. By using the site, you can obtain thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest forms such as the Oregon Purchase Order for Car within minutes. If you already possess a subscription, Log In and obtain the Oregon Purchase Order for Car from the US Legal Forms library. The Download option will be available for each form you view. You can access all previously downloaded forms in the My documents tab of your account.

If you wish to use US Legal Forms for the first time, here are straightforward instructions to get started: Ensure you have selected the correct form for your city/state. Click on the Review option to evaluate the content of the form. Read the form description to confirm that you have chosen the appropriate form.

Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you desire.

Gain access to the Oregon Purchase Order for Car with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If the form does not meet your needs, utilize the Search area at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Next, choose the pricing plan you prefer and provide your details to register for an account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Select the format and download the form to your device.

- Make modifications. Fill out, edit, print, and sign the downloaded Oregon Purchase Order for Car.

Form popularity

FAQ

Shopping in Oregon to avoid sales tax can be advantageous, particularly for larger purchases. While many out-of-state buyers take this route, you need to be aware of your own state’s tax laws regarding out-of-state purchases. Using an Oregon Purchase Order for Car can streamline your shopping experience and help you keep track of your transactions.

To buy a car in Oregon and avoid sales tax, first, ensure that you plan your purchase accordingly. Research dealerships and private sellers who offer the best deals. Once you find your car, an Oregon Purchase Order for Car can facilitate the transaction, ensuring all necessary details are documented properly.

Many buyers consider purchasing a car in Oregon to avoid California's sales tax, which is a valid strategy. However, be aware that California may impose tax when you register the vehicle there. Using an Oregon Purchase Order for Car can facilitate your purchase, but ensure you are informed about the tax implications once you return to California.

Yes, you can buy a car in Oregon even if you do not live there. Many shoppers from neighboring states choose Oregon for vehicle purchases due to its lack of sales tax. To complete your transaction smoothly, prepare an Oregon Purchase Order for Car. Remember to familiarize yourself with any local laws that may apply.

Yes, in Oregon, a bill of sale is recommended when buying a car, as it serves as proof of the transaction. While it may not be legally required for all sales, having an Oregon Purchase Order for Car can simplify this process and provide necessary documentation. This document helps protect both the buyer and the seller by clearly outlining the sale's details. Always keep a copy of the bill of sale for your records.

To fill out an Oregon title when selling a car, locate the title document and find the 'Seller' section. Clearly write your name and address, then sign and date the title. Be sure to accurately fill in the buyer's information, including their name and address, to ensure a smooth transfer. Using an Oregon Purchase Order for Car can help you document this transaction effectively.

To buy a car in Oregon, you will need a valid form of identification, necessary funds for the purchase, and an Oregon Purchase Order for Car if you want to take advantage of the state's benefits. Most dealerships will also require proof of insurance before you can drive your new vehicle off the lot. Preparing these items in advance can help you have a smooth buying experience.

Yes, you can buy a car in Oregon even if you are not a resident. Using an Oregon Purchase Order for Car allows out-of-state buyers to take advantage of the state's unique vehicle purchase benefits. However, it's still essential to check your home state's regulations regarding out-of-state purchases to avoid unexpected issues.

To register a vehicle in Oregon, you typically need the vehicle title, proof of identity, and an Oregon Purchase Order for Car if applicable. Additionally, you might need a bill of sale and proof of residence. Gathering these documents in advance can streamline your registration process.

Traveling to Oregon to buy a car can be beneficial due to the absence of a sales tax. Many shoppers find that they save significantly when they utilize an Oregon Purchase Order for Car, along with potential lower prices from local dealerships. However, consider travel costs and how they affect your overall savings before making a decision.