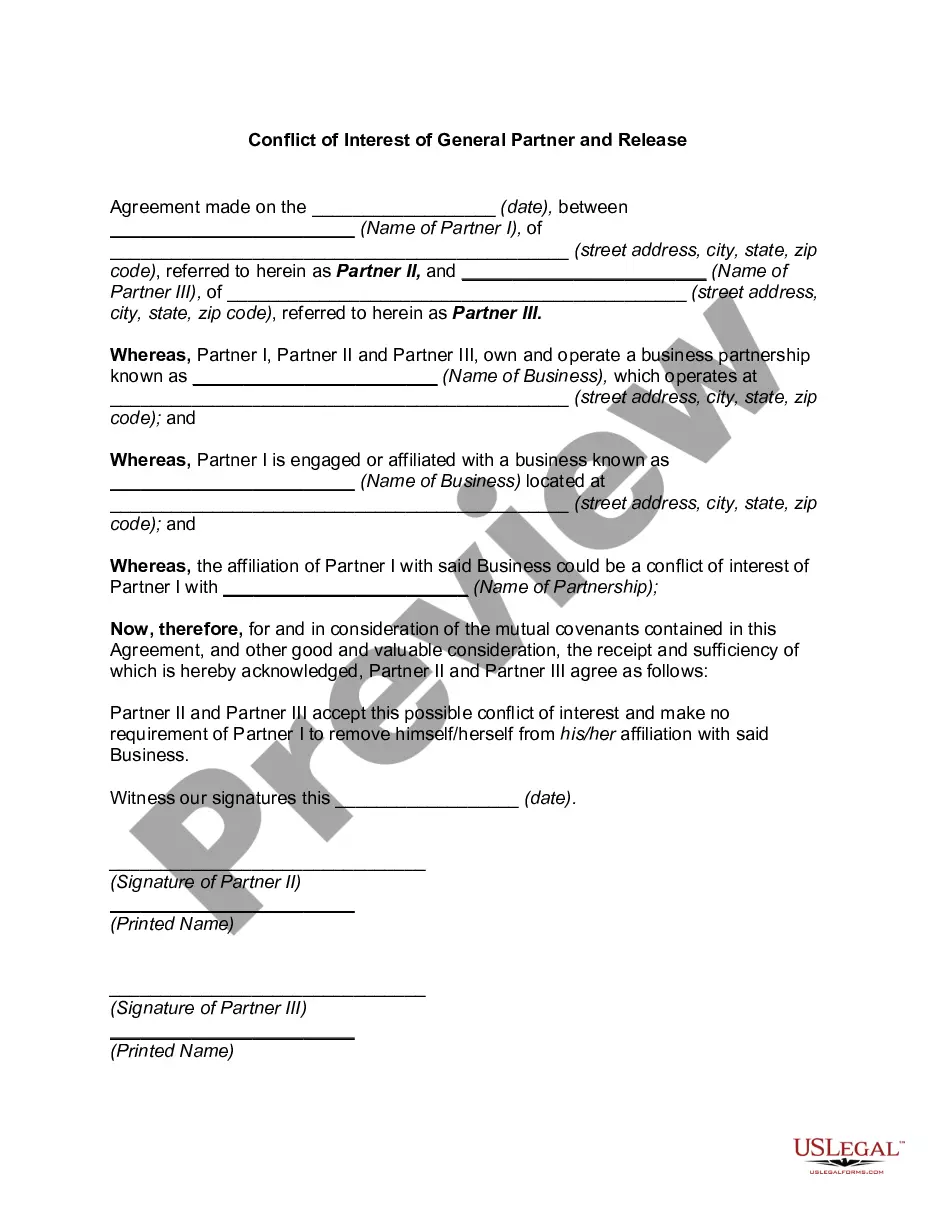

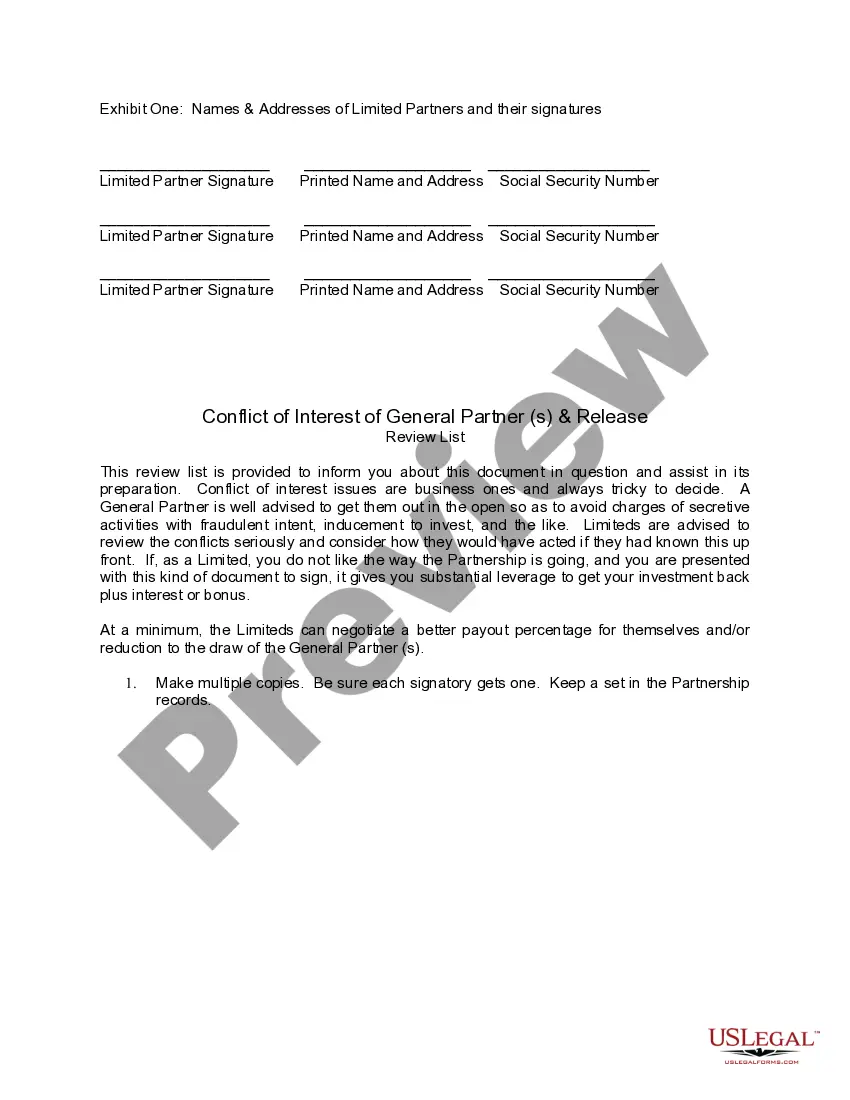

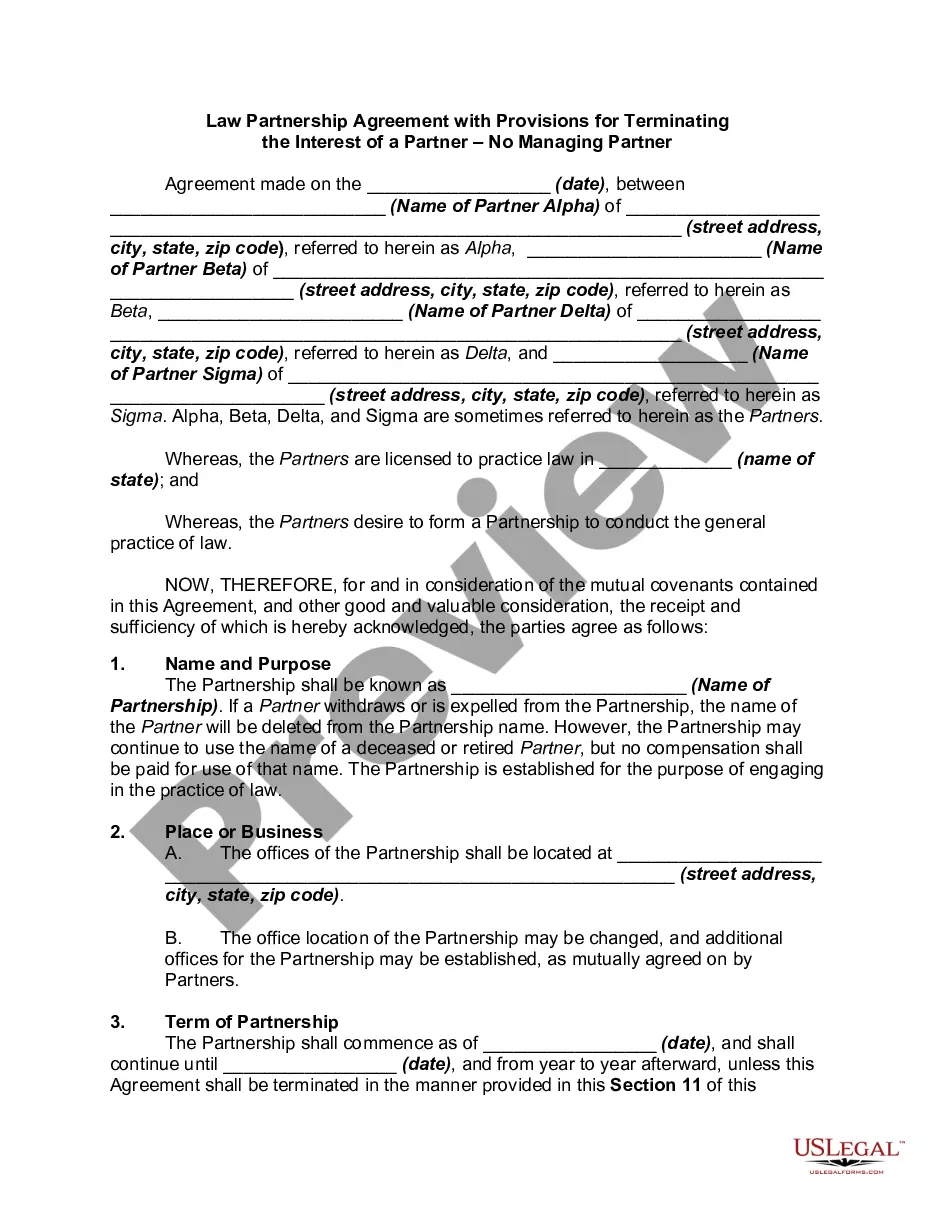

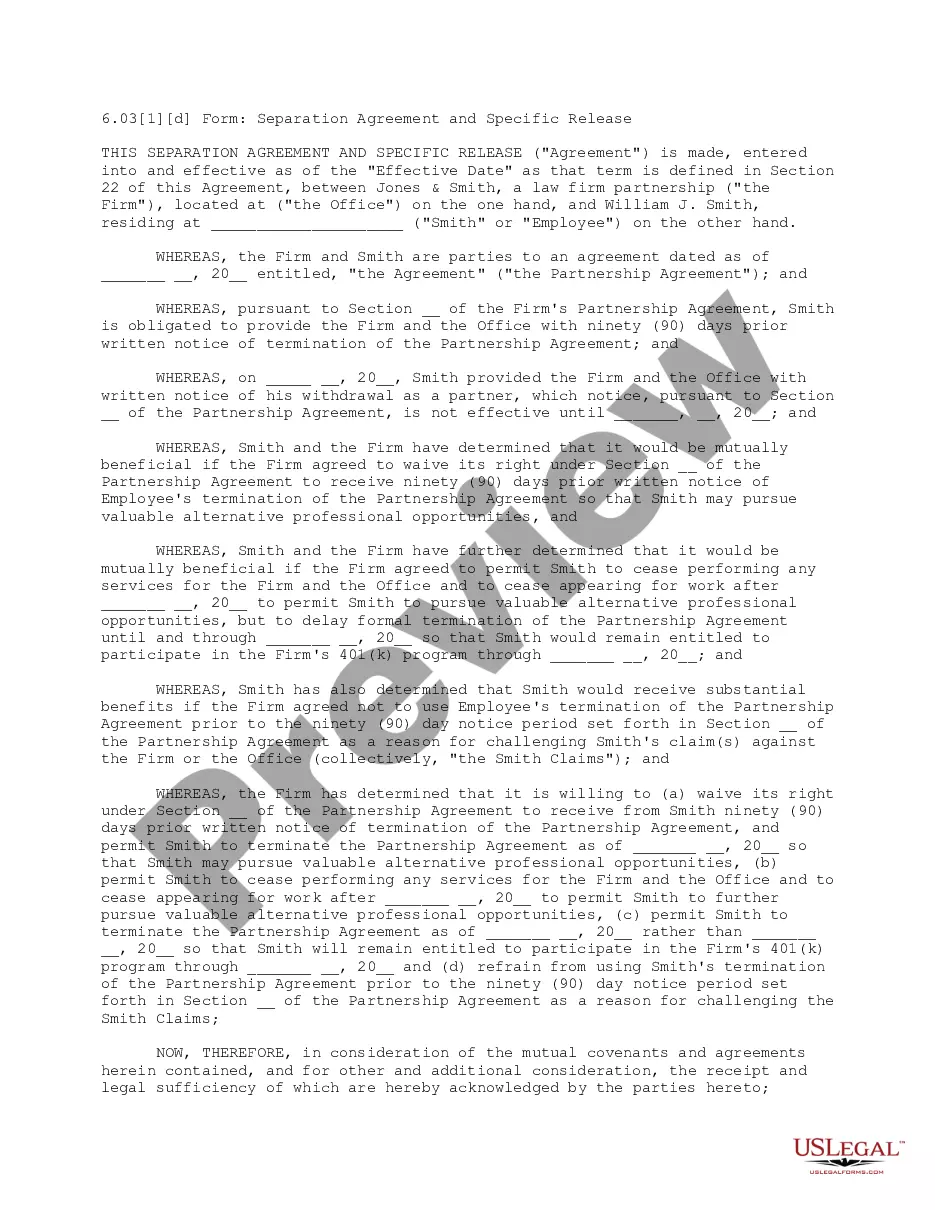

Oregon Conflict of Interest of General Partner and Release

Description

How to fill out Conflict Of Interest Of General Partner And Release?

Are you presently situated in a location where you frequently require documentation for either business or personal purposes almost every workday.

There are numerous legitimate document templates accessible online, yet finding versions you can rely on can be challenging.

US Legal Forms offers a vast array of form templates, such as the Oregon Conflict of Interest of General Partner and Release, designed to comply with both federal and state regulations.

Select a convenient document format and download your copy.

You can locate all the document templates you have acquired in the My documents menu. You can download another copy of the Oregon Conflict of Interest of General Partner and Release at any time, if necessary. Just click on the desired form to download or print the document template.

Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid mistakes. The service provides expertly crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Subsequently, you will be able to download the Oregon Conflict of Interest of General Partner and Release template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Identify the form you require and ensure it is correct for your city/region.

- Use the Preview button to review the form.

- Check the details to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you want, complete the necessary information to create your account, and process the payment using PayPal or a Visa or Mastercard.

Form popularity

FAQ

A limited partnership (LP) exists when two or more partners go into business together, but the limited partners are only liable up to the amount of their investment. An LP is defined as having limited partners and a general partner, which has unlimited liability.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

Ordinarily, partners cannot sue each other for damages based on partnership business, at least not until there has been an action for dissolution and accounting.

Partners are 'jointly and severally liable' for the firm's debts. This means that the firm's creditors can take action against any partner. Also, they can take action against more than one partner at the same time. This applies even if there is a partnership agreement that says otherwise.

If a partner breaches the terms of the agreement, the non-breaching parties can sue for breach of contract. Other contractual terms that may allow remaining partners to sue a departing partner include: Noncompete clause. Buy/sell terms.

In a general partnership: all partners (called general partners) are personally liable for all business debts, including court judgments. each individual partner can be sued for the full amount of any business debt (though that partner can in turn sue the other partners for their share of the debt), and.

Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

While it's never the ideal solution, the answer is yes. Sometimes the only way to resolve an issue with a business partner is through a lawsuit. If your business partner is engaging in conduct that is harmful to the company, or that violates their obligation to the company, a lawsuit may be the only option.