Oregon Charity Subscription Agreement

Description

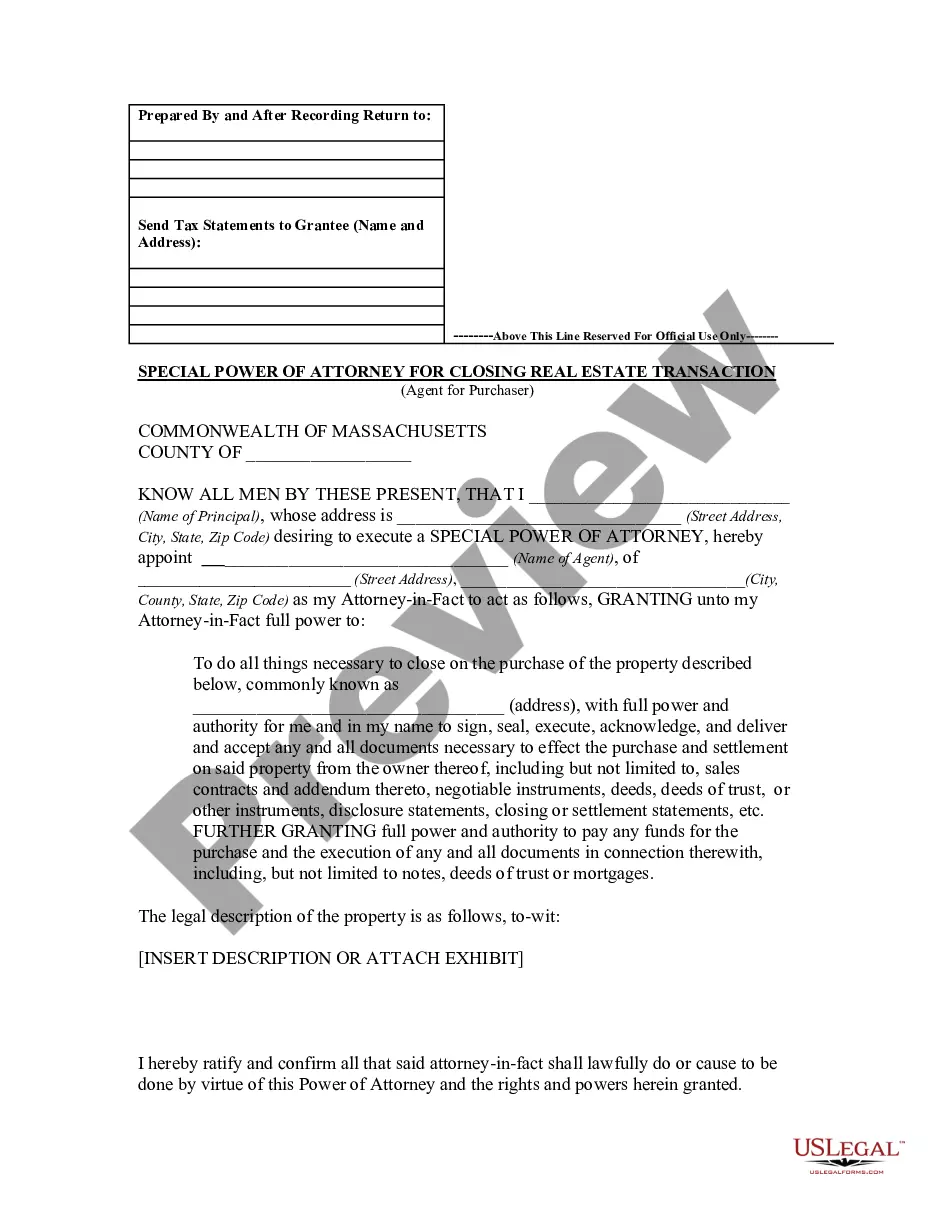

How to fill out Charity Subscription Agreement?

You can spend hours online searching for the authentic document template that meets the federal and state criteria you require.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can conveniently download or print the Oregon Charity Subscription Agreement from our platform.

To find another version of the form, use the Search section to locate the template that fits your needs and requirements.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the Oregon Charity Subscription Agreement.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for your desired state/city.

- Read the form description to ensure you have selected the right form.

Form popularity

FAQ

In California, a pledge is enforceable as a binding contract only if there is consideration. In certain other states, the rules are less strict: Even a promise to make a payment to a charitable organization without anything given in return may be enforceable as a matter of public policy.

Most courts view charitable pledges as legally enforceable commitments. Failure to enforce pledge collection could result in personal liability for the trustees of a non-profit. IRS rules prohibit donors from fulfilling a legally enforceable pledge from their donor advised fund.

Under traditional contract law principles, a charitable pledge is enforceable if it meets the requirements for a legally binding contract. There must be an agreement between the donor and the charity -- in effect, the donor must promise to make a gift and the charity must promise to accept it.

A charitable pledge is enforceable if it is a legally binding contract. A legally binding contract exists when there is agreement between the parties and there has been consideration given in exchange for the pledge.

The person or institution giving a gift is called the donor, and the person or institution getting the gift is called the donee.

A charitable pledge is enforceable if it is a legally binding contract. A legally binding contract exists when there is agreement between the parties and there has been consideration given in exchange for the pledge.

A charitable subscription, also called a charitable pledge, is a donor's written or oral promise or statement of intent to contribute money or property to a charity.

If there is no acceptance, the donation cannot be formalized. Therefore, any donation contract is subject to these conditions: It is an act free and it is made voluntary. Cannot be done on future goods, i.e. the goods must be currently owned by the donor.

Donation is an act of liberality whereby a person disposes gratuitously of a thing or right in favor of another, who accepts it. An agreement between the donor and the donee is essential like in any other contract.