Oregon Sample Letter for Tax Return for Supplement

Description

How to fill out Sample Letter For Tax Return For Supplement?

Are you currently inside a place that you need files for possibly enterprise or individual purposes nearly every day time? There are a variety of authorized papers themes available on the net, but getting kinds you can trust isn`t simple. US Legal Forms offers 1000s of form themes, such as the Oregon Sample Letter for Tax Return for Supplement, that happen to be published to fulfill federal and state demands.

Should you be currently informed about US Legal Forms web site and possess your account, just log in. Following that, you may acquire the Oregon Sample Letter for Tax Return for Supplement design.

If you do not offer an account and wish to start using US Legal Forms, abide by these steps:

- Obtain the form you require and ensure it is for that correct area/state.

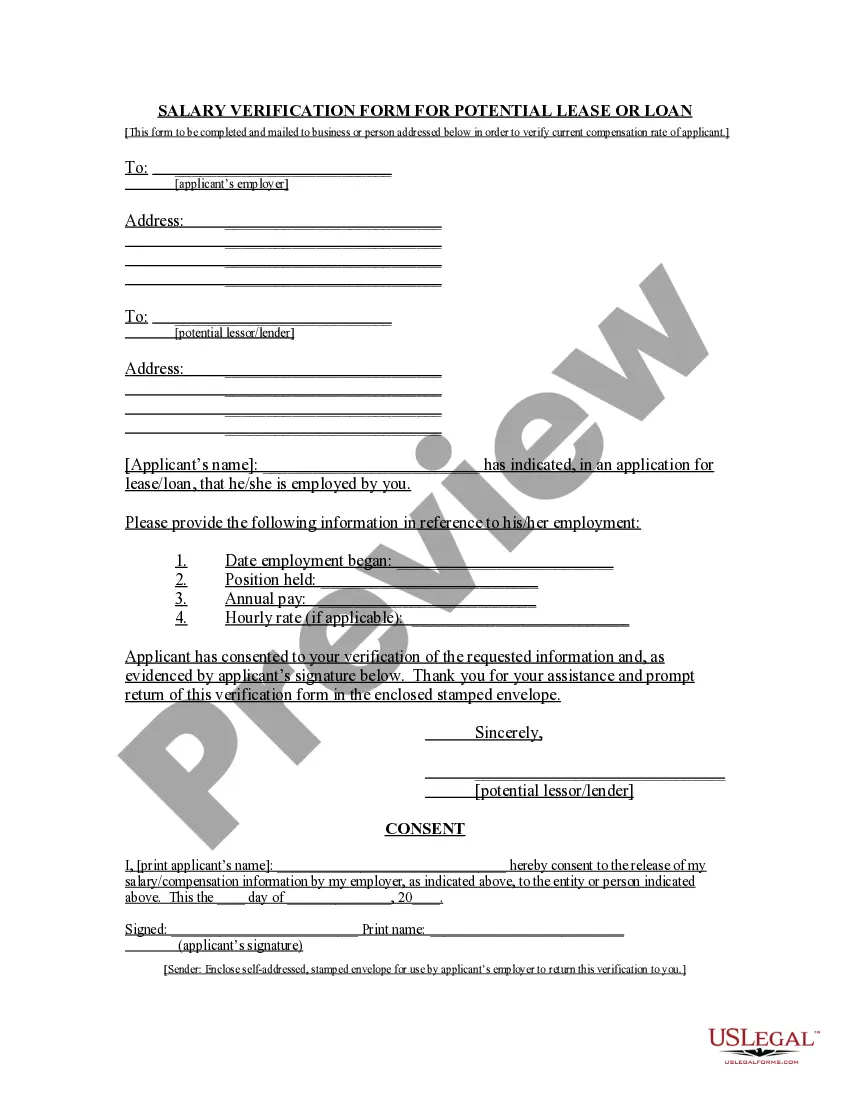

- Make use of the Review key to examine the shape.

- Browse the description to ensure that you have chosen the proper form.

- In the event the form isn`t what you`re seeking, use the Search discipline to discover the form that fits your needs and demands.

- Once you discover the correct form, simply click Acquire now.

- Opt for the costs prepare you desire, fill in the required info to generate your account, and buy the order utilizing your PayPal or bank card.

- Select a hassle-free file structure and acquire your version.

Get every one of the papers themes you have purchased in the My Forms food selection. You can get a extra version of Oregon Sample Letter for Tax Return for Supplement at any time, if required. Just select the essential form to acquire or produce the papers design.

Use US Legal Forms, one of the most extensive collection of authorized forms, in order to save time and avoid errors. The assistance offers skillfully manufactured authorized papers themes which you can use for a range of purposes. Make your account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

Submitting documents Log into My Account for Individuals or Represent a Client. Select ?Submit document? and follow the instructions. Enter the tax year and the reference number found in the upper right corner of the letter received. Browse your hard drive to locate the files you have scanned and select one for upload.

Send your return to the following:For individuals served by tax services offices in:Canada Revenue Agency Tax Centre 2251 Rene-Levesque Boulevard Jonquiere QC G7S 5J2Chicoutimi, Monteregie-Rive-Sud, Outaouais, Quebec, Rimouski, and Trois-Rivieres6 more rows

Purpose of Schedule OR-21-MD Pass-through entities (PTEs) electing to pay the PTE elective tax (PTE-E tax) use Schedule OR-21-MD to provide informa- tion about the members of the PTE. Schedule OR-21-MD must be included with Form OR-21 when the return is filed. Entities that are PTEs owned entirely by such individuals.

15, Circular E, Employer's Tax Guide. The current rate for supplemental wages up to $1M is 22% for Federal and 8% for Oregon State. For supplemental wages above $1M the Federal rate increases to 37%.

Mailing Your Tax Return Here is a list of what you might need: Information slips especially if you have received an amended copy: T4, T4A, T3, T4RSP, T4RIF, RL-1, RL-2, etc. Forms, certifications, and schedules: T1135, T776, T778, T2125, schedule 2, schedule 5, T2202, etc. Provincial claims: form 428, 479, BEN, etc.

2022 Form OR-40, Oregon Individual Income Tax Return for Full-year Residents, 150-101-040.

You can submit either online or through the mail. Once the CRA reviews your return, you'll receive a notice of assessment (NOA). This document is packed with important information, including whether you owe the government money or can expect to get a refund back.

How To Mail Documents to the IRS - Bulletproof Method - YouTube YouTube Start of suggested clip End of suggested clip And you're going to need to get a form which is this return receipt and also this other littleMoreAnd you're going to need to get a form which is this return receipt and also this other little form that accompanies it. And that's the certified mail receipt that proves.