Oregon Sample Letter for Fee Structures for Bankruptcies

Description

How to fill out Sample Letter For Fee Structures For Bankruptcies?

Are you inside a situation in which you will need papers for possibly company or specific reasons virtually every day time? There are a lot of legal document themes available online, but finding kinds you can trust is not effortless. US Legal Forms offers a large number of kind themes, much like the Oregon Sample Letter for Fee Structures for Bankruptcies, which can be composed to meet state and federal requirements.

Should you be previously acquainted with US Legal Forms website and have a free account, just log in. Following that, you can obtain the Oregon Sample Letter for Fee Structures for Bankruptcies template.

Should you not provide an account and wish to start using US Legal Forms, follow these steps:

- Obtain the kind you require and make sure it is for your correct city/region.

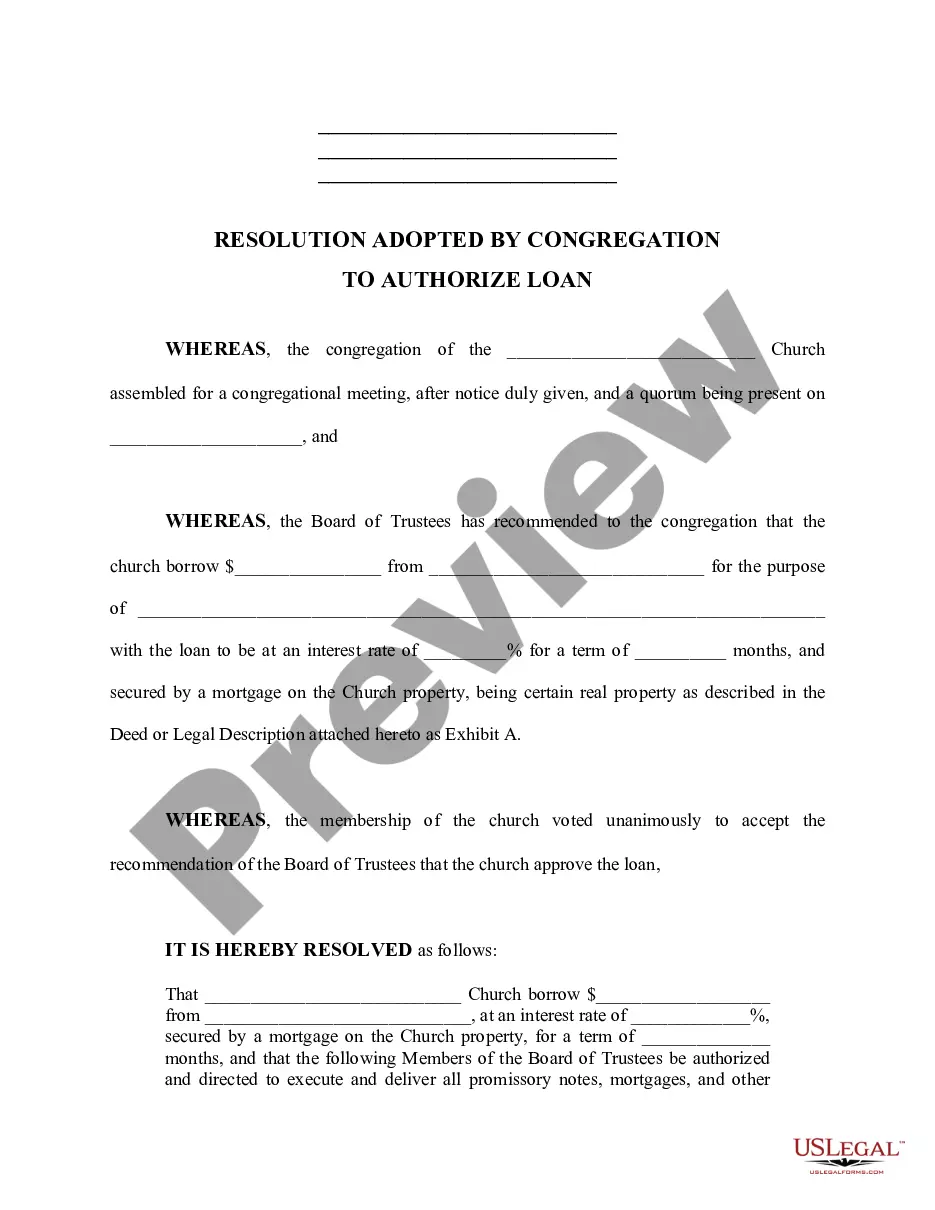

- Use the Review button to analyze the form.

- See the outline to actually have selected the appropriate kind.

- If the kind is not what you`re looking for, take advantage of the Lookup area to discover the kind that fits your needs and requirements.

- Once you get the correct kind, click on Purchase now.

- Opt for the costs strategy you want, complete the necessary info to produce your money, and pay for your order utilizing your PayPal or Visa or Mastercard.

- Choose a practical document formatting and obtain your copy.

Find each of the document themes you may have bought in the My Forms menu. You may get a more copy of Oregon Sample Letter for Fee Structures for Bankruptcies whenever, if possible. Just click the necessary kind to obtain or produce the document template.

Use US Legal Forms, the most considerable assortment of legal forms, in order to save time and stay away from faults. The support offers appropriately manufactured legal document themes which can be used for a selection of reasons. Create a free account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

Disposable Income and Chapter 13 If you are filing for Chapter 13, the answer is no, not for the duration of the process. The court will calculate your necessary expenses (food, utilities, etc.) and that will be the amount of money you retain once your payment plan obligations are met.

Chapter 13 cases can be filed for no money down because the attorney fees and court costs can be rolled into a 3-5 year repayment plan. While you're at it, you can also wipe away all of your other unsecured debt (credit cards, medical bills, payday loans, old collections, etc.).

However, there are certain restrictions and limitations on what you can and cannot do after filing for Chapter 7 bankruptcy. Avoid Spending Outside Your Income Levels. ... You Cannot Neglect Your Alimony & Child Support Obligations After Chapter 7. ... You Cannot Ignore Student Loans. ... You Cannot Eliminate Most Tax Debt.

Funds received after the date of an Order of Dismissal or an Order of Conversion in a confirmed case and after the Trustee has closed the case will be disbursed directly to the debtor(s). These refunds will be generated once per month, near the end of the month, prior to the regular disbursement cycle.

Your bankruptcy begins when you file for bankruptcy with a Licensed Insolvency Trustee (LIT), as they are the only professionals in Canada that are licensed and regulated to administer bankruptcies. Your trustee settles all of your debts by paying the proceeds of your non-exempt assets to your creditors.

The Minimum Percentage of Debt Repayments In A Chapter 13 Bankruptcy Is 8 To 10 Percent.