Oregon Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

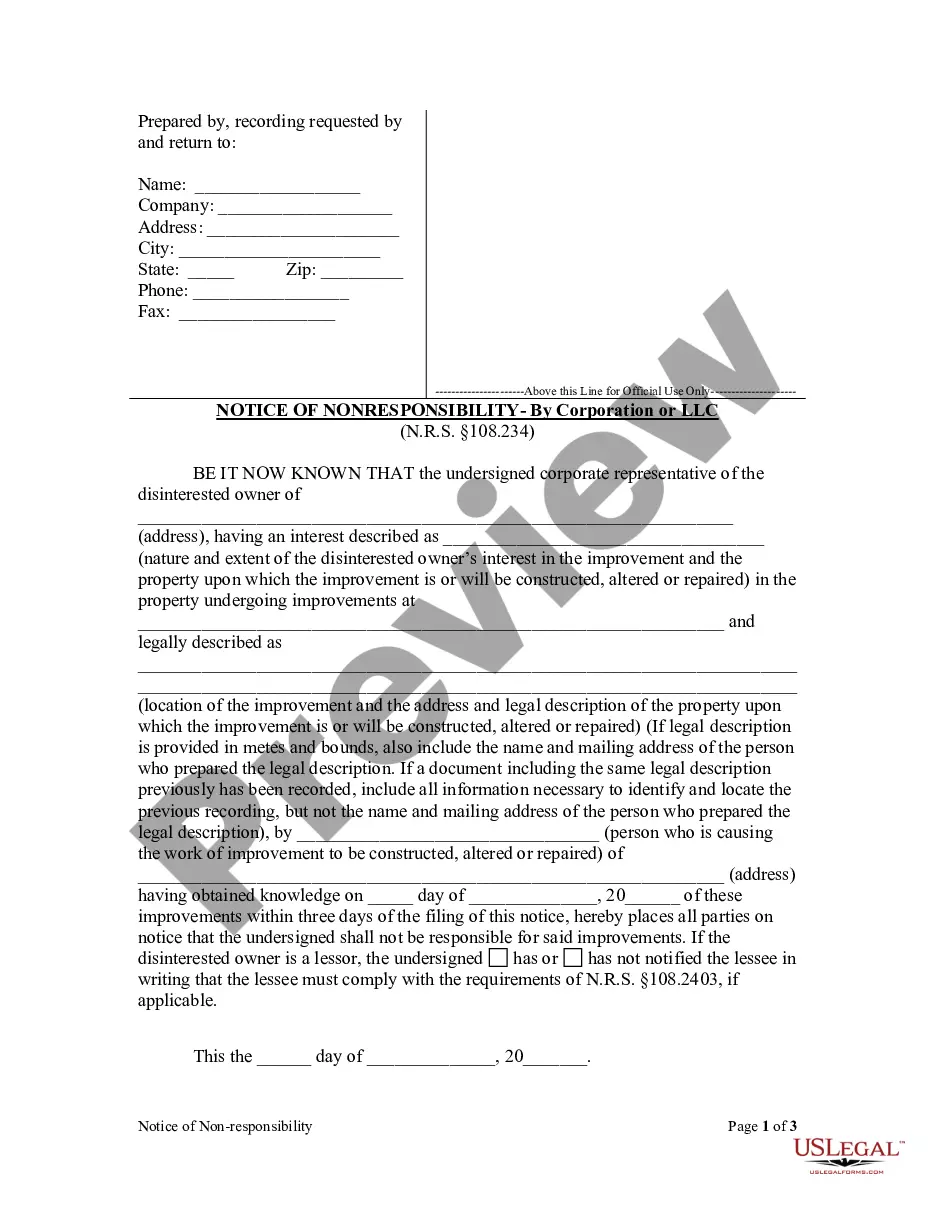

How to fill out Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

It is possible to spend several hours on the Internet attempting to find the legitimate record web template which fits the state and federal needs you want. US Legal Forms gives a huge number of legitimate varieties that are reviewed by professionals. It is possible to down load or produce the Oregon Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse from the assistance.

If you already have a US Legal Forms account, it is possible to log in and click the Acquire switch. Afterward, it is possible to comprehensive, change, produce, or indicator the Oregon Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse. Each and every legitimate record web template you get is the one you have eternally. To have an additional duplicate of the purchased kind, visit the My Forms tab and click the related switch.

Should you use the US Legal Forms web site for the first time, adhere to the easy guidelines under:

- Initially, ensure that you have chosen the proper record web template for that area/town that you pick. Browse the kind explanation to ensure you have chosen the appropriate kind. If accessible, utilize the Preview switch to look with the record web template also.

- If you would like discover an additional variation from the kind, utilize the Look for discipline to obtain the web template that suits you and needs.

- Once you have found the web template you want, simply click Acquire now to carry on.

- Find the prices prepare you want, enter your references, and register for your account on US Legal Forms.

- Full the transaction. You can utilize your bank card or PayPal account to purchase the legitimate kind.

- Find the file format from the record and down load it to your gadget.

- Make changes to your record if required. It is possible to comprehensive, change and indicator and produce Oregon Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse.

Acquire and produce a huge number of record web templates using the US Legal Forms Internet site, which offers the greatest variety of legitimate varieties. Use specialist and condition-specific web templates to tackle your business or personal requirements.

Form popularity

FAQ

A beneficiary deed is a type of deed that transfers property to a beneficiary. Most deeds transfer property in the present. In contrast, a beneficiary deed can be used to make arrangements today to pass down property in the future.

However, Lady Bird deeds are not recognized in Oregon. Nonetheless, similar outcomes can often be achieved through the use of a revocable living trust or a TOD deed.

Cons To Using Beneficiary Deed Estate taxes. Property transferred may be taxed. No asset protection. The beneficiary receives the property without protection from creditors, divorces, and lawsuits. Medicaid eligibility. ... No automatic transfer. ... Incapacity not addressed. ... Problems with beneficiaries.

In the Erickson case, the Oregon Supreme Court found that the use of certain language ensured that unmarried people could create a right of survivorship despite the abolishment of joint tenancy estates by the General Laws of Oregon in 1862.

An Oregon domestic partnership couple may take title as tenants in common or with rights of survivorship, but should state their election expressly in their deed, e.g., John Doe and Fred Jones as tenants in common or John Doe and Fred Jones as Oregon registered domestic partners with the right of survivorship.

Yes, Oregon does have a transfer-on-death deed (also known as a TOD deed or a beneficiary deed) option that allows property owners to transfer ownership of their real property to one or more designated beneficiaries upon their death.

Tenancy by the entirety is a form of ownership recognized in Oregon that is available only to legally married husband and wife. The law sees the husband and wife as one person. Therefore, they do not own one-half interests in the property, but each own the entire property.

A Will provides instructions for all of the assets included in your estate, whereas a beneficiary designation is for a specific asset. Further, a Will is something that you set up on your own , whereas a beneficiary designation is a document required by the company holding the asset.