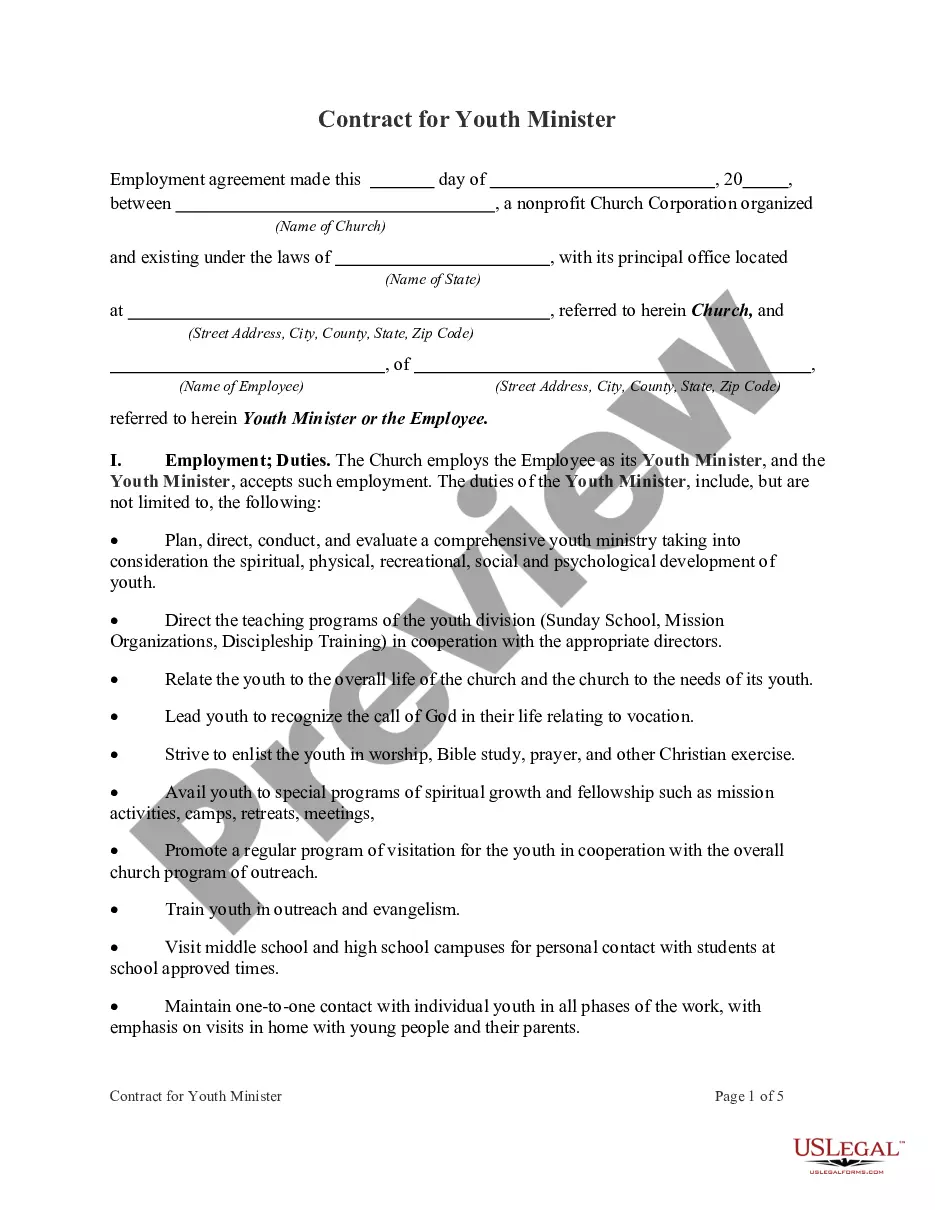

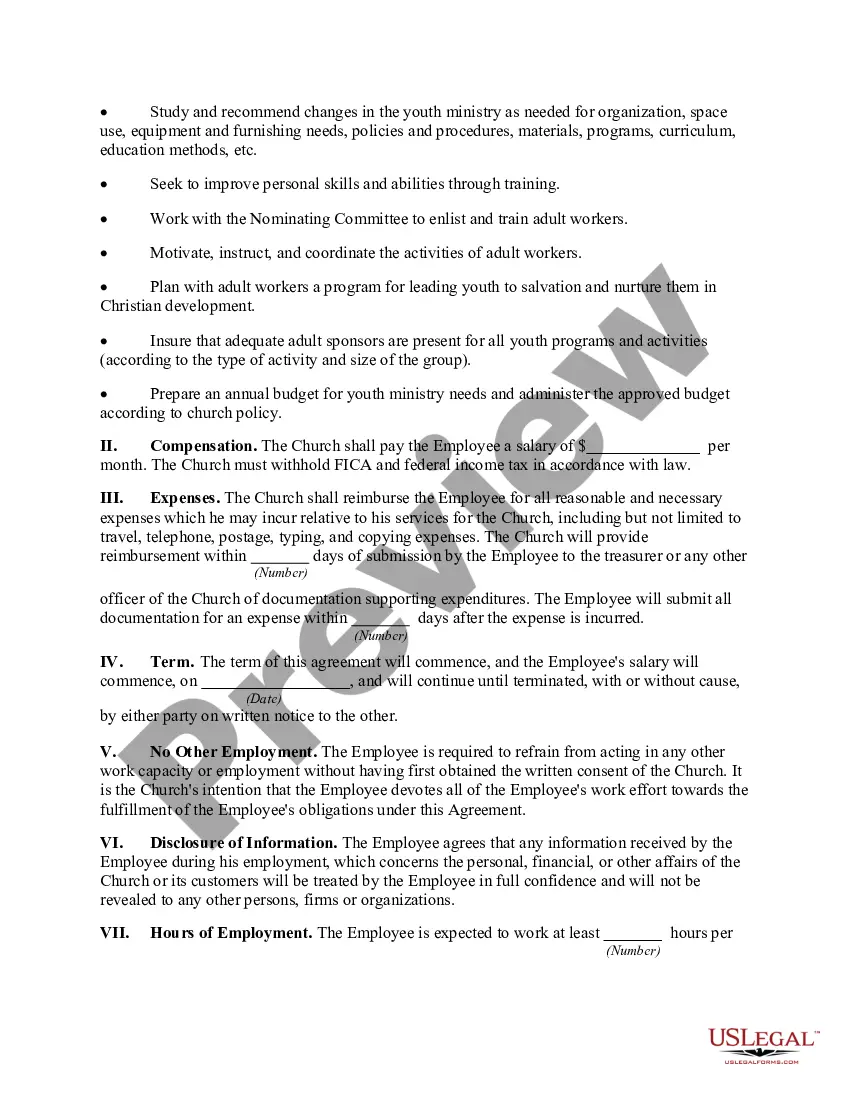

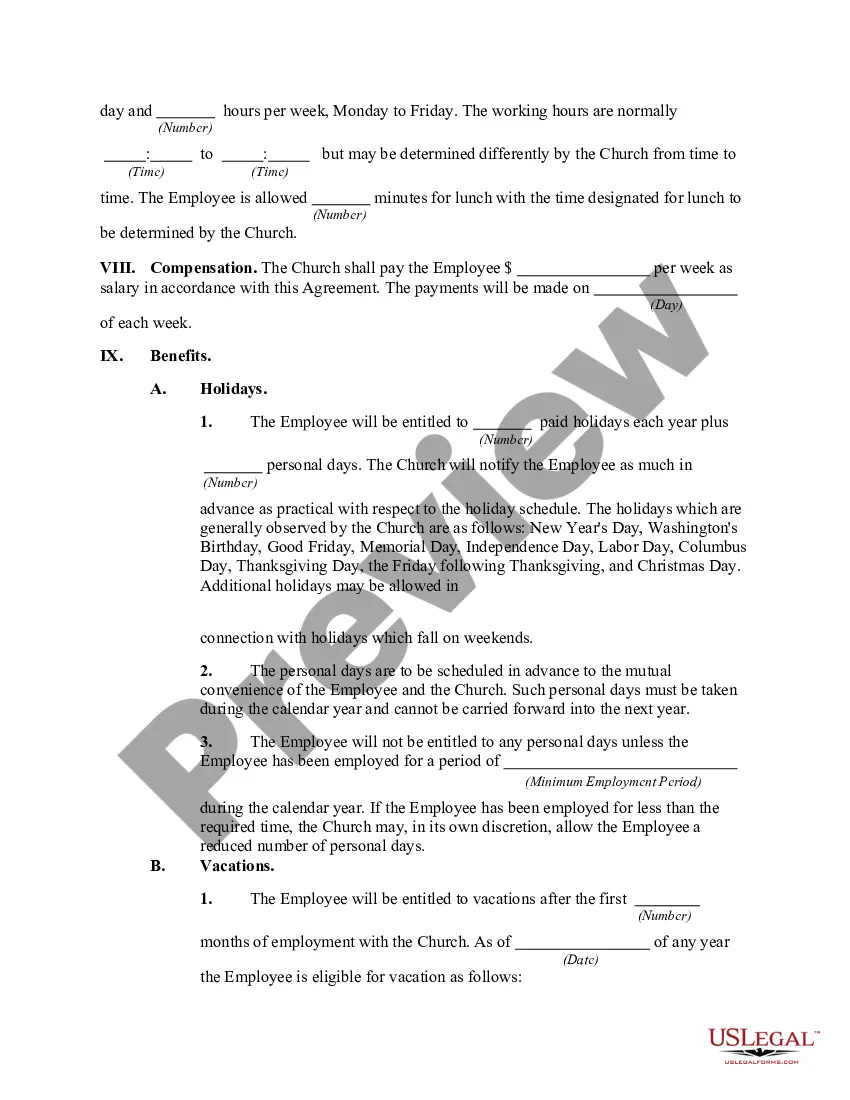

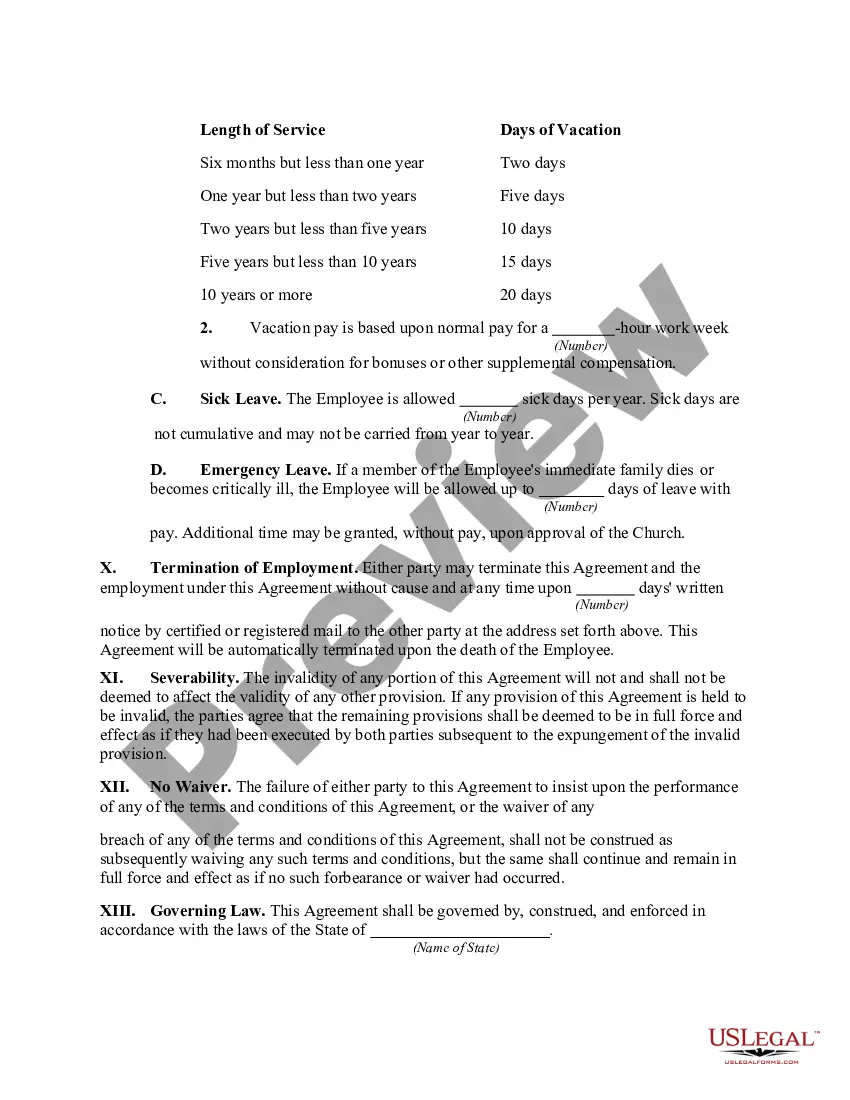

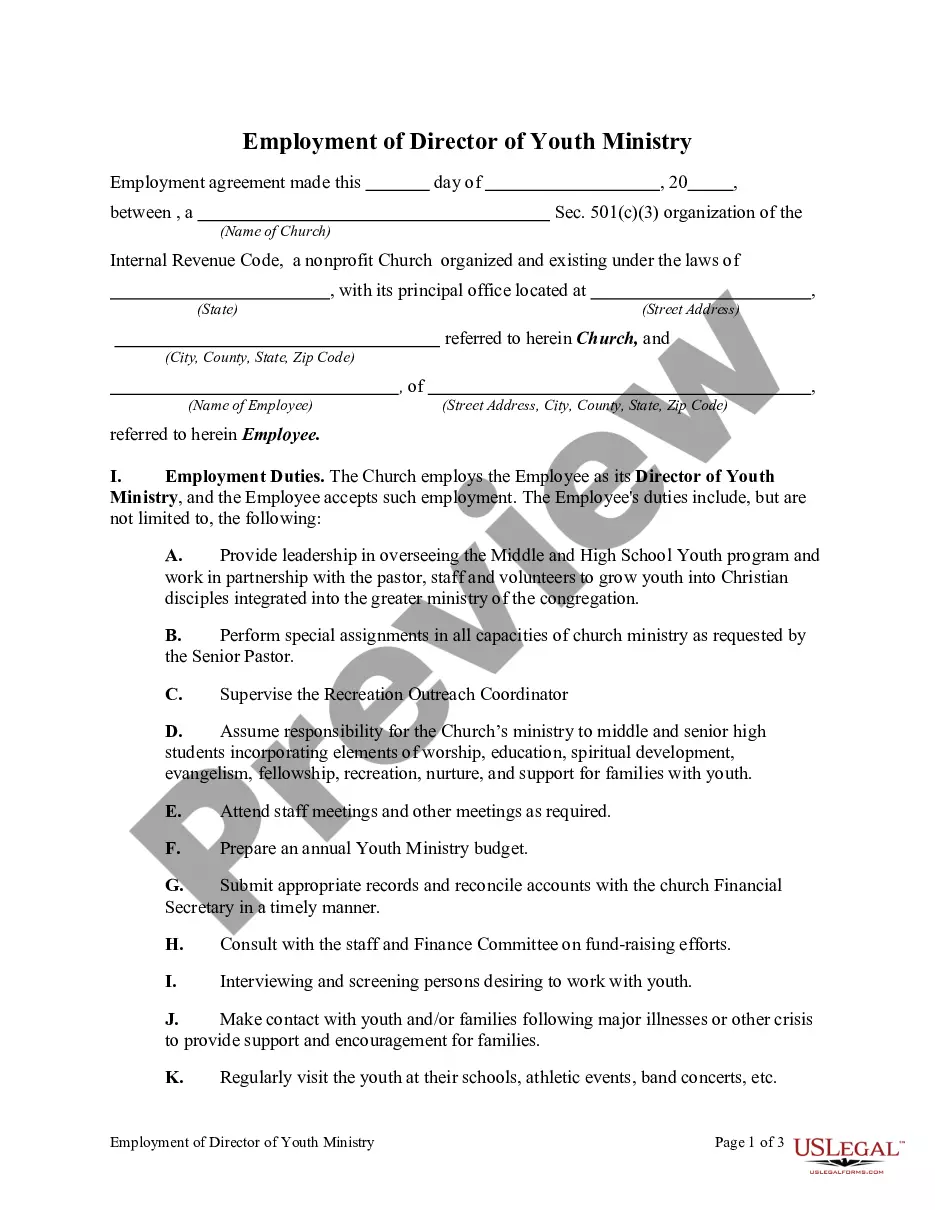

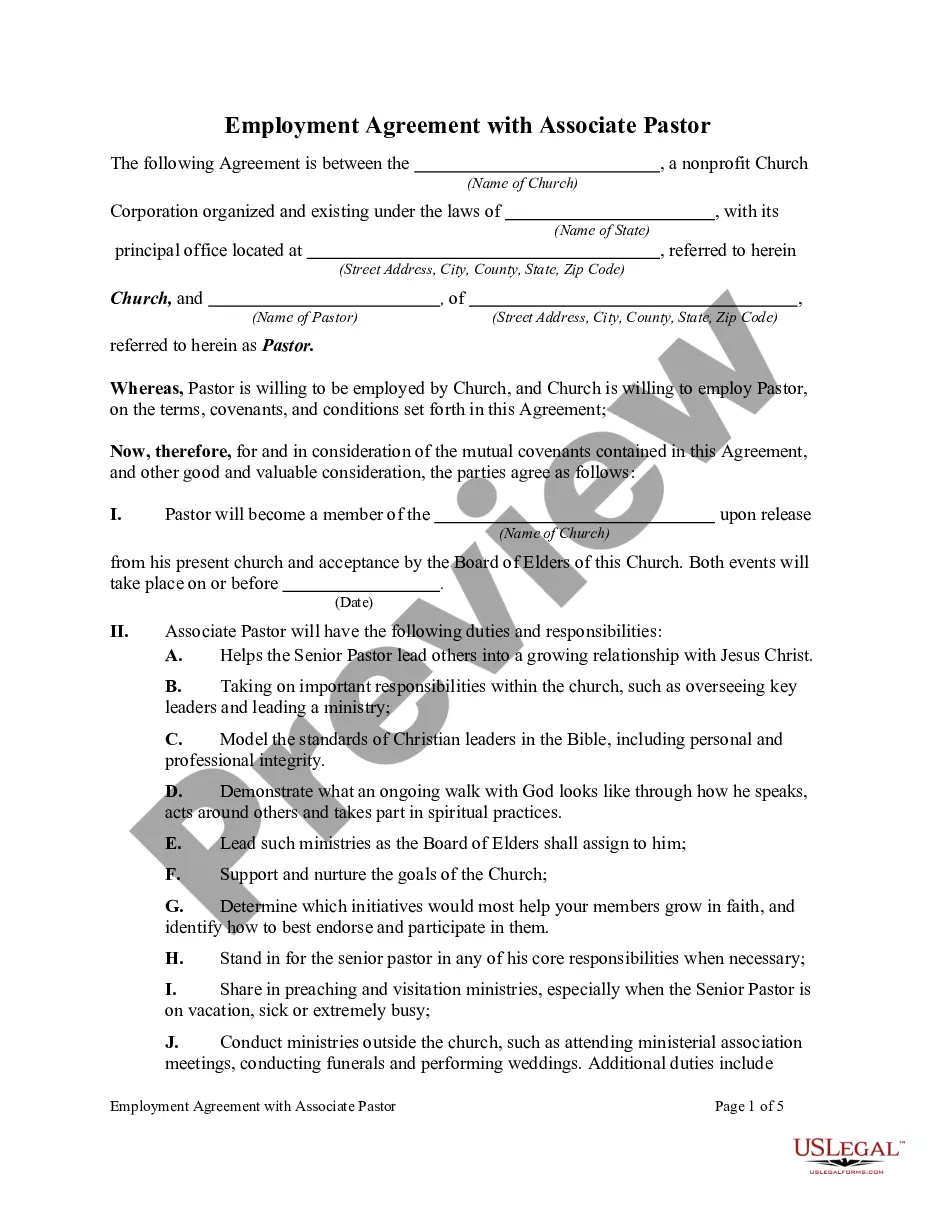

Oregon Contract for Youth Minister

Description

How to fill out Contract For Youth Minister?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal document templates that you can purchase or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the most current versions of forms like the Oregon Contract for Youth Minister in moments.

If you have a monthly membership, Log In to access the Oregon Contract for Youth Minister in the US Legal Forms library. The Download button will be available on every form you view. You can access all previously obtained forms from the My documents section of your account.

Every template you save in your account has no expiration date and is yours permanently. Hence, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Oregon Contract for Youth Minister with US Legal Forms, the most extensive library of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the content of the form. Check the form description to confirm you have chosen the right one.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that fits.

- If you are satisfied with the form, confirm your choice by clicking the Purchase Now button. Then, select the pricing plan you prefer and enter your information to register for an account.

- Complete the transaction. Use your Visa, Mastercard, or PayPal account to finish the purchase.

- Choose the format and download the form to your device.

- Make changes. Fill out, edit, and print and sign the downloaded Oregon Contract for Youth Minister.

Form popularity

FAQ

Yes. Members of the clergy (ministers, members of a religious order, and Christian Science practitioners and readers) and religious workers (church employees) must pay self-employment tax (SE tax).

Ministers are self-employed for Social Security tax purposes with respect to their ministerial services, even though most are treated as employees for federal income tax purposes. Self-employment tax is assessed on taxable compensation and nontaxable housing allowance/parsonage.

If you are a pastor and performing religious duties, then you are self-employed for income tax purposes and you should not have social security and medicare taxes withheld.

While they can be considered an employee of a church, for federal income tax purposes a pastor is considered self-employed by the IRS. Some pastors are considered independent contractors if they aren't affiliated with one specific church, like traveling evangelists.

A minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax purposes but not for self-employment tax purposes.

Church Employees and Federal Income Taxes For state and federal government taxes, clergy employees are considered employees, while also regarded as self-employed for social security and medicare taxes.

A typical master's degree program lasts two years, while a dual degree program, which combines the Master of Arts in Youth Ministry with a Master of Divinity program, tend to consist of four years of study. You might also be interested in a service-based program, such as the Master of Arts in Urban Studies.

For services in the exercise of the ministry, members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld. They must pay social security and Medicare by filing Schedule SE (Form 1040), Self-Employment Tax.

Wages Continue to GrowThe national average salary for a youth pastor in 2020 was $48,938. This represents a 2.1 percent gain over the 2019 average. In fact, youth pastor salaries have increased by over 2 percent every single year for the past four years.

Youth pastors have a rather flexible work schedule. They work an average of 40 hours a week. Their working hours also depend on the schedule of activities.