A motion to release property is a pleading asking a judge to issue a ruling that will result in the release of property or a person from custody. When property is held in custody, a motion to release must be filed in order to get it back. There are a number of situations where this may become necessary. These can include cases where property is confiscated and the cause of the confiscation is later deemed spurious, as well as situations where people deposit money with a court as surety in a case or in response to a court order. For example, someone brought to small claims court and sued for back rent might write a check to the court for the amount owed, and the landlord would need to file a motion to release for the court to give him the money.

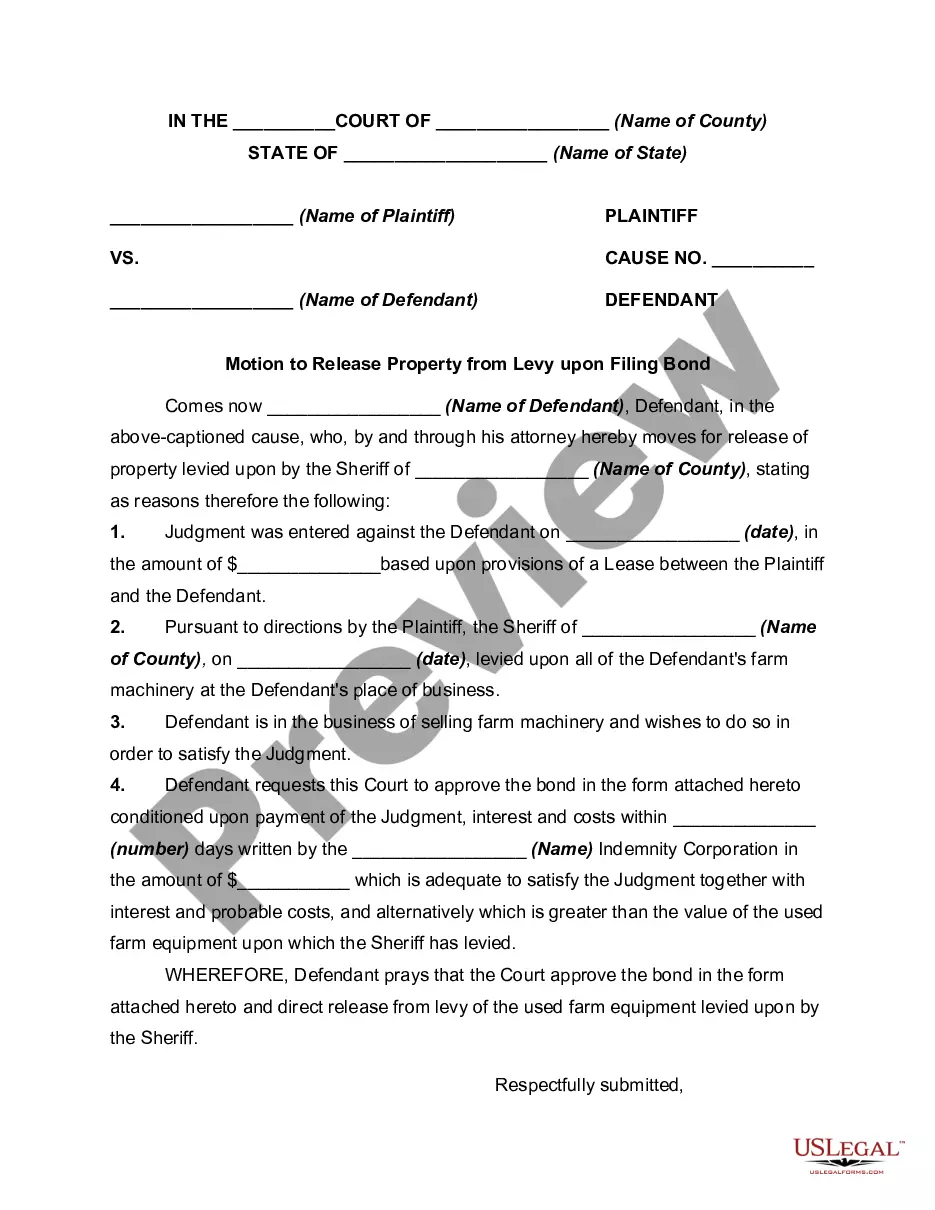

Oregon Motion to Release Property from Levy upon Filing Bond

Description

How to fill out Motion To Release Property From Levy Upon Filing Bond?

You are able to spend hrs on-line trying to find the authorized file design that fits the state and federal demands you will need. US Legal Forms offers a large number of authorized kinds that happen to be analyzed by specialists. You can actually down load or print the Oregon Motion to Release Property from Levy upon Filing Bond from the support.

If you already have a US Legal Forms account, you can log in and click the Down load switch. Following that, you can full, modify, print, or signal the Oregon Motion to Release Property from Levy upon Filing Bond. Each and every authorized file design you acquire is your own eternally. To get yet another duplicate of any acquired kind, visit the My Forms tab and click the related switch.

If you work with the US Legal Forms website the first time, follow the straightforward directions under:

- First, ensure that you have selected the correct file design to the county/area of your liking. Look at the kind outline to make sure you have selected the appropriate kind. If accessible, use the Review switch to search through the file design as well.

- If you would like locate yet another edition in the kind, use the Search area to obtain the design that meets your requirements and demands.

- Upon having located the design you desire, click Buy now to move forward.

- Select the costs program you desire, enter your credentials, and sign up for a free account on US Legal Forms.

- Full the transaction. You can use your bank card or PayPal account to pay for the authorized kind.

- Select the structure in the file and down load it for your product.

- Make modifications for your file if possible. You are able to full, modify and signal and print Oregon Motion to Release Property from Levy upon Filing Bond.

Down load and print a large number of file templates making use of the US Legal Forms web site, that offers the largest variety of authorized kinds. Use specialist and express-distinct templates to deal with your business or specific needs.

Form popularity

FAQ

The easy definition is that a judgment is an official decision rendered by the court with regard to a civil matter. A judgment lien, sometimes referred to as an ?abstract of judgment,? is an involuntary lien that is filed to give constructive notice and is to attach to the Judgment Debtor's property and/or assets.

A motion to modify or set aside an order or judgment or request a new hearing must be accompanied by an affidavit that states with reasonable particularity the facts and legal basis for the motion.

The judgment lien attaches to all real property that the judgment debtor acquires in the county at any time after the judgment is entered and before the judgment lien expires.

A writ of execution must be directed to a sheriff and must contain the name of the court, the names of the parties to the action and the case number for the action. The writ must contain a mailing address for the judgment creditor.

A judgment lien is any lien placed on the defendant's assets as a result of a court judgment. If a lien were placed on a home, the judgment creditor could then seek to foreclose on the property, in the same way a mortgage holder such as a bank could foreclose if it were not paid.

?Replevin? is a process whereby seized goods may be restored to their owner. In a replevin case, the Plaintiff claims a right to personal property (as opposed to real property/real estate) which has been wrongfully taken or detained by the defendant and seeks to recover that personal property.

Way too long to ignore. For non-governmental judgments, they last for 10 (yep, ten) years. And, so long as the creditor files a renewal prior to the expiration of that ten-year term, it is renewed for another 10 years.

The judge's decision is final. Once you receive your notice that the judgment was entered, you must send the defendant a written demand for payment. This letter must be sent by certified mail, return receipt requested. The Oregon Judicial Department does not provide forms for demand letters.