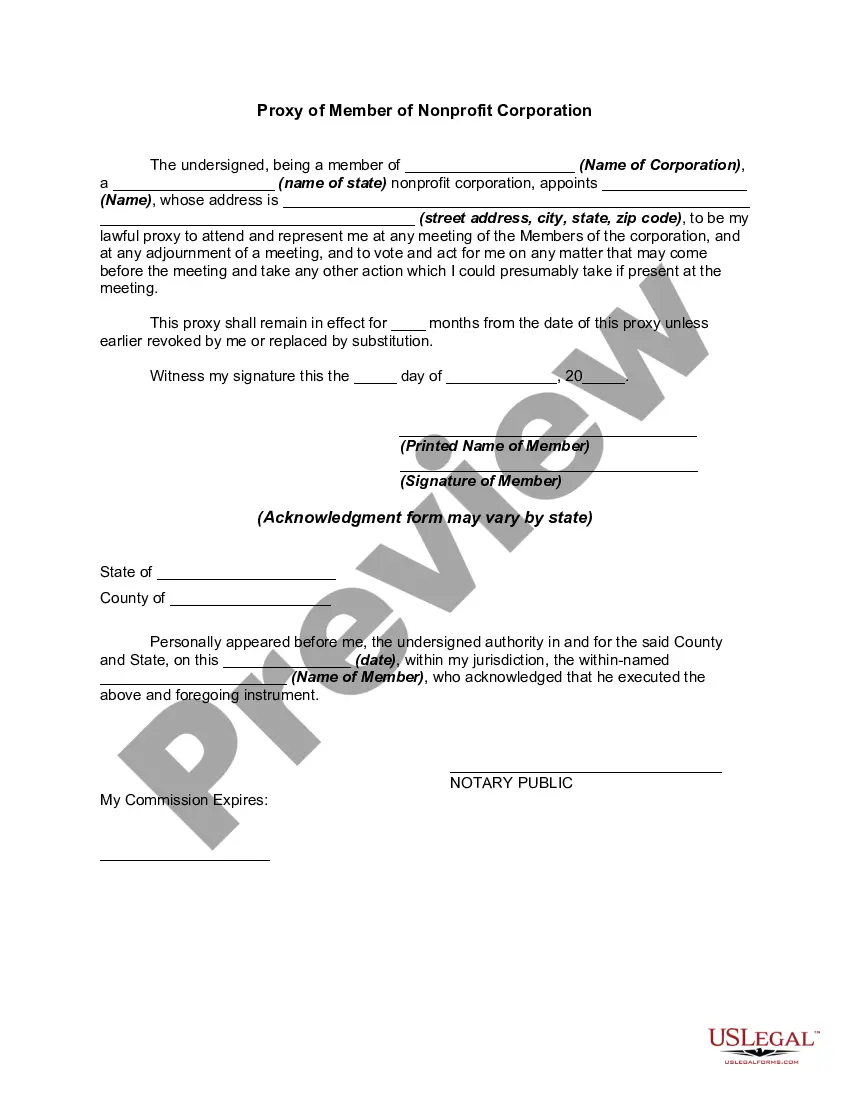

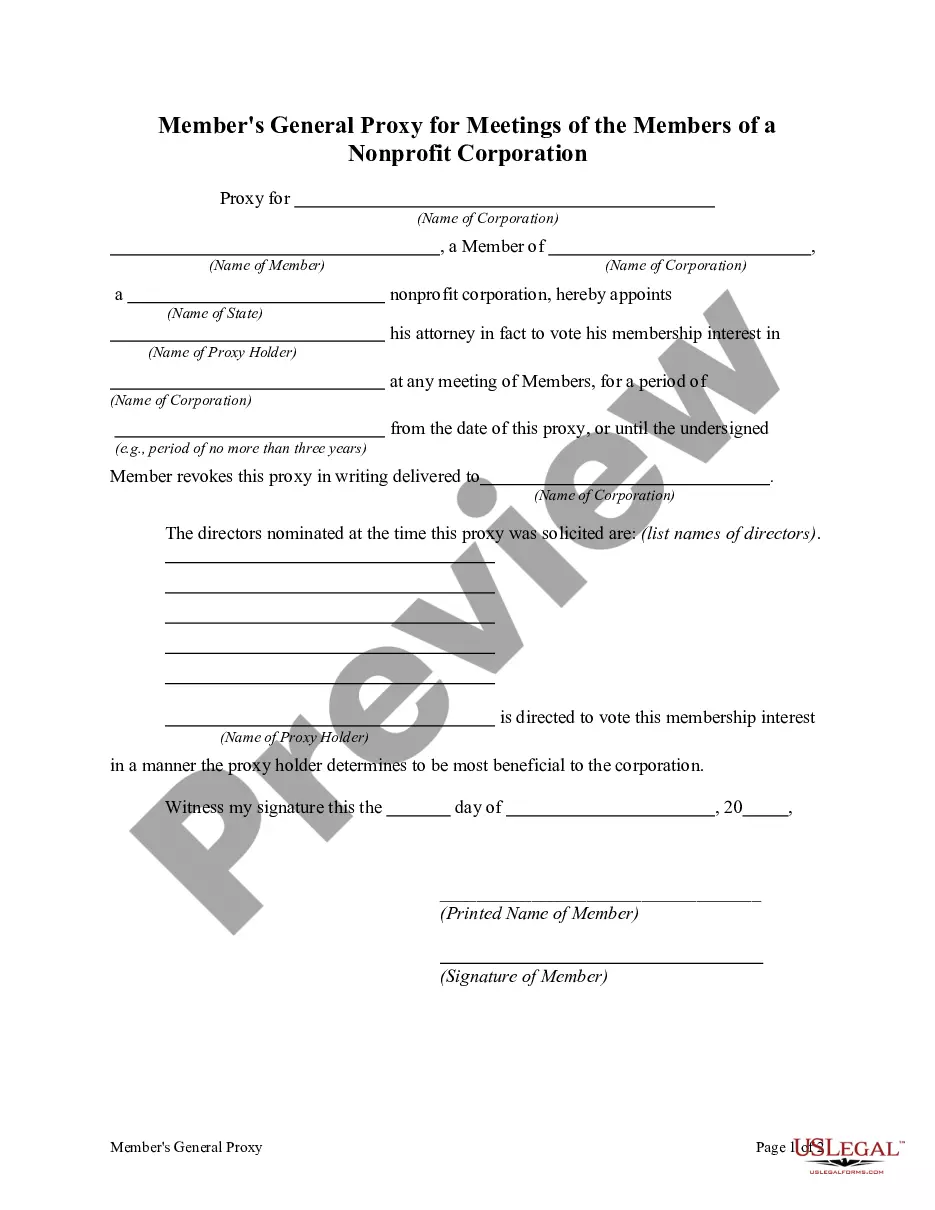

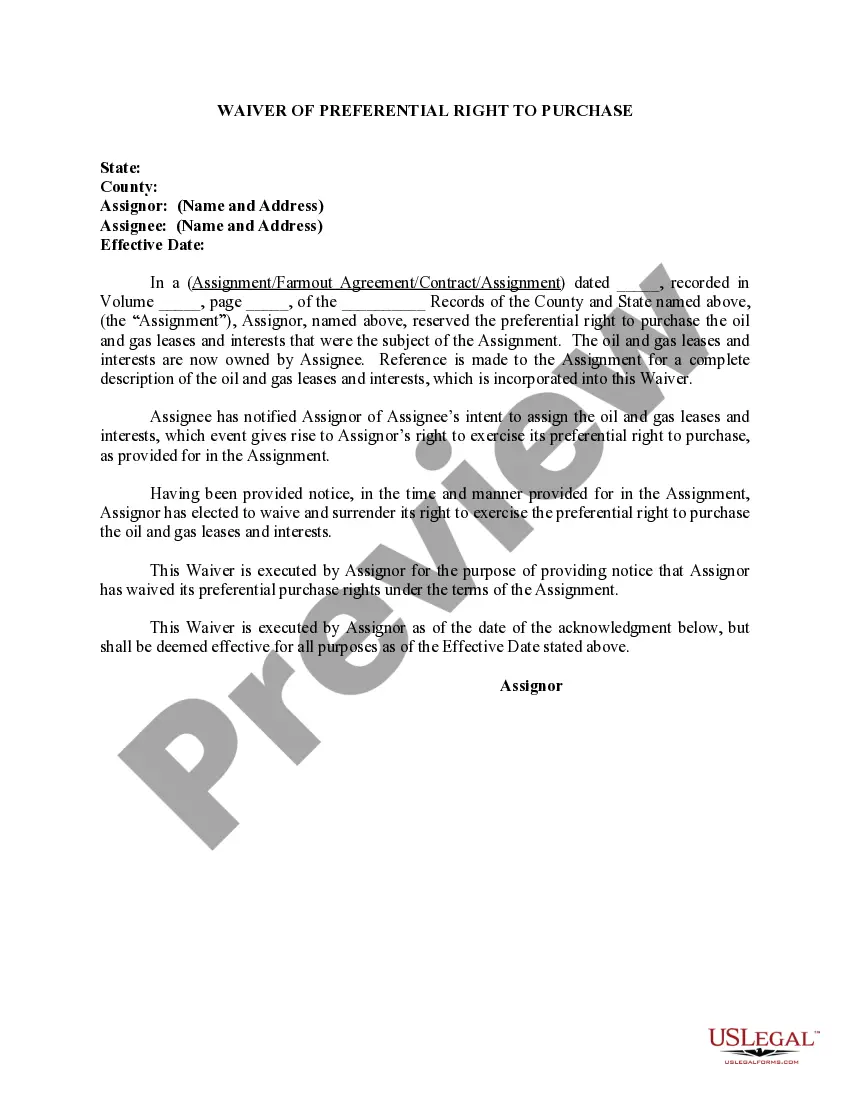

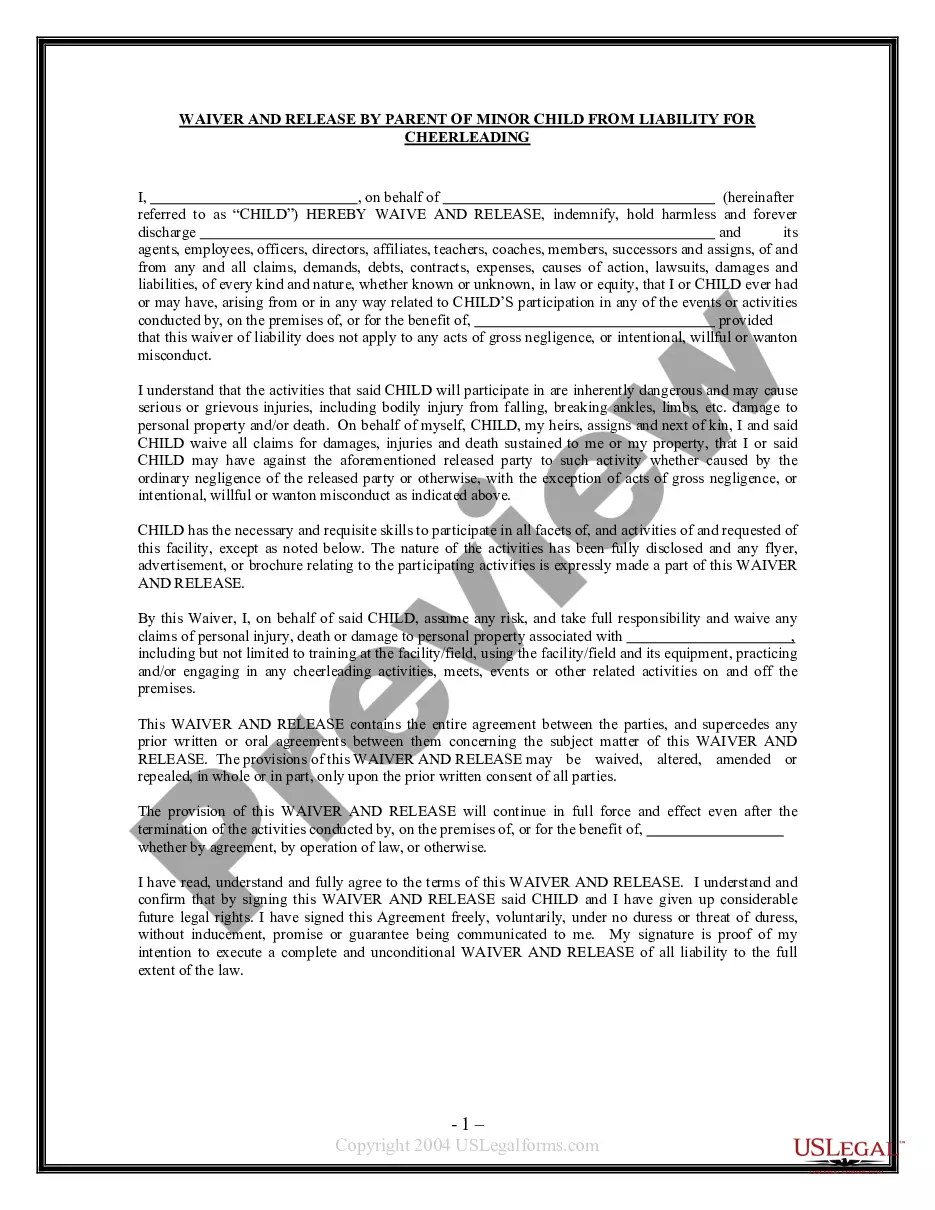

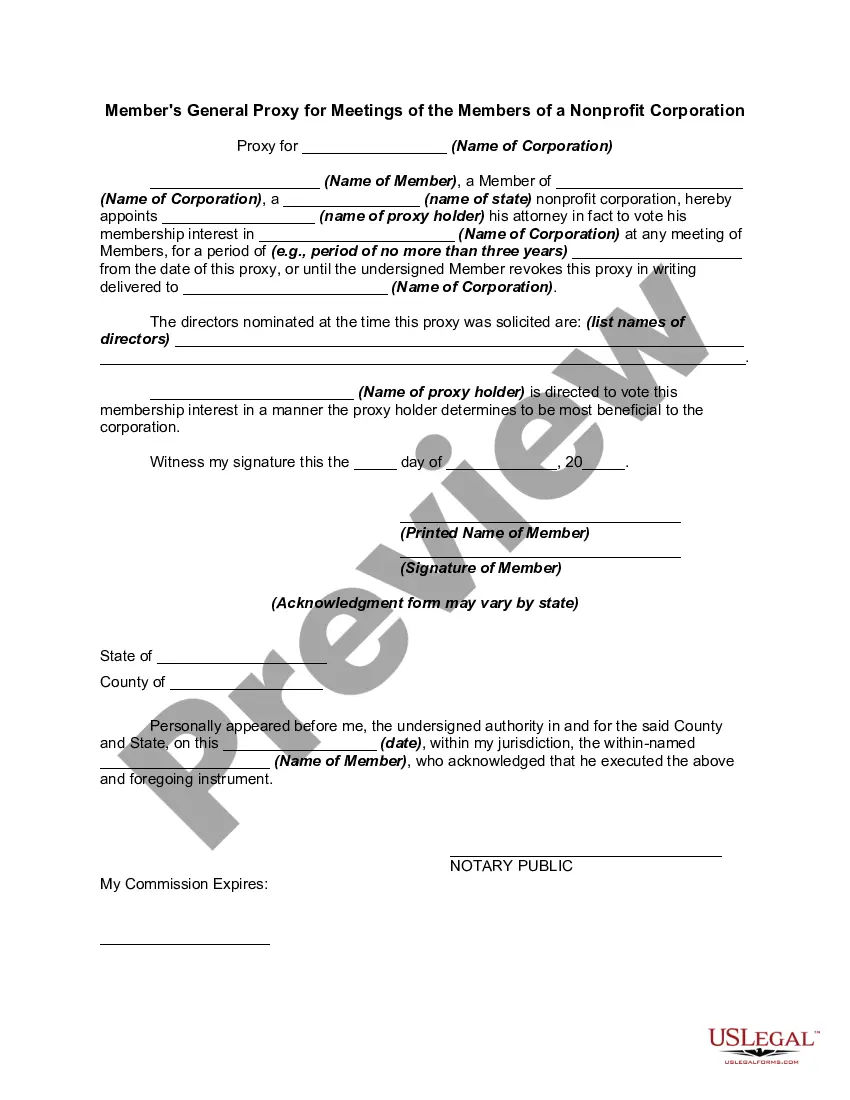

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Member's General Proxy for Meetings of the Members of a Nonprofit Corporation

Description

How to fill out Member's General Proxy For Meetings Of The Members Of A Nonprofit Corporation?

Finding the correct legal document template can be challenging. Naturally, there are numerous templates available online, but how do you locate the legal form you need.

Use the US Legal Forms website. The service provides a plethora of templates, including the Oregon Member's General Proxy for Meetings of the Members of a Nonprofit Corporation, suitable for both business and personal needs. All forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Oregon Member's General Proxy for Meetings of the Members of a Nonprofit Corporation. Use your account to review the legal forms you have previously acquired. Navigate to the My documents section of your account to retrieve another copy of the documents you need.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Oregon Member's General Proxy for Meetings of the Members of a Nonprofit Corporation. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to obtain professionally crafted documents that comply with state requirements.

- Firstly, ensure you have selected the appropriate form for your location/region.

- You can preview the form using the Review button and examine the form details to confirm it is suitable for your needs.

- If the form does not meet your requirements, use the Search feature to locate the correct form.

- Once you are confident that the form is appropriate, click on the Get now button to acquire the form.

- Choose your preferred pricing plan and enter the required information.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

Two or more offices may be held by the same individual, except the president may not also serve as secretary or treasurer.

Unless otherwise prohibited by the bylaws, a person can usually hold more than one office in a nonprofit organization. It is not unusual in a small organization for the same person to serve as both secretary and treasurer, for example.

A conflict of interest occurs when a director, officer, key employee, or other person in a position to influence the nonprofit (an insider) may benefit personally in some way from a transaction or relationship with the nonprofit organization that he or she serves.

Board directors are not employees and instead have a unique legal status with respect to corporations. Board directors are typically compensated for their service through stipend, equity, or both. Board directors also clearly perform a service for the corporate entities that appoint them.

Yes and no. In most states it is legal for executive directors, chief executive officers, or other paid staff to serve on their organizations' governing boards. But it is not considered a good practice, because it is a natural conflict of interest for executives to serve equally on the entity that supervises them.

Can the same person be the President, Secretary and Treasurer of a corporation? Yes. A single individual may simultaneously serve as President, Secretary and Treasurer. This is common in small corporations.

A nonprofit can have a president/CEO and an executive director if the organization maintains a specific structure. For example: President/CEO who has full authority for operations.

Board members are not considered employees of the organization, even though they may be compensated for participation on retainer or with per-meeting fees. Board members are typically outside experts and leaders who hold full-time positions of leadership outside in their chosen profession.

Directors and officers who are paid by a nonprofit must be classified for payroll and other tax purposes. They can either be employees or independent contractors. The nonprofit must withhold and pay payroll taxes to the IRS for employees. There is no such requirement for independent contractors.

Can my board of directors contain family members? Yes, but be aware that the IRS encourages specific governance practices for 501(c)(3) board composition. In general, having related board members is not expressly prohibited.