Oregon Employee Suggestion Form

Description

How to fill out Employee Suggestion Form?

You can dedicate numerous hours online searching for the authorized document template that aligns with the federal and state regulations you desire.

US Legal Forms offers thousands of legal templates that are examined by professionals.

It is easy to obtain or print the Oregon Employee Suggestion Form from my services.

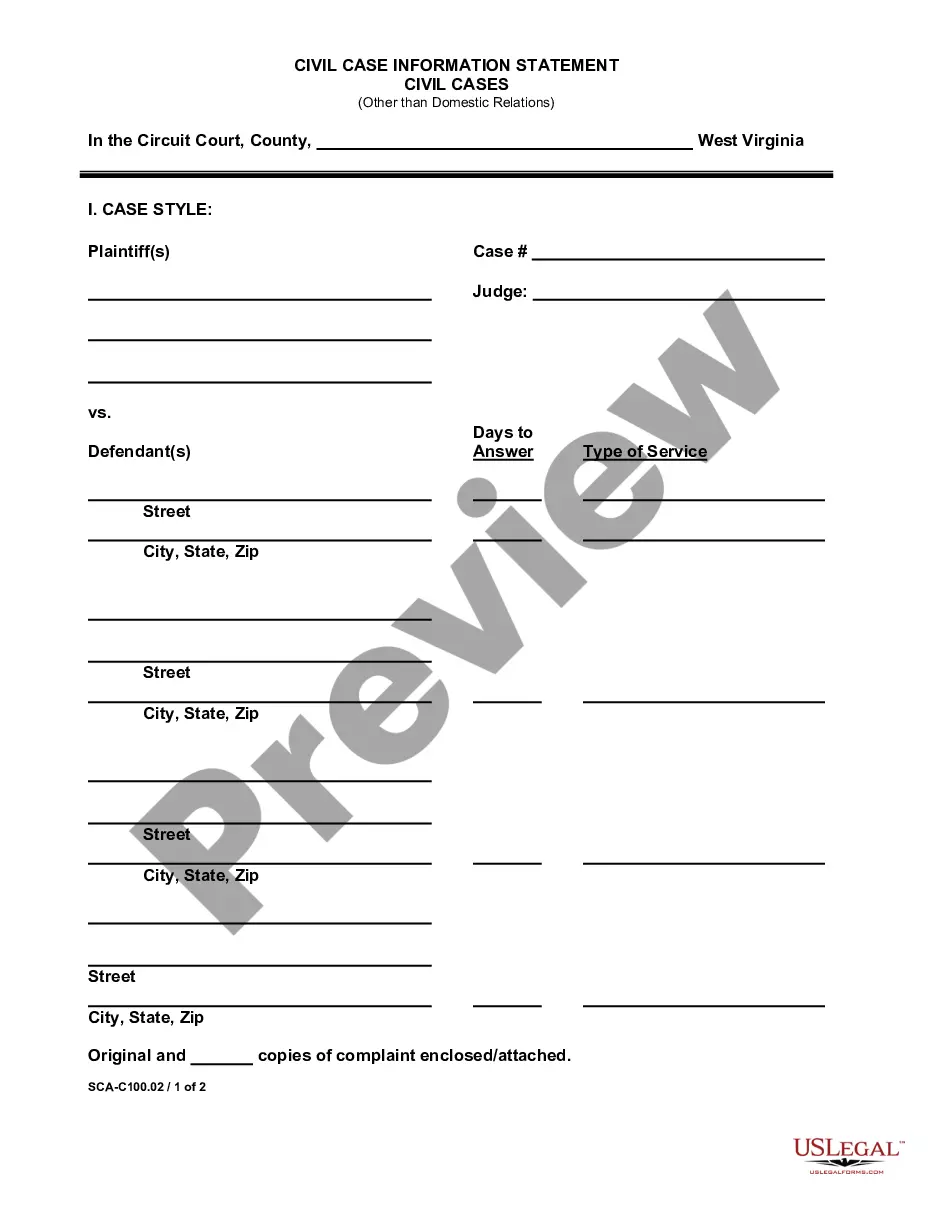

If available, use the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, edit, print, or sign the Oregon Employee Suggestion Form.

- Every legal document template you download is your property indefinitely.

- To retrieve another copy of any purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Check the form outline to confirm you have chosen the correct form.

Form popularity

FAQ

Form 40 is the tax return form specifically designed for Oregon residents to report their taxable income and calculate their tax obligations. This form is essential for anyone who meets the income requirements set by the state. Accurately completing this form helps ensure compliance with Oregon tax laws. For easy access to the form and assistance, check out USLegalForms, which offers comprehensive resources.

You can file your Oregon OQ online through the Oregon Department of Revenue's official website. This digital approach is convenient and allows for quicker processing times compared to paper forms. Be sure to follow all prompts carefully to ensure successful submission. For a smoother experience, visit USLegalForms for guidance on online filing processes.

Form 132 in Oregon is a tax credit form used for various purposes, including business tax credits and other specific tax benefits. This form helps to claim credits that reduce your tax liability. Understanding the use and eligibility for this form is crucial for accurate tax filing. USLegalForms can help demystify such forms by providing user-friendly explanations and templates.

Filing an Oregon state tax return is necessary if your income exceeds state-defined thresholds or if you have specific tax liabilities. Review your financial situation carefully, as nonfiling can lead to penalties. If you're unsure, use resources like USLegalForms for clarification and access to relevant forms to assist you.

You need to file form 40 if you are a resident of Oregon and meet the income filing requirements set by the state. This is the standard form for reporting individual income taxes. If your income reaches the designated threshold, filing is mandatory. Platforms like USLegalForms can provide the necessary forms and additional guidance.

To amend your Oregon OQ form, retrieve the original form you submitted and fill out a new version, marking the necessary changes. Clearly label this new submission as an amendment to avoid confusion. After completing the form, submit it according to the instructions for the original filing. Using USLegalForms can simplify this process by providing essential guidance and resources.

You need to file Oregon form OR WR if you are claiming a refund for any Oregon taxes withheld during the tax year. This form allows individuals to report their withholding and request any eligible refunds. Ensure that you have accurate records of your withholding amounts. For streamlined filing, check out USLegalForms, which provides helpful tips and the necessary forms.

Whether you need to file taxes on a $5,000 income depends on your filing status and other sources of income. Generally, individuals who make below a certain income threshold may not be required to file. However, consider filing anyway if you had tax withheld, as you may receive a refund. Resources like USLegalForms can offer clarity on your filing obligations.

To change your Oregon tax withholding, complete the Employee's Withholding Allowance Certificate, also known as the Oregon form W-4. Submit this updated form to your employer, who will adjust your tax deductions accordingly. Be proactive about reviewing your withholding annually or when your financial situation changes. Resources like USLegalForms provide templates and instructions for these documents.

If you live or work in the Portland Metro area and your income exceeds the threshold, then you must complete form MET 40. This form applies to both residents and non-residents who meet the income criteria. It's essential to stay compliant by filing accurately. For assistance, consider utilizing USLegalForms, which offers insights on Portland tax requirements.