Oregon Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

US Legal Forms - among the largest collections of legal documents in the USA - offers a vast selection of legal document templates that you can download or print.

While utilizing the site, you can find thousands of documents for business and personal purposes, categorized by types, states, or keywords. You will discover the most recent versions of templates such as the Oregon Notice of Default on Promissory Note Installment in just minutes.

If you already have an account, Log In and download the Oregon Notice of Default on Promissory Note Installment from your US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded documents from the My documents section of your account.

Make modifications. Fill out, edit, and print the downloaded Oregon Notice of Default on Promissory Note Installment.

Each template you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you need. Access the Oregon Notice of Default on Promissory Note Installment with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple tips to help you get started.

- Ensure you have selected the correct document for your city/state. Click the Preview button to review the document’s content. Check the document summary to ensure you have selected the appropriate template.

- If the document does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the document, confirm your selection by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finish the transaction.

- Choose the format and download the document to your device.

Form popularity

FAQ

To issue a notice of default, you first need to draft the document according to the requirements of your state. Ensure that you include all pertinent details such as borrower information and default specifics. After drafting the notice, deliver it to the borrower through a method that confirms receipt. Utilizing a template for an Oregon Notice of Default on Promissory Note Installment from uslegalforms can streamline this process.

An example of a default notice includes specific details such as the amount past due, the payment due date, and instructions on how to remedy the situation. It clearly identifies the obligations under the promissory note while also acting as a warning. For those seeking guidance, using an Oregon Notice of Default on Promissory Note Installment template can provide a solid foundation.

A notice of default on a promissory note is a formal declaration that a borrower has failed to meet the payment terms of the note. This notice informs the borrower of their delinquency and typically outlines the steps they can take to address it. Understanding the significance of this document helps ensure compliance with lending laws and protects your interests.

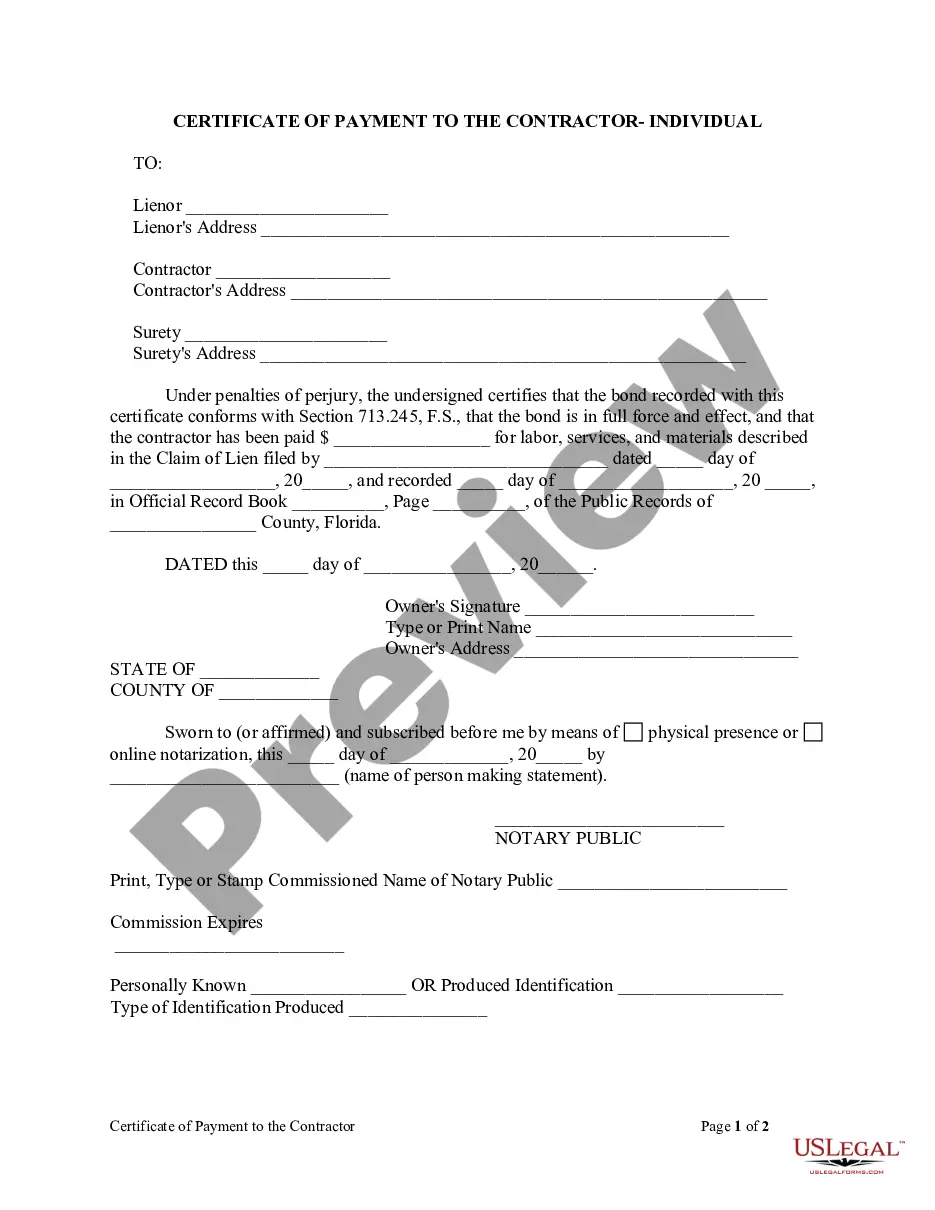

A notice of default typically includes the title 'Notice of Default,' followed by the date, borrower and lender's names, and a description of the default. Visually, it is clear and direct, often formatted as a formal letter. Utilizing an Oregon Notice of Default on Promissory Note Installment template from uslegalforms can help create an effective document.

Writing a notice of default begins with clearly stating the parties involved, the details of the promissory note, and the specific default terms. It is important to use concise language while including a deadline for the borrower to rectify the situation. By creating a professional Oregon Notice of Default on Promissory Note Installment, you establish a clear communication path.

When someone defaults on a promissory note, it’s essential to review the terms of the agreement first. You should then consider sending a formal Oregon Notice of Default on Promissory Note Installment. This notice serves as a crucial step in the process and notifies the borrower of the default, allowing you to potentially initiate collection efforts.

To issue a default notice, you first need to confirm that the borrower has indeed missed one or more payments on the promissory note. Then, draft a formal Oregon Notice of Default on Promissory Note Installment that clearly states the amount due, the payment history, and any applicable late fees. It is essential to send this notice to the borrower, allowing them the opportunity to rectify the situation. Consider using platforms like uslegalforms to access templates that simplify the process and ensure compliance with state laws.

To write a default notice for an Oregon Notice of Default on Promissory Note Installment, start by addressing the borrower clearly. Include details such as the amount owed, payment due dates, and the specific terms that were violated. It's important to state that the borrower has a right to remedy the default within a certain period. Providing a straightforward and professional tone enhances clarity and encourages prompt action.

The default rate on a promissory note is usually a higher interest rate that takes effect upon default. This rate serves as a penalty for failing to make timely payments. Understanding how the default rate applies can prepare you for potential consequences related to an Oregon Notice of Default on Promissory Note Installment.

The default clause of a promissory note outlines what constitutes default and the rights of the lender in such cases. This clause typically includes the processes for notifying the borrower and potential remedies. Recognizing the default clause's significance is vital when dealing with an Oregon Notice of Default on Promissory Note Installment.