Oregon Release of Lien for Materials

Description

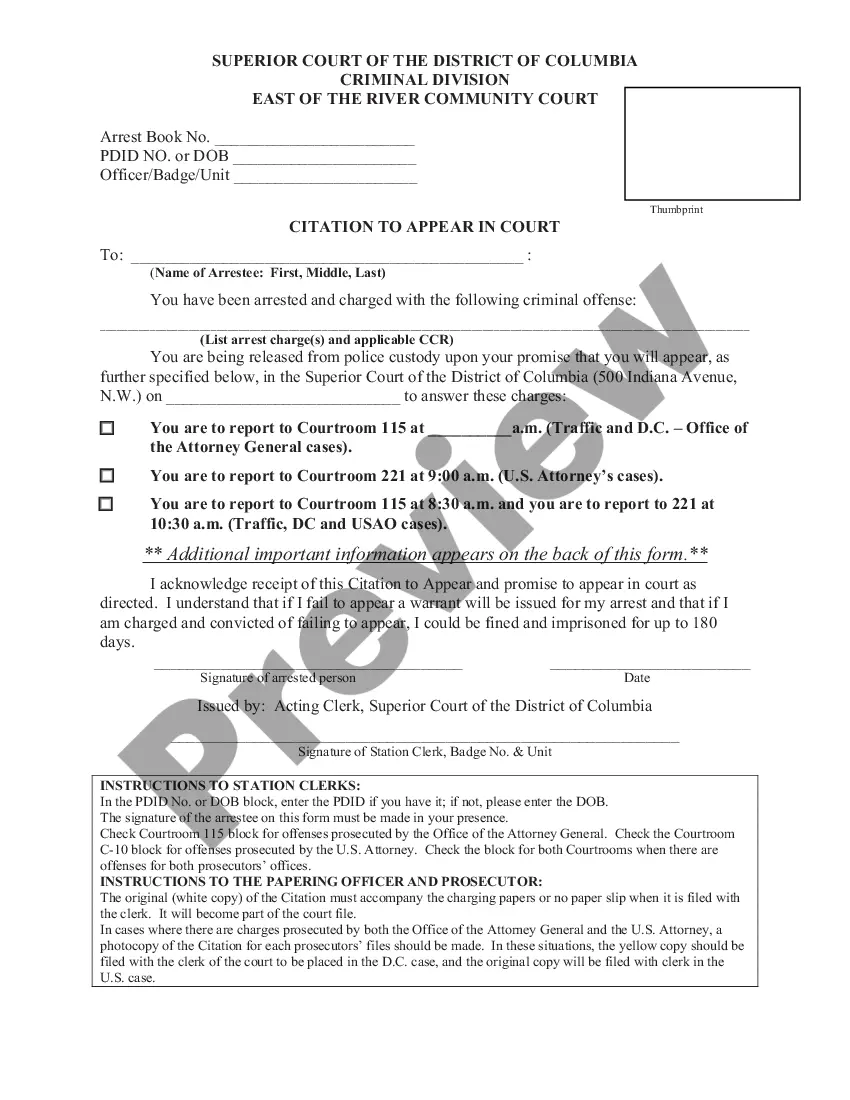

How to fill out Release Of Lien For Materials?

Choosing the best legitimate record format can be a have difficulties. Obviously, there are a lot of layouts accessible on the Internet, but how can you get the legitimate form you need? Use the US Legal Forms website. The assistance delivers a huge number of layouts, including the Oregon Release of Lien for Materials, which can be used for company and personal demands. Each of the varieties are checked by specialists and meet federal and state requirements.

If you are presently authorized, log in for your bank account and then click the Down load key to have the Oregon Release of Lien for Materials. Utilize your bank account to check through the legitimate varieties you have acquired in the past. Proceed to the My Forms tab of your own bank account and get one more copy of your record you need.

If you are a fresh consumer of US Legal Forms, listed below are basic guidelines that you should follow:

- Initial, make certain you have selected the right form for the metropolis/area. It is possible to check out the shape while using Preview key and study the shape description to make certain this is the best for you.

- In case the form will not meet your expectations, utilize the Seach field to find the correct form.

- When you are sure that the shape is acceptable, click on the Acquire now key to have the form.

- Pick the prices plan you need and enter in the necessary information. Create your bank account and pay money for your order using your PayPal bank account or bank card.

- Select the document format and obtain the legitimate record format for your gadget.

- Complete, modify and print and indication the obtained Oregon Release of Lien for Materials.

US Legal Forms may be the most significant local library of legitimate varieties in which you can find numerous record layouts. Use the service to obtain skillfully-produced files that follow condition requirements.

Form popularity

FAQ

How long does a judgment lien last in Oregon? A judgment lien in Oregon will remain attached to the debtor's property (even if the property changes hands) for ten years.

The deadline to file a lien in Oregon is the earlier of 75 days after the claimant's last furnishing of labor and/or materials or 75 days after the completion of the project.

No. There is no statutory requirement in Oregon that a lien waiver be notarized. However, OR Rev Stat § 701.630 (2015) specifically notes that an ?original contractor or subcontractor may require that . . . waivers of lien be notarized? by contract.

Under Oregon's laws, those who work on your property or provide labor, equipment, services or materials and are not paid have a right to enforce their claim for payment against your property. This claim is known as a construction lien.

Lien release bonds can be a useful way for owners to free their property from lien claims, enabling them to refinance or sell the property. While this does not free them from their obligation to pay off their debt, it serves as a substitute of one form of payment security to another. Bonding a Mechanics Lien: How Does it Work? - RCM&D rcmd.com ? blog ? bonding-a-mechanics-lie... rcmd.com ? blog ? bonding-a-mechanics-lie...

Statute of Limitation on Tax Collection However, the statute of 10 years limitation on judgment liens begins to run on a tax lien as soon as the tax warrant is filed pursuant to ORS 314.430. Such lien may be renewed by court order without loss of priority. Department of Revenue - Oregon Secretary of State sos.state.or.us ? oard ? viewSingleRule.action sos.state.or.us ? oard ? viewSingleRule.action

The bond shall be in an amount not less than 150 percent of the amount claimed under the lien, or in the amount of $1,000, whichever is greater.

No lien for materials or supplies shall have priority over any recorded mortgage or trust deed on either the land or improvement unless the person furnishing the material or supplies, not later than eight days, not including Saturdays, Sundays and other holidays as defined in ORS 187.010 (Legal holidays), after the ... ORS 87.025 ? Priority of perfected liens - OregonLaws - Public.Law public.law ? statutes ? ors_87 public.law ? statutes ? ors_87

Once you have received payment from the customer, you must complete and file an Oregon satisfaction of lien form to release a mechanic's lien in Oregon (also known as a construction lien). Oregon Lien Releases: How to Cancel a Lien in OR northwestlienservice.com ? blog ? oregon-lien-rel... northwestlienservice.com ? blog ? oregon-lien-rel...