The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. TILA applies only to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use. This form was designed to cover an situation where the Seller is not a creditor as defined by the TILA.

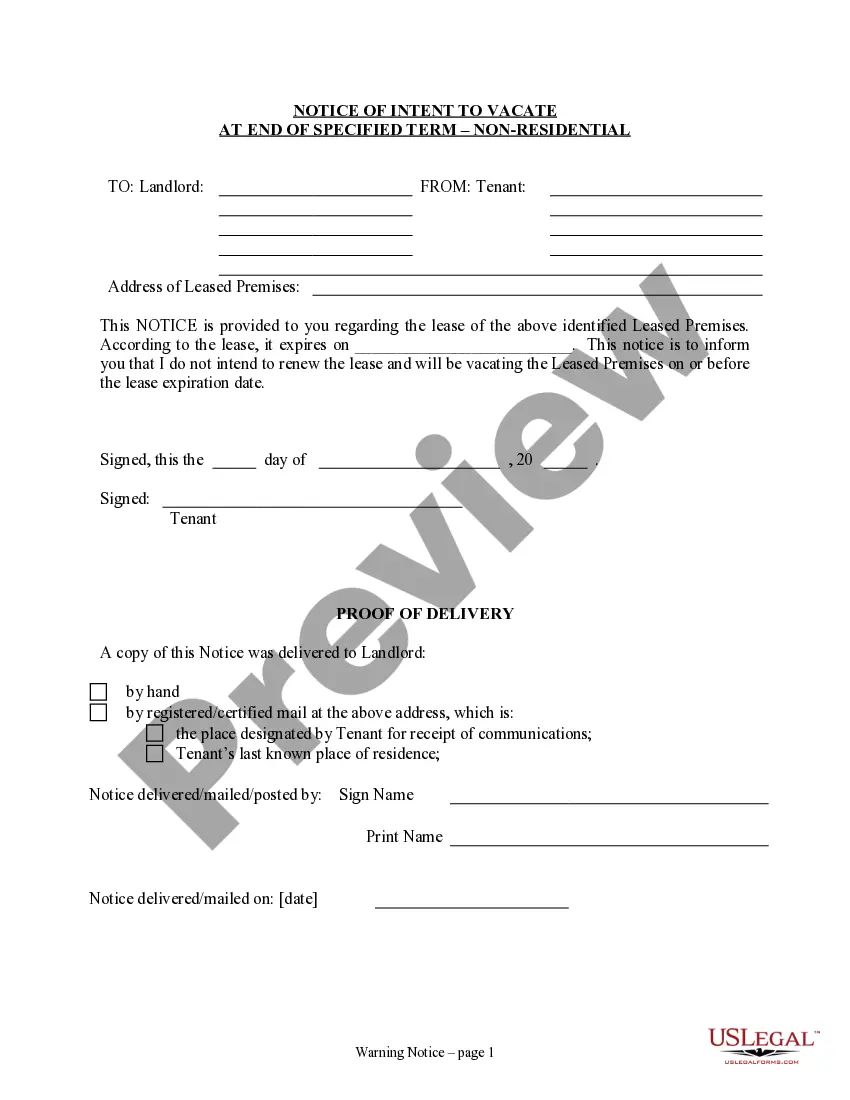

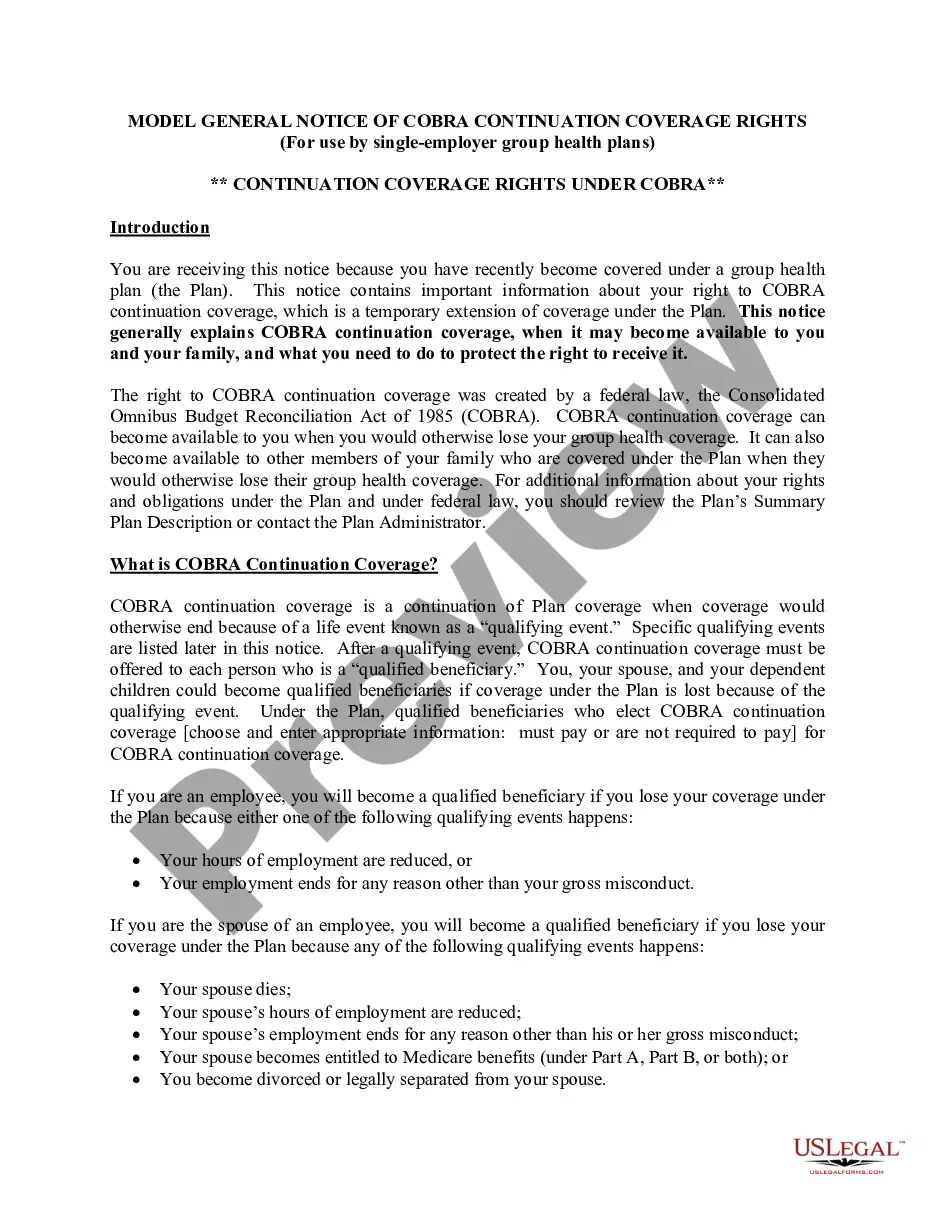

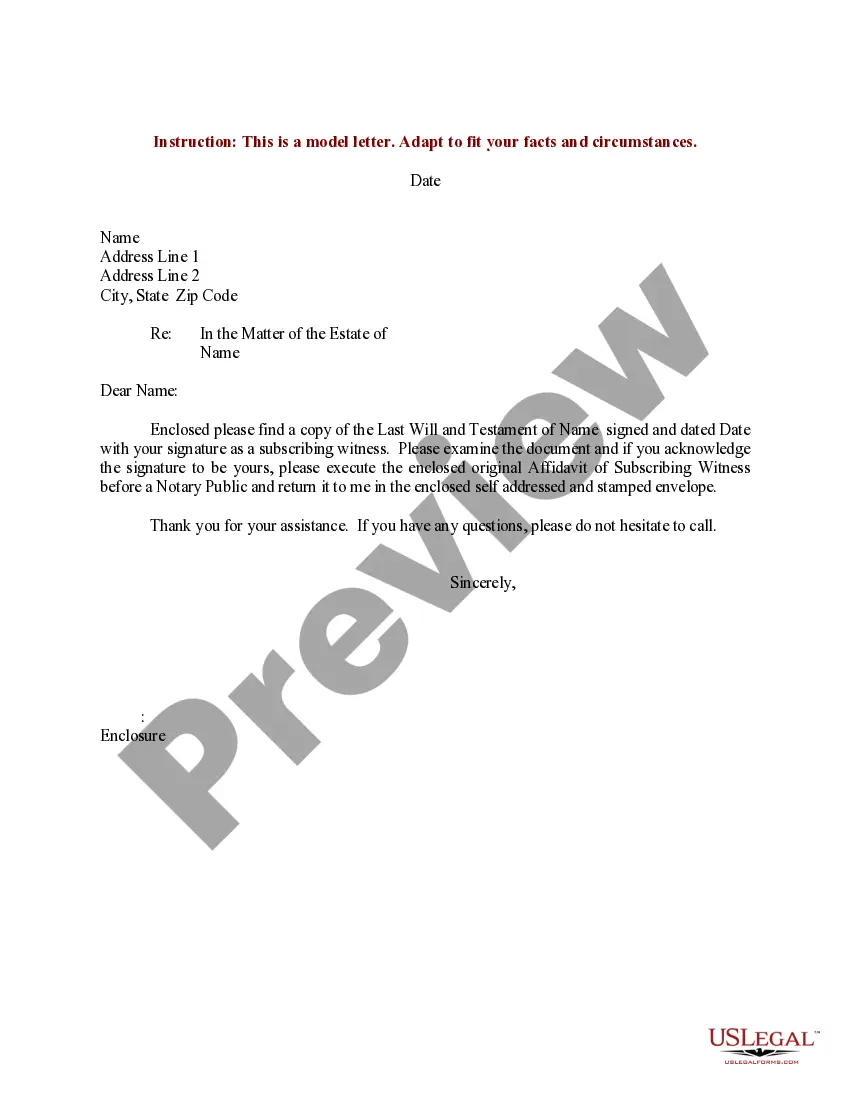

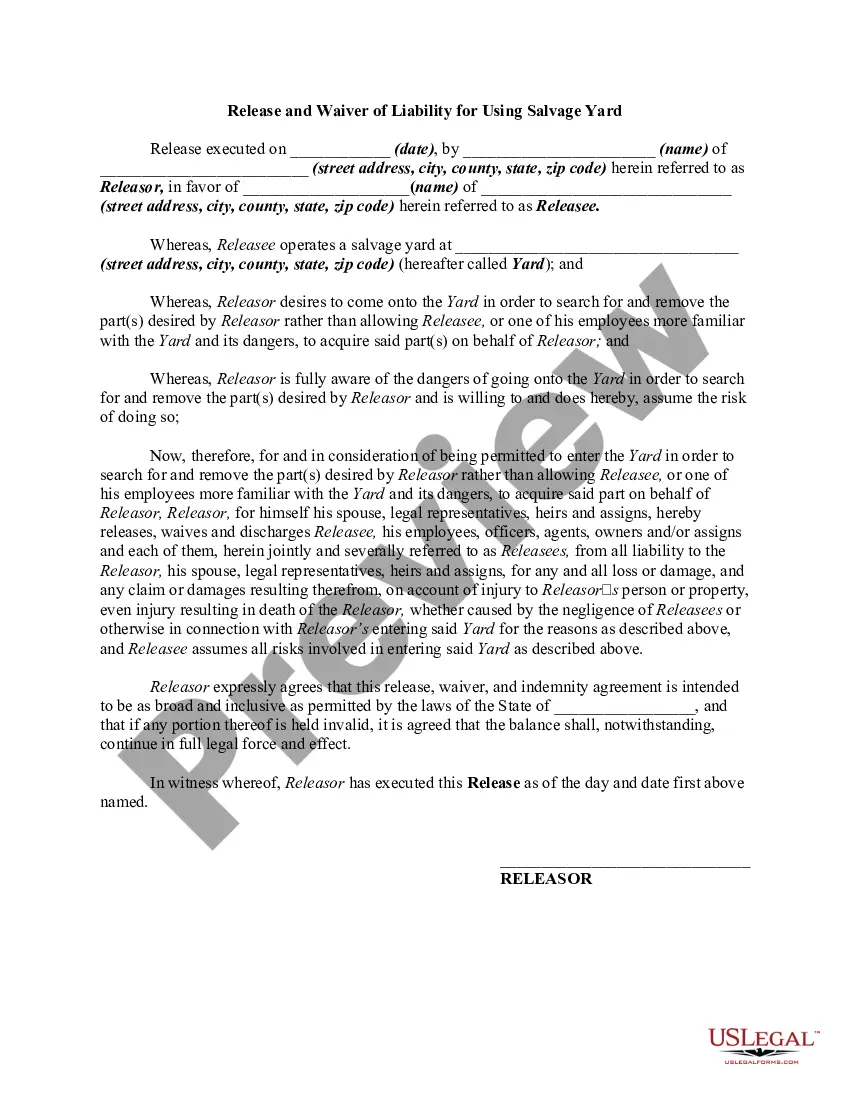

Oregon Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement

Description

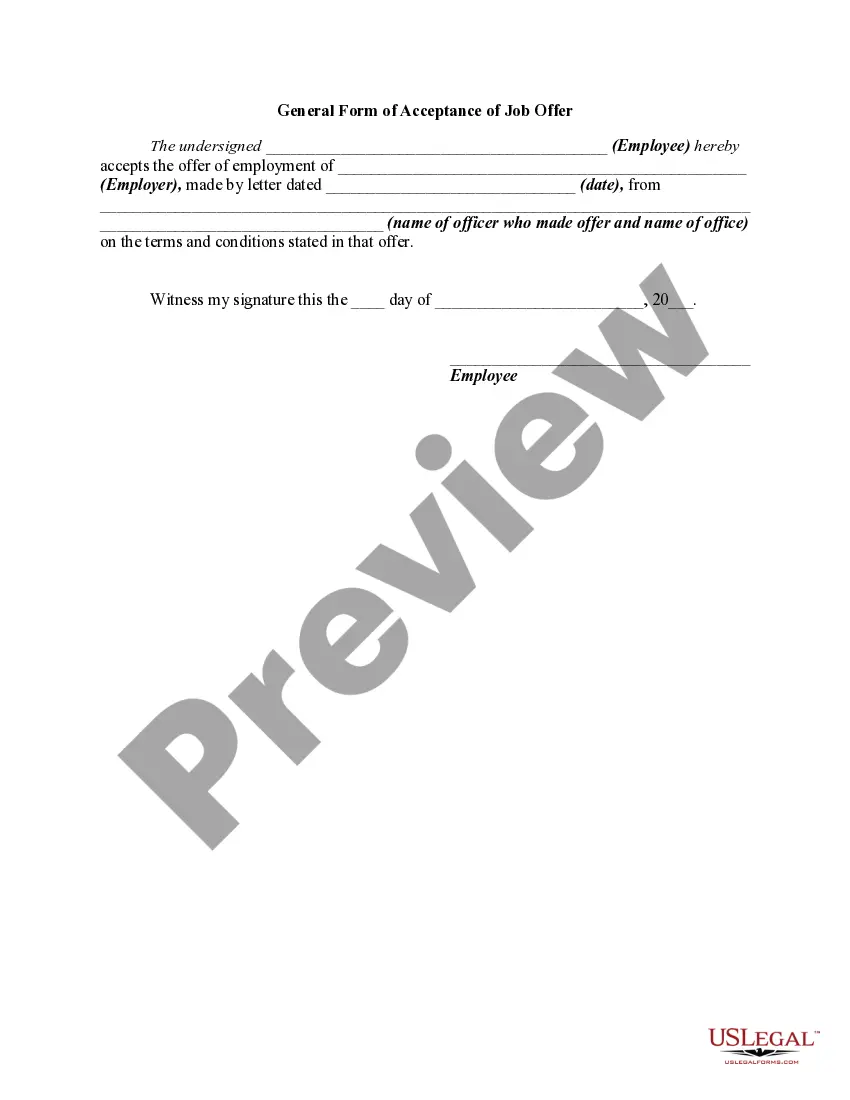

How to fill out Installment Sale Not Covered By Federal Consumer Credit Protection Act With Security Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms like the Oregon Installment Sale not governed by the Federal Consumer Credit Protection Act with Security Agreement in just minutes.

If the form does not meet your requirements, utilize the Search bar at the top of the screen to find the right one.

If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred pricing plan and provide your details to register for an account.

- In case you already have a subscription, Log In and retrieve Oregon Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement from the US Legal Forms library.

- The Download button will appear on each document you access.

- You have access to all previously purchased forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple instructions to get started.

- Make sure you have selected the correct form for your region/state.

- Click the Preview button to review the contents of the form.

Form popularity

FAQ

Yes, you can choose to elect out of an installment sale, but it typically involves specific conditions. If both parties agree, they can modify the terms or terminate the contract. It is advisable to review the terms of the Oregon Installment Sale not covered by the Federal Consumer Credit Protection Act with Security Agreement to ensure compliance with any legal requirements. Legal guidance can also help navigate this process efficiently.

In the case of an installment sale, the property does not automatically receive a step-up in basis at death. The tax implications depend on several factors, including how the property is held. It is crucial to examine how a contract is structured within an Oregon Installment Sale not covered by the Federal Consumer Credit Protection Act with Security Agreement. Consulting with a tax professional can provide insights specific to your situation.

Typically, both sellers and buyers can benefit from an installment sale, depending on their goals. Sellers can receive steady income over time while transferring property ownership. Buyers enjoy the flexibility of making payments instead of paying the full amount upfront. Therefore, an Oregon Installment Sale not covered by the Federal Consumer Credit Protection Act with Security Agreement can create a mutually beneficial arrangement.

When an installment sale contract lacks provisions for interest payments, the buyer generally pays only the principal amount over time. This arrangement can benefit the buyer by reducing overall costs. However, it is essential to clarify this aspect in the Oregon Installment Sale not covered by the Federal Consumer Credit Protection Act with Security Agreement, as it may affect the seller's expectations. Consider discussing this with a legal expert to understand the implications fully.

If the buyer cannot make payments on an Oregon Installment Sale not covered by the Federal Consumer Credit Protection Act with Security Agreement, the seller may have the right to terminate the contract. In this case, the seller can reclaim the property, provided that the contract allows it. The seller may also seek any unpaid payments through legal means. It is important to review the specific terms laid out in the contract.

A home solicitation contract is a legally binding agreement made between a seller and a buyer during a direct sales encounter at the buyer's home. These contracts must meet specific legal requirements to protect consumer rights. Recognizing the implications of such contracts, especially in relation to the Oregon Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, is important for making informed purchasing decisions.

The Oregon Home Solicitation Act specifically addresses sales that take place at homes or other non-commercial venues. This law not only protects consumers but also establishes guidelines that sellers must follow to ensure fair practices. Knowledge of the Oregon Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement is crucial when navigating these regulations.

Electing out of installment sale reporting involves notifying the seller of your choice not to report the transaction. This can be particularly relevant in contexts involving the Oregon Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement. To ensure compliance and understanding, consider using resources like uslegalforms, which offer guidance on necessary steps and documentation.

Oregon's solicitation law regulates how sellers can approach consumers at home. It requires sellers to provide clear information about their products, avoid deceptive practices, and allows consumers to cancel a sale if they feel pressured. Understanding how these laws connect to the Oregon Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement is essential for both buyers and sellers.

The Home Solicitation Sales Act in Oregon governs transactions made in a consumer's home, ensuring transparency in sales practices. This act provides consumers with the right to cancel a transaction made at home within three days. If you are entering into an Oregon Installment Sale not covered by the Federal Consumer Credit Protection Act with Security Agreement, you should be aware of these rights. Uslegalforms provides the information you need to make informed decisions in your home transactions.