Oregon Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Consumer Loan Application - Personal Loan Agreement?

If you wish to finish, download, or print valid document formats, utilize US Legal Forms, the largest collection of legal templates available online.

Employ the site’s straightforward and convenient search to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and input your details to create an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Oregon Consumer Loan Application - Personal Loan Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Oregon Consumer Loan Application - Personal Loan Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/country.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read through the description.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the screen to find other versions of your legal form template.

Form popularity

FAQ

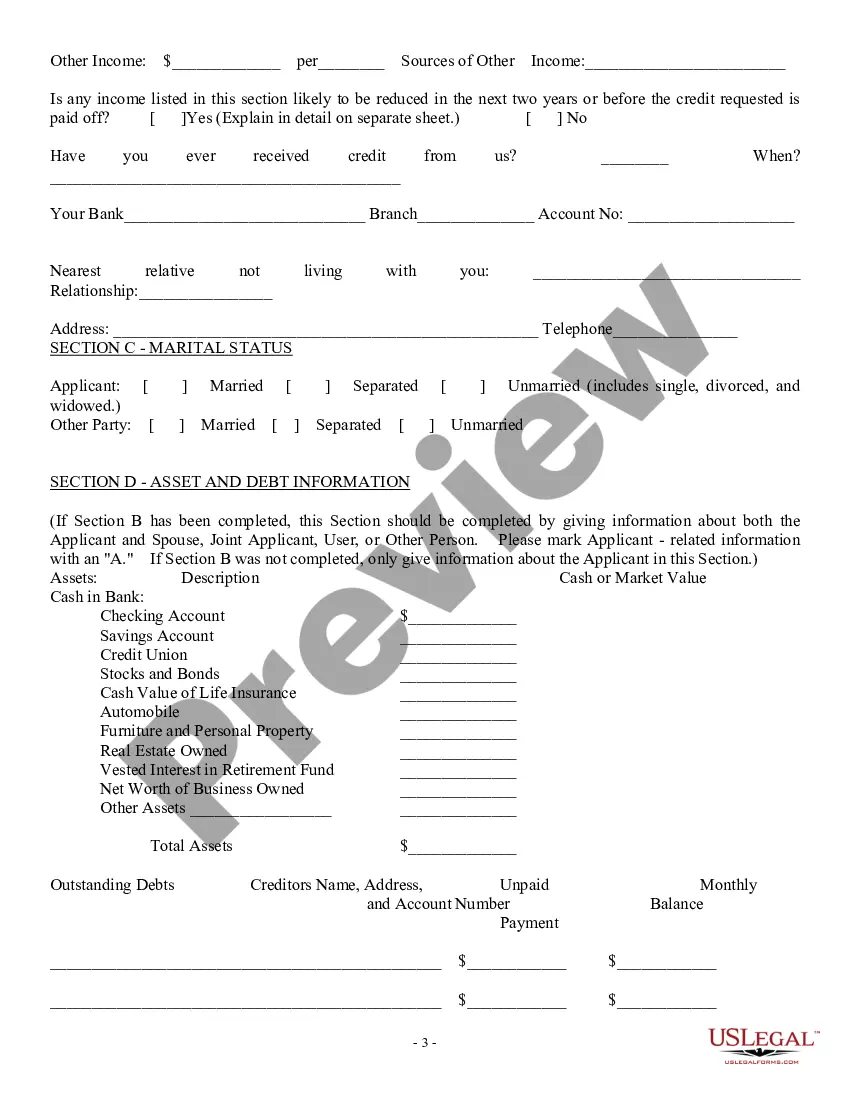

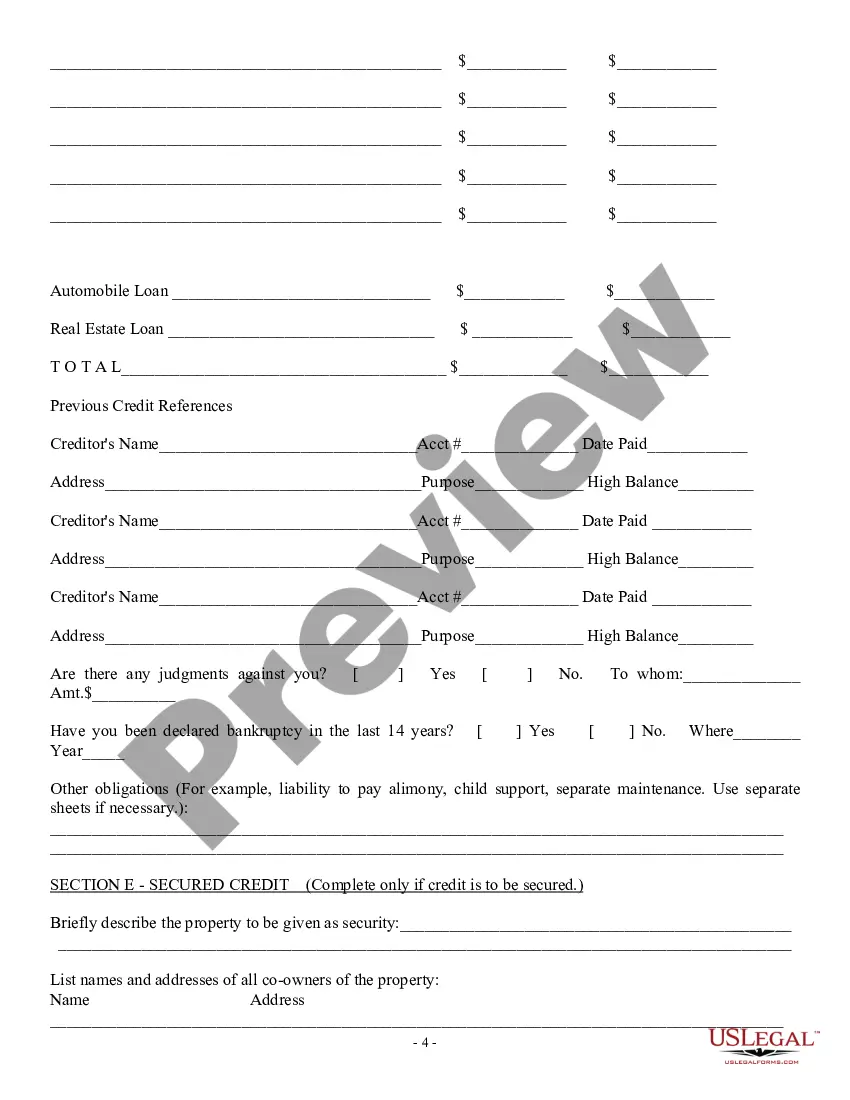

A secured loan uses an asset you own as collateral; the lender can take the asset if you don't repay the loan. An unsecured loan requires no collateral. They usually have higher interest rates than secured loans because they are riskier for lenders.

Consumer credit, or consumer debt, is personal debt taken on to purchase goods and services. Although any type of personal loan could be labeled consumer credit, the term is more often used to describe unsecured debt of smaller amounts.

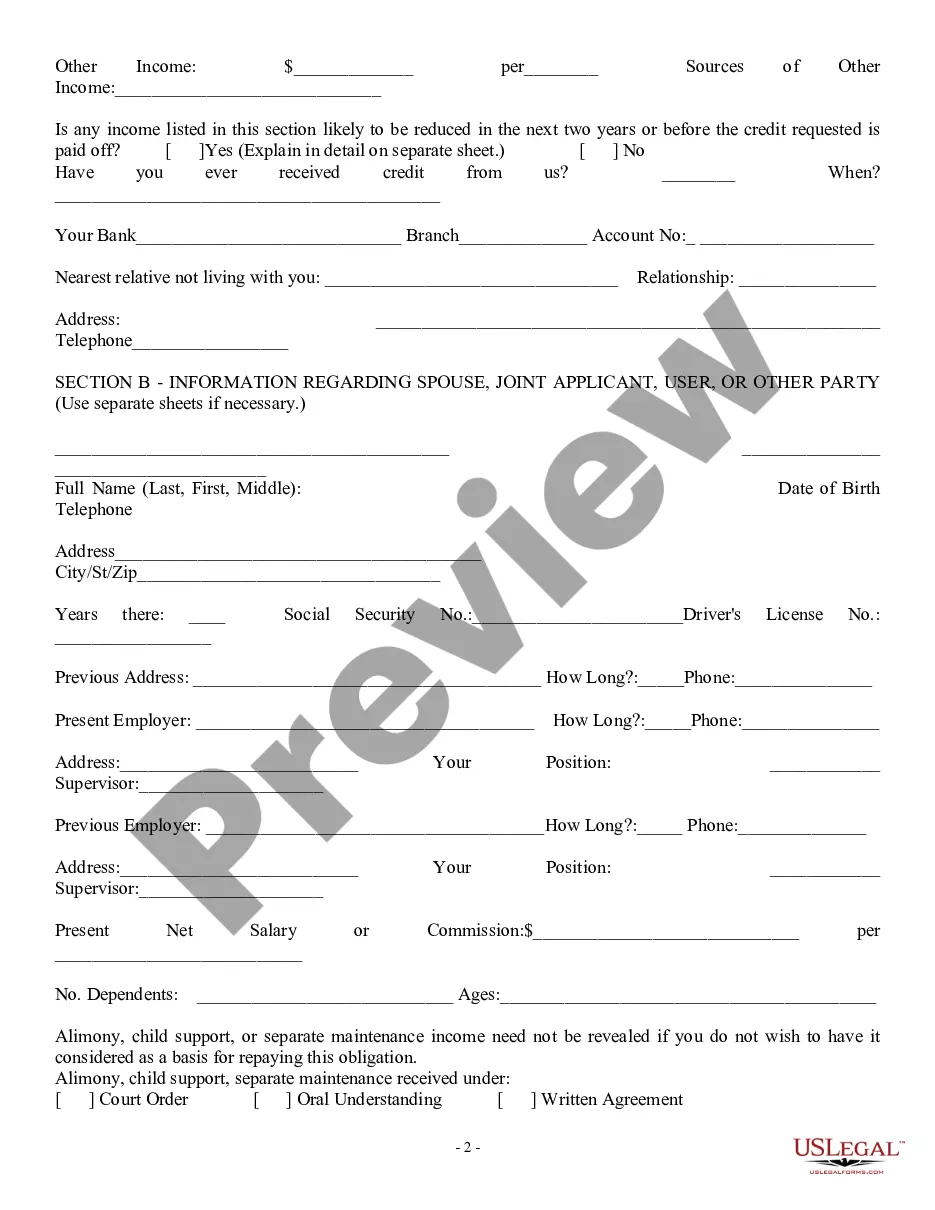

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Consumer lending includes closed- and open-end credit extended to individuals for household, family, and other personal expenditures and includes credit cards, auto loans, and student loans.

You can get a personal loan with a job offer letter through Upstart, as long as the offer letter states your future start date and compensation. Some other lenders may also accept a job offer letter as proof of employment, but it's not common for major personal loan providers.

The biggest difference between a consumer loan and a personal loan is that consumer loans can include revolving credit. Personal loans are nonrevolving financial lending products that provide borrowers with a lump sum of money and payment schedule for repaying the loan.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

A personal loan (also known as a consumer loan) describes any situation in which an individual borrows money for personal need, including making investments in a company. All personal loans have three common elements: Evidence of the debt (promissory note)