Oregon Employment Verification Letter for Social Security

Description

How to fill out Employment Verification Letter For Social Security?

Selecting the appropriate legitimate document template can pose challenges.

Indeed, there are numerous designs accessible online, but how do you locate the official form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions to follow: First, ensure you have selected the correct form for the city/state. You can review the form using the Preview option and read the form description to confirm it is the right one for you. If the form does not meet your needs, use the Search area to find the correct form. Once you are confident that the form is appropriate, click the Acquire now option to obtain the form. Choose the pricing plan you desire and input the required information. Create your account and pay for the transaction using your PayPal account or Visa or Mastercard. Select the document format and download the legal document template to your device. Complete, modify, and print and sign the downloaded Oregon Employment Verification Letter for Social Security. US Legal Forms is the largest library of legal forms where you can access a variety of document templates. Use the service to download properly crafted paperwork that conform to state standards.

- The platform offers thousands of templates, including the Oregon Employment Verification Letter for Social Security, which is applicable for both business and personal needs.

- All of the forms are verified by experts and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Obtain option to retrieve the Oregon Employment Verification Letter for Social Security.

- Use your account to browse through the legal forms you may have obtained previously.

- Go to the My documents tab of your account to download another copy of the documents you require.

Form popularity

FAQ

Qualifications for EUC:Your base year wages must equal or exceed 40 times your weekly benefit amount. (If your claim pays 26 weeks of benefits, you have met this qualification.) Your most recent claim must have tired regular benefits or be expired.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

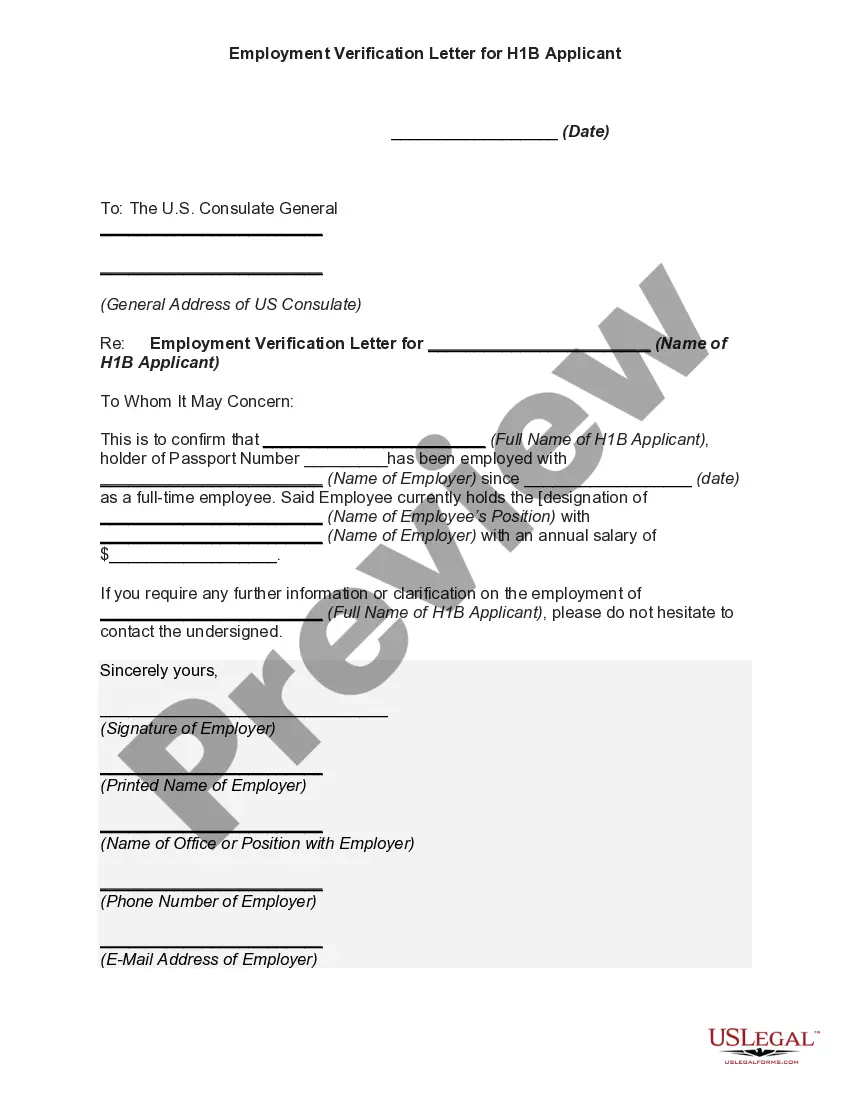

Pay stubs and W-2 forms are commonly used as proof of employment.Your employer may write a verification letter or use an automated verification service to confirm your job title, employment history, and salary information.More items...?

Additional information about SSNVS may be found at . Employers and third-party submitters will be able to verify up to 10 employee SSNs using speech recognition technology through this automated telephone application.

How Can You Run a Background Check on Yourself?Online databases. Search online public records databases to see your information.Social media. Google yourself and look at your social media profiles.Court records.References.Credit report.The right background check company.

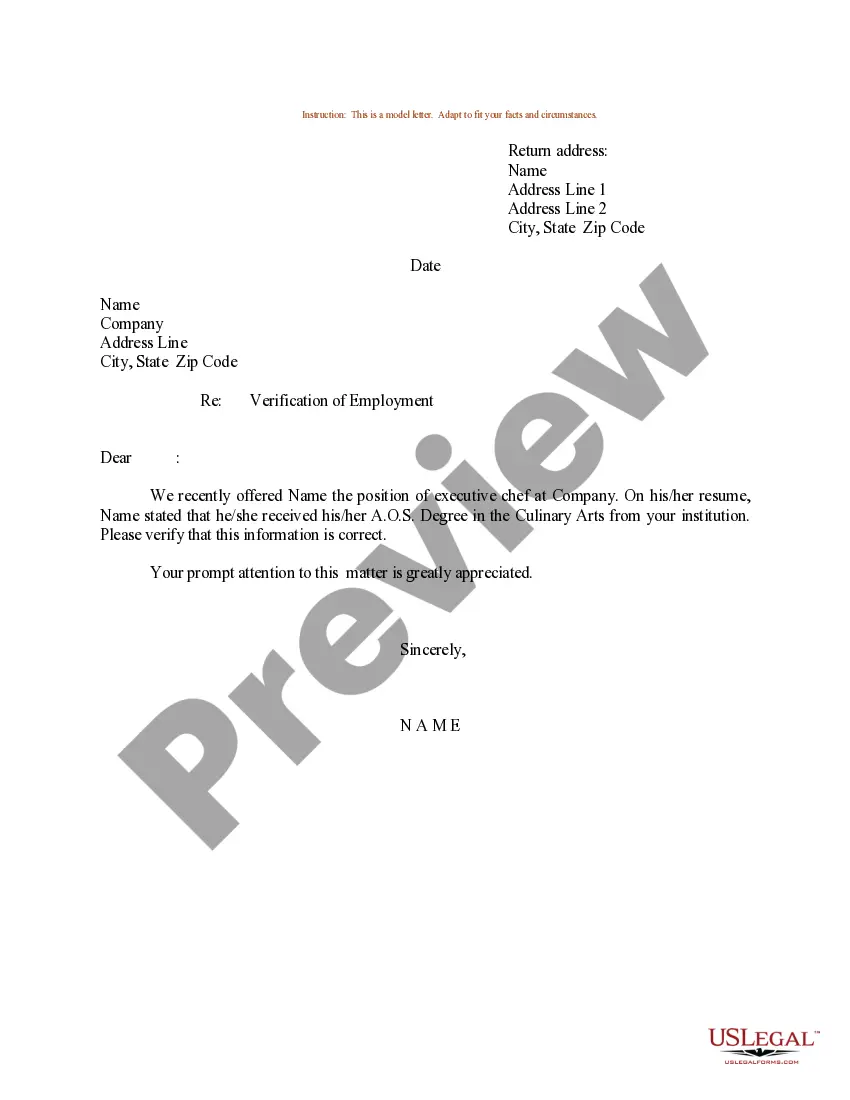

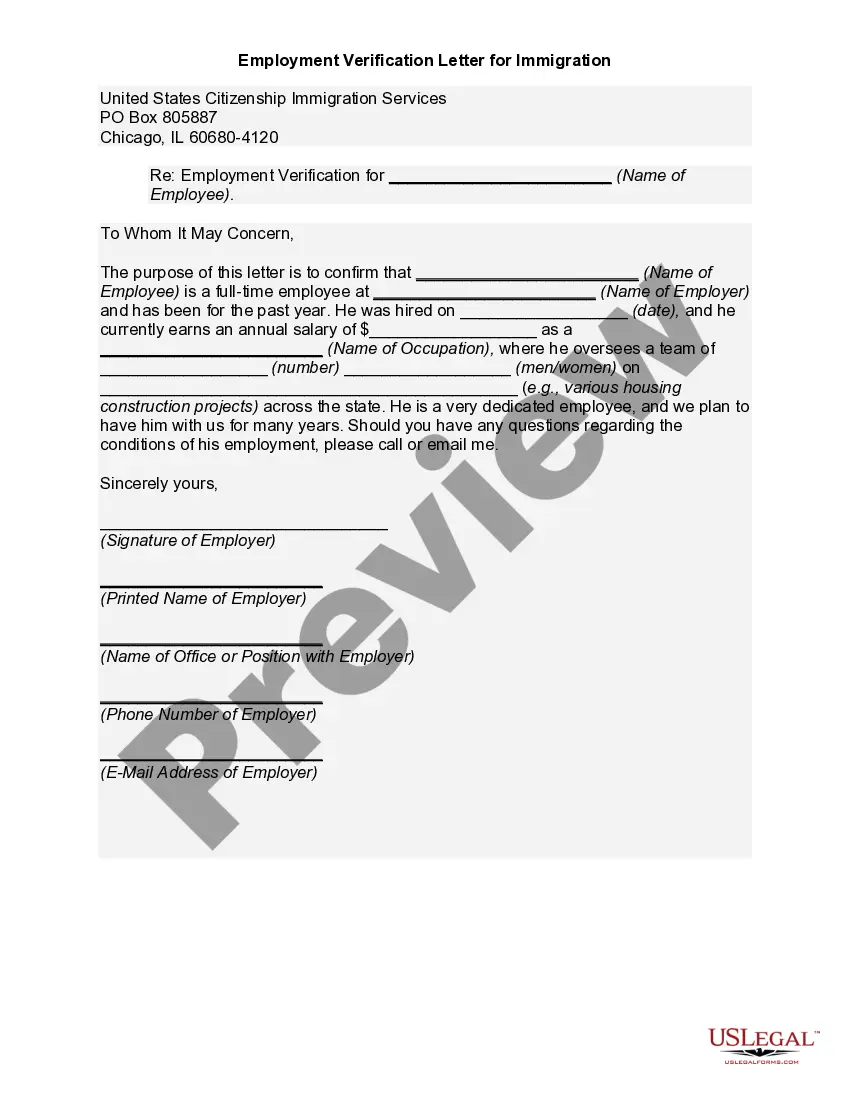

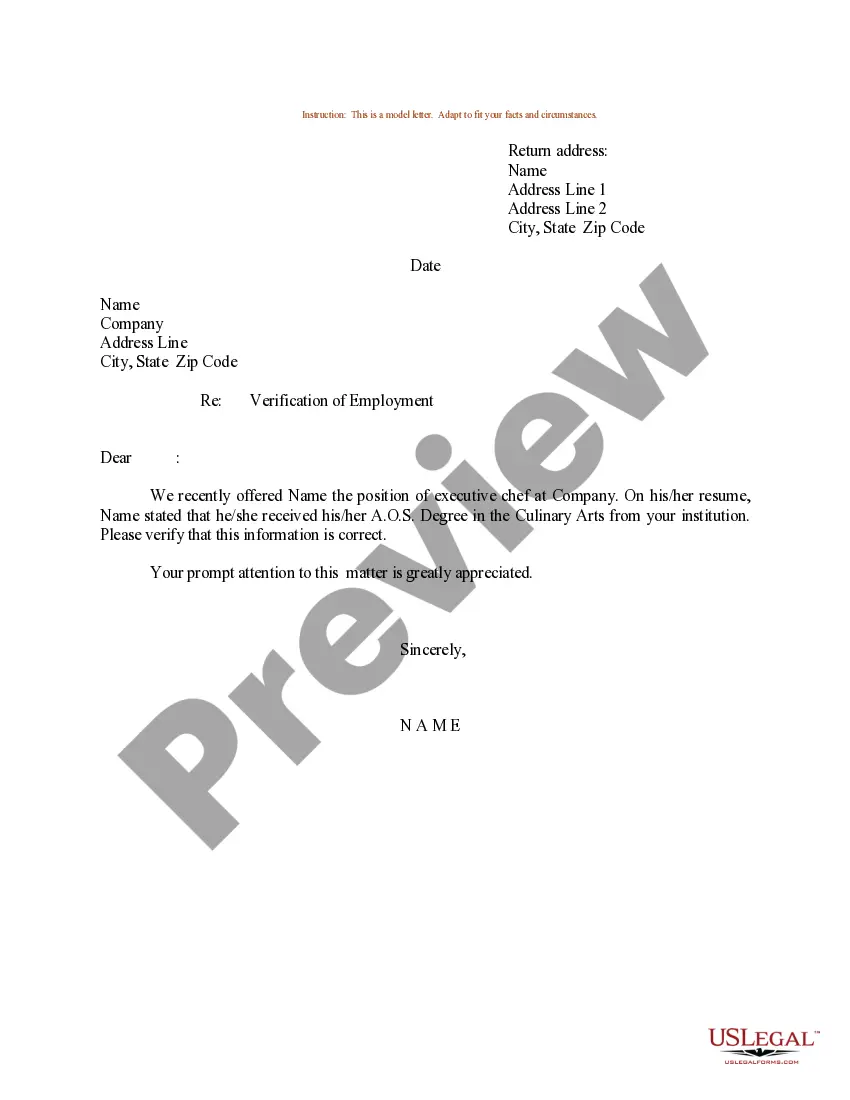

Employment verification letters are both requested and sent from two parties. For example, an outside agency may writer an employment verification letter to validate employment. And a company or HR department will write employment verification letters to confirm employment. Then send that letter to the agency.

While the majority of employment verifications can be completed in less than 72 hours, there are several reasons it may take longer. There may be difficulty identifying what we at Clarifacts call the Established Verifying Contact (EVC). This is the person or department that has the employment records available to them.

How to Request the LetterAsk your supervisor or manager. This is often the easiest way to request the letter.Contact Human Resources.Get a template from the company or organization requesting the letter.Use an employment verification service.

So, can you write a proof of income letter for self-employment on your behalf? The answer is yes. Write an income verification letter and use the following accepted documentation to prove your income: IRS Form 1099 Miscellaneous Income used by freelancers to record any job that paid $600 or more. Tax returns.