Oregon Sample Letter for Tax Deeds

Description

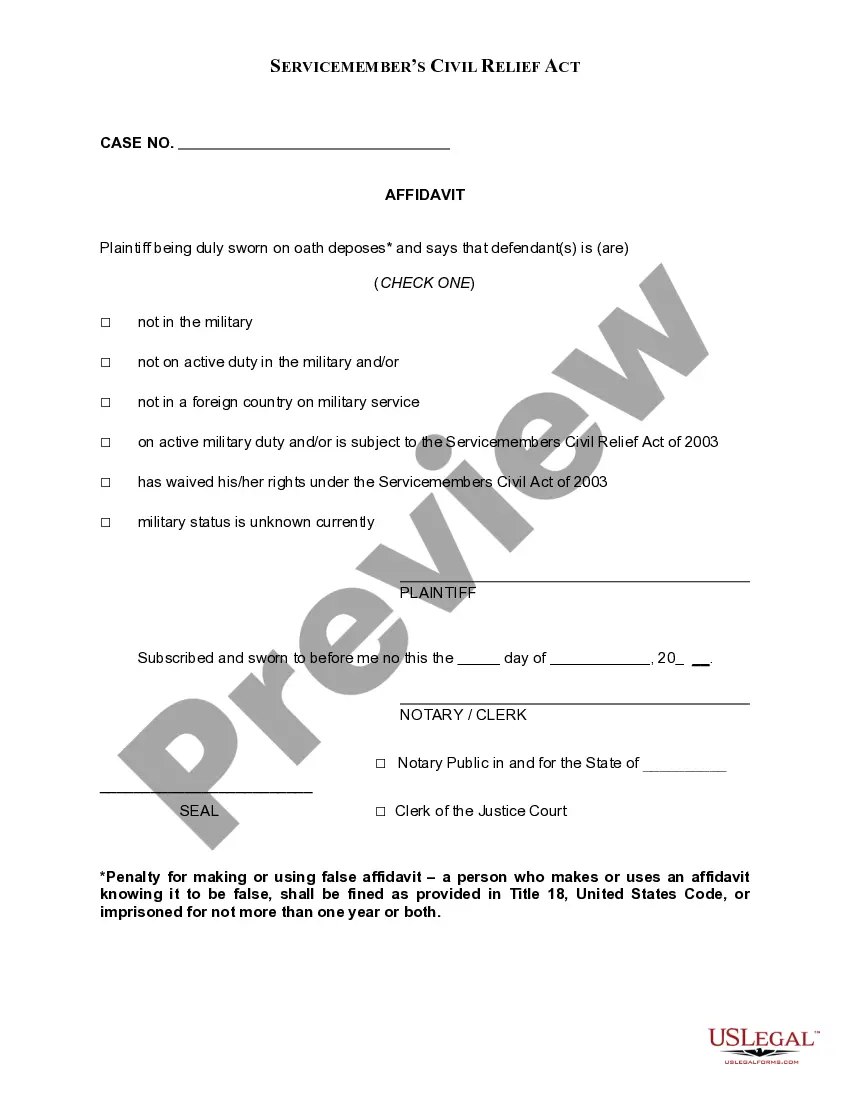

How to fill out Sample Letter For Tax Deeds?

Are you presently in a role where you require documents for potential organization or personal use on a near-daily basis? There are numerous legal document templates available online, but locating trustworthy ones isn't simple. US Legal Forms offers a vast selection of form templates, including the Oregon Sample Letter for Tax Deeds, which can be tailored to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Oregon Sample Letter for Tax Deeds template.

If you do not have an account and wish to begin using US Legal Forms, follow these steps: Obtain the form you need and ensure it is for the correct city/state. Utilize the Preview button to examine the form. Read the description to confirm that you have selected the appropriate form. If the form is not what you require, use the Search section to find the form that fulfills your needs and specifications. Once you locate the correct form, click Buy now. Select the pricing plan you desire, complete the necessary information to create your account, and make a purchase using your PayPal or credit card. Choose a suitable file format and download your copy. Find all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the Oregon Sample Letter for Tax Deeds at any time, if necessary. Simply click on the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

- The service provides professionally crafted legal document templates that you can use for a variety of purposes.

- Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

Counties in Oregon acquire fee title to tax foreclosed properties and do not sell tax liens or tax lien certificates. The County may sell tax foreclosed properties through a public auction. There is no set time of year when an auction occurs.

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

Once judgment is granted by the circuit court, a two- year redemption period begins. To redeem your property during this period, you must pay all taxes and interest for all years shown on the judgment and decree, the 5 percent penalty, interest on the judgment, plus a $50 redemption fee.

Notice of Assessment: We send you this letter if you have unpaid taxes after the due date of payment. Notice and Demand for Payment: This is the second request for full payment of taxes owed.

We administer Oregon tax laws, support partners' programs, and act as a central debt collection agency for other state agencies, boards, commissions, and local governments.

In Oregon, real property is normally subject to foreclosure three years after the taxes become delinquent. Property taxes can be paid in full by November 15 or in three installments: November 15, February 15, and May 15. If the taxes are not paid by then, they are considered delinquent as of May 16.

The limit is based on a property's maximum assessed value (MAV). MAV can't increase by more than 3 percent each year, unless there are changes to the property, such as the addition of a new structure, improvement of an existing structure, or subdivision or partition of the property.

So, you will owe a total penalty of 25 percent of any tax not paid. A 100 percent penalty is also charged if you do not file a return for three consecutive years by the due date of the third year, including extensions. In some situations, additional penalties may be added.

Property Tax Payments Property tax statements are mailed before October 25 every year. Pay your taxes in full by November 15 or make partial payments with further installments due in February and May.

A lien secures the state's interest in your property when you don't pay your tax debt. A garnishment takes property or assets to pay the tax debt. If you don't pay in full or set up a payment plan, we can garnish, seize, and/or sell the real or personal property that you own or have an interest in.