Oregon Receipt Template for Cash Payment

Description

How to fill out Receipt Template For Cash Payment?

Finding the appropriate authentic file template can be challenging.

Naturally, there is a wide range of designs accessible online, but how do you locate the authentic version you require.

Utilize the US Legal Forms website.

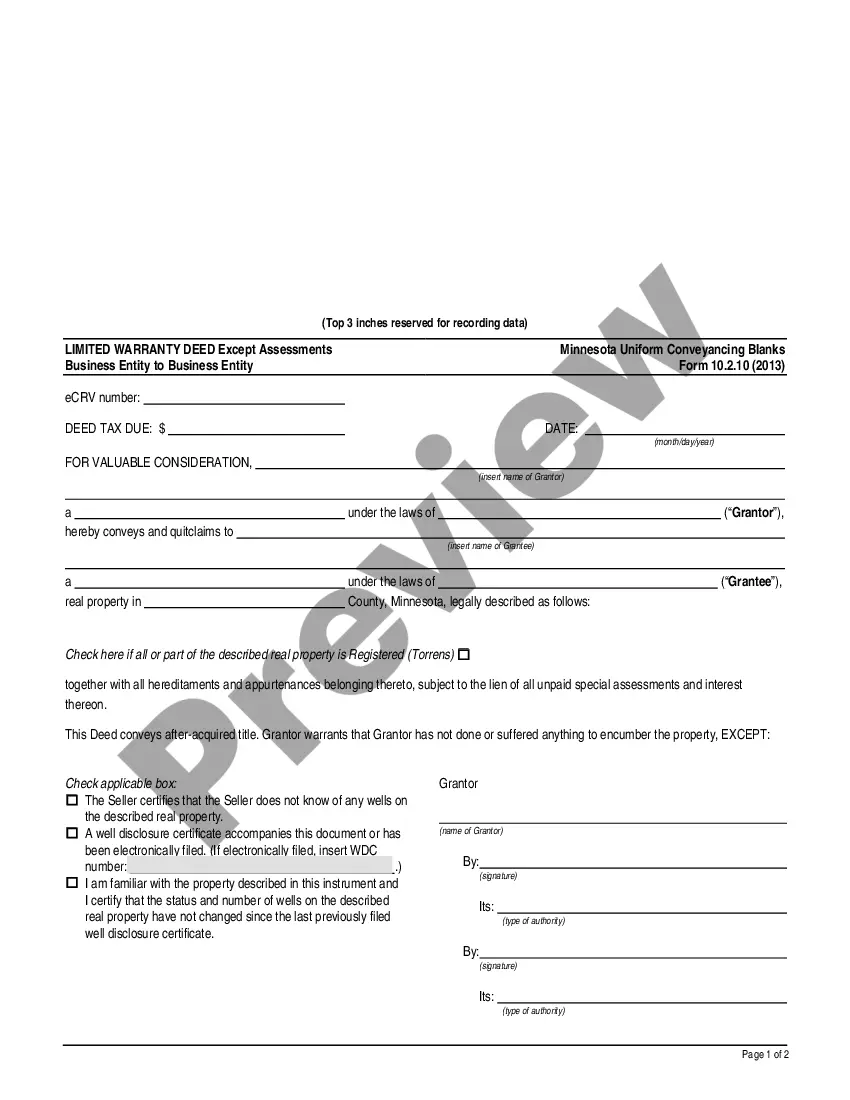

First, ensure you have selected the correct form for your city/state. You can check the form using the Preview option and review the form details to confirm this is the right one for you.

- This service offers thousands of designs, such as the Oregon Receipt Template for Cash Payment, which can be used for both business and personal requirements.

- All the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already a registered user, Log In to your account and click the Acquire button to access the Oregon Receipt Template for Cash Payment.

- Use your account to view the legal forms you have previously purchased.

- Visit the My documents tab of your account and download another copy of the document you need.

- If you are a first-time user of US Legal Forms, here are some simple instructions for you to follow.

Form popularity

FAQ

Just make sure they include:The date of payment,A description of the services or goods purchased,The amount paid in cash, and.The name of the company or person paid.

This is the information that should be included on a receipt: Your company's details including name, address, telephone number, and/or e-mail address. The date the transaction took place. List of products/services with a brief description of each along with the quantity delivered.

Just make sure they include:The date of payment,A description of the services or goods purchased,The amount paid in cash, and.The name of the company or person paid.28-Oct-2014

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

Format of Cash ReceiptThe date on which the transaction happened.The unique number assigned to the document for identification.The name of the customer.The amount of cash received.The method of payment, i.e., by cash, cheque, etc.;The signature of the vendor.

What information must I put on a receipt?your company's details including name, address, phone number and/or email address.the date of transaction showing date, month and year.a list of products or services showing a brief description of the product and quantity sold.More items...

Write down the payment method and the customer's name. On the last line of the receipt write the customer's full name. If they paid by credit card, have them sign the bottom of the receipt. Then, make a copy of the receipt and keep it for your records and hand the customer the original receipt.

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

How to Write a ReceiptDate;Receipt Number;Amount Received ($);Transaction Details (what was purchased?);Received by (seller);Received from (buyer);Payment Method (cash, check, credit card, etc.);Check Number (if applicable); and.More items...?

To prove that cash is income, use:Invoices.Tax statements.Letters from those who pay you, or from agencies that contract you out or contract your services.Duplicate receipt ledger (give one copy to every customer and keep one for your records)