An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

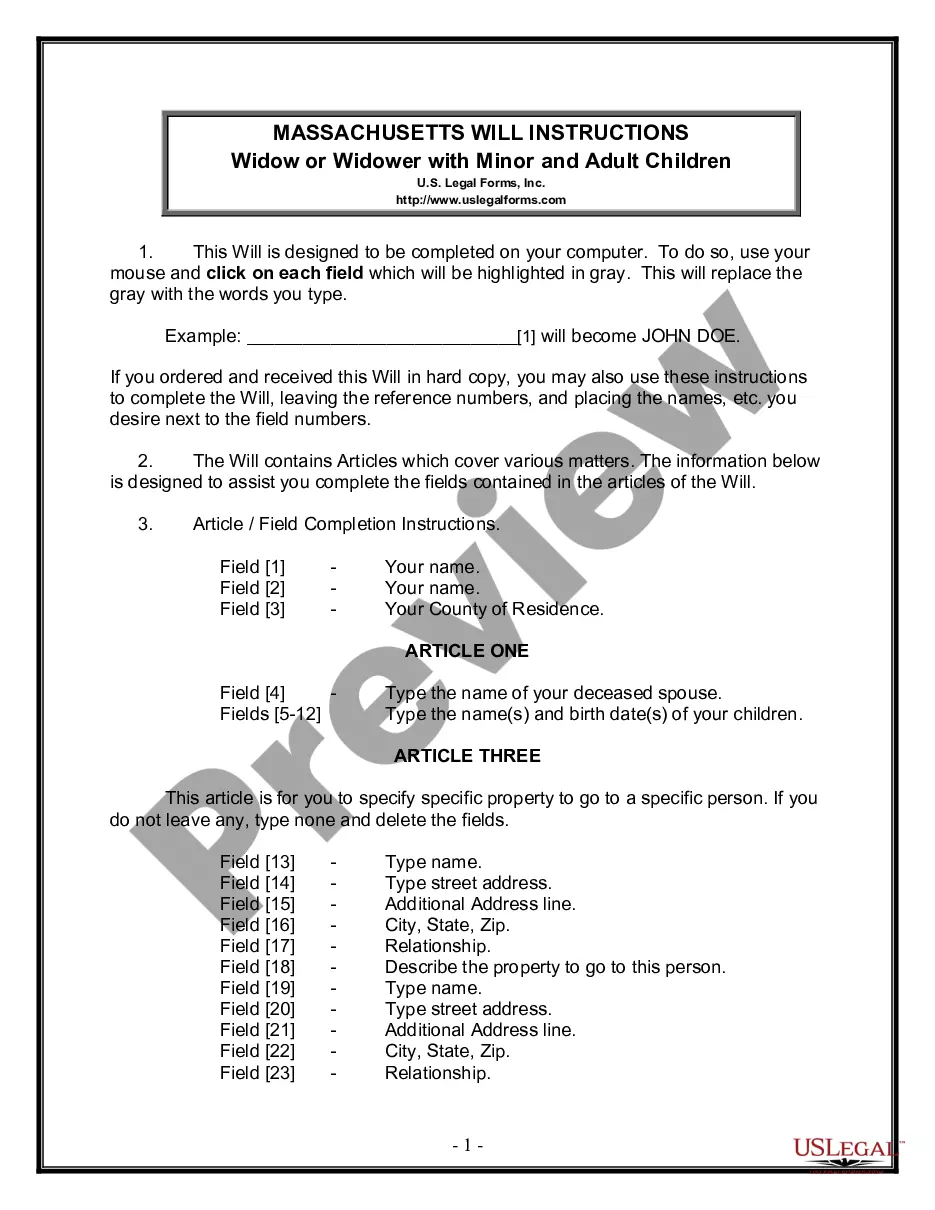

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

Are you presently in a location where you need documents for either professional or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable versions can be difficult.

US Legal Forms provides a vast array of form templates, such as the Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust, which are created to meet federal and state standards.

Once you find the correct form, click Buy now.

Choose the payment option you prefer, fill out the necessary details to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the correct area/state.

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the correct form.

- If the form does not match your needs, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

Yes, trust beneficiary income is typically taxable to the beneficiaries who receive it. When managing a trust under the Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust, beneficiaries may need to report their share of the trust income on their tax returns. It’s wise to consult a tax professional to understand your tax obligations and any potential deductions.

To allocate trust income to beneficiaries, follow the terms outlined in the trust agreement. The Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust allows you to clearly define the shares of income designated for each beneficiary. It's important to track the trust’s earnings and maintain transparent communication with beneficiaries to ensure everyone understands their allocation.

Allocating trust income involves determining how much of the income generated by the trust will be distributed to beneficiaries. You can use the Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust to specify the proportion each beneficiary receives. This process often includes reviewing the trust document, any applicable state laws, and the specific arrangements made by the grantor.

Trust income is generally taxed based on the type of income and the beneficiary's tax situation. Beneficiaries typically report their share of the trust's income on their personal tax returns, meaning an Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust can directly impact their tax liabilities. It is important to track distributions and understand their tax effects. Engaging with UsLegalForms can help clarify these responsibilities and ensure accurate reporting.

The distribution of income from a trust involves paying out earnings to beneficiaries as specified in the trust document. This process can cover various structures, including an Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust, which allows for a more controlled and predictable distribution. Clarity in the trust's distribution terms helps beneficiaries understand what to expect. When in doubt, platforms like UsLegalForms can provide templates to ensure distributions align with legal standards.

Yes, Oregon taxes trust income under specific circumstances. If the trust generates income, the state typically requires that income be reported on an Oregon tax return. Furthermore, when considering an Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust, understanding how these tax implications affect your overall financial strategy is crucial. Utilizing resources like UsLegalForms can simplify the process of managing trust income and ensuring compliance with state tax laws.

Beneficiaries are typically taxed on the income distributed from the trust at their ordinary income tax rates. This also applies to the income derived from the Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust. Understanding this tax obligation can help beneficiaries plan effectively.

In Oregon, there is no inheritance tax. However, if the estate exceeds a certain value, it may be subject to estate tax. Knowing these limits is vital for beneficiaries, especially when evaluating income from the Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust.

Yes, in Oregon, beneficiaries have the right to see the trust. This right provides clarity on how the trust operates and how assets are being managed. Understanding these details is particularly relevant when discussing the Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust.

Income from a trust is typically distributed based on the trust's terms. This may include regular payments to beneficiaries or one-time distributions. Understanding this distribution process is essential, especially for those involved with the Oregon Assignment by Beneficiary of a Percentage of the Income of a Trust.