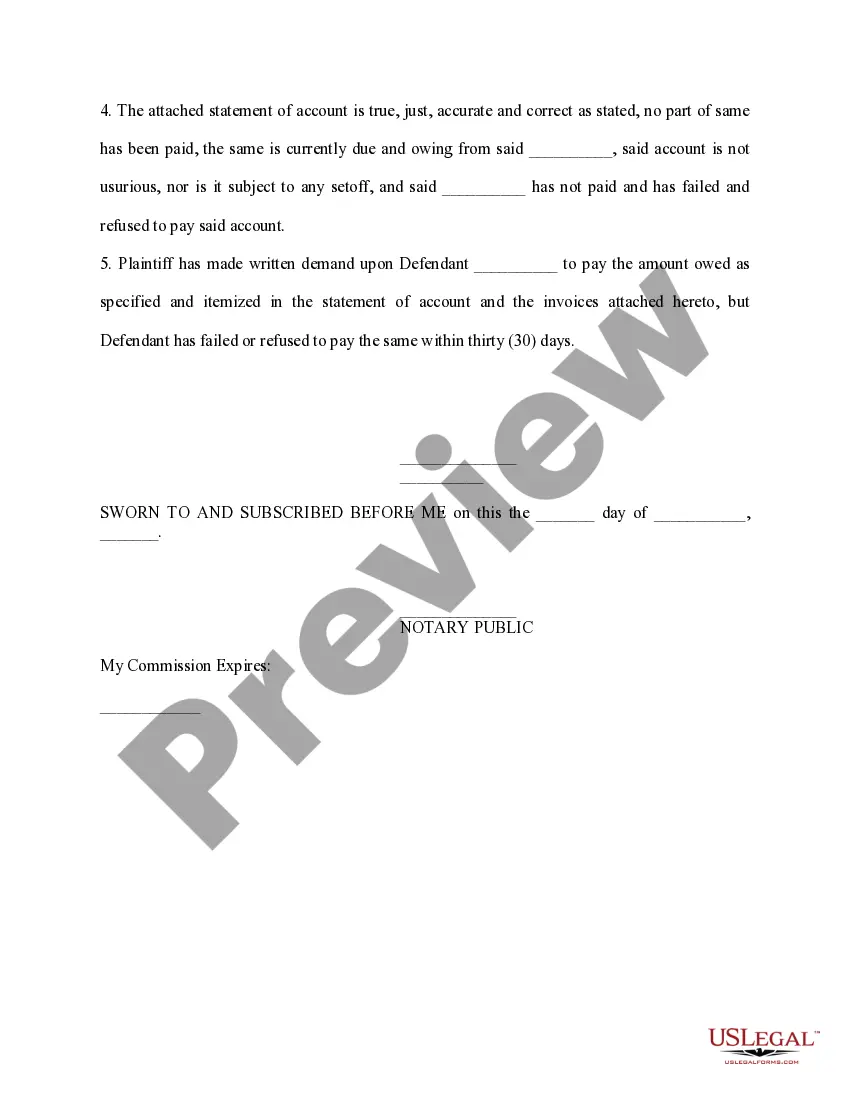

Oregon Affidavit of Amount Due on Open Account

Description

How to fill out Affidavit Of Amount Due On Open Account?

Are you inside a placement that you need to have papers for both business or person reasons nearly every working day? There are plenty of lawful file web templates available on the Internet, but locating versions you can trust isn`t straightforward. US Legal Forms offers a huge number of type web templates, just like the Oregon Affidavit of Amount Due on Open Account, which are published to fulfill state and federal requirements.

When you are presently familiar with US Legal Forms web site and possess your account, simply log in. Next, you are able to download the Oregon Affidavit of Amount Due on Open Account web template.

Should you not have an accounts and want to begin using US Legal Forms, abide by these steps:

- Find the type you need and make sure it is for your correct town/region.

- Make use of the Review key to check the shape.

- Read the outline to actually have selected the proper type.

- If the type isn`t what you are searching for, utilize the Look for field to obtain the type that meets your requirements and requirements.

- Once you discover the correct type, just click Purchase now.

- Choose the rates plan you want, fill in the required details to produce your bank account, and buy the transaction utilizing your PayPal or credit card.

- Decide on a practical document structure and download your backup.

Get every one of the file web templates you may have bought in the My Forms food selection. You can aquire a additional backup of Oregon Affidavit of Amount Due on Open Account whenever, if needed. Just select the necessary type to download or print out the file web template.

Use US Legal Forms, probably the most extensive selection of lawful forms, in order to save time as well as steer clear of errors. The assistance offers appropriately manufactured lawful file web templates that can be used for a variety of reasons. Create your account on US Legal Forms and begin creating your daily life a little easier.

Form popularity

FAQ

Oregon Income Tax Brackets for 2023 Here's how it breaks down for this individual: The first $4,050 of income is taxed at 4.75% ($192) The next portion of income from $4,050 to $10,200 is taxed at 6.75% ($415) The next portion of income from $10,200 to $125,000 is taxed at 8.75% ($10,045)

Form OR-19 is used to report tax payments withheld by pass-through entities (PTEs) with distributive income from Oregon sources. The tax withheld is a prepayment of Oregon income and excise tax for the PTE's owners.

PTE tax allows an entity taxed as a partnership or S Corporation to make a tax payment on behalf of its partners. The business pays an elective tax of 9.3% of qualified net income to the Franchise Tax Board.

Use Form OR-W-4 to tell your employer or other payer how much Oregon income tax to withhold from your wages or other periodic income.

Pass-Through Entity Annual Withholding Return A Pass-Through Entity (PTE) is generally an entity that passes its income or losses through to its owners instead of paying the related tax at the entity level. A PTE can be any of the following: Estates. Trusts. S corporations.

Purpose of Schedule OR-21-MD Pass-through entities (PTEs) electing to pay the PTE elective tax (PTE-E tax) use Schedule OR-21-MD to provide informa- tion about the members of the PTE. Schedule OR-21-MD must be included with Form OR-21 when the return is filed. Entities that are PTEs owned entirely by such individuals.

Example of the tax savings this credit could save: If Partnership A has matching Federal and MA income of $100,000 and made PTE/BAIT estimated payments equal to the 5% MA tax rate, the amount of tax paid at the entity level is $5,000. This reduces taxable federal income of the entity by $5,000 to $95,000.

Purpose of form Form OR-19 is used to report tax payments withheld by pass-through entities (PTEs) with distributive income from Oregon sources. The tax withheld is a prepayment of Oregon income and excise tax for the PTE's owners. For composite filing information, see Publication OR-OC.

Full-year residents File Form OR-40 if you (and your spouse, if married and filing a joint return) are a full-year resident. You're a full-year resident if all of the following are true: You think of Oregon as your permanent home. Oregon is the center of your financial, social, and family life.

Purpose of form The withheld tax is a prepayment of Oregon income and excise tax for nonresident owners of pass-through entities. Form OR-19-AF is for nonresident owners who don't elect to join in a composite filing, are not exempt from withholding, and don't want the PTE to withhold tax on their behalf.