If you wish to total, acquire, or printing lawful file templates, use US Legal Forms, the most important assortment of lawful forms, which can be found online. Utilize the site`s basic and handy research to discover the papers you need. Different templates for business and specific uses are categorized by groups and says, or keywords and phrases. Use US Legal Forms to discover the Oregon Agreement By Heirs to Substitute New Note for Note of Decedent in just a couple of click throughs.

Should you be previously a US Legal Forms client, log in for your account and then click the Down load option to have the Oregon Agreement By Heirs to Substitute New Note for Note of Decedent. You may also accessibility forms you in the past delivered electronically within the My Forms tab of your own account.

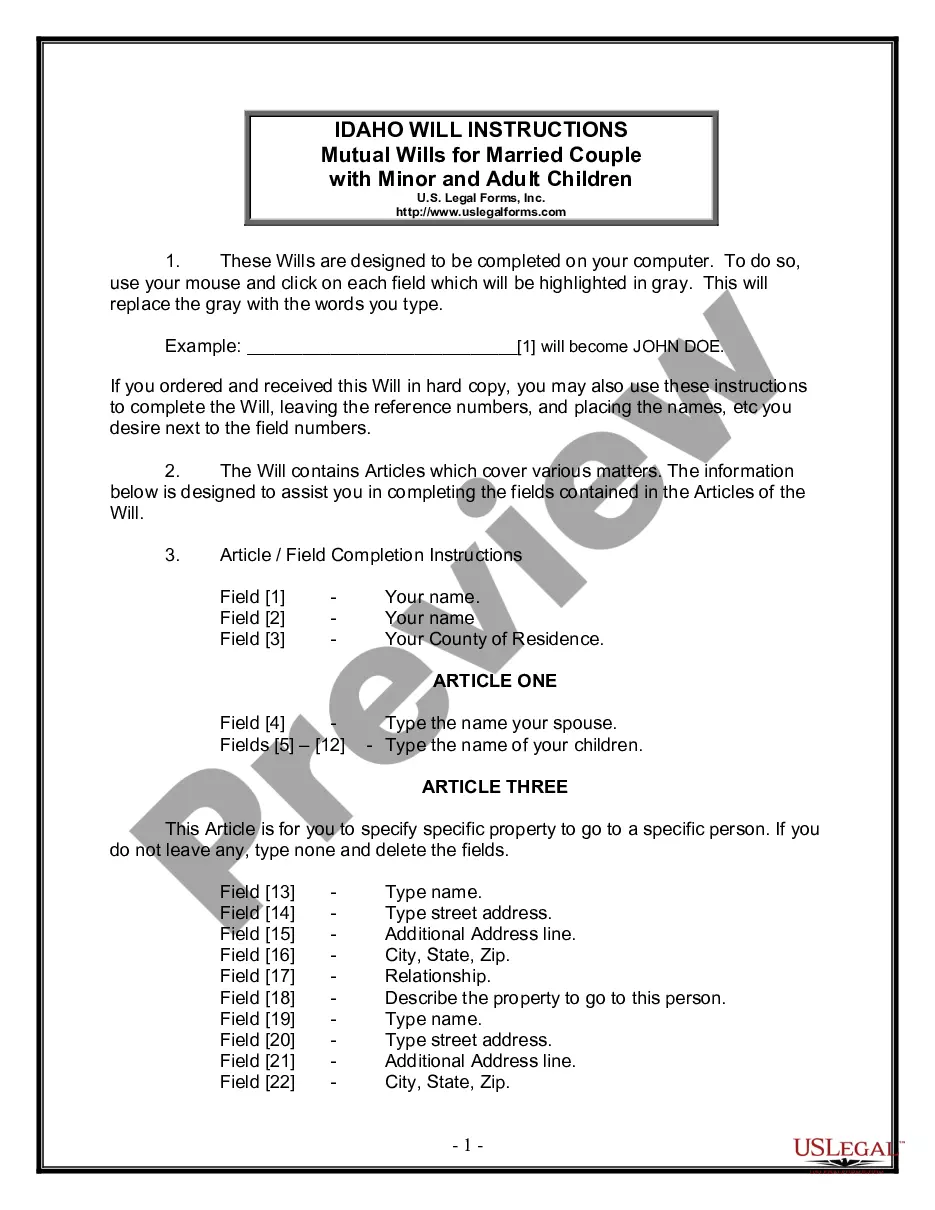

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have selected the form for the correct area/land.

- Step 2. Take advantage of the Preview solution to examine the form`s content. Never forget to read the explanation.

- Step 3. Should you be unsatisfied with the develop, use the Research industry near the top of the display screen to get other models of your lawful develop design.

- Step 4. After you have discovered the form you need, select the Get now option. Opt for the pricing strategy you favor and include your credentials to register on an account.

- Step 5. Procedure the financial transaction. You can utilize your charge card or PayPal account to complete the financial transaction.

- Step 6. Select the format of your lawful develop and acquire it on the product.

- Step 7. Complete, modify and printing or signal the Oregon Agreement By Heirs to Substitute New Note for Note of Decedent.

Every lawful file design you get is yours for a long time. You have acces to each develop you delivered electronically in your acccount. Go through the My Forms section and pick a develop to printing or acquire again.

Be competitive and acquire, and printing the Oregon Agreement By Heirs to Substitute New Note for Note of Decedent with US Legal Forms. There are thousands of skilled and status-specific forms you may use for your business or specific requires.