This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

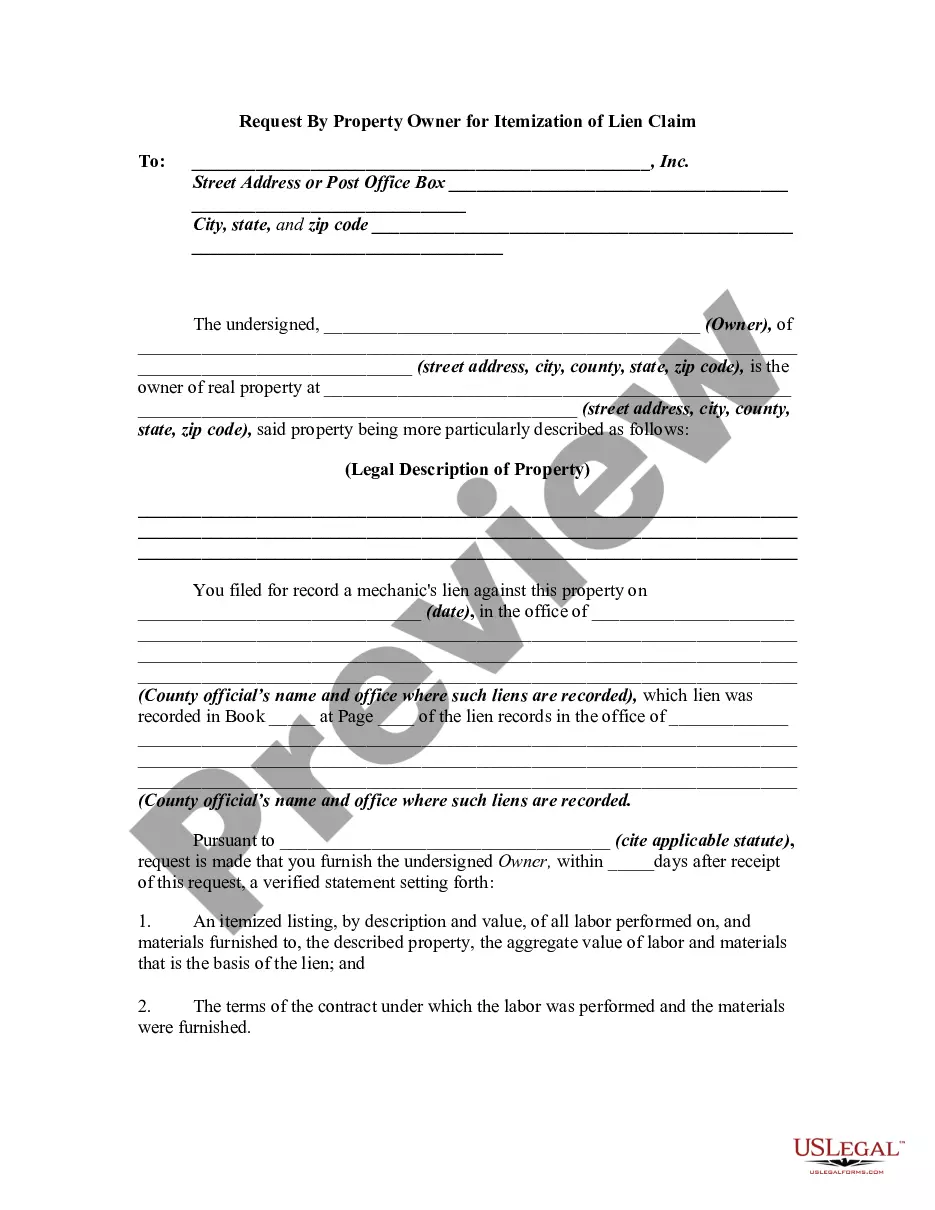

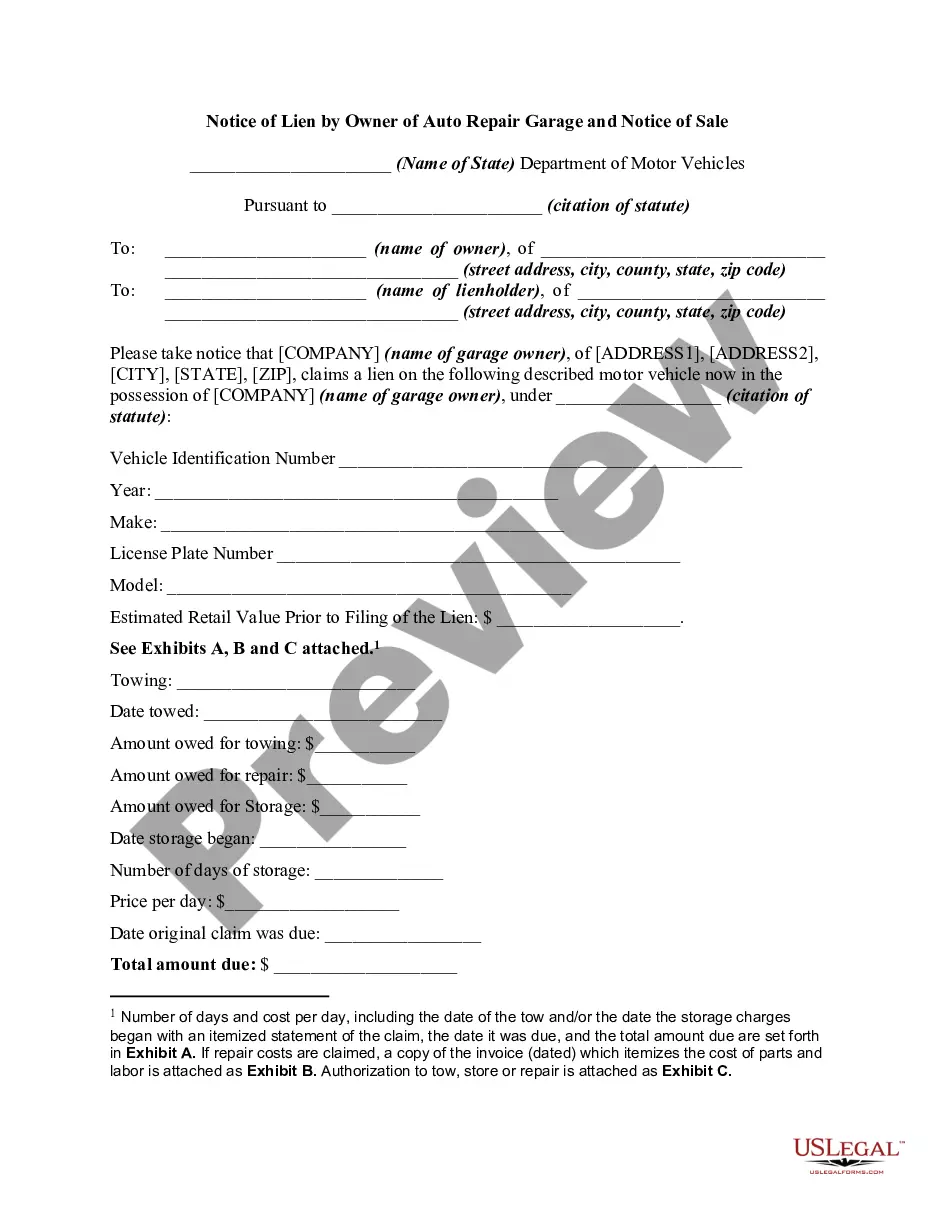

Oregon Request By Property Owner for Itemization of Lien Claim

Description

How to fill out Request By Property Owner For Itemization Of Lien Claim?

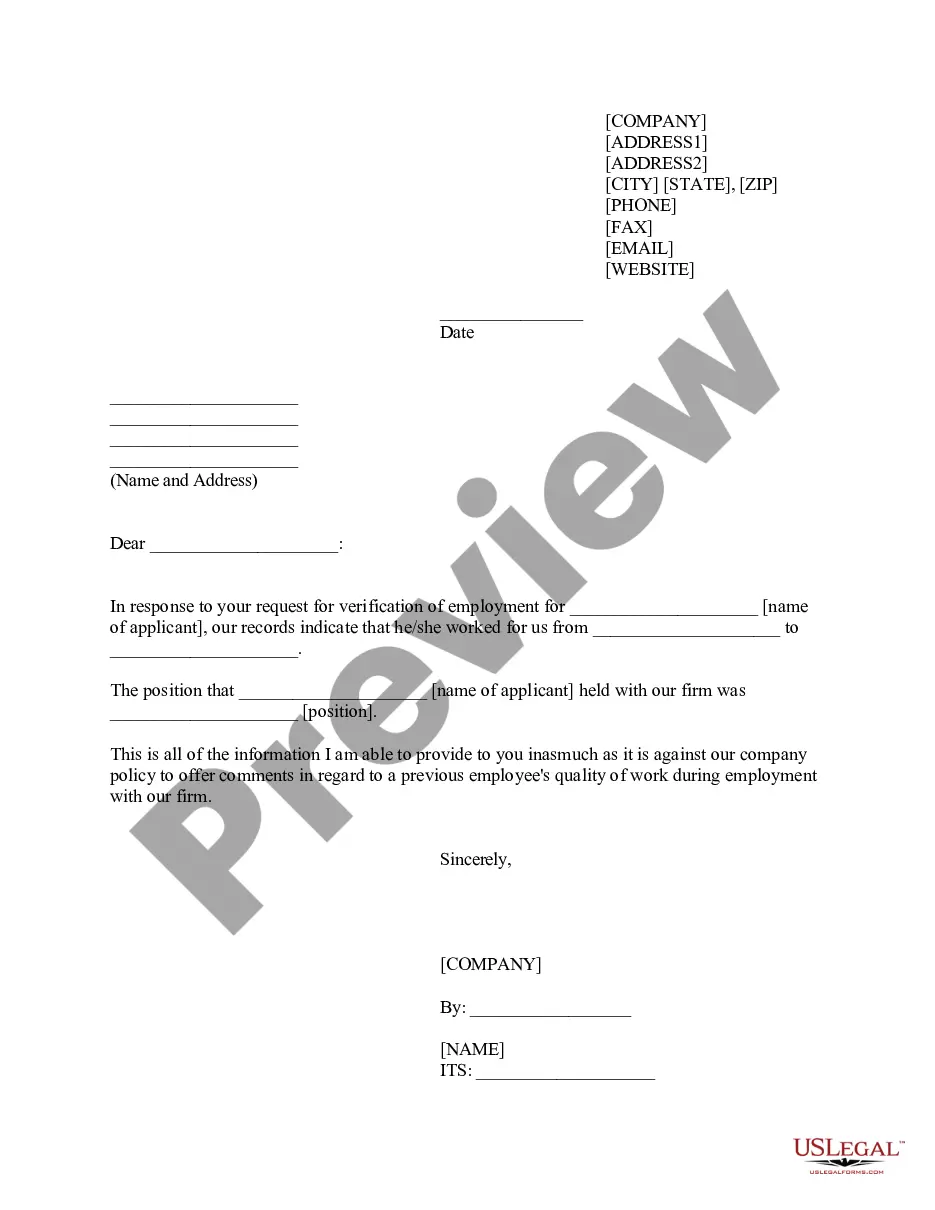

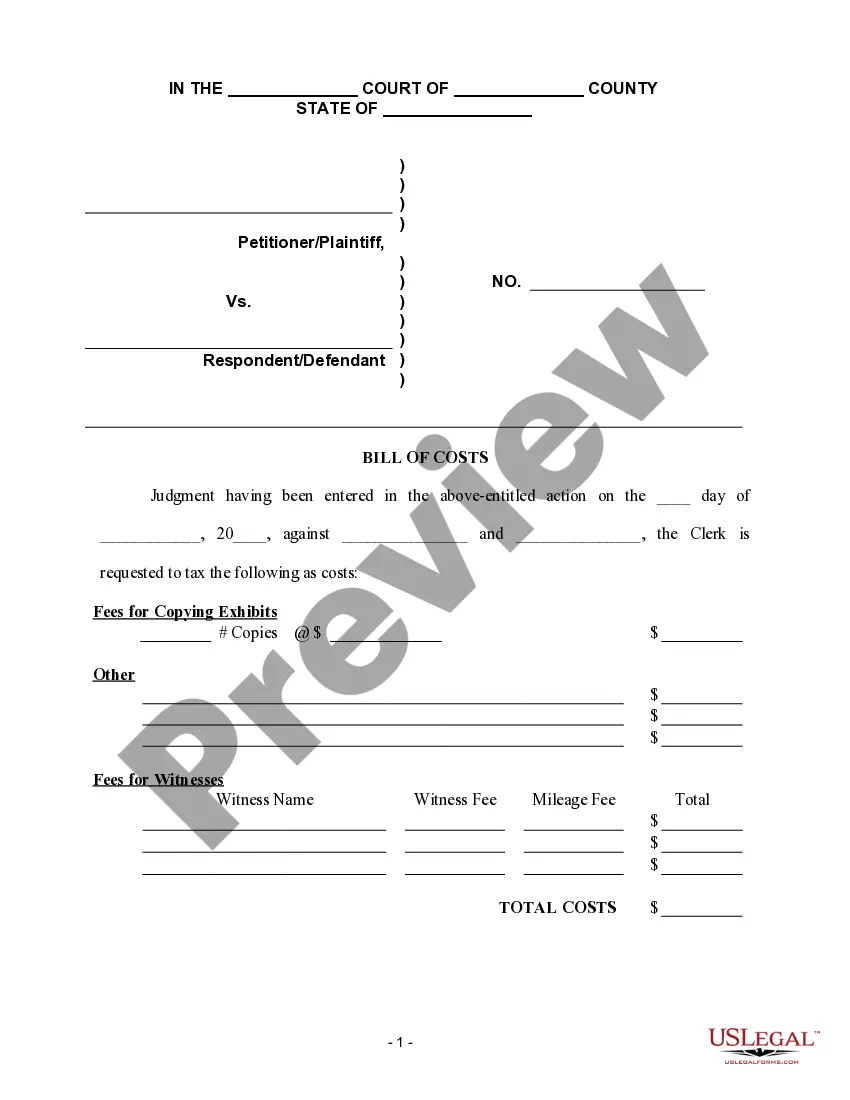

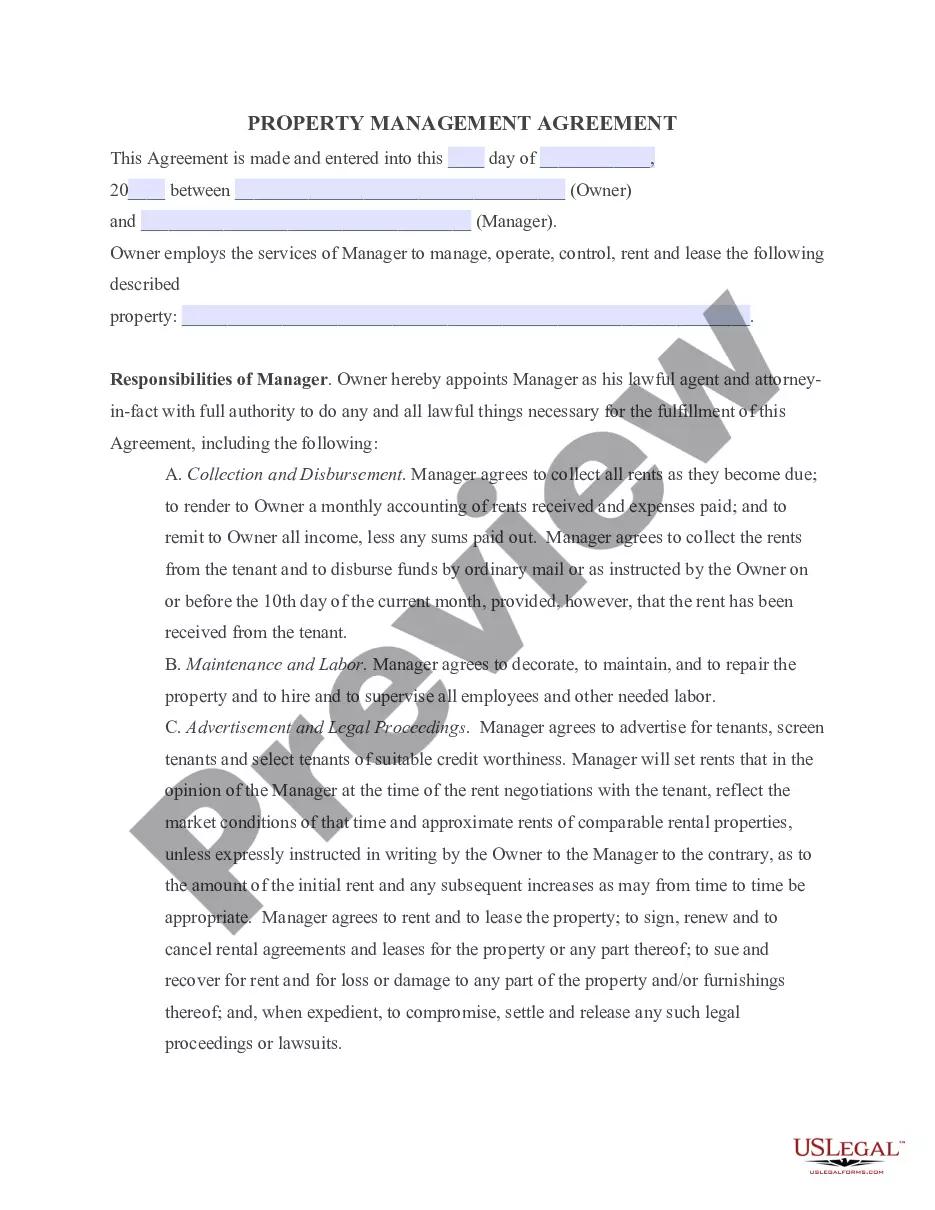

Have you been inside a placement where you require documents for both enterprise or person reasons virtually every working day? There are tons of legitimate file templates available on the net, but getting versions you can rely on isn`t easy. US Legal Forms offers a huge number of kind templates, much like the Oregon Request By Property Owner for Itemization of Lien Claim, which are written to satisfy federal and state requirements.

When you are currently knowledgeable about US Legal Forms internet site and get a free account, just log in. After that, you are able to obtain the Oregon Request By Property Owner for Itemization of Lien Claim format.

Should you not provide an accounts and wish to begin using US Legal Forms, adopt these measures:

- Get the kind you will need and make sure it is for that correct city/area.

- Utilize the Review key to check the shape.

- Look at the outline to actually have selected the correct kind.

- When the kind isn`t what you are looking for, use the Search industry to find the kind that fits your needs and requirements.

- If you obtain the correct kind, simply click Get now.

- Pick the pricing prepare you want, fill out the desired information to generate your bank account, and buy the order utilizing your PayPal or charge card.

- Choose a hassle-free data file file format and obtain your copy.

Locate each of the file templates you have bought in the My Forms menus. You can get a more copy of Oregon Request By Property Owner for Itemization of Lien Claim at any time, if required. Just click the necessary kind to obtain or print the file format.

Use US Legal Forms, one of the most substantial variety of legitimate kinds, to conserve some time and stay away from errors. The services offers expertly created legitimate file templates that can be used for a variety of reasons. Create a free account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

Section 87.035 - Perfecting lien; filing claim of lien; contents of claim (1) Every person claiming a lien created under ORS 87.010(1) or (2) shall perfect the lien not later than 75 days after the person has ceased to provide labor, rent equipment or furnish materials or 75 days after completion of construction, ...

Statute of Limitation on Tax Collection However, the statute of 10 years limitation on judgment liens begins to run on a tax lien as soon as the tax warrant is filed pursuant to ORS 314.430. Such lien may be renewed by court order without loss of priority.

Liens generally follow the "first in time, first in right" rule, which says that whichever lien is recorded first in the land records has higher priority than later recorded liens. For example, a mortgage has priority over a judgment lien if the lender records it before the judgment creditor records its lien.

No lien for materials or supplies shall have priority over any recorded mortgage or trust deed on either the land or improvement unless the person furnishing the material or supplies, not later than eight days, not including Saturdays, Sundays and other holidays as defined in ORS 187.010 (Legal holidays), after the ...

A lien that has priority over another lien is called a "superior" lien. A low-priority lien is called a "junior" lien. If a home has more than one lien, priority determines the lienholders' rights following a foreclosure sale.

Property owners can be forced to pay the lien holder (the person claiming the lien) or face a potential court order to sell the property for payment. Property owners can be liable if the general contractor does not pay subcontractors, employees, materials suppliers, and equipment rental companies.

Tax liens are involuntary and occur when a homeowner does not pay their federal, state, or local taxes. If this happens, a tax lien is placed against your property. This lien takes priority over all other liens and stays there until the debt is completely paid.