Oregon Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

Have you ever been in a situation where you require paperwork for certain companies or specific purposes almost on a daily basis.

There are numerous authentic document templates obtainable online, yet finding reliable ones can be challenging.

US Legal Forms offers thousands of template forms, such as the Oregon Agreement for Purchase of Business Assets from a Corporation, designed to comply with state and federal regulations.

Once you find the proper template, click Buy now.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can always download another copy of the Oregon Agreement for Purchase of Business Assets from a Corporation if necessary. Just click on the desired form to download or print the template. Utilize US Legal Forms, one of the largest collections of legitimate forms, to save time and avoid errors. The service offers well-designed legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you're already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterwards, you'll be able to download the Oregon Agreement for Purchase of Business Assets from a Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/area.

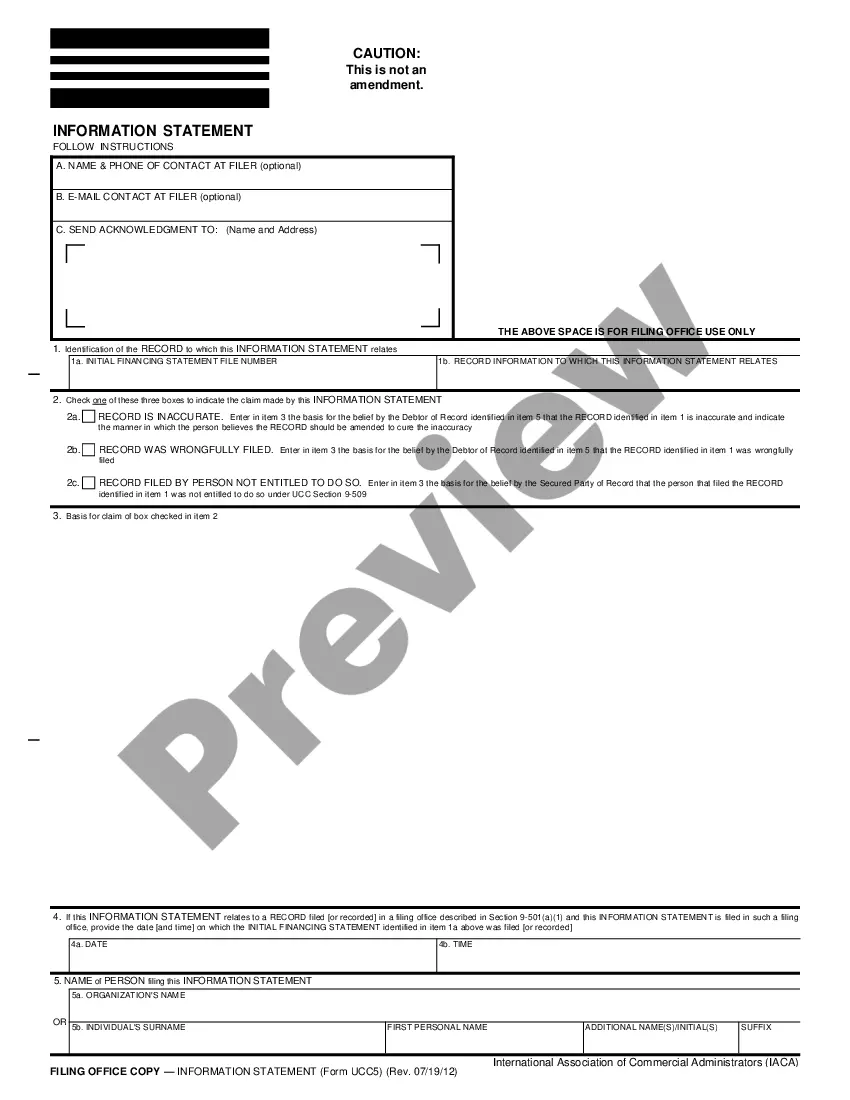

- Use the Preview button to examine the document.

- Review the details to confirm that you've selected the right form.

- If the document isn't what you're looking for, use the Search field to find the template that suits your needs.

Form popularity

FAQ

A unit purchase agreement is a legal document that business owners can use to buy goods and services. The seller can offer significant discounts on products or services for bulk purchases. The buyer may then choose not to use all of their allotted units if they do not need them at the time of sale.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

What does sale of assets mean? When companies let go of some assets in exchange for needed cash or other forms of compensation, that is the sale of assets. It's important to note that this term only applies when a company is selling part of their assets and not when all of them are for sale.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

Your company will also still exist after an asset sale, and administratively you will still need to take steps to dissolve the company and deal with any remaining liabilities and assets. Unlike a stock sale, 100% of the interests of a company can usually be transferred without the consent of all of the stockholders.

When someone buys a corporation's assets, the corporation sells its property, like its contracts, furniture, fixtures, and equipment, for money or in exchange for other property. The corporation gets the money and the buyer gets the assets.

Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership. The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.