Oregon Electronic Publishing Agreement

Description

How to fill out Electronic Publishing Agreement?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a wide range of legal document formats that you can download or create.

By using the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the latest versions of forms like the Oregon Electronic Publishing Agreement within minutes.

If you already have an account, Log In and obtain the Oregon Electronic Publishing Agreement from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms from the My documents tab of your account.

Process the transaction. Use a credit card or PayPal account to complete your purchase.

Select the format and download the form to your device. Make edits. Complete, edit, and print, then sign the downloaded Oregon Electronic Publishing Agreement. Every template you add to your account has no expiration date and belongs to you forever. So, if you wish to download or create another version, just go to the My documents section and click on the form you desire. Access the Oregon Electronic Publishing Agreement with US Legal Forms, the most extensive collection of legal document formats. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Before using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your area/region.

- Click on the Review button to examine the form's details.

- Check the form information to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your credentials to create an account.

Form popularity

FAQ

To mail the Oregon OQ, you need to send it to the address specified on the form, which may vary based on your filing situation. Ensure your documents are securely mailed and consider tracking your submission. To streamline mailing processes in the future, refer to the Oregon Electronic Publishing Agreement, which provides updated mailing addresses and procedures for various tax documents.

Yes, Oregon does allow the electronic filing of amended returns, which simplifies the process significantly. Use approved e-filing software or websites that accommodate this feature. The Oregon Electronic Publishing Agreement can assist by guiding you through the e-filing options available, making sure your amendments are submitted correctly.

The Oregon form 40X is used for filing an amended personal income tax return. This form allows taxpayers to correct errors on their original return or to claim additional credits. Utilizing the Oregon Electronic Publishing Agreement can provide clear instructions on completing the form, ensuring your amendments are filed correctly and promptly.

Yes, if you have issued 1099 forms, you must file them with the state of Oregon, especially if the payments were made to Oregon residents. Filing ensures compliance with state tax regulations. Utilizing the Oregon Electronic Publishing Agreement may make it easier to manage submissions and maintain records of your filings. This ensures everything is documented properly.

As of now, the IRS does not provide a direct filing option available specifically in Oregon. Taxpayers must utilize official platforms or authorized software to file their taxes. For a smoother process, explore the Oregon Electronic Publishing Agreement, which can assist you in navigating the state's requirements and filing options effectively.

The state of Oregon may manually process your return for various reasons, such as discrepancies or missing information in your filing. Manual reviews ensure accuracy and compliance with tax laws. To expedite future filings, employing the Oregon Electronic Publishing Agreement can enhance the accuracy of your submissions. This can reduce the chances of manual intervention.

If you are wondering about your amended refund in Oregon, you can check the status online through the Oregon Department of Revenue's website. They provide insights into the processing status, helping you stay informed. If further assistance is needed, consider utilizing resources like the Oregon Electronic Publishing Agreement for updates. This platform can streamline your queries regarding your tax returns.

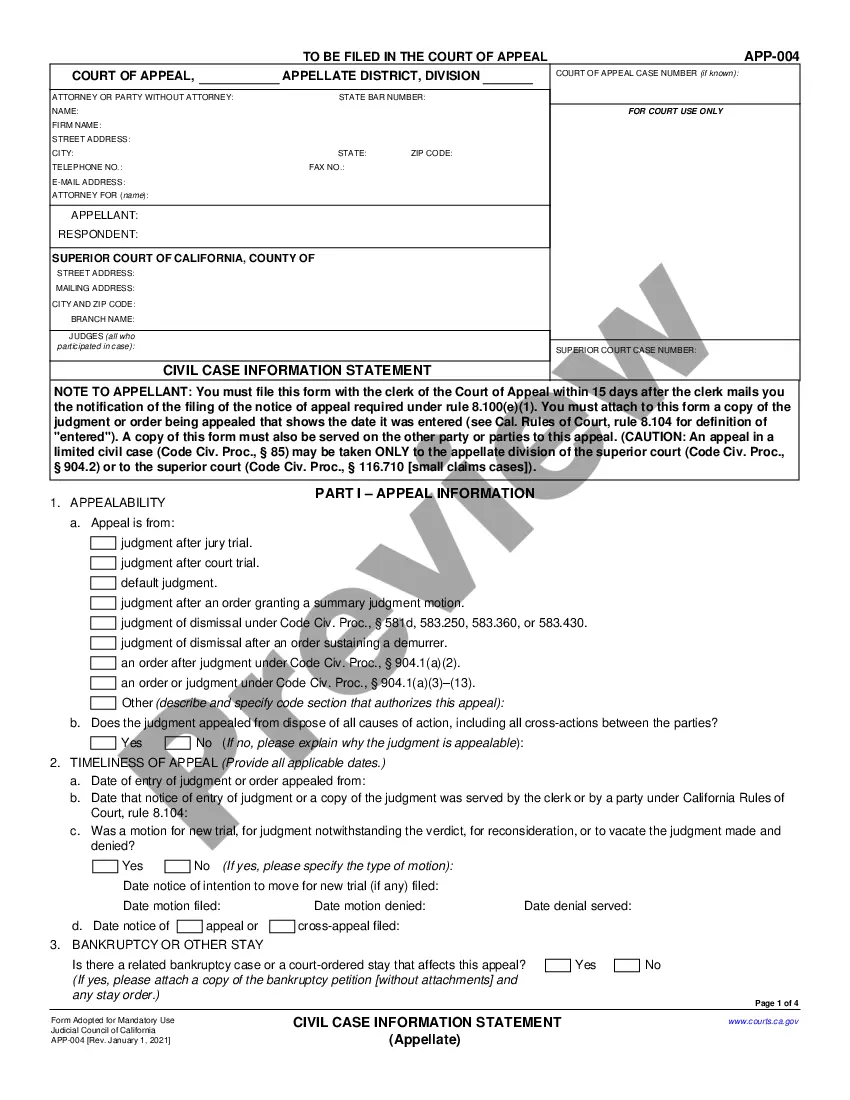

To file a motion or an answer in Oregon, you need to prepare the appropriate documents, ensuring they align with the legal requirements. Once completed, file your documents with the correct court, either electronically or in person. It's beneficial to refer to the Oregon Electronic Publishing Agreement for guidance on submission methods. This ensures your documents are filed correctly and processed efficiently.

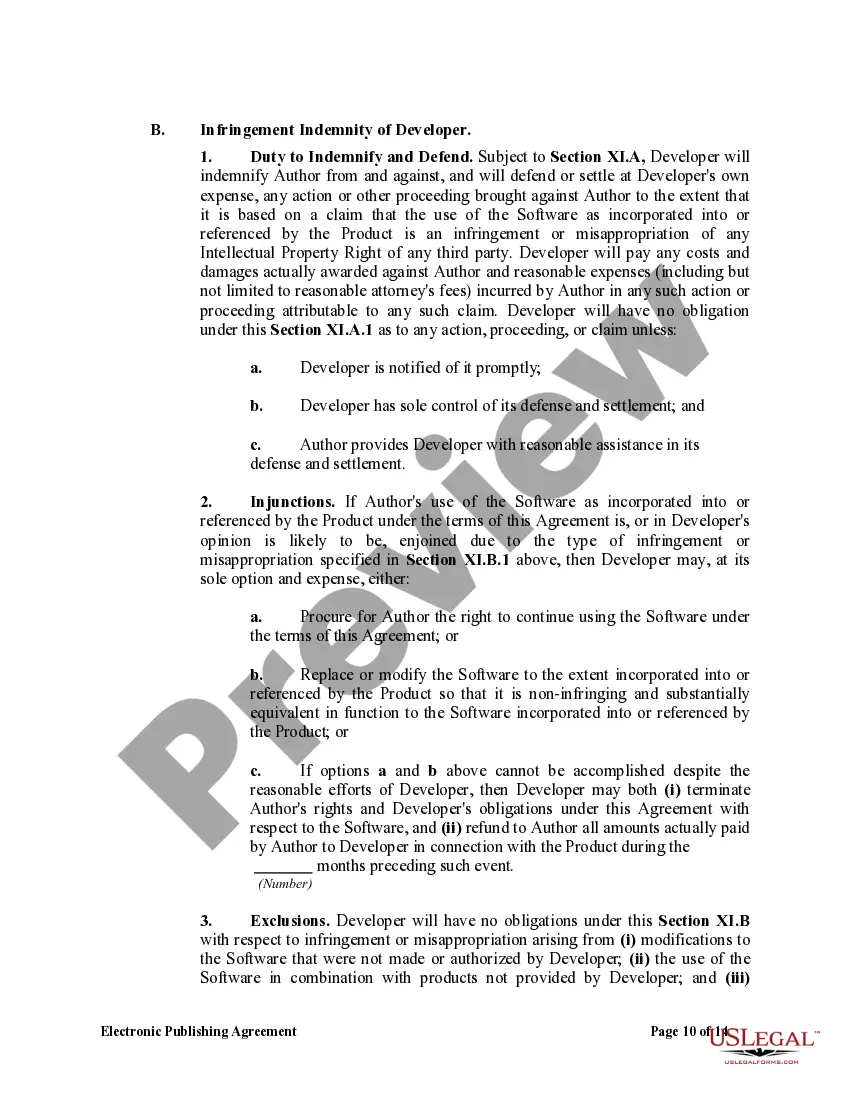

A journal publishing agreement outlines the terms between an author and a publisher regarding the publication of scholarly articles. These agreements specify rights, responsibilities, royalties, and distribution methods. If you are entering into an Oregon Electronic Publishing Agreement for a journal, make sure to understand the unique terms that correspond with academic publishing standards.

Yes, electronic signatures can be accepted for most agreements under US law. They hold the same legal weight as traditional signatures, as long as both parties agree to use them. This makes electronic signatures especially useful when executing an Oregon Electronic Publishing Agreement, ensuring a quick and efficient signing process.