Oregon Shareholder and Corporation agreement to issue additional stock to a third party to raise capital

Description

How to fill out Shareholder And Corporation Agreement To Issue Additional Stock To A Third Party To Raise Capital?

Are you in a situation where you require paperwork for possibly professional or personal aims almost every day.

There are numerous legal document templates accessible online, but locating versions you can trust isn't straightforward.

US Legal Forms offers thousands of form templates, including the Oregon Shareholder and Corporation agreement to issue additional shares to a third party for funding, which are designed to comply with state and federal regulations.

Once you obtain the correct form, click Purchase now.

Select the payment plan you desire, enter the required information for your payment method, and pay for your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Subsequently, you can download the Oregon Shareholder and Corporation agreement to issue additional shares to a third party for funding template.

- If you lack an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct region/county.

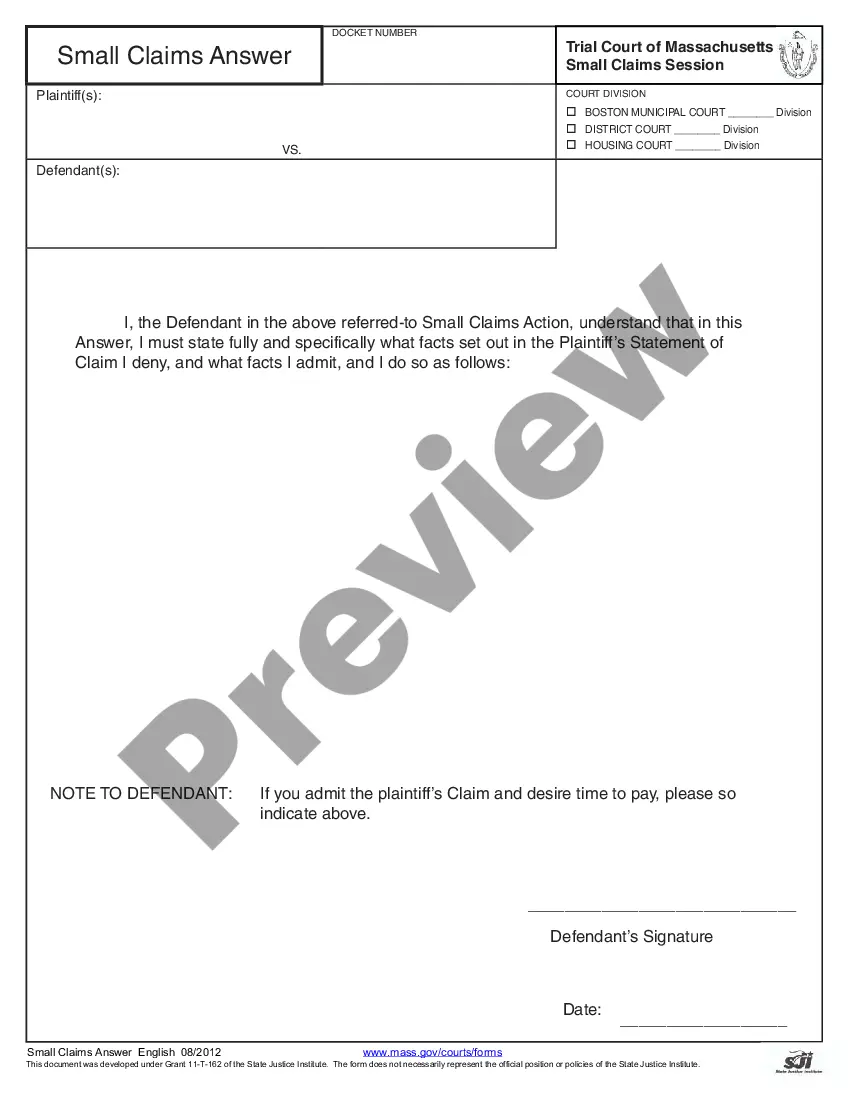

- Utilize the Preview option to review the form.

- Check the description to confirm that you have selected the appropriate form.

- If the form isn’t what you are looking for, use the Search field to find a form that meets your requirements.

Form popularity

FAQ

Corporate StockholdersWhoever owns any of the outstanding stock of a company is legally an owner. A C corporation can have an unlimited number of owners, and publicly traded corporations such as Apple, IBM or Wal-Mart have many thousands of shareholder owners.

The number of shares represents the authorized shares. The number of authorized shares can be increased by the shareholders of the company at annual shareholder meetings, provided a majority of the current shareholders vote for the change.

Bylaws work in conjunction with a company's articles of incorporation to form the legal backbone of the business and govern its operations. A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations.

Issuing of extra shares will require a resolution to be passed by a general meeting of the company shareholders. The only way of avoiding diluting the company further by issuing shares to new investors is by existing shareholders taking up the extra shares on top of their own.

In some cases, a company will own stock in itself. These shares are known as treasury stock. Unlike typical shares, treasury stock does not grant voting rights or the ability to receive dividends. If a company decides to sell treasury stock, those shares will convert to outstanding shares.

Unless you indicate differently in your articles of incorporation or by-laws, your corporation's board of directors can generally issue shares whenever it wishes, to whomever it chooses, and for whatever value it decides.

However, a company commonly has the right to increase the amount of stock it's authorized to issue through approval by its board of directors. Also, along with the right to issue more shares for sale, a company has the right to buy back existing shares from stockholders.

How to Issue Stock: Method 2 Issuing StockCalculate the amount of capital that is needed.Review the number of authorized shares that are available.Calculate the total value of the shares that will be issued.Determine if preferred or common shares should be issued.Calculate the total number of shares to issue.More items...

When companies issue additional shares, it increases the number of common stock being traded in the stock market. For existing investors, too many shares being issued can lead to share dilution. Share dilution occurs because the additional shares reduce the value of the existing shares for investors.

Value Concentration A company is more likely to issue new shares when its stock is overvalued so that it can receive more money for each share sold. Positive investor sentiment for overvalued stocks may allow a company to set the issuing price even higher than its stock's current market price.