Oregon Contract between General Agent of Insurance Company and Independent Agent

Description

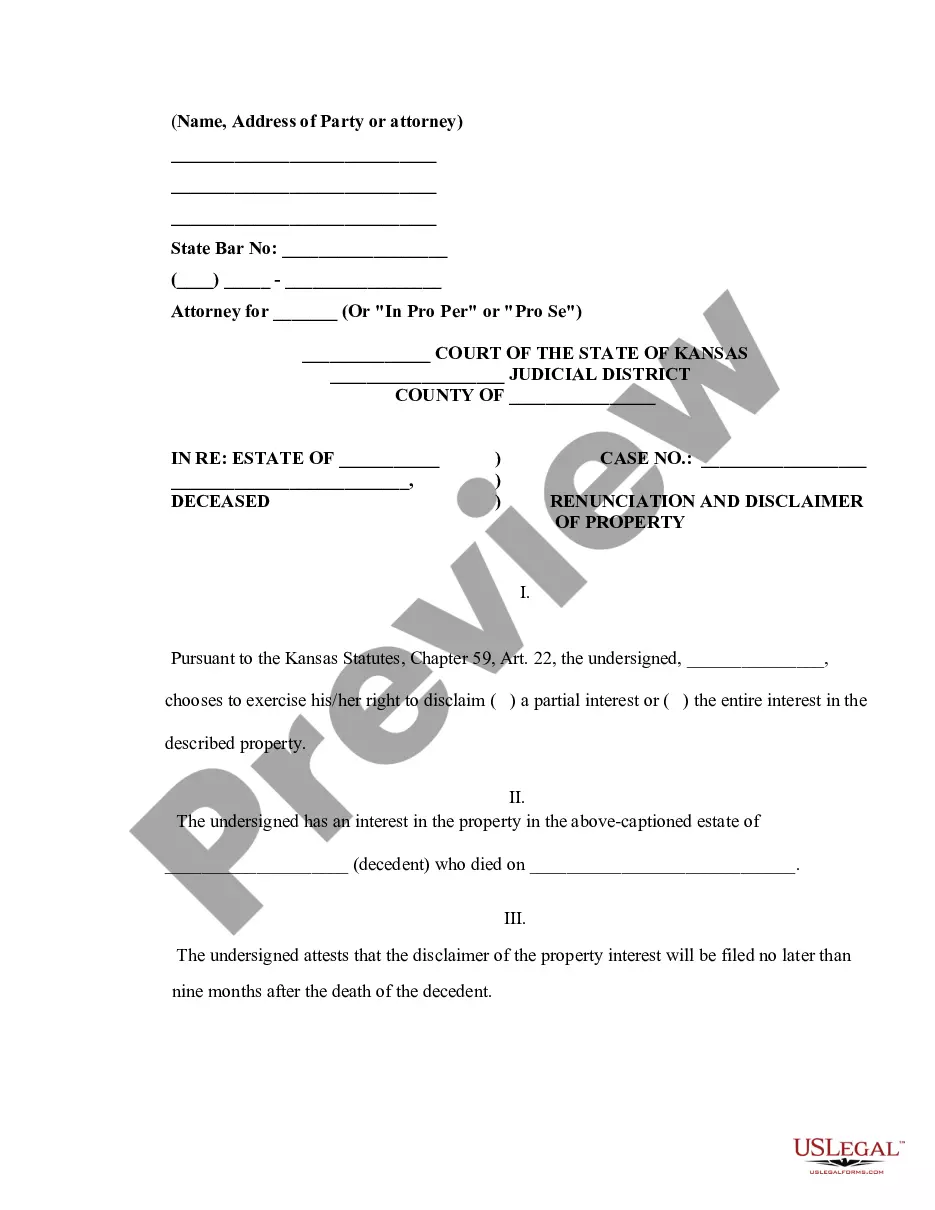

In view of the fact that insurance is a closely regulated business, local state law and insurance regulations should be consulted when using this form.

How to fill out Contract Between General Agent Of Insurance Company And Independent Agent?

Have you found yourself in a situation where you require documents for both business or specific needs nearly every day.

There are numerous legal document templates accessible online, but locating forms you can trust is challenging.

US Legal Forms provides a vast selection of document templates, including the Oregon Contract between General Agent of Insurance Company and Independent Agent, which are designed to comply with federal and state regulations.

Once you locate the appropriate template, click Buy now.

Choose the payment plan you prefer, provide the necessary information to create your account, and complete the purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Oregon Contract between General Agent of Insurance Company and Independent Agent template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for the correct city/state.

- Utilize the Review option to evaluate the document.

- Check the summary to confirm you have selected the right template.

- If the template is not what you are looking for, use the Search field to find the template that suits your needs.

Form popularity

FAQ

The insurance clause in a contract outlines the coverage obligations of the parties involved. It specifies what types of insurance are required, the coverage limits, and the responsibilities for maintaining that insurance. When referencing an Oregon Contract between General Agent of Insurance Company and Independent Agent, understanding this clause is vital for risk management. Uslegalforms provides templates and guidance to help you draft clear and effective insurance clauses.

Yes, you need a license to sell insurance in Oregon. The state requires all insurance agents and brokers to hold appropriate licenses. If you aim to enter into an Oregon Contract between General Agent of Insurance Company and Independent Agent, ensure you comply with Oregon's regulations. Consider uslegalforms for resources that can guide you through the licensing steps.

Yes, you must have a license to sell insurance in the USA. Each state has its own licensing requirements, which means what works in one state may not apply in another. If you're dealing with an Oregon Contract between General Agent of Insurance Company and Independent Agent, you should understand Oregon's specific regulations. By using platforms like uslegalforms, you can navigate through the licensing process more easily.

The difficulty of obtaining an insurance license can depend on individual experiences, but many consider the health insurance license to be one of the more challenging ones to acquire. This is partly due to the complex regulations and extensive knowledge required. For agents entering into an Oregon Contract between General Agent of Insurance Company and Independent Agent, the commitment to thorough training and study is crucial for overcoming these challenges. Choosing the right resources and preparation strategies will make a significant difference.

The earnings of a life insurance agent in Oregon can vary widely based on experience, commission structure, and sales volume. On average, agents can make between $50,000 and $100,000 annually, with some exceeding these figures through bonuses and commissions. Engaging in an Oregon Contract between General Agent of Insurance Company and Independent Agent may provide additional earning potential by expanding your product offerings. Networking and building relationships can enhance your success in this competitive field.

Yes, a license is required to sell insurance in Oregon. Each insurance agent must hold specific licenses for different types of insurance they wish to sell, including life, health, and property insurance. If you are entering an Oregon Contract between General Agent of Insurance Company and Independent Agent, obtaining the necessary licenses will ensure you comply with state regulations and provide your clients with the best service. It's crucial to stay informed about the licensing requirements in your area.

In Oregon, the process to obtain a life insurance license typically takes around four to six weeks. This timeline includes completing required pre-licensing education and passing the examination. If you are working under an Oregon Contract between General Agent of Insurance Company and Independent Agent, it can be beneficial to complete this process swiftly, as it allows you to begin selling life insurance products sooner. Proper preparation can significantly reduce potential delays.

Acquiring an Oregon driver's license usually involves several steps, including completing a driver's education course, passing a knowledge test, and doing a behind-the-wheel driving test. Generally, you can expect the process to take a few weeks, depending on your preparation. For agents operating under an Oregon Contract between General Agent of Insurance Company and Independent Agent, having a valid driver's license may open up more opportunities for meeting clients and conducting business. Ensure you gather all necessary documents to expedite the process.

The profitability of an insurance agent can vary based on several factors, including the type of insurance sold and the commission structure in place. Typically, agents sell various insurance products, which can lead to diverse income sources. By establishing an Oregon Contract between General Agent of Insurance Company and Independent Agent, agents can gain access to more products, enhancing their profitability. It's essential for agents to continually build their client base and refine their sales strategies for sustained success.