Oregon Minutes for Partnership

Description

How to fill out Minutes For Partnership?

You have the capability to invest a number of hours online attempting to locate the valid document template that meets the state and federal criteria you require.

US Legal Forms provides thousands of valid forms that can be assessed by experts.

You are able to download or print the Oregon Minutes for Partnership from their service.

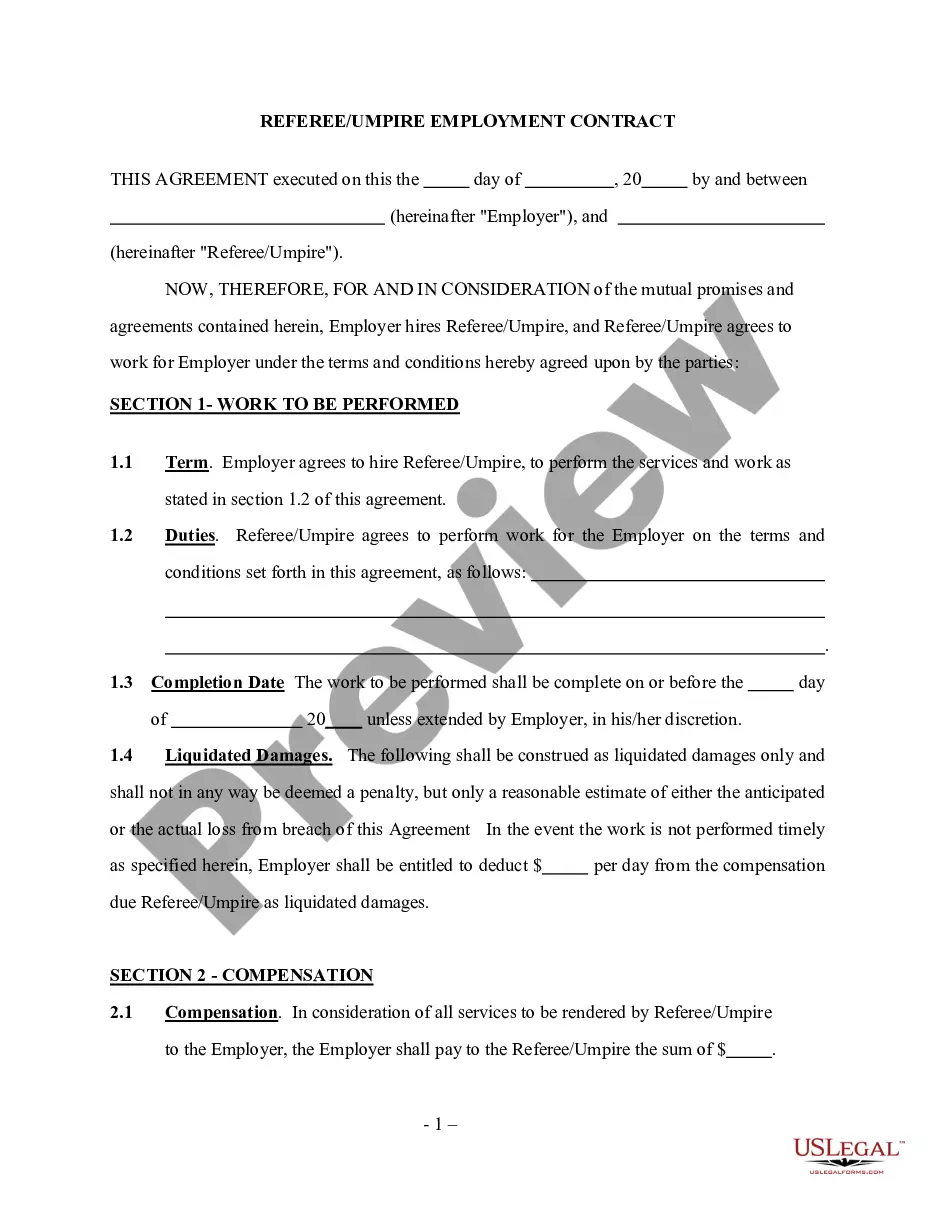

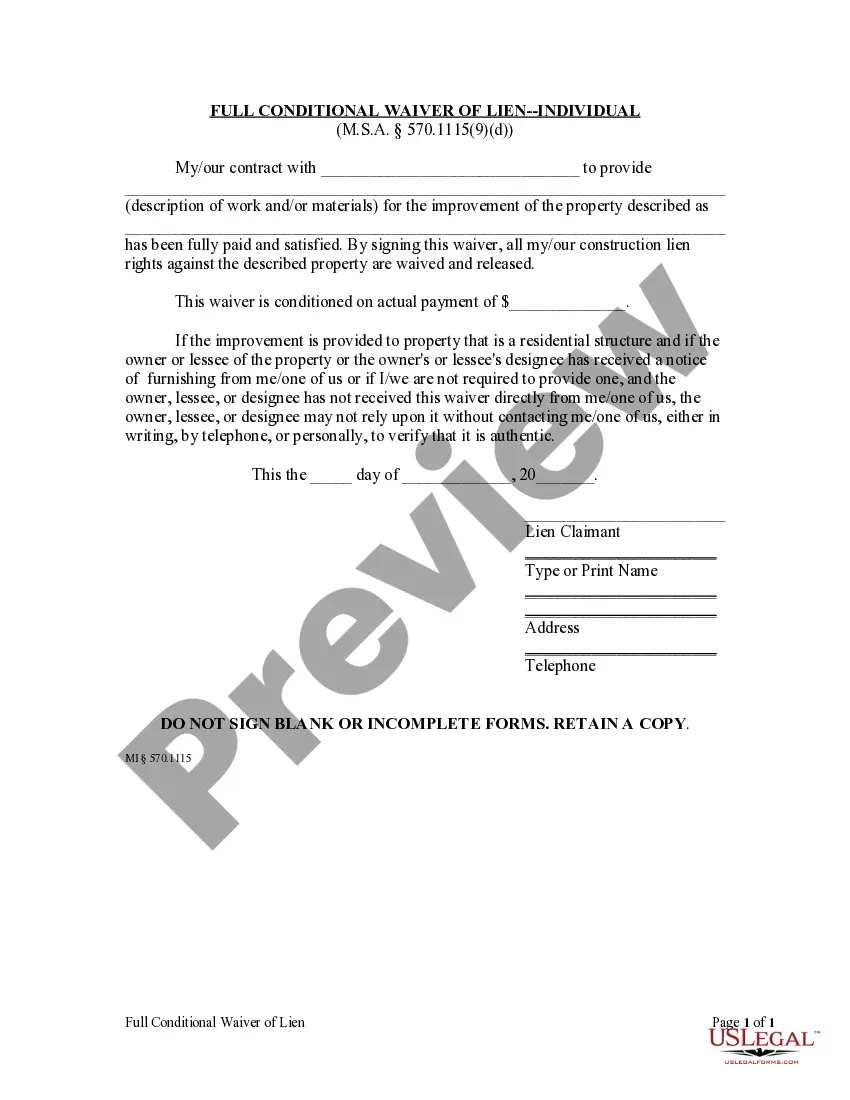

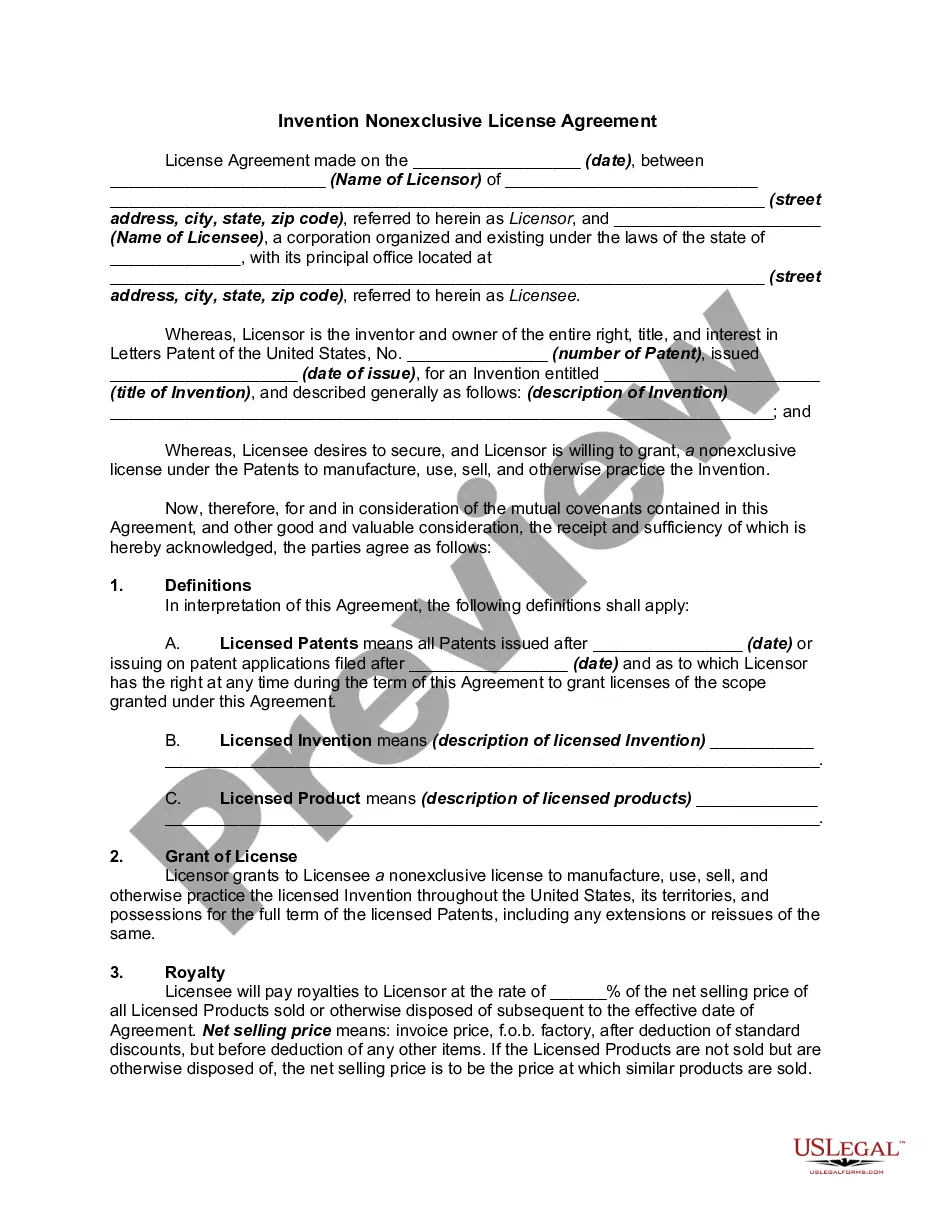

If available, utilize the Review button to examine the document template as well. In order to find another version of the form, use the Search field to obtain the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you can sign in and then click the Download button.

- Then, you can complete, edit, print, or sign the Oregon Minutes for Partnership.

- Every valid document template you purchase is yours indefinitely.

- To obtain an additional copy of a purchased form, navigate to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, adhere to the straightforward instructions below.

- First, ensure you have chosen the correct document template for your chosen state/city.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

Oregon partnerships do not file a standard partnership tax return as corporations do; instead, they typically file an informational return. Each partner reports their share of the partnership income or loss on their individual tax returns, reflecting their earnings generated from the partnership. It is crucial to stay informed about tax obligations, including any requirements related to Oregon Minutes for Partnership, as this documentation can aid in tax reporting. Consulting with uslegalforms can provide valuable resources and forms tailored to your needs.

Yes, partnerships do have minutes, often referred to as Oregon Minutes for Partnership. These minutes are important for documenting significant decisions, discussions, and agreements made during partnership meetings. While they are not a legal requirement, maintaining them helps establish transparency and accountability among partners, which can be particularly beneficial in resolving disputes. Utilizing uslegalforms can simplify the process of creating and organizing your partnership minutes.

To form a partnership, you need at least two individuals who agree to run a business together. You must create a partnership agreement that clarifies roles, responsibilities, and profit allocation. While registration is typically not mandatory with the state, it is advisable to keep detailed Oregon Minutes for Partnership for clarity and record-keeping. Using platforms like uslegalforms can streamline the creation of your partnership agreement.

Starting a Domestic Partnership in Oregon requires you to file a Declaration of Domestic Partnership with the state. You and your partner must meet specific eligibility criteria, such as being 18 years or older and sharing a common residence. Once your application is approved, you’ll receive confirmation, which allows you to enjoy the rights and benefits associated with your Oregon Minutes for Partnership. Consider exploring uslegalforms for additional guidance throughout the process.

To set up a partnership in Oregon, you first need to choose a unique name for your partnership and ensure it complies with state regulations. Next, you should draft a partnership agreement that outlines each partner's contributions, responsibilities, and profit-sharing arrangements. It’s important to file any required forms with the state and obtain any necessary licenses or permits. After these steps, you'll have established a solid foundation for your Oregon Minutes for Partnership.

To record partnership income, each partner must report their share of income on their personal tax return. Partnerships typically file an annual return, Form 1065, to report annual income, deductions, and credits. Understanding the implications of Oregon Minutes for Partnership is vital to ensure accurate reporting and compliance. Utilizing reliable record-keeping practices will enhance your partnership's financial transparency.

The 3 year rule specifies that if you own property in Oregon and do not establish residency elsewhere, you may be considered a resident for tax purposes. This could impact how you handle Oregon Minutes for Partnership since residency status correlates with tax liabilities. It’s wise to evaluate your circumstances, especially if you are involved in a partnership that generates income. Being informed will aid in managing your partnership's financial responsibilities.

The 6 month rule states that if you physically reside in Oregon for more than six months within a year, you may be deemed a tax resident. This can have significant implications for any business partnerships you have, particularly regarding tax compliance. Considering Oregon Minutes for Partnership can help clarify responsibilities in your partnership agreements. Proper understanding of this rule can save you time and hassle.

To be considered a resident of Oregon, you should live in the state for more than 200 days in a year. Being classified as a resident affects how Oregon Minutes for Partnership are treated, especially concerning tax requirements. It's vital to maintain accurate records of your days spent in Oregon to support your residency claims. Always consult your accountant for precise guidance.

You can live in Oregon for up to 200 days without being classified as a resident for tax purposes. However, this rule can vary based on your specific circumstances and activities in the state. Understanding how your time in Oregon relates to Oregon Minutes for Partnership is crucial for effective tax planning. Staying informed ensures you avoid any unexpected tax liabilities.