Oregon Corporation - Minutes

Description

How to fill out Corporation - Minutes?

Locating the appropriate legal document design can be challenging.

Certainly, there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms platform. The service provides thousands of templates, such as the Oregon Corporation - Minutes, that you can use for business and personal purposes.

If the form does not meet your needs, utilize the Search field to find the correct form. Once you confirm that the form is appropriate, click the Buy now button to acquire the form. Choose the payment plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document design to your device. Complete, modify, print, and sign the downloaded Oregon Corporation - Minutes. US Legal Forms is the largest collection of legal forms where you can find various document templates. Use the service to obtain professionally prepared documents that adhere to state regulations.

- All of the forms are verified by experts and comply with federal and state regulations.

- If you are already a member, Log In to your account and then click the Download button to obtain the Oregon Corporation - Minutes.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account and download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and read the form description to make sure it is suitable for you.

Form popularity

FAQ

Yes, corporations are required to keep meeting minutes as part of their official records. These minutes document the decisions made during meetings and demonstrate compliance with corporate governance laws. Maintaining accurate Oregon Corporation - Minutes can protect your entity and provide clarity in your operational processes.

Bylaws of a corporation in Oregon are the internal rules that govern the operation of the business. They outline the roles of officers, procedures for meetings, and how decisions are made within the corporation. Properly drafted bylaws are crucial as they form the foundation of your Oregon Corporation - Minutes documentation.

The 200-day rule in Oregon refers to the requirement for corporations to adopt their initial corporate bylaws within 200 days of their formation. This rule ensures that all operational guidelines are established early, thereby facilitating governance. Adhering to this rule is essential for maintaining accurate Oregon Corporation - Minutes.

Federal tax extensions can apply at the state level, including Oregon. While the extension gives you additional time to file your federal taxes, Oregon allows a matching extension if you notify the state accordingly. Thus, keeping your Oregon Corporation - Minutes updated aligns with your overall filing strategy.

Yes, Oregon honors federal extensions as long as the requirements are met. This means that if you extend your federal tax return, you also have an automatic extension for your Oregon return. Utilizing this option can simplify your planning and filings related to Oregon Corporation - Minutes.

Oregon does accept federal extensions for corporations as well. When you file for an extension federally, you automatically receive additional time to file your Oregon tax return, provided that you submit your application correctly. This feature is beneficial for corporations managing their Oregon Corporation - Minutes, ensuring they meet the necessary timeframes.

Yes, Oregon accepts federal extensions for S corporations. However, you must file your Oregon state tax return by the extended deadline, which is typically six months after your federal deadline. This allows you to enjoy more time for tax preparation while ensuring compliance with Oregon Corporation - Minutes requirements.

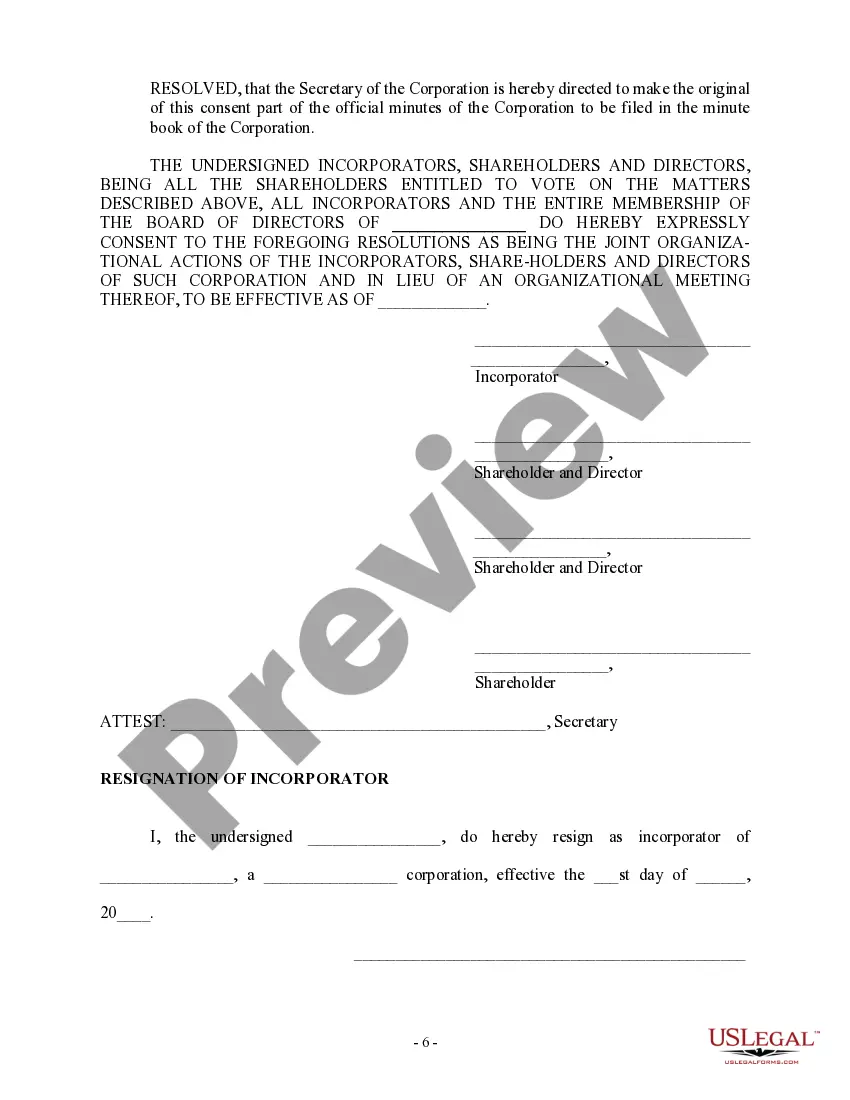

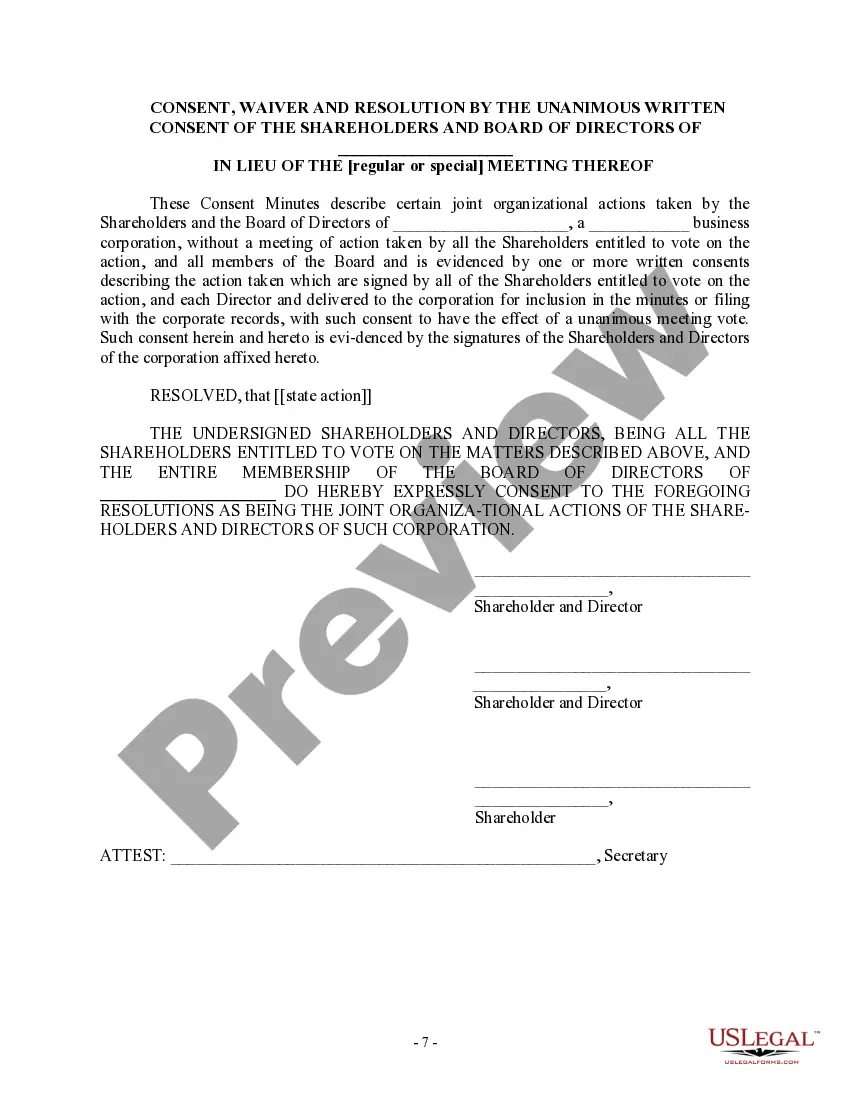

To record corporate meeting minutes effectively, start by noting the date, time, and location of the meeting, along with a list of attendees. Capture key points discussed, decisions made, and any action items assigned during the meeting. After drafting the minutes, ensure they are reviewed, approved, and filed properly as part of your Oregon Corporation record. For guidance and templates, consider using US Legal Forms, which provides resources tailored to your needs.

Failing to maintain corporate minutes can lead to legal issues and jeopardize the protection of your personal assets. Without Oregon Corporation - Minutes, you may struggle to prove that you are following proper corporate procedures. This lack of documentation can result in challenges during audits or legal proceedings. To avoid these problems, it’s crucial to establish a reliable way to track and store meeting records, such as using US Legal Forms.

Generally, you do not need to file corporate meeting minutes with the state; however, you must keep them in your corporate records. The state of Oregon requires corporations to maintain accurate minutes to demonstrate that meetings were held and decisions made. Having well-documented Oregon Corporation - Minutes can help you resolve disputes and meet legal obligations. US Legal Forms can assist you in creating and storing these essential records.