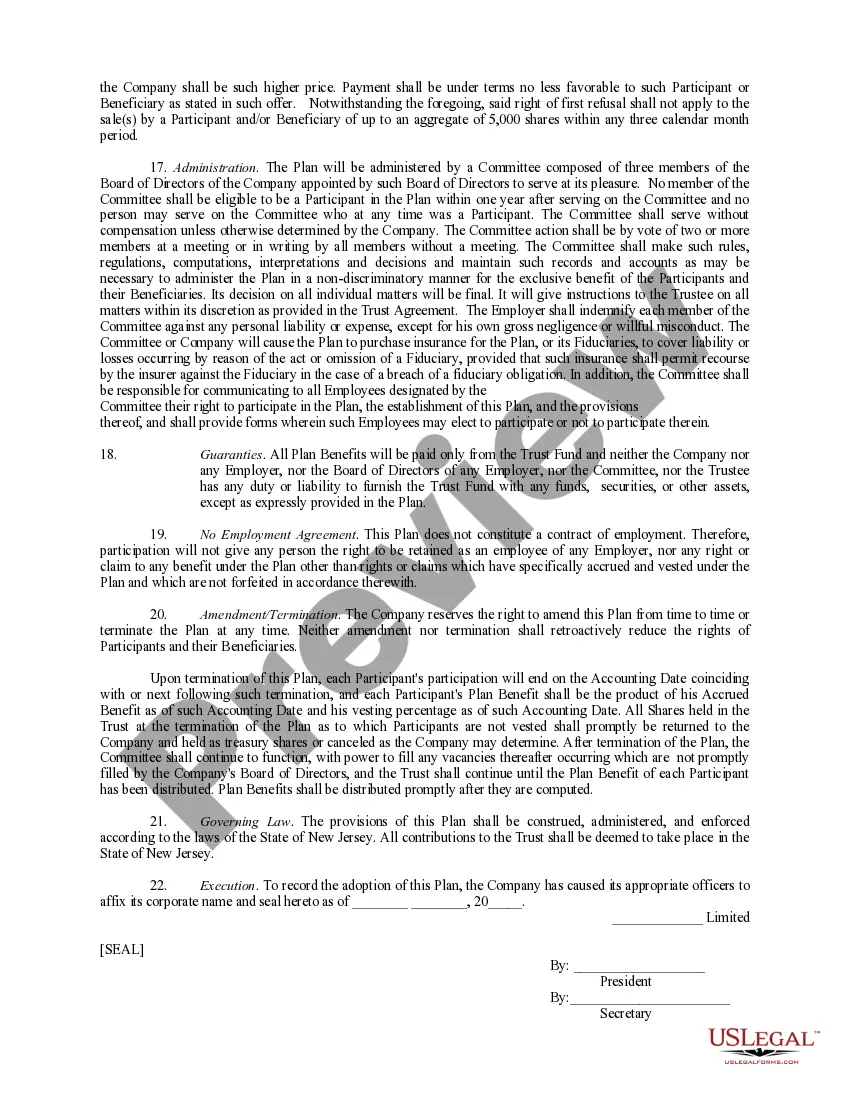

Oregon Executive Employee Stock Incentive Plan

Description

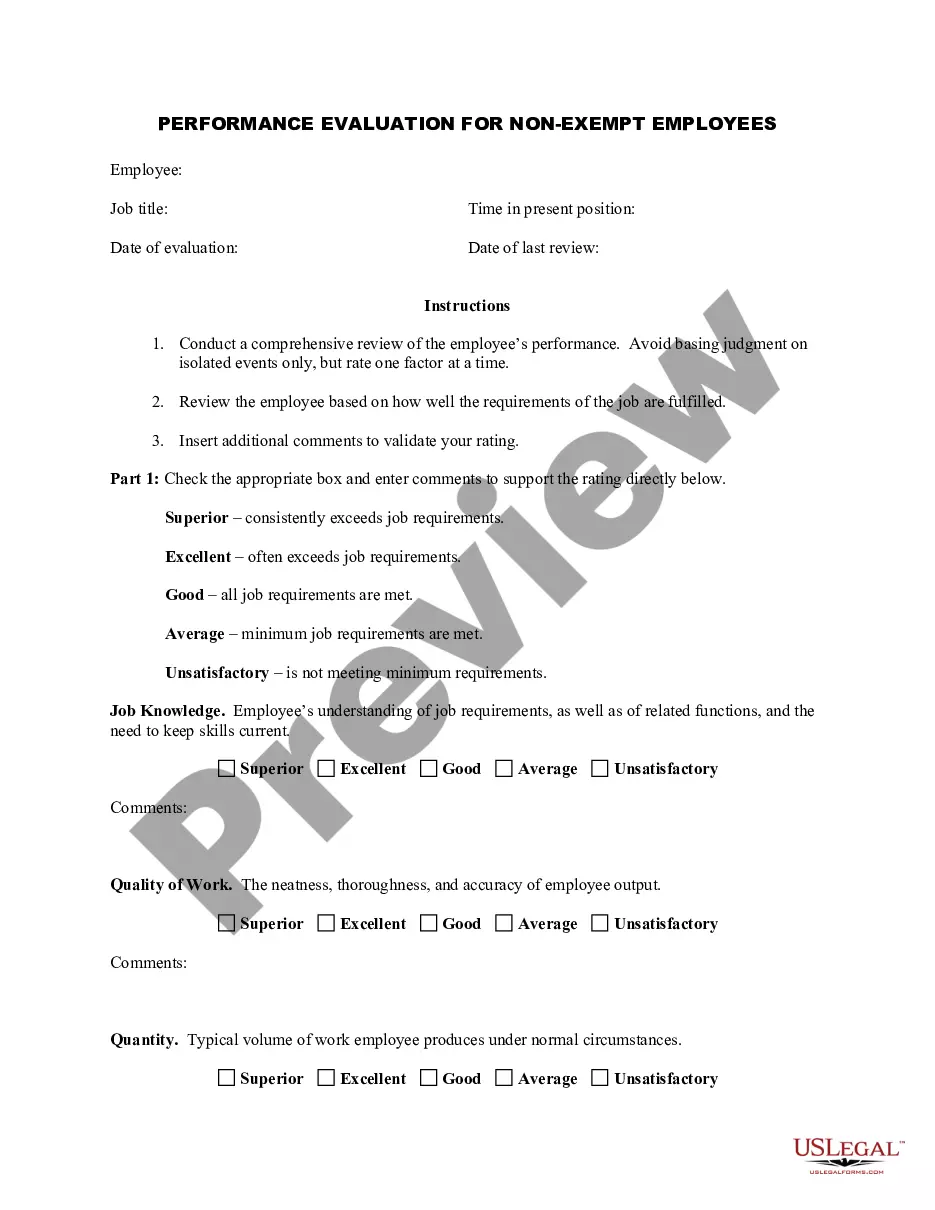

How to fill out Executive Employee Stock Incentive Plan?

If you intend to be thorough, acquire, or print sanctioned document formats, utilize US Legal Forms, the premier compilation of legal documents, which is accessible online.

Employ the website’s straightforward and user-friendly search to locate the documents you require. Various templates for business and personal purposes are sorted by categories and states, or keywords.

Use US Legal Forms to find the Oregon Executive Employee Stock Incentive Plan in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to all forms you saved in your account. Visit the My documents section and select a form to print or download again.

Compete and obtain, and print the Oregon Executive Employee Stock Incentive Plan with US Legal Forms. There are countless professional and state-specific documents you can use for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the Oregon Executive Employee Stock Incentive Plan.

- You can also access documents you previously stored in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for your specific city/state.

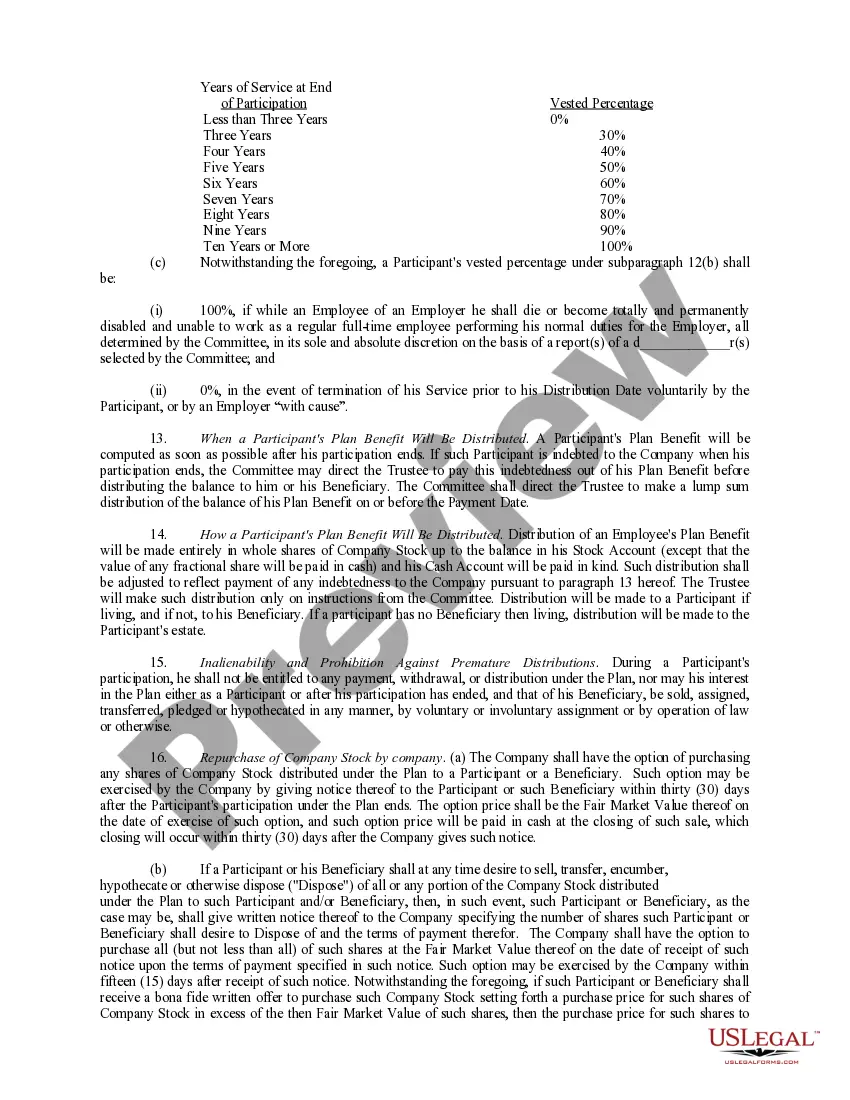

- Step 2. Use the Preview option to review the content of the form. Do not forget to check the description.

- Step 3. If you are not satisfied with the form, employ the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing option you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Oregon Executive Employee Stock Incentive Plan.

Form popularity

FAQ

When you exercise your incentive stock options from your Oregon Executive Employee Stock Incentive Plan, it is crucial to understand how this affects your taxes. First, you do not report the exercise on your regular income tax return, but you need to report it when you sell the stock. You should consult a tax professional for accurate advice tailored to your situation, but generally, you will report any capital gains on the sale of the stock on Schedule D.

A typical executive compensation package often includes a combination of salary, bonuses, stock options, and other benefits. This diverse structure helps ensure that executives are rewarded not only for their current performance but also for their contributions to future company success. In the realm of the Oregon Executive Employee Stock Incentive Plan, these packages can be tailored to align with corporate goals while fostering loyalty among top performers.

An ESOP, or Employee Stock Ownership Plan, is a program that gives employees an ownership interest in the company, often viewed as a retirement benefit. In contrast, an incentive plan typically includes stock options or performance bonuses that are directly tied to achieving specific business objectives. Understanding these differences is critical when considering an Oregon Executive Employee Stock Incentive Plan, as both can play a key role in executive retention and motivation.

The primary purpose of offering executive stock options is to motivate and retain top talent within the organization. By linking compensation with company performance, executives are incentivized to work towards increasing the company's value. In the context of the Oregon Executive Employee Stock Incentive Plan, these options can encourage long-term commitment and align executive interests with shareholder goals.

Incentive stock options are typically awarded to employees who contribute significantly to the growth and success of a company. The definition of eligible recipients often depends on specific criteria established in the Oregon Executive Employee Stock Incentive Plan. If you are an employee looking to understand your options, consider leveraging resources available on platforms like U.S. Legal Forms for guidance.

Eligibility for Incentive Stock Options generally includes employees who are granted the options as part of an approved plan. You must meet specific criteria outlined in the Oregon Executive Employee Stock Incentive Plan to ensure your eligibility. Moreover, be aware that certain limits apply to ownership and timing to maintain eligibility under IRS regulations.

Individuals who are employees of the company are the primary candidates for incentive stock options. To qualify, you must be granted these options under a plan that adheres to federal regulations. The Oregon Executive Employee Stock Incentive Plan is an excellent framework for ensuring compliance and maximizing benefits for qualifying employees.

In general, incentive stock options (ISOs) are specifically designed for employees of a company. Thus, non-employees typically do not qualify for these options. However, certain plans may allow for alternative forms of stock incentives for non-employees. It is essential to consult with a legal expert familiar with the Oregon Executive Employee Stock Incentive Plan to explore all available options.