Oregon Deferred Compensation Agreement - Short Form

Description

How to fill out Deferred Compensation Agreement - Short Form?

Are you currently in a situation where you require documents for various business or specific purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Oregon Deferred Compensation Agreement - Short Form, which can be tailored to meet state and federal requirements.

Once you find the right form, simply click Acquire now.

Choose the payment plan you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Oregon Deferred Compensation Agreement - Short Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

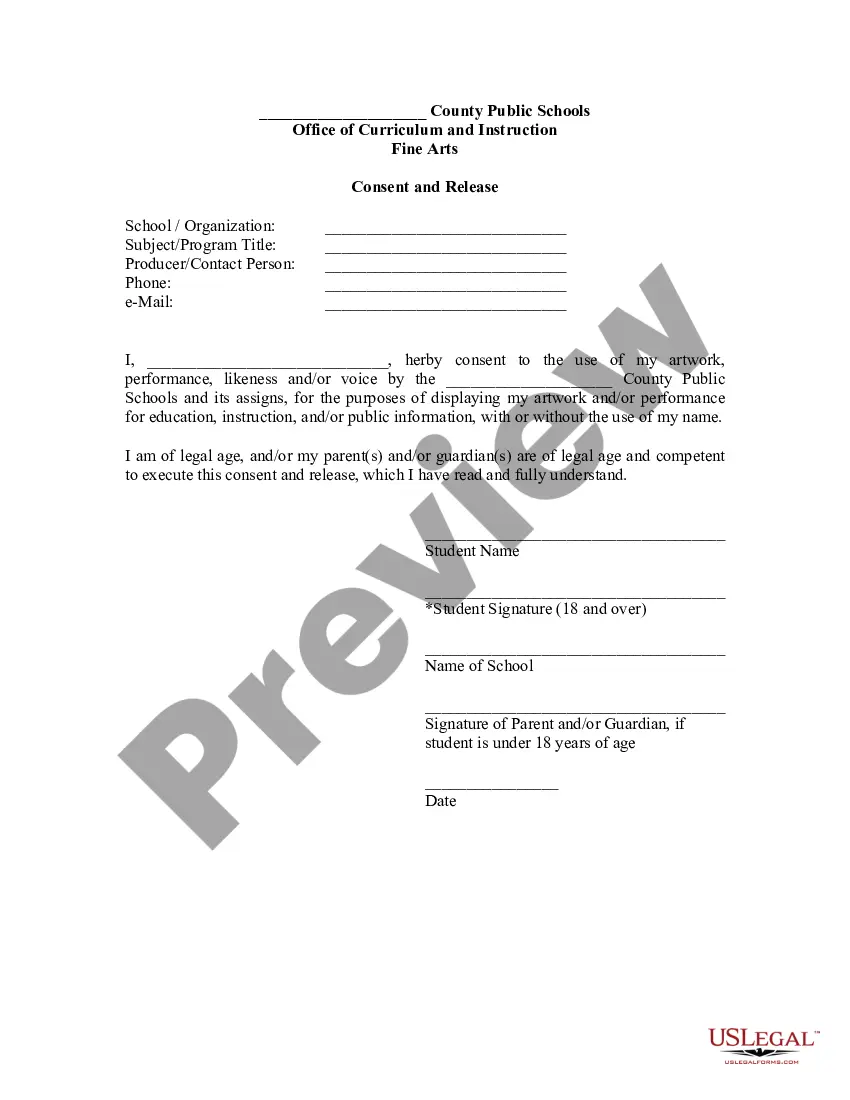

- Use the Preview button to review the form.

- Check the outline to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Menu Oregon.gov. The Oregon Savings Growth Plan (OSGP) is the state of Oregon's 457(b) deferred compensation plan that provides public employees a convenient way to save for retirement.

User authentication with Identity-Aware ProxyOn this page.Download the code.Review the application code.Deploy to App Engine.Restrict access with IAP.Deploy to App Engine.Examine the application files.Turn off IAP.More items...?

IAP can be measured directly or indirectly.Direct measurement is obtained via a needle or catheter in the peritoneal space, and IAP is measured using a fluid column or pressure transducer system.IAP is usually measured indirectly via the patient's bladder.More items...

The Oregon Savings Growth Plan (OSGP) is a 457(b) deferred compensation plan that provides public employees with a convenient way to contribute to their retirement. It allows employees to contribute a portion of their salary on a pre- or post-tax basis.

200bOSGP200b200b is a 457(b) deferred compensation plan that provides Oregon public employees with a convenient way to save for retirement by allowing them to contribute a portion of their salary on a pre or after tax basis. All state employees, and local governments who opt to participate, are eligible to enroll upon hire.

An in-app purchase (IAP) is something bought from within an application, typically a mobile app running on a smartphone or other mobile device. Software vendors can sell all manner of things from within apps. In games, for example, users can buy characters, upgrade abilities and spend real money on in-game currencies.

Your IAP is subject to earnings or losses until you receive the funds. PERS works with employers to ensure that member contributions are accurate and complete before allocating earnings on a year-end balance basis so members are not adversely affected by posting delays or corrections.

200bOSGP200b200b is a 457(b) deferred compensation plan that provides Oregon public employees with a convenient way to save for retirement by allowing them to contribute a portion of their salary on a pre or after tax basis.

Get an ID token for the IAP-secured client ID:Android: Use the Google Sign-In API to request an OpenID Connect (OIDC) token. Set the requestIdToken client ID to the client ID for the resource you're connecting to.iOS: Use Google Sign-In to get an ID token.

Eligible employees include full-time and part-time Faculty, Classified, Managerial, Academic Professionals, Confidentials, and Casual employees. The Oregon Savings Growth Plan (OSGP) is a 457 deferred compensation plan that provides you with a convenient way to save for your retirement.