Oregon Partial Release of Property From Deed of Trust for Corporation

Description

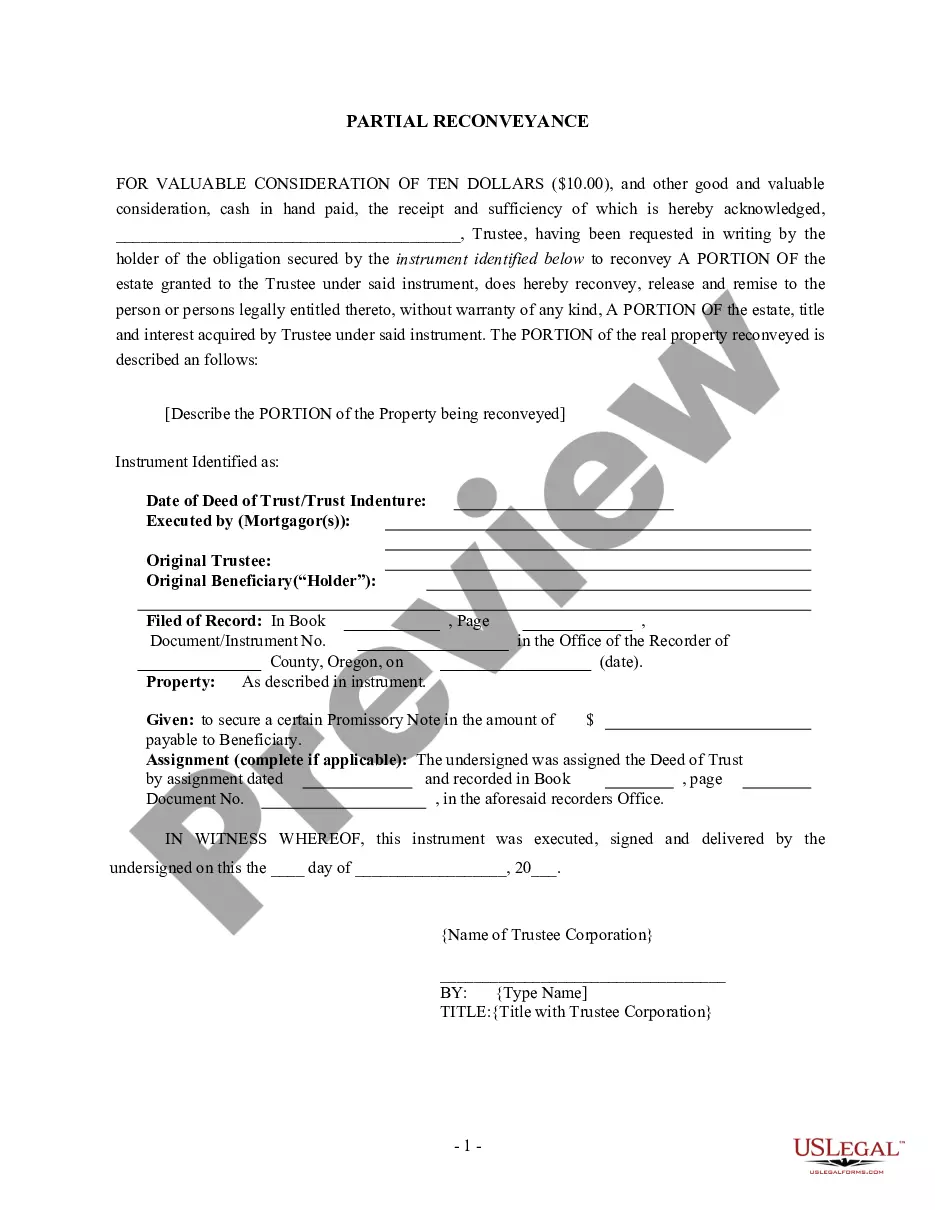

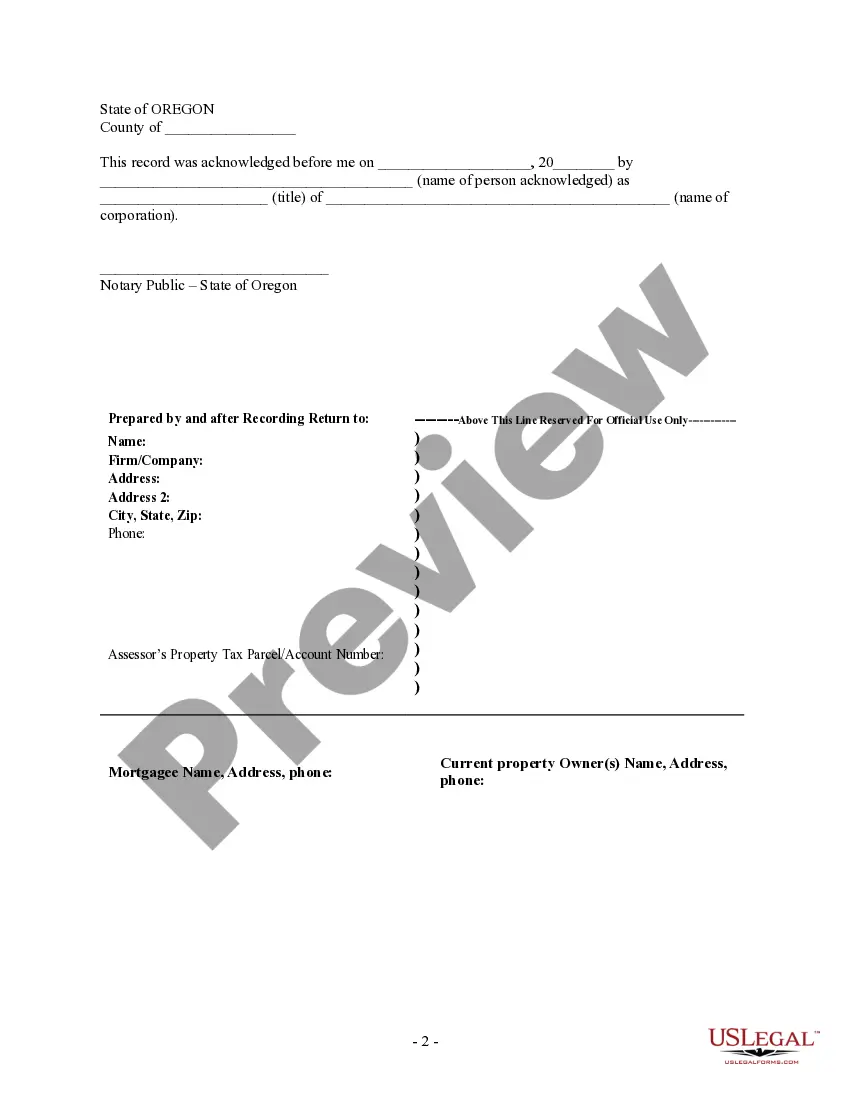

How to fill out Oregon Partial Release Of Property From Deed Of Trust For Corporation?

Creating documents isn't the most simple task, especially for people who rarely work with legal papers. That's why we advise using accurate Oregon Partial Release of Property From Deed of Trust for Corporation samples created by skilled attorneys. It gives you the ability to eliminate difficulties when in court or dealing with formal organizations. Find the templates you require on our website for high-quality forms and accurate descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will automatically appear on the template webpage. Right after accessing the sample, it will be saved in the My Forms menu.

Users with no an activated subscription can quickly create an account. Make use of this brief step-by-step help guide to get the Oregon Partial Release of Property From Deed of Trust for Corporation:

- Be sure that the sample you found is eligible for use in the state it’s needed in.

- Confirm the file. Utilize the Preview feature or read its description (if offered).

- Click Buy Now if this form is the thing you need or return to the Search field to get another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After doing these easy steps, it is possible to complete the form in your favorite editor. Check the filled in info and consider requesting a lawyer to examine your Oregon Partial Release of Property From Deed of Trust for Corporation for correctness. With US Legal Forms, everything gets much easier. Try it now!

Form popularity

FAQ

To access the unclaimed property database by telephone, contact the State Controller's Customer Service Unit. California residents can call toll-free, at 800-992-4647 between the hours of AM and PM, Monday through Friday (except holidays). Those outside California may call (916) 323-2827.

The executor or administrator must complete the claim. If there's more than one executor or administrator, all must be part of the claim. Search online for the unclaimed money. Lodge a claim online for the unclaimed money.

Relatives are entitled to unclaimed money belonging to a deceased family member.A substantial amount of this unclaimed money belongs to people who have died. Unclaimed money can legally be claimed by relatives of a deceased person.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

The basis of property inherited from a decedent is generally one of the following: The fair market value (FMV) of the property on the date of the decedent's death (whether or not the executor of the estate files an estate tax return (Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return)).

Go to the clerks office in whatever town/city you are looking to target. There should be public computers you can use to access public data. Ask one of the workers there to help you find certificates of Devise/Probates. These certificates would show you who just inherited any property.

Hi, No, ancestral property be cannot be sold without consent of successors in case of major and in in case of minority you might have to take permission from the court. And if property disposed without consent can be reclaimed.

If you decide that you do not want to keep an inherited home, your best choice is to sell it with the help of an experienced realtor. This is an opportunity to sell an unwanted property for cash, but you need the help of a professional to secure a good deal.

This will usually be more than the prior owner's basis. The bottom line is that if you inherit property and later sell it, you pay capital gains tax based only on the value of the property as of the date of death.