Oregon Trust Transfer Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

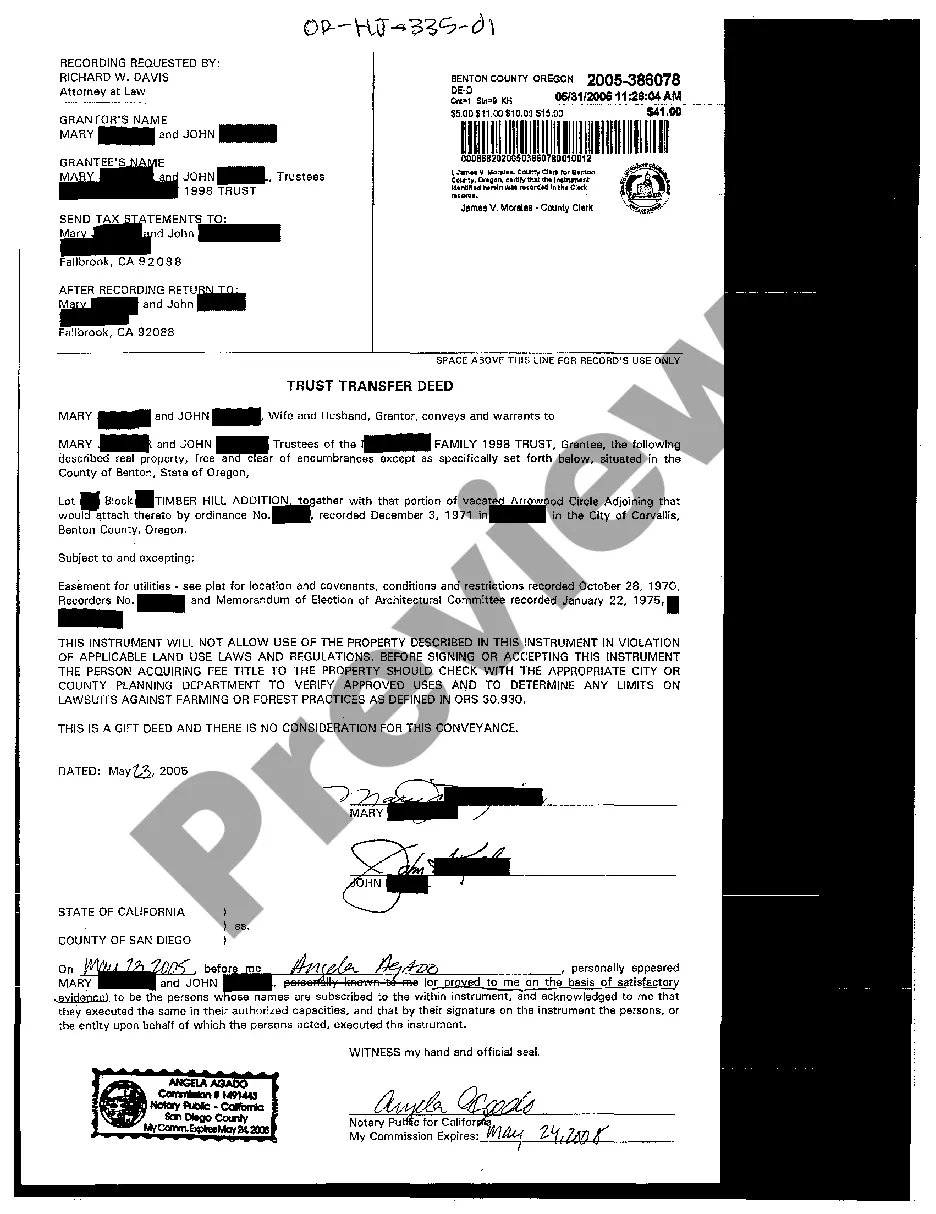

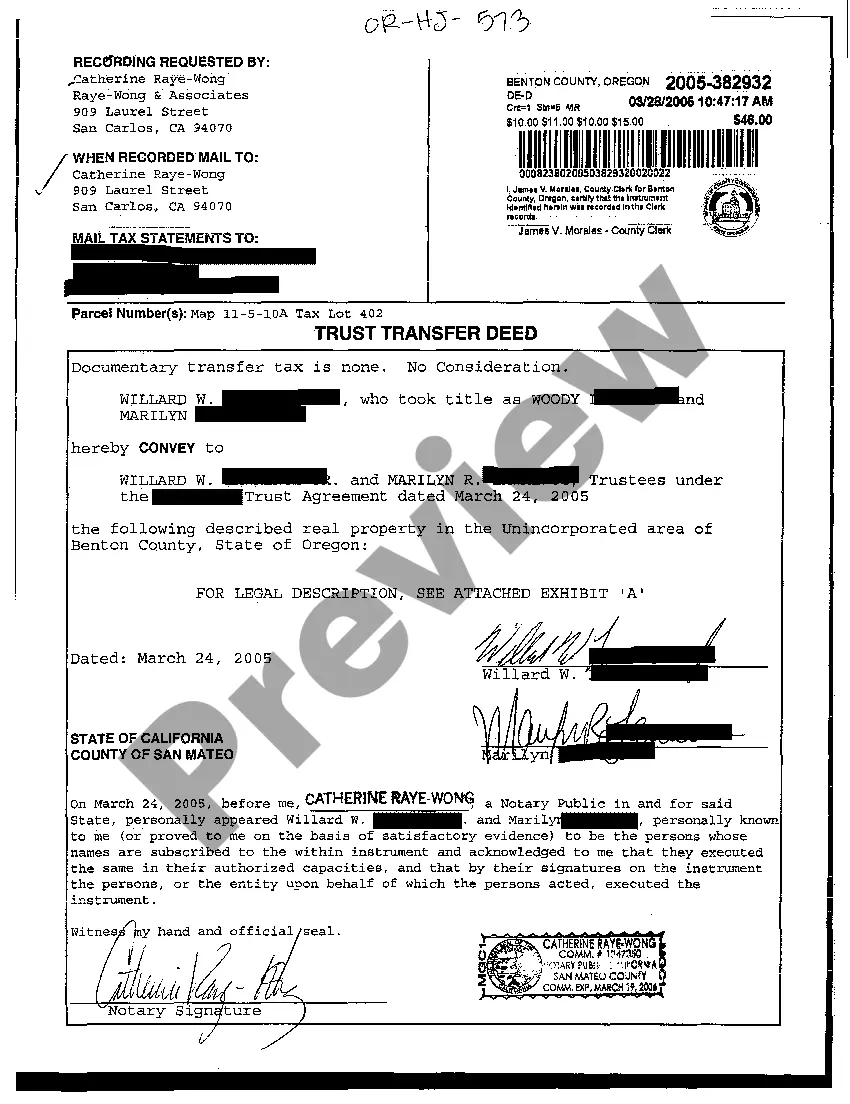

Trust Transfer Deed: A legal document used to transfer property from one party to another within the framework of a trust arrangement. Commonly referred to as a 'Deed of Trust,' this document differs from a traditional property deed in that it involves a trustee, who holds the property's title for the benefit of the trust beneficiaries.

Step-by-Step Guide to Creating a Trust Transfer Deed

- Determine the Necessity: Decide if transferring property into a trust is appropriate for your estate planning needs.

- Select a Trustee: Choose a reliable and trustworthy individual or institution to act as trustee.

- Prepare the Deed: Draft the trust transfer deed, detailing the property being transferred and the terms of the trust.

- Sign and Notarize: Have the trust deed signed by the relevant parties and notarized to ensure its legality and enforceability.

- Record the Deed: File the trust transfer deed with the appropriate county recorder to officially transfer the title and record the deed in public records.

Risk Analysis

- Legal Disputes: Improper drafting can lead to disputes among beneficiaries or with the trustee.

- Financial Implications: Transferring property to a trust might affect the property's tax status and eligibility for certain financial benefits.

- Trustee Issues: Choice of an unreliable trustee can lead to mismanagement of the property.

Key Takeaways

Trust transfer deeds are essential tools in estate planning, used to smoothly transition property ownership under the protection of a trust. Ensuring the document is correctly drafted and legally sound is vital to avoid future complications.

Best Practices

- Hire a Professional: Engage a knowledgeable estate attorney to ensure the trust deed adheres to local laws and meets all legal requirements.

- Clarify Terms: Clearly define the trust terms to all parties involved to prevent misunderstandings and disputes.

- Regular Reviews: Regularly review and update the trust document as needed to reflect changes in laws or in personal circumstances.

FAQ

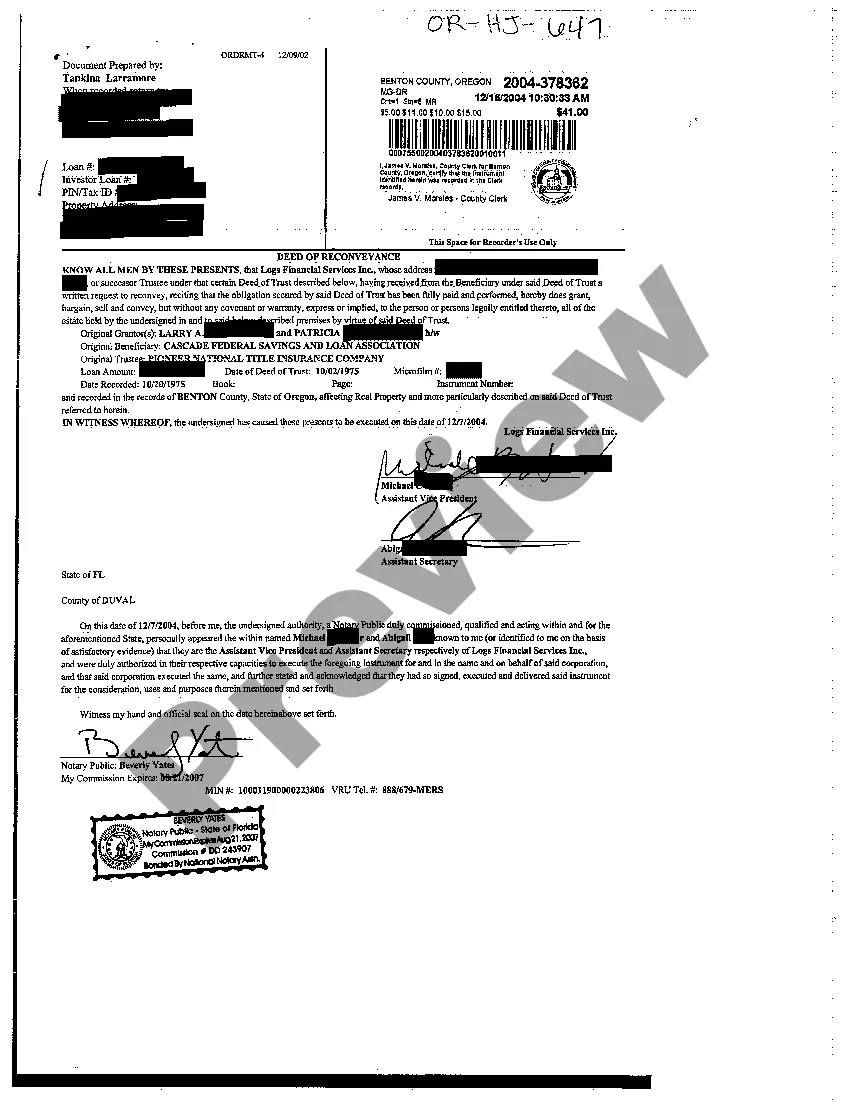

- What is the difference between a Trust Transfer Deed and a Mortgage? A trust transfer deed involves a trustee, whereas a mortgage is a loan secured by real property without involving a trustee.

- Can a Trust Transfer Deed be reversed? Reversing a trust transfer deed generally requires the consent of all parties involved, including beneficiaries and sometimes requires legal action.

How to fill out Oregon Trust Transfer Deed?

The work with papers isn't the most easy process, especially for those who almost never work with legal papers. That's why we advise using accurate Oregon Trust Transfer Deed samples created by skilled attorneys. It gives you the ability to avoid difficulties when in court or dealing with formal organizations. Find the templates you need on our site for high-quality forms and exact descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will automatically appear on the template web page. After accessing the sample, it’ll be stored in the My Forms menu.

Customers with no an active subscription can easily create an account. Utilize this short step-by-step help guide to get your Oregon Trust Transfer Deed:

- Make certain that file you found is eligible for use in the state it is necessary in.

- Confirm the document. Use the Preview option or read its description (if available).

- Click Buy Now if this form is what you need or use the Search field to find a different one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after completing these simple steps, you can fill out the sample in your favorite editor. Double-check filled in data and consider requesting an attorney to examine your Oregon Trust Transfer Deed for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

A conveyance of land in Oregon, or of any estate or interest therein located in Oregon, can be created, transferred, or declared by a deed in writing and should be signed by the person of lawful age (or their agent) from whom the estate or interest is intended to pass.

A deed conveys ownership; a deed of trust secures a loan.

In order to transfer real property held in a living trust, the trustee executes a trustee's deed. The trustee's deed is one in a class of instruments named descriptively after the granting party, rather than the warranty of title conveyed (think administrator's deed, executor's deed, sheriff's deed).

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.