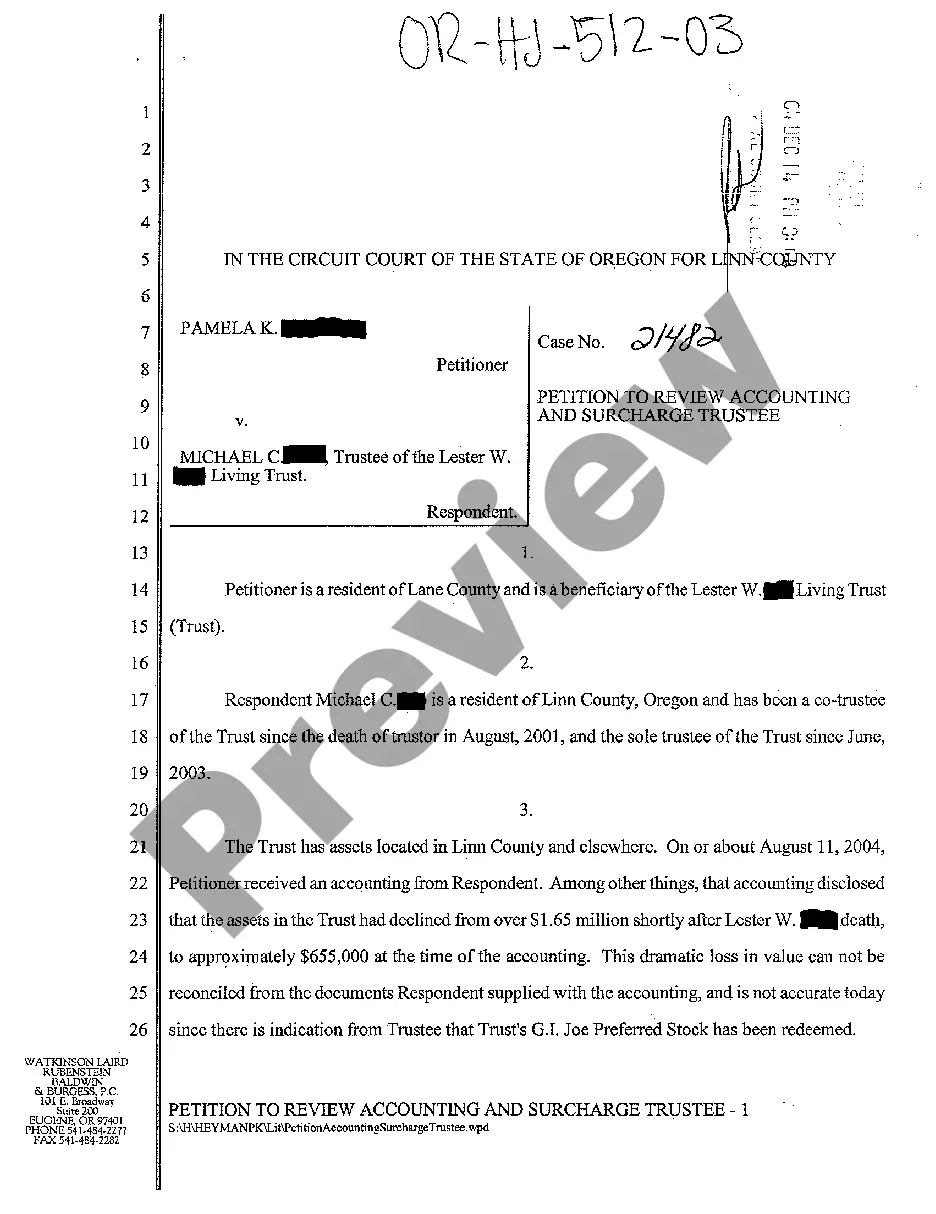

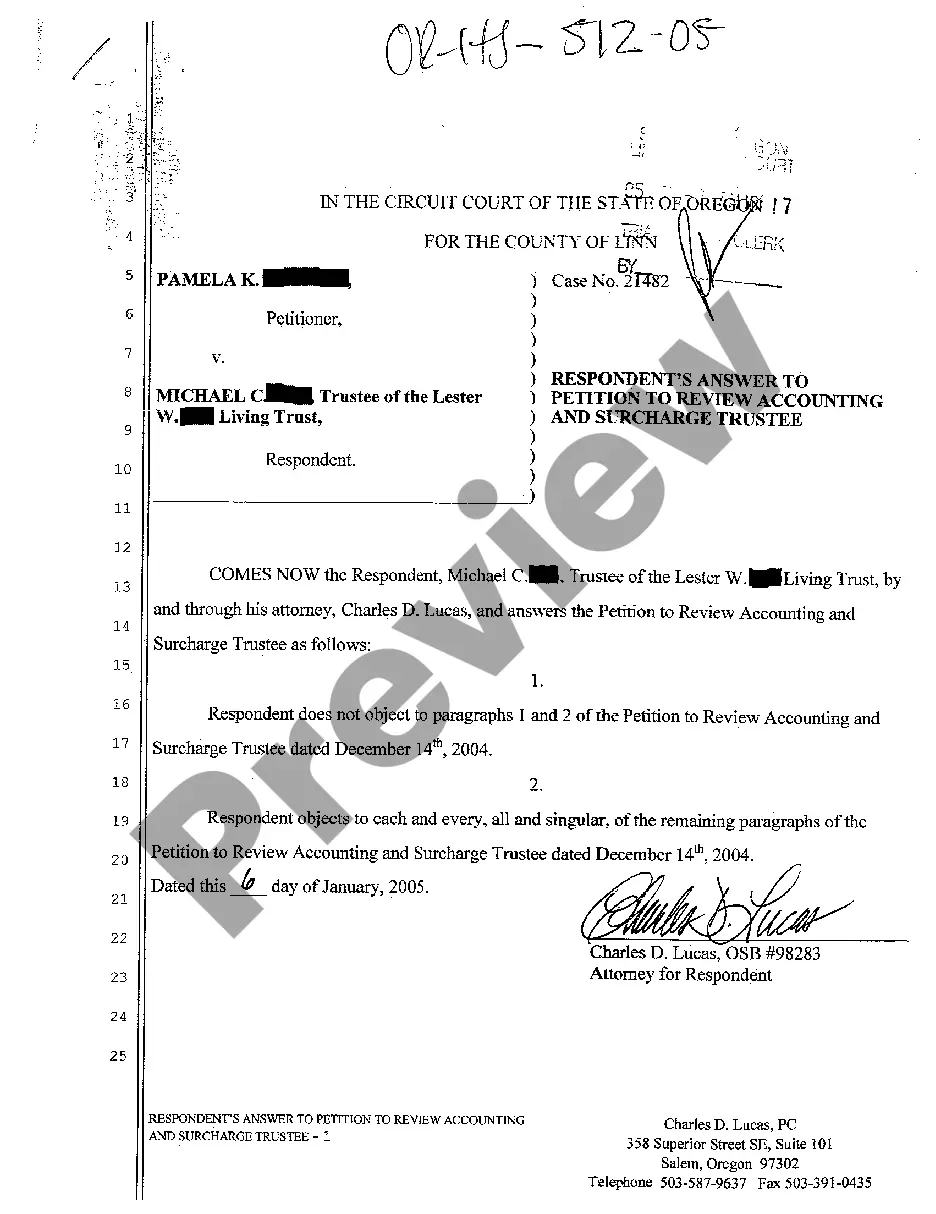

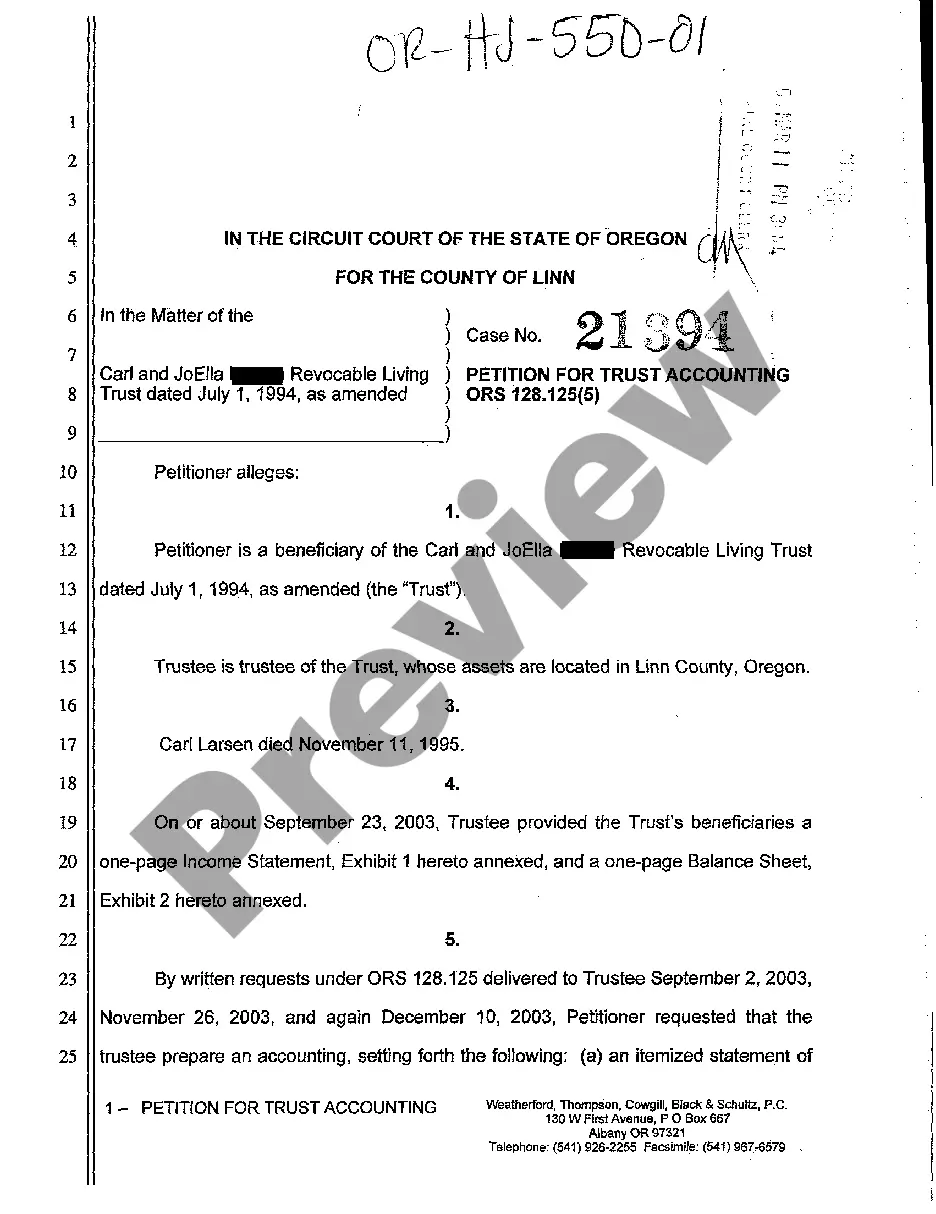

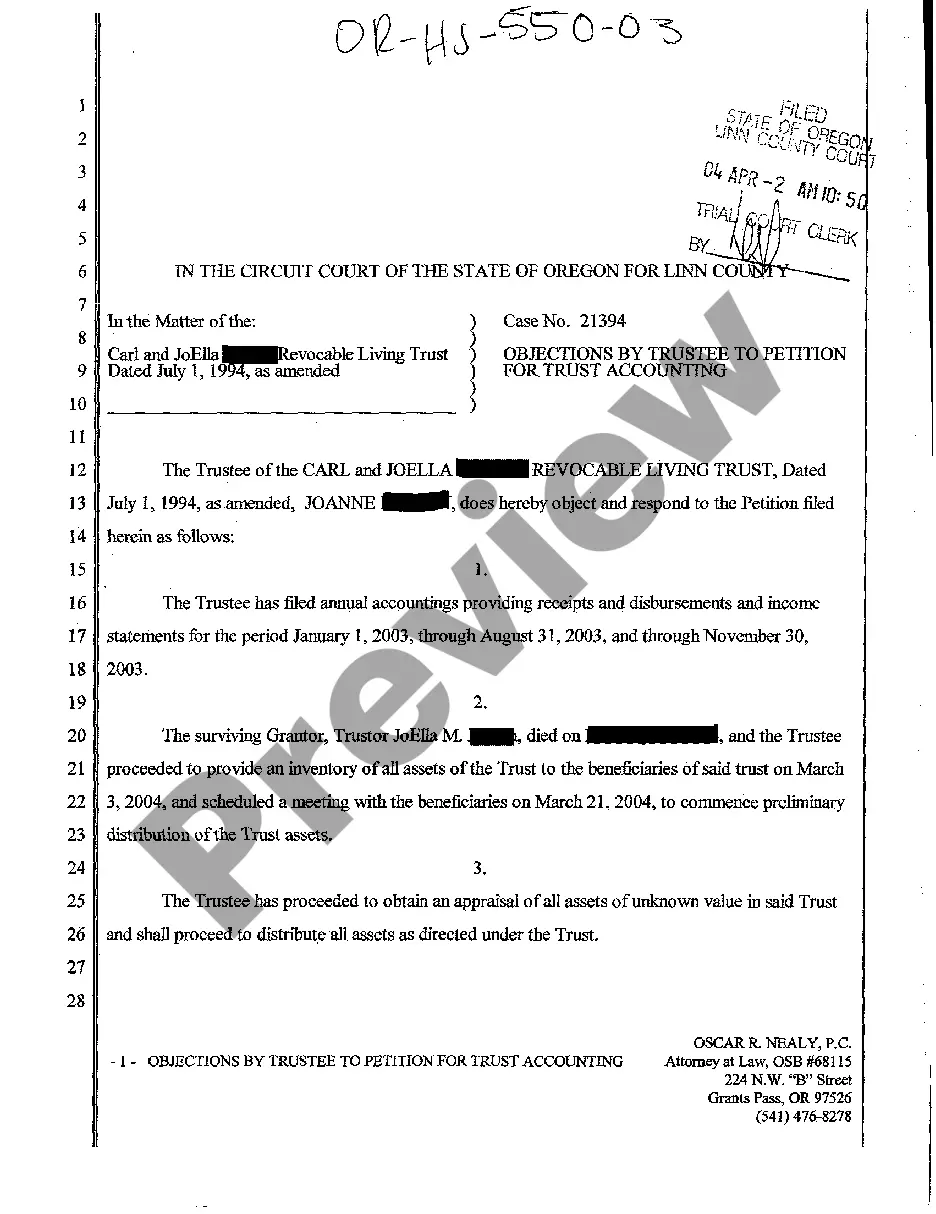

Oregon Petition to Review Accounting and Surcharge Trustee

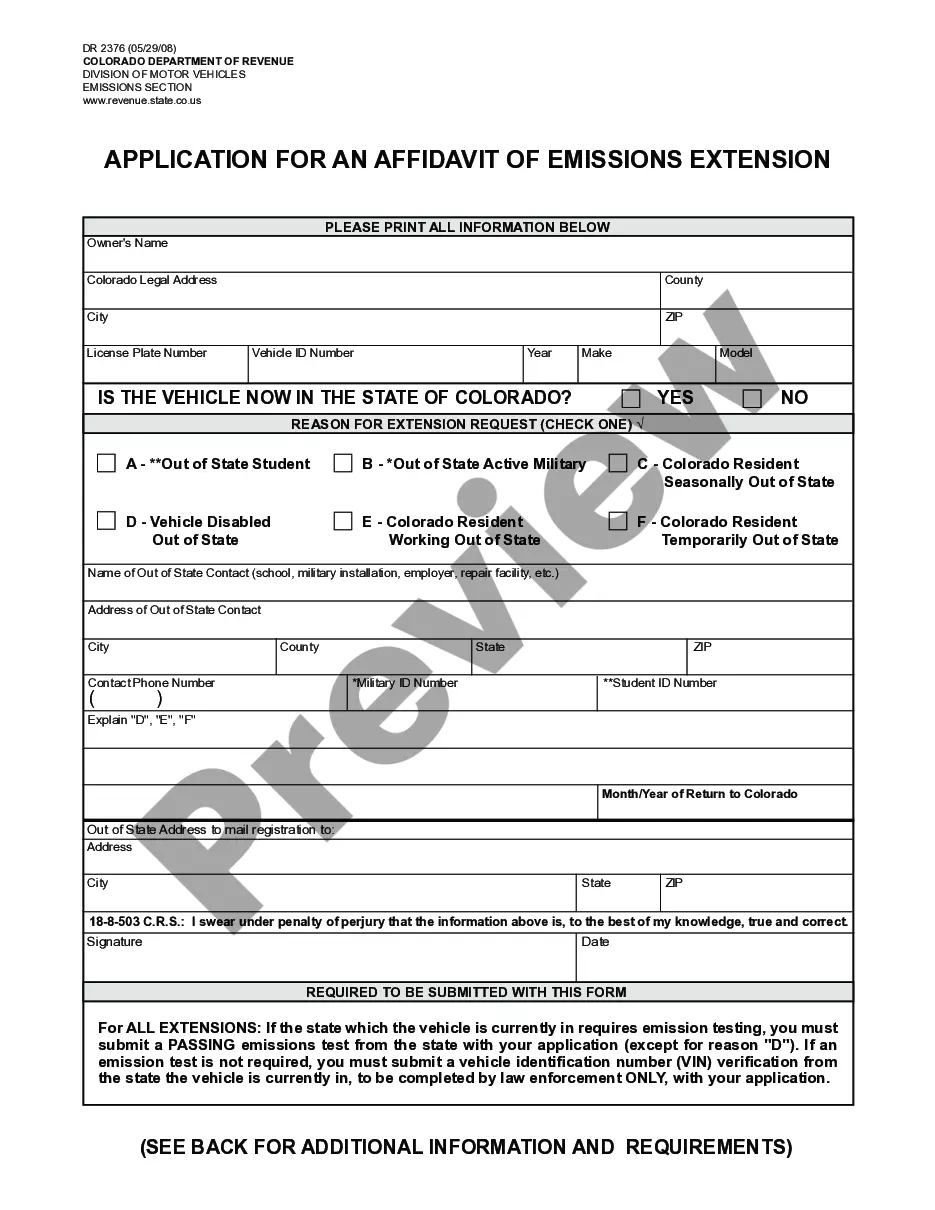

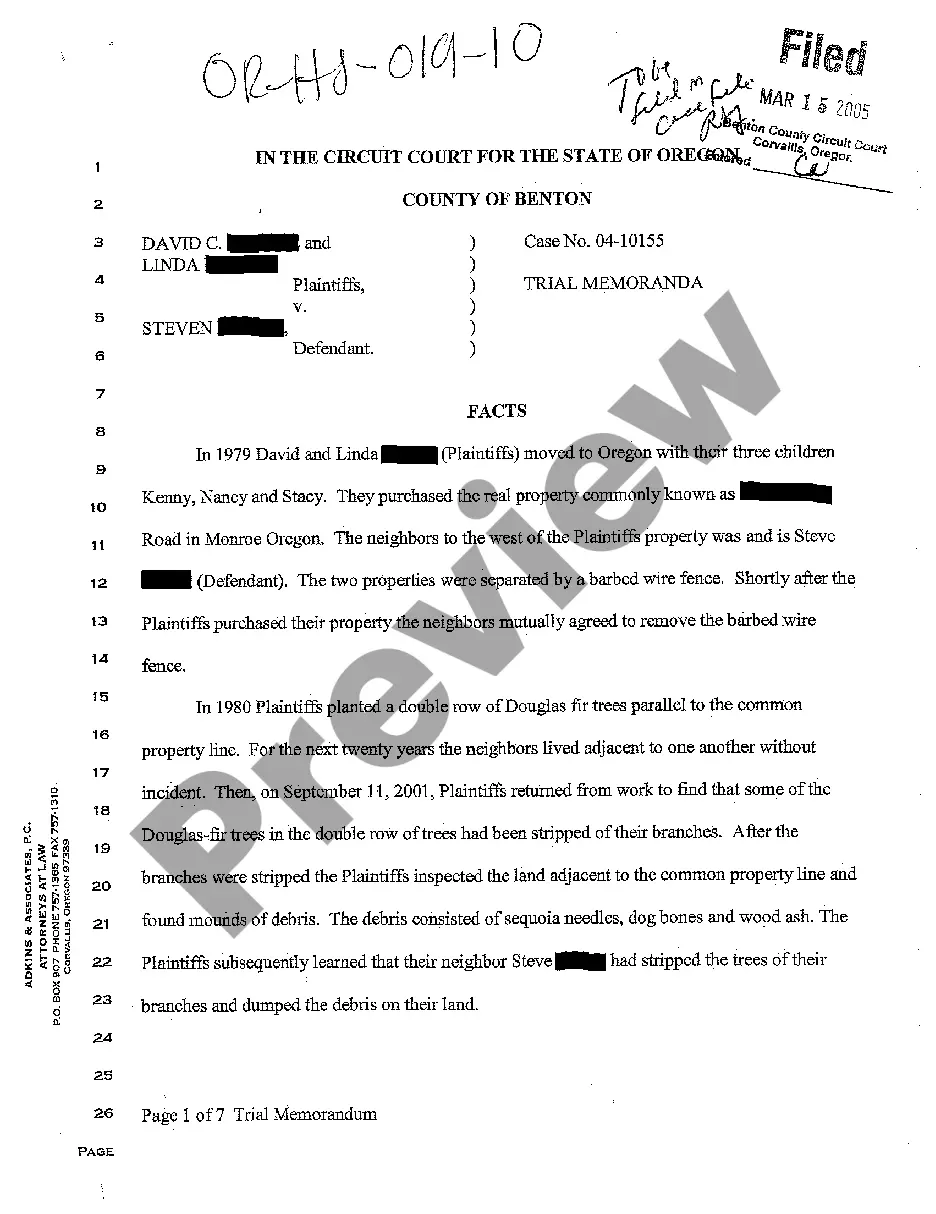

Description

How to fill out Oregon Petition To Review Accounting And Surcharge Trustee?

The work with documents isn't the most straightforward process, especially for those who rarely work with legal papers. That's why we advise making use of correct Oregon Petition to Review Accounting and Surcharge Trustee templates made by skilled lawyers. It gives you the ability to avoid troubles when in court or dealing with official institutions. Find the templates you need on our website for high-quality forms and correct explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the template page. Right after getting the sample, it’ll be stored in the My Forms menu.

Customers without an active subscription can quickly get an account. Use this simple step-by-step guide to get the Oregon Petition to Review Accounting and Surcharge Trustee:

- Make sure that the document you found is eligible for use in the state it is required in.

- Confirm the file. Make use of the Preview feature or read its description (if available).

- Buy Now if this sample is the thing you need or go back to the Search field to find another one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After finishing these straightforward actions, you are able to fill out the sample in a preferred editor. Double-check completed information and consider requesting a legal professional to examine your Oregon Petition to Review Accounting and Surcharge Trustee for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

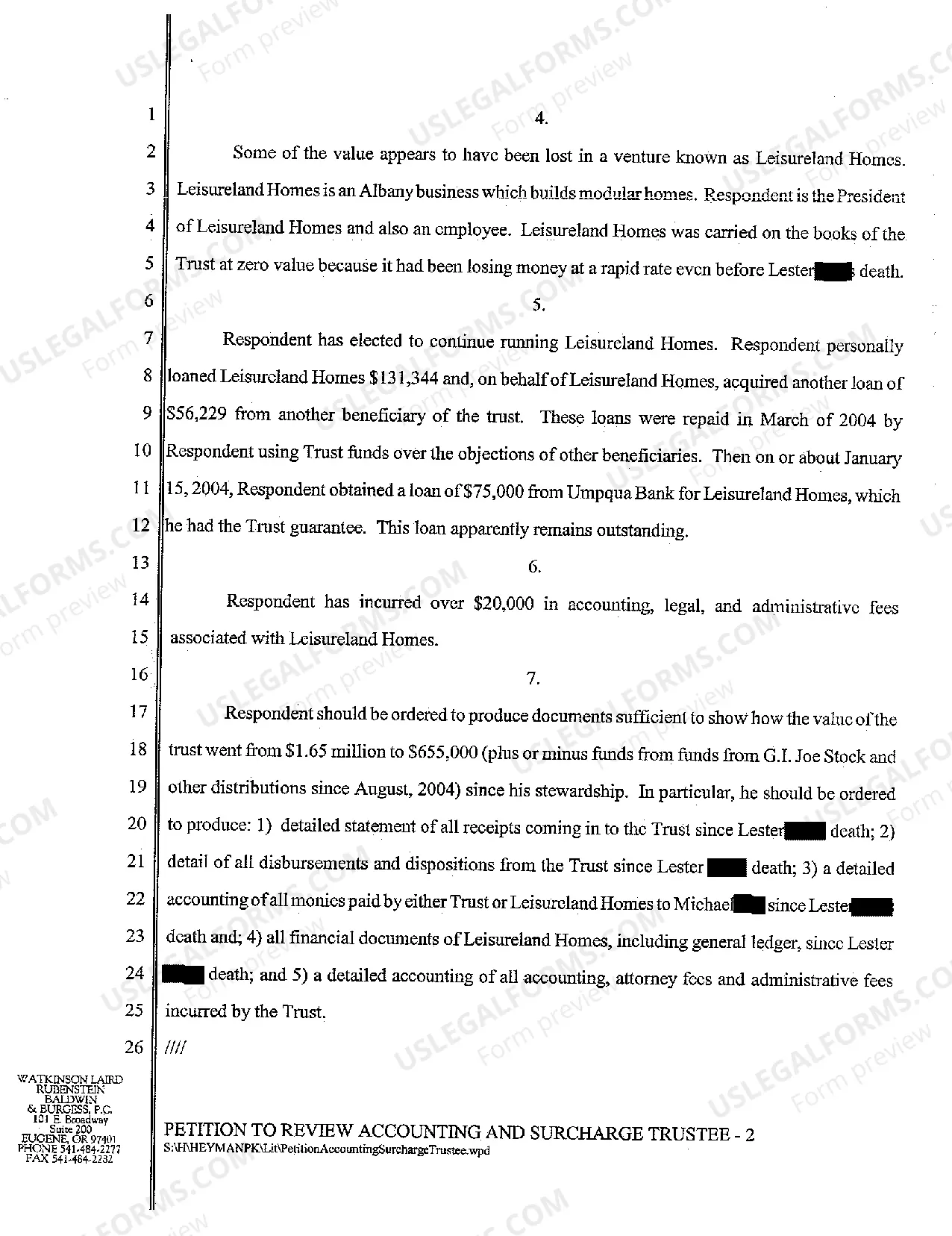

Generally, the trustee only has to provide the annual accounting to each beneficiary to whom income or principal is required or authorized in the trustee's discretion to be currently distributed. The trust document has to be read and interpreted to determine who is entitled to accountings.

To familiarise itself with the terms of the trust especially beneficiaries and trust property; to act honestly, reasonably and in good faith; to preserve and not waste the value of the trust assets; to accumulate or pay income as directed by the trust instrument;

Taxes paid, disbursements made to trust beneficiaries, and gains and losses on trust assets. Fees and expenses paid to advisors of the trustee, such as attorneys, CPAs, and financial advisors.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

Yes, a beneficiary can sue a trustee, but be aware, a judge will only entertain it if you have used reasonable care and allowing time for the trustee to respond. Transparency and bookkeeping will be the primary focus. Fiduciary duty calls out to be transparent and gives updates to beneficiaries and heirs.

If you fail to receive a trust distribution, you may want to consider filing a petition to remove the trustee. A trust beneficiary has the right to file a petition with the court seeking to remove the trustee. A beneficiary can also ask the court to suspend the trustee pending removal.

If the trustee fails to account, he or she is in violation of the statute and his or her fiduciary duty. If the beneficiaries are harmed by the lack of accounting, the trustee may be liable. Further, the court may become involved, may levy sanctions and could even remove the trustee.

When a trustee acts in this fraudulent manner, they violate beneficiary rights and endanger trust assets. The abused beneficiaries can respond by petitioning for a trust accounting and then the eventual removal of the trustee.