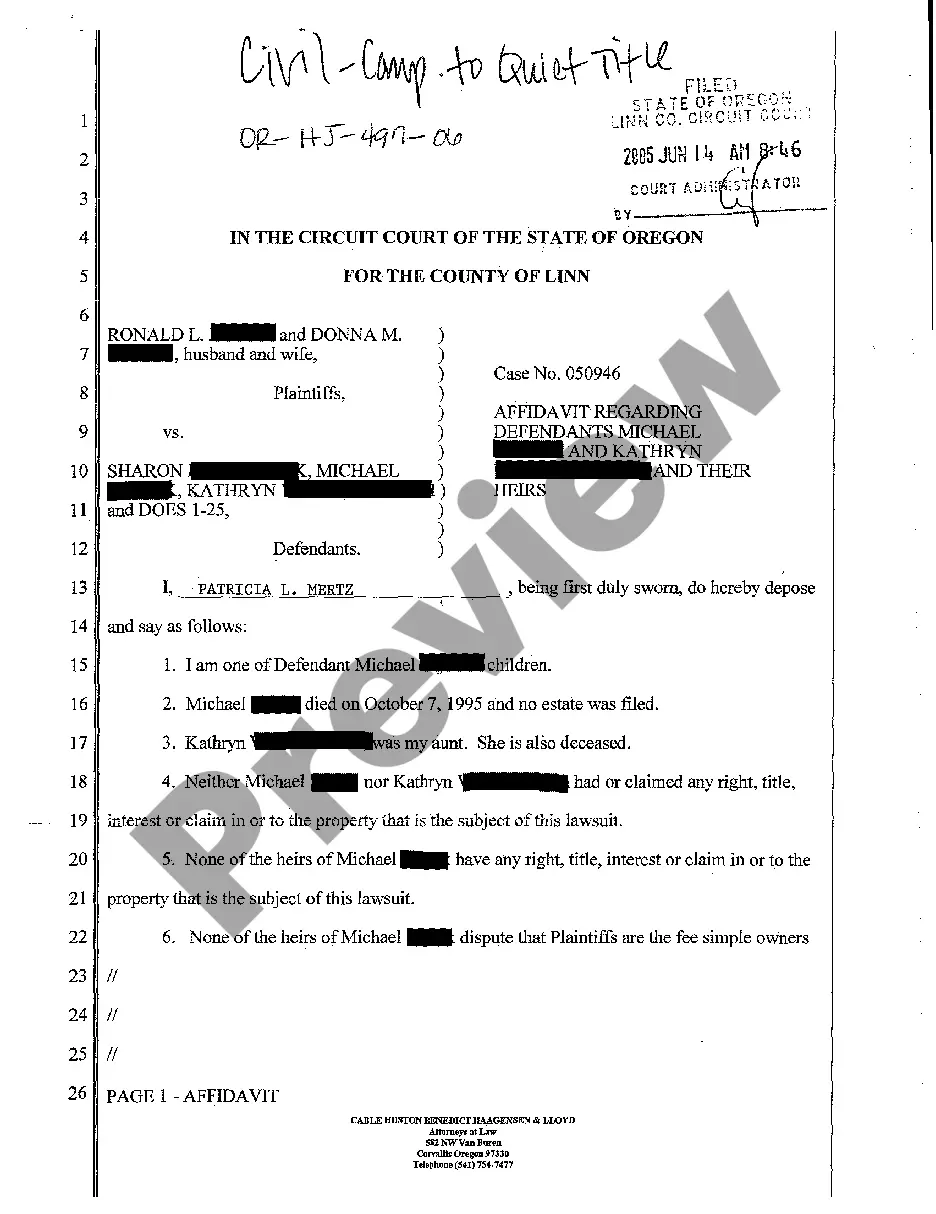

Oregon Affidavit Regarding Defendants and their Heirs

Description

How to fill out Oregon Affidavit Regarding Defendants And Their Heirs?

Among numerous paid and free templates that you can get on the internet, you can't be certain about their accuracy and reliability. For example, who made them or if they’re competent enough to take care of what you need those to. Always keep calm and use US Legal Forms! Locate Oregon Affidavit Regarding Defendants and their Heirs templates made by skilled legal representatives and avoid the expensive and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to draft a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you are searching for. You'll also be able to access all your earlier downloaded examples in the My Forms menu.

If you’re making use of our service the first time, follow the instructions listed below to get your Oregon Affidavit Regarding Defendants and their Heirs easily:

- Ensure that the document you discover is valid in the state where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing process or look for another template using the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you have signed up and purchased your subscription, you can use your Oregon Affidavit Regarding Defendants and their Heirs as often as you need or for as long as it remains valid in your state. Revise it in your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

A lawsuit for quiet title must be brought in local Superior Court. To begin the lawsuit, the plaintiff (the lender or homeowner) files a complaint with the court followed by a Notice of Pendency of Action (a Lis Pendens) that is recorded with the county recorder and filed with the court.

The purpose of the quiet title action is to eliminate an adverse claim to a legal interest in the property and to establish, perfect, or quiet the title in the property in one or more of the claimants.

What Is a Quiet Title Action? A quiet title action, also known as an action of quiet title, is a circuit court actionor lawsuitthat is filed with the intended purpose to establish or settle the title to a property.

Why would a property owner file a quiet title suit?the owner against liabilities and losses resulting from title defects. A lender's title insurance policy generally protects. the lender against the possibility that the lender's lien cannot be enforced.