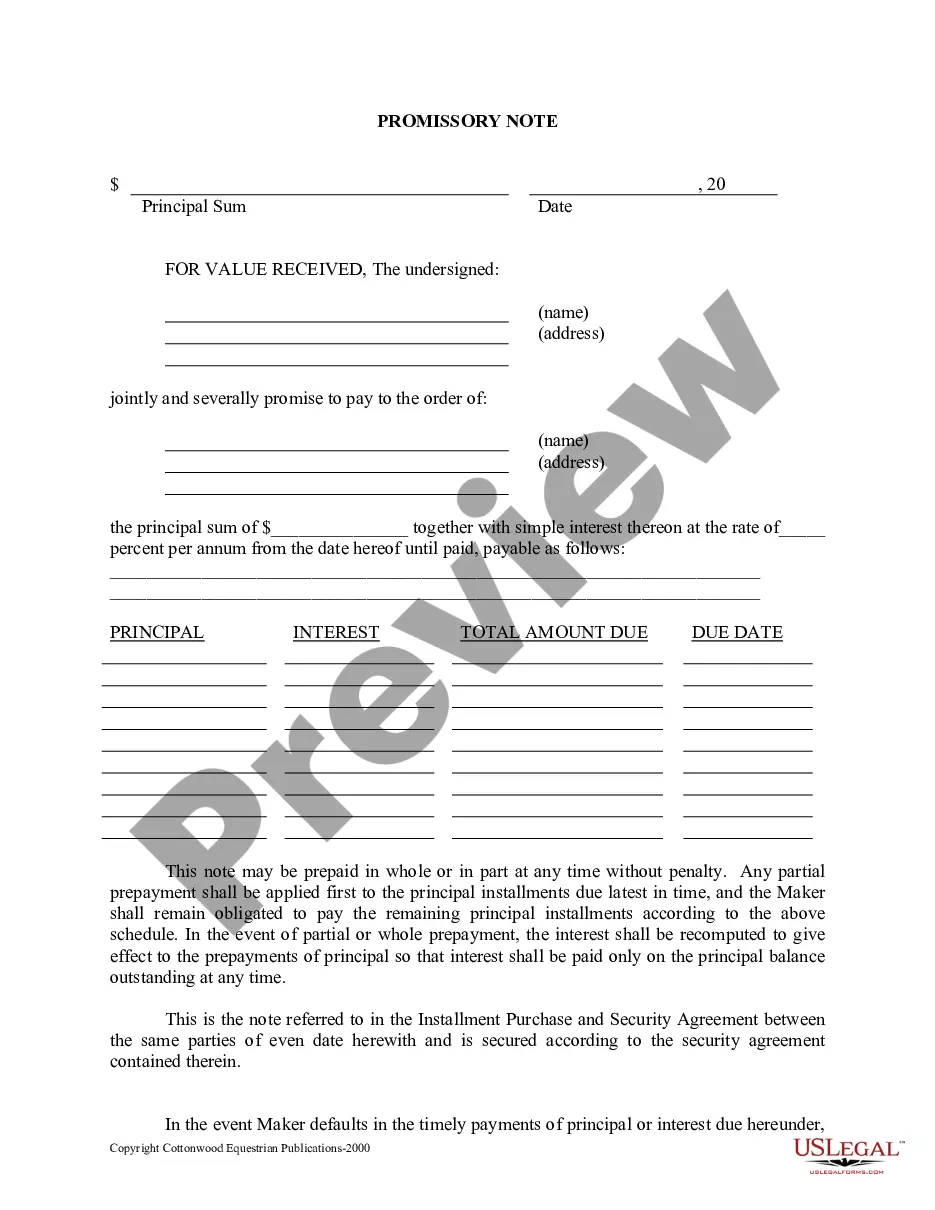

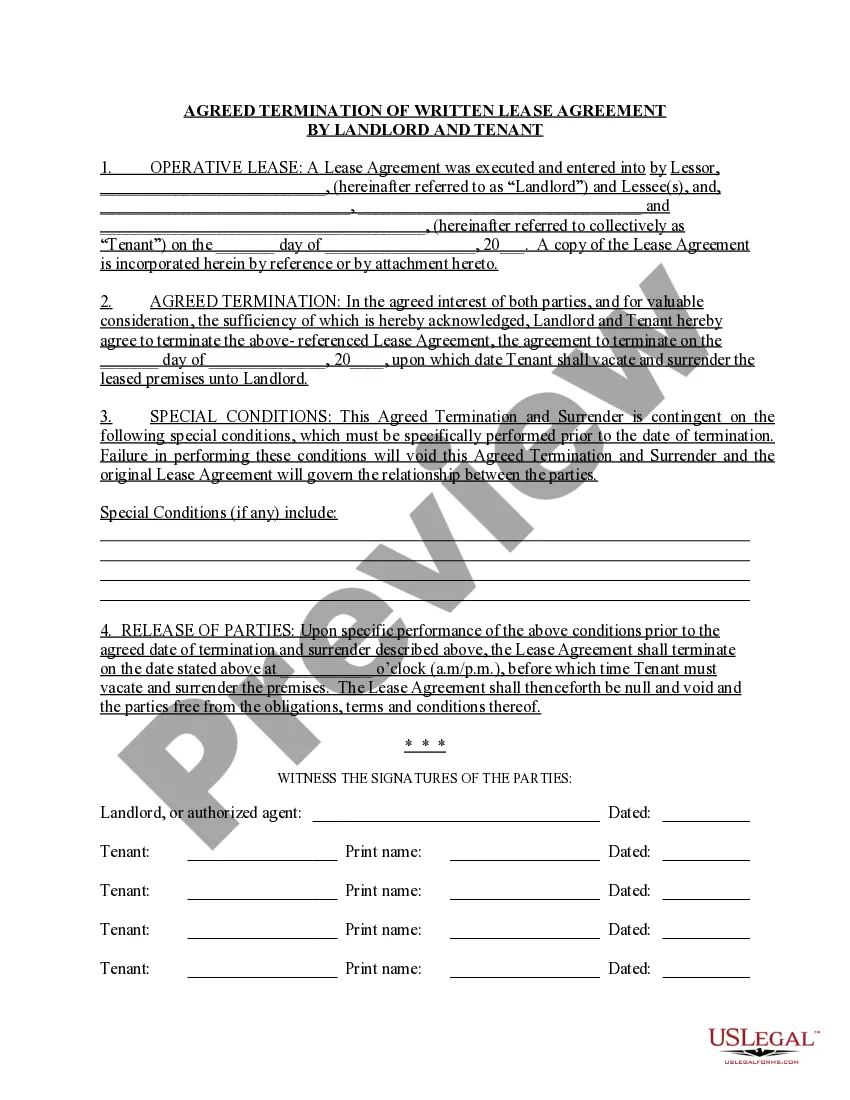

Oregon Complaint for Foreclosure Due to Breach of Promissory Note and Mortgage Agreement

Description

How to fill out Oregon Complaint For Foreclosure Due To Breach Of Promissory Note And Mortgage Agreement?

When it comes to completing Oregon Complaint for Foreclosure Due to Breach of Promissory Note and Mortgage Agreement, you almost certainly imagine a long procedure that requires getting a suitable form among hundreds of similar ones after which being forced to pay out an attorney to fill it out for you. On the whole, that’s a slow and expensive option. Use US Legal Forms and choose the state-specific template within clicks.

If you have a subscription, just log in and click Download to have the Oregon Complaint for Foreclosure Due to Breach of Promissory Note and Mortgage Agreement sample.

In the event you don’t have an account yet but need one, follow the step-by-step manual listed below:

- Be sure the document you’re getting is valid in your state (or the state it’s required in).

- Do it by looking at the form’s description and by clicking on the Preview function (if available) to view the form’s content.

- Click Buy Now.

- Select the appropriate plan for your financial budget.

- Join an account and choose how you want to pay out: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Get the file on the device or in your My Forms folder.

Skilled legal professionals draw up our samples to ensure after downloading, you don't need to bother about editing and enhancing content material outside of your individual info or your business’s info. Sign up for US Legal Forms and receive your Oregon Complaint for Foreclosure Due to Breach of Promissory Note and Mortgage Agreement sample now.

Form popularity

FAQ

Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions. You have a few options if someone who has borrowed money from you does not pay you back. First, you should ask for the repayment in writing.

However, in California, the lender is not required to produce a Promissory Note to conduct a non-judicial foreclosure (also known as a Trustee's Sale).The Promissory Note is the debt instrument, just like an IOU. The person holding the original is the one the borrower has to pay.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.