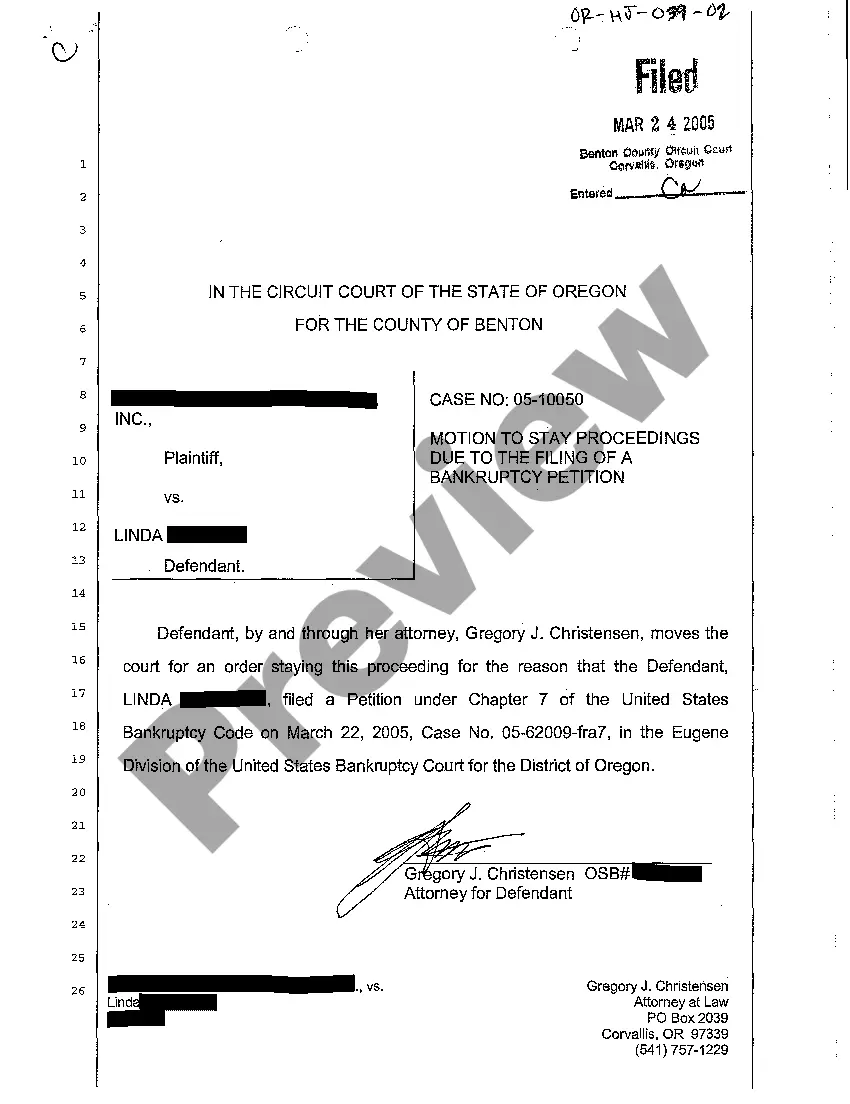

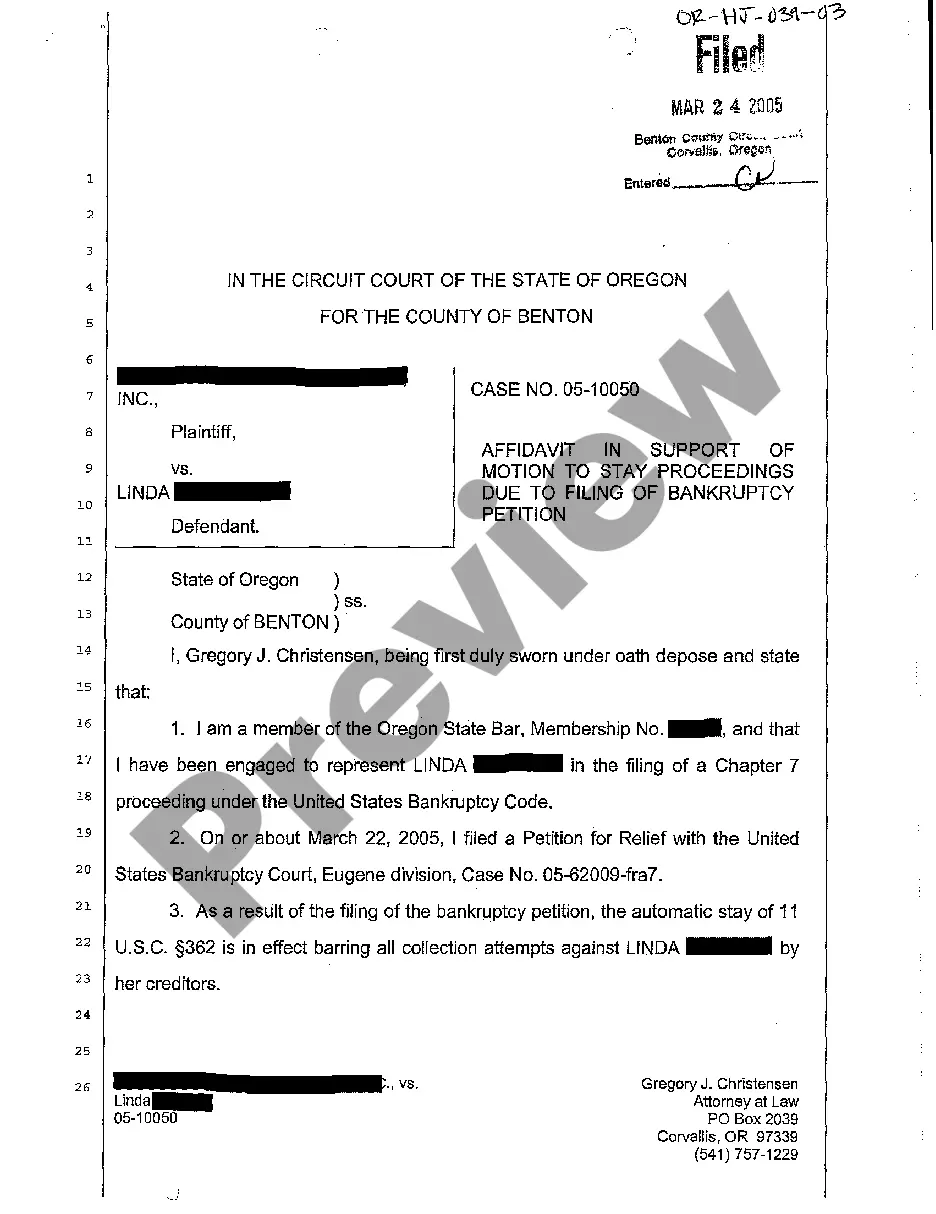

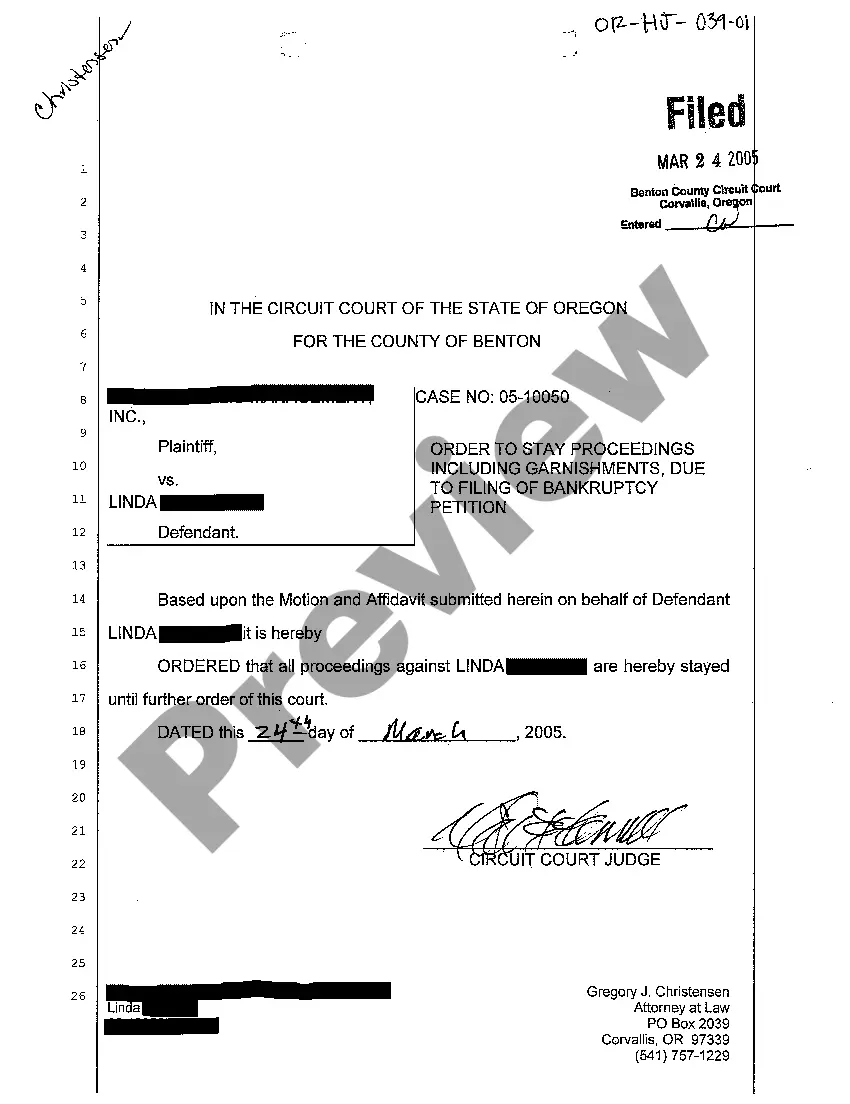

Oregon Order to Stay Proceedings Including Garnishment, Due to Filing of Chapter 7 Bankruptcy Petition

Description

How to fill out Oregon Order To Stay Proceedings Including Garnishment, Due To Filing Of Chapter 7 Bankruptcy Petition?

When it comes to completing Oregon Order to Stay Proceedings Including Garnishment, Due to Filing of Chapter 7 Bankruptcy Petition, you most likely visualize a long procedure that consists of finding a suitable form among countless very similar ones then needing to pay out a lawyer to fill it out for you. In general, that’s a slow and expensive choice. Use US Legal Forms and choose the state-specific document in a matter of clicks.

If you have a subscription, just log in and then click Download to have the Oregon Order to Stay Proceedings Including Garnishment, Due to Filing of Chapter 7 Bankruptcy Petition sample.

If you don’t have an account yet but want one, stick to the point-by-point guide listed below:

- Be sure the document you’re saving is valid in your state (or the state it’s required in).

- Do it by looking at the form’s description and by visiting the Preview function (if offered) to view the form’s information.

- Simply click Buy Now.

- Select the suitable plan for your financial budget.

- Sign up to an account and select how you would like to pay out: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Get the record on your device or in your My Forms folder.

Professional legal professionals draw up our samples so that after downloading, you don't have to bother about enhancing content outside of your personal details or your business’s details. Join US Legal Forms and receive your Oregon Order to Stay Proceedings Including Garnishment, Due to Filing of Chapter 7 Bankruptcy Petition example now.

Form popularity

FAQ

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

There is no wage garnishment tax deduction that can automatically reduce your income tax if you have wages garnished. However, if your wages are being garnished to pay a tax-deductible expense, like medical debt, you may be able to deduct those payments.

Wages garnished prior to filing, particularly within 90 days, may be recovered by the trustee for the benefit of your creditors.

Bankruptcy Will Discharge Most Lawsuit Judgments If your lender obtains a judgment, it can garnish your wages or go after your assets to satisfy the outstanding judgment. Fortunately, filing for bankruptcy can stop the garnishment and wipe out your obligation to pay back discharged debts.

Pay the debt in full. Make alternative repayment arrangements. Apply to pay by instalments through the court. Use the Bankruptcy Act.

If your wages are being garnished, or you fear they soon will be, filing for Chapter 7 bankruptcy will stop the garnishment (also called wage attachment) in most cases. This happens because bankruptcy's automatic stay prohibits most creditors from continuing with collection actions during your bankruptcy case.

If you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court. You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

Include in your letter what steps you plan to take to address the default, such as making a reasonable effort at a payment plan. Mention any circumstances that have changed recently to make your ability to pay off the debt more likely. This conveys to the creditor your goodwill toward satisfying the debt.

2)What Happens When the Wage Garnishment is Paid? The wage garnishment continues until the debt is paid in full. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt. It is difficult to stop a wage garnishment after it begins.