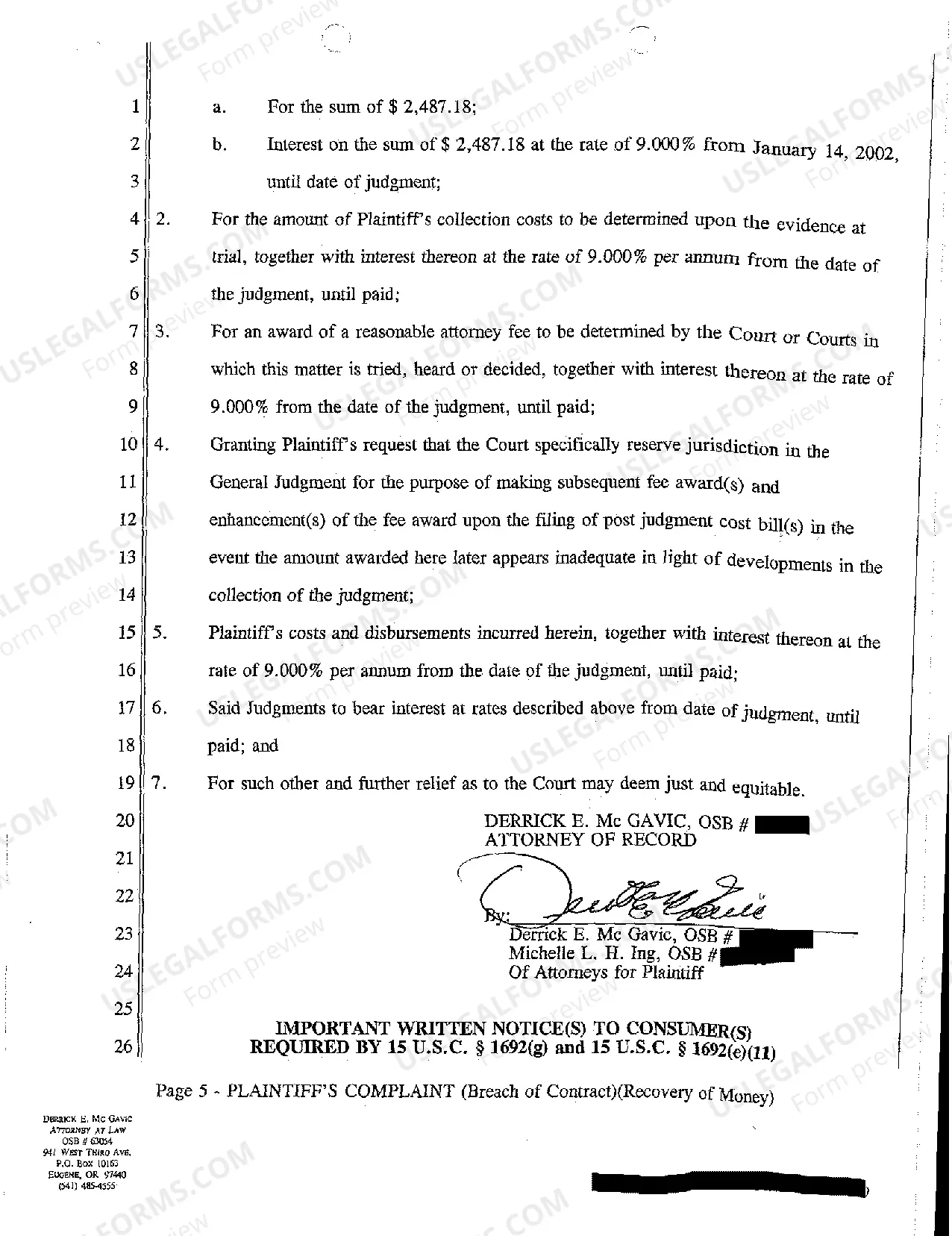

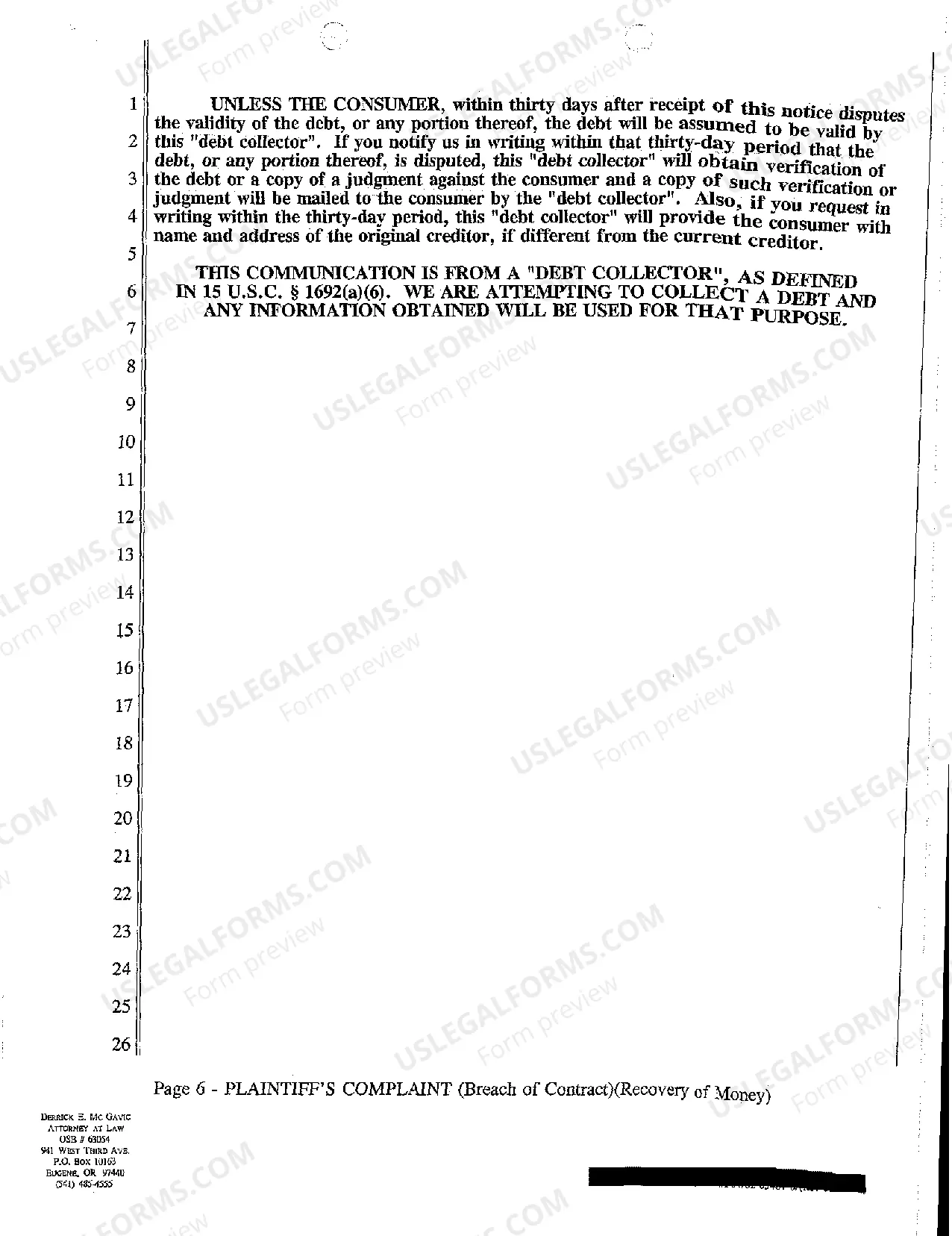

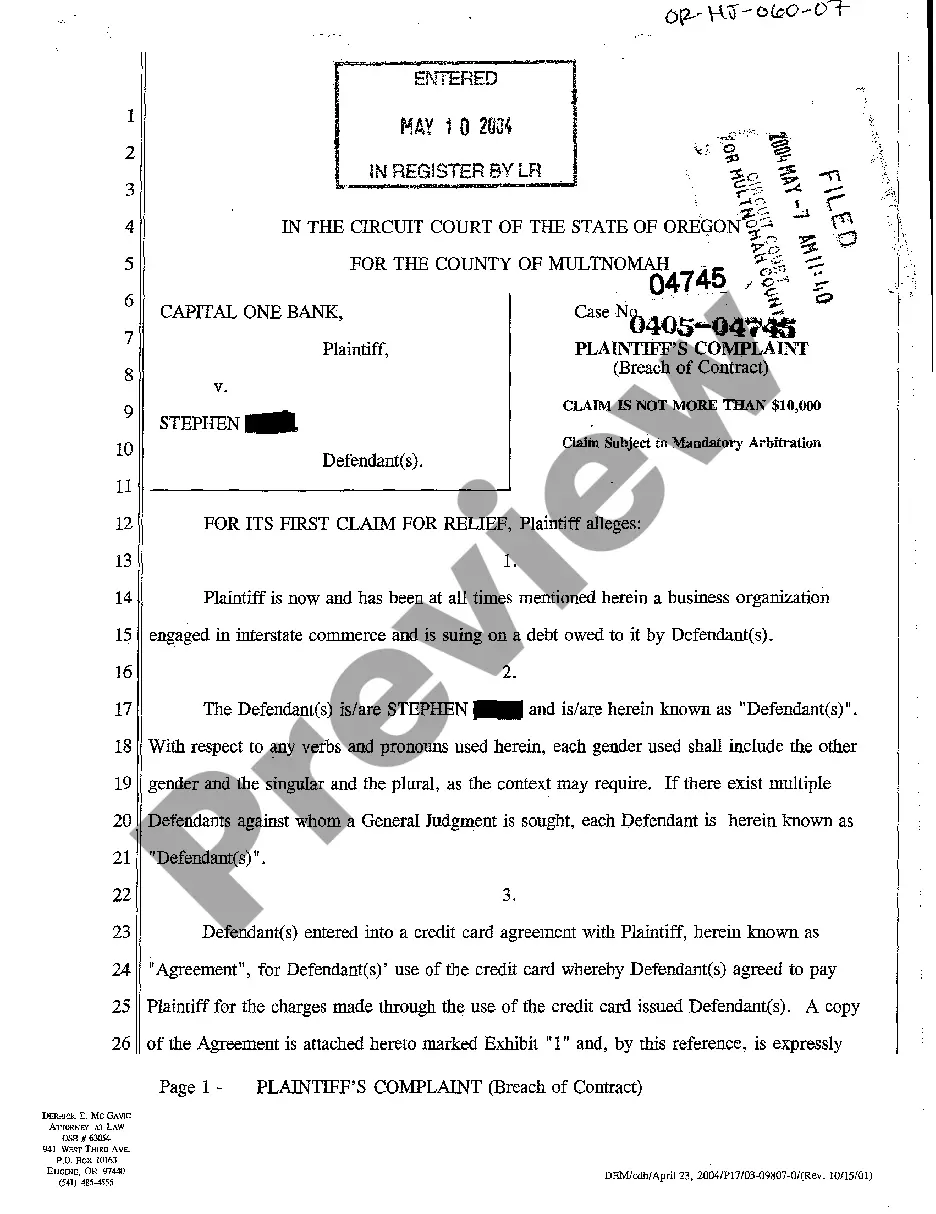

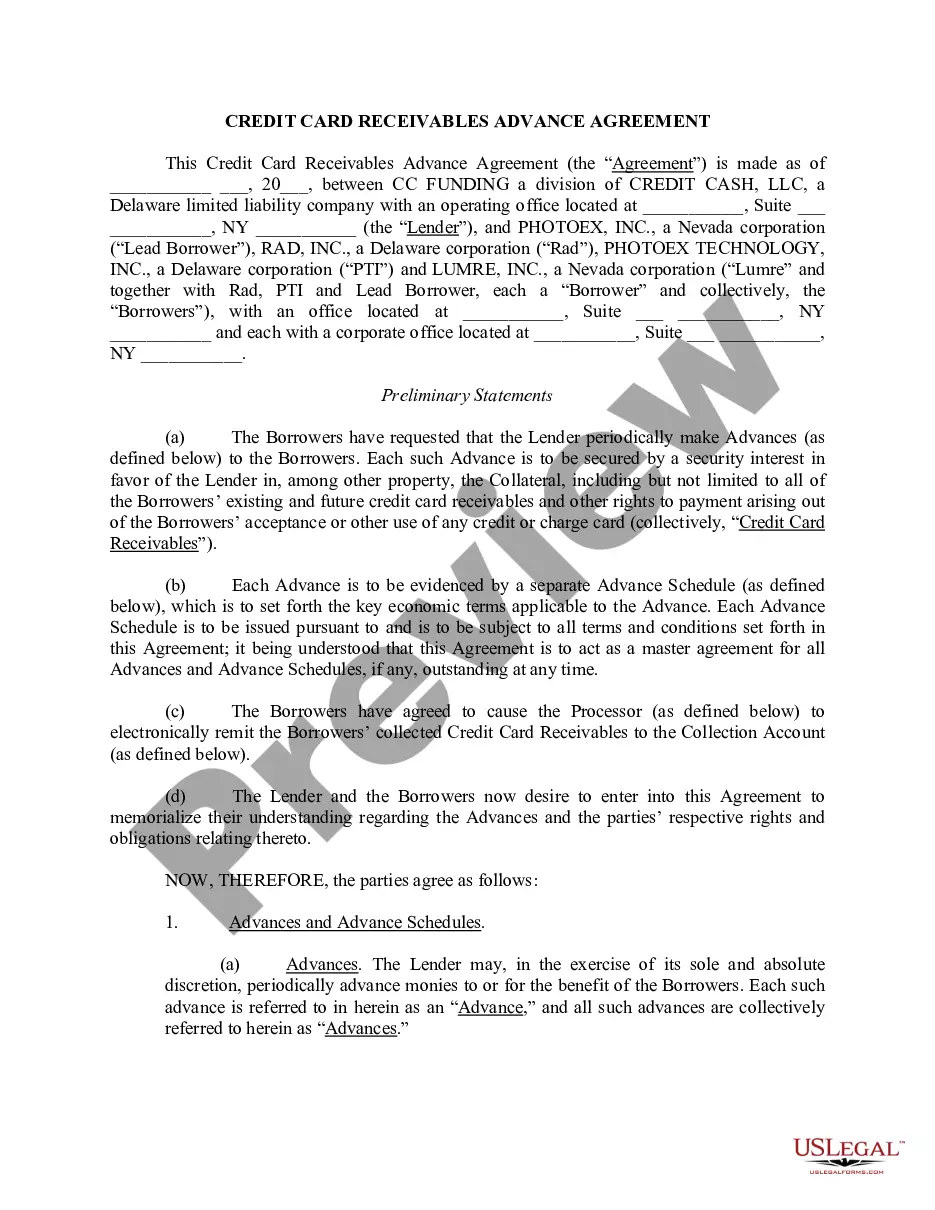

Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money

Description

How to fill out Oregon Complaint For Breach Of Credit Card Agreement And Recovery Of Money?

When it comes to completing Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money, you almost certainly think about an extensive process that consists of finding a suitable sample among a huge selection of similar ones and then being forced to pay legal counsel to fill it out to suit your needs. In general, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific template within clicks.

In case you have a subscription, just log in and then click Download to have the Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money form.

If you don’t have an account yet but need one, keep to the step-by-step manual below:

- Be sure the file you’re getting is valid in your state (or the state it’s required in).

- Do this by reading the form’s description and through clicking the Preview function (if offered) to see the form’s content.

- Click Buy Now.

- Choose the suitable plan for your budget.

- Subscribe to an account and choose how you would like to pay: by PayPal or by credit card.

- Save the document in .pdf or .docx file format.

- Get the document on your device or in your My Forms folder.

Professional attorneys draw up our samples to ensure after downloading, you don't have to bother about editing and enhancing content outside of your individual information or your business’s information. Sign up for US Legal Forms and receive your Oregon Complaint for Breach of Credit Card Agreement and Recovery of Money document now.

Form popularity

FAQ

When drafting an answer, one must: (1) follow the local, state, and federal court rules; (2) research the legal claims in the adversary's complaint; (3) respond to the adversary's factual allegations; and (4) assert affirmative defenses, counterclaims, cross-claims, or third-party claims, if applicable.

Don't admit liability for the debt; force the creditor to prove the debt and your responsibility for it. File the Answer with the Clerk of Court. Ask for a stamped copy of the Answer from the Clerk of Court. Send the stamped copy certified mail to the plaintiff.

Consider the Statute of Limitations. Breach of Contract Must Be Material & Cause Damage. Mediation & Arbitration. Determine the Appropriate Court to File Your Lawsuit. Determine How You Will Serve the Defendant. Prepare Your Complaint and Documentation. Hiring an Attorney.

Read the summons and make sure you know the date you must answer by. Read the complaint carefully. Write your answer. Sign and date the answer. Make copies for the plaintiff and yourself. Mail a copy to the plaintiff. File your answer with the court by the date on the summons.

Provide the name of the court at the top of the Answer. You can find the information on the summons. List the name of the plaintiff on the left side. Write the case number on the right side of the Answer. Address the Judge and discuss your side of the case. Ask the judge to dismiss the case.

If you rushed into a business transaction or loaned money to a friend in need and haven't been paid back, you may have questions about suing for money owed without a contract. Just watch an episode of People's Court or Judge Judy and you'll see that, yes, you can sue over a verbal agreement.

Contact the clerk's office of the court where the lawsuit was filed. You'll find a phone number and address for the clerk's office on your summons. The clerk will be able to tell you exactly what documents you should file with your answer and whether any filing fee is required.

First of all, you can sue your contractor for breach of contract, even without a written contract, and she can sue you as well.In other words, the two of you may have created an oral contract, on the basis of which either of you can sue.

1Don't admit liability for the debt; force the creditor to prove the debt and your responsibility for it.2File the Answer with the Clerk of Court.3Ask for a stamped copy of the Answer from the Clerk of Court.4Send the stamped copy certified mail to the plaintiff.