Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary.

What this document covers

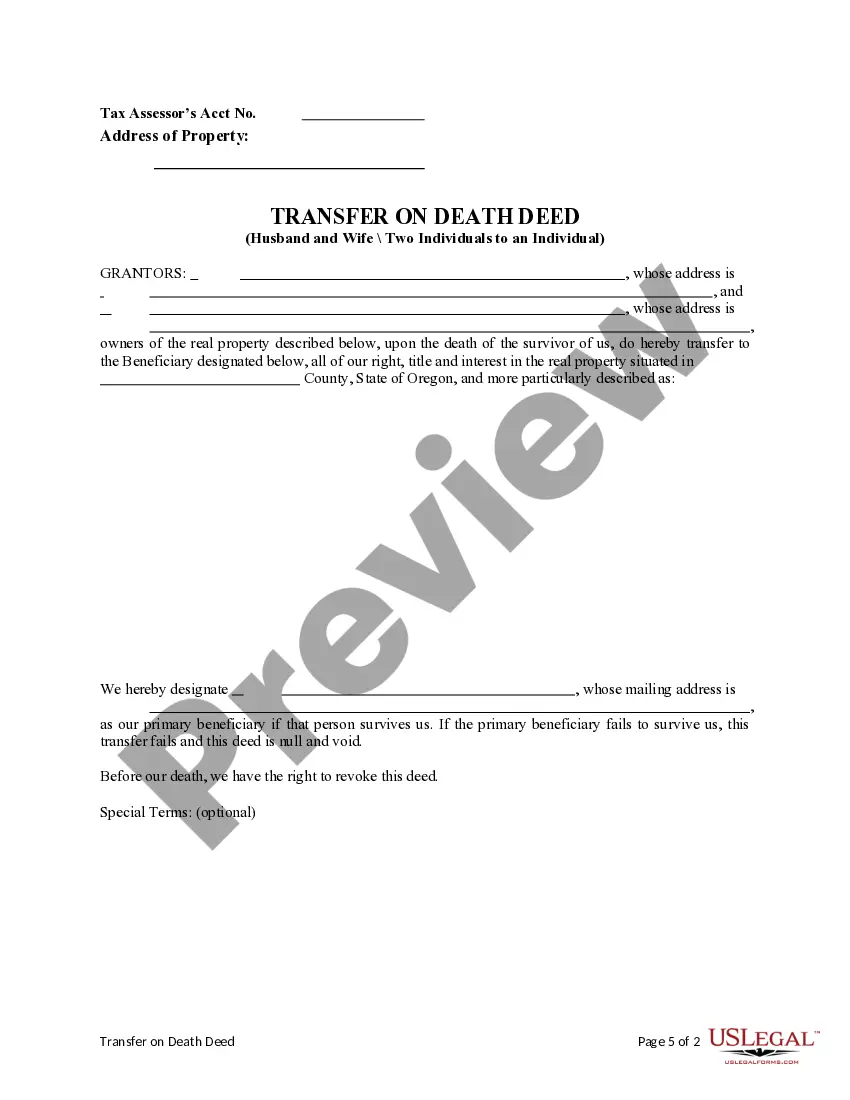

The Transfer on Death Deed is a legal document that allows a property owner, specifically husband and wife, to transfer ownership of real estate to a designated individual upon the death of the last surviving owner. This deed is revocable until the passing of the grantor, at which point the designated beneficiary obtains the property, provided they survive the grantors. Unlike other transfer deeds, this form does not include an alternate beneficiary, which means if the primary beneficiary cannot accept the property, the deed becomes void.

Key parts of this document

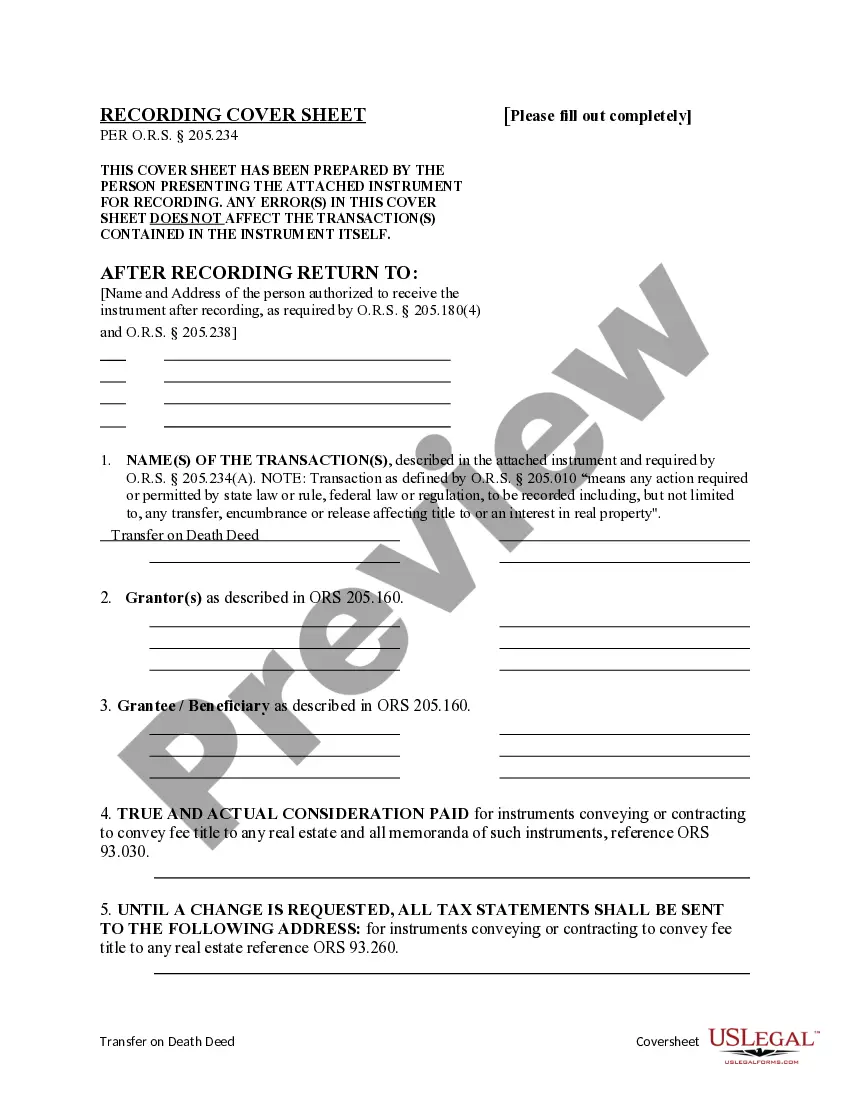

- Grantors: Identifies the husband and wife transferring the property.

- Grantee/Beneficiary: Designates the individual who will receive the property upon the death of the last surviving grantor.

- Revocation clause: States that the deed can be changed or revoked until the death of the last grantor.

- Effectiveness clause: Specifies that the transfer is effective only upon the death of the last surviving grantor.

- Notice and recording requirements: Indicates that the deed must be recorded before the grantor's death.

Common use cases

This form is useful for couples wishing to transfer their property to a single individual upon the passing of the last owner. It is ideal for those who want to ensure that their home or property bypasses probate and goes directly to the intended beneficiary, simplifying the inheritance process. This form is particularly relevant for those who do not wish to designate an alternate beneficiary.

Intended users of this form

This form is intended for:

- Couples, including spouses, who own property together.

- Individuals who want to leave their property to a specific person without complications.

- Those who desire a revocable method to transfer ownership upon death.

Completing this form step by step

- Identify the grantors by providing the names of the husband and wife.

- Specify the grantee/beneficiary by entering the name of the individual who will receive the property.

- Complete any necessary information about the property being transferred, including its address.

- Review all entries for accuracy to ensure the document reflects the intended transfer.

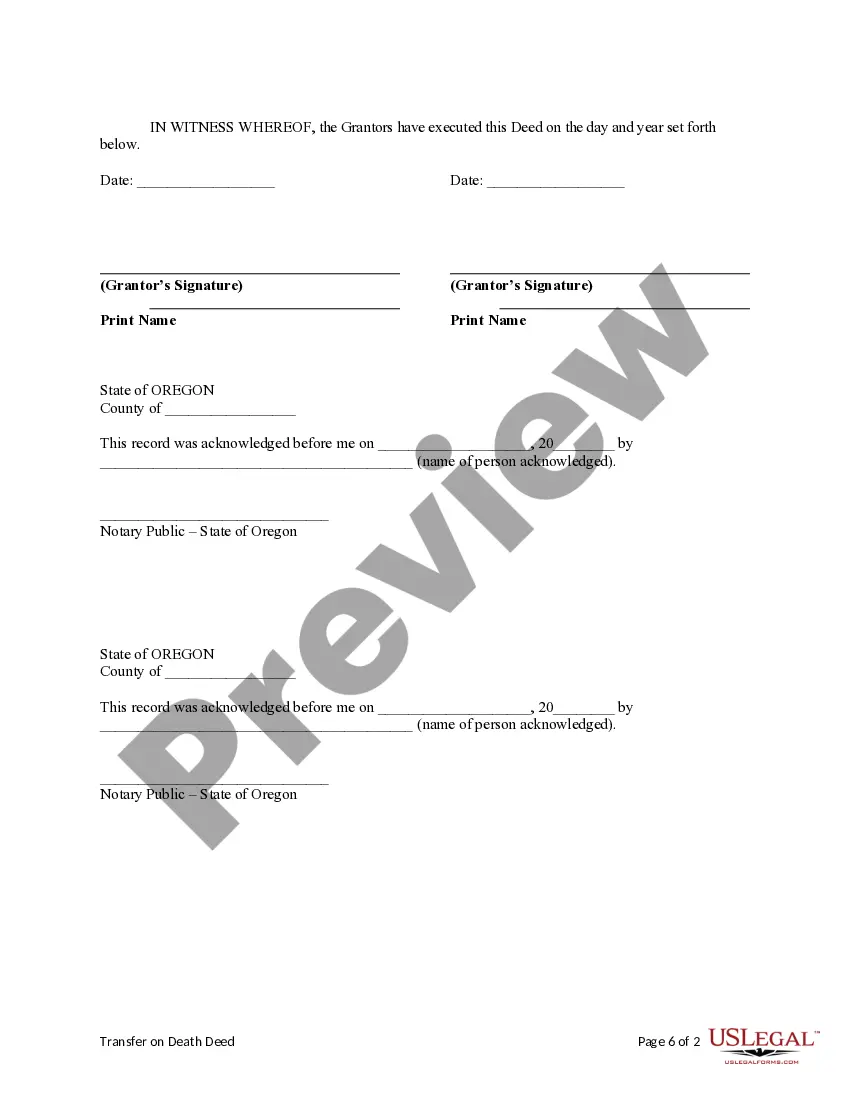

- Sign the document in accordance with state regulations to validate the transfer.

- Record the deed with the County Clerk Recorder in the county where the property is located.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Avoid these common issues

- Failing to record the deed before the death of the last grantor, resulting in the transfer being null and void.

- Omitting the full legal description of the property, which may cause confusion regarding the propertyâs boundaries.

- Not having the document signed properly, which may invalidate the deed.

- Choosing a beneficiary who does not survive the grantors, which renders the transfer ineffective due to lack of an alternate beneficiary.

Why use this form online

- Convenience of downloading and completing the form at any time without the need for an appointment.

- Editability allows for easy modifications before finalizing the transfer details.

- Reliability of using forms drafted by licensed attorneys to meet legal standards.

Form popularity

FAQ

Effective January 1, 2012, Oregon law provides for a new form of deed known as a transfer on death (TOD) deed. These deeds allow an owner of real property to designate a beneficiary who will obtain title to that real property when the owner dies, without having to go through probate (subject to some exceptions).

Accounts or assets with named beneficiaries may be transferred without going through the probate process.If there is a TOD on the account, the assets will only go to the beneficiary if both joint owners pass away. In either case, the asset will not likely go through probate.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

On a nonretirement account, designating a beneficiary or beneficiaries establishes a transfer on death (TOD) registration for the account. For an individual account, a TOD registration generally allows ownership of the account to be transferred to the designated beneficiary upon your death.

An account holder may choose to list both of their children as equal beneficiaries. However, an account holder can also choose to list individuals in unequal amounts. For example, you could designate a primary beneficiary to receive 50 percent of the funds and two secondary beneficiaries who receive 25 percent each.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.