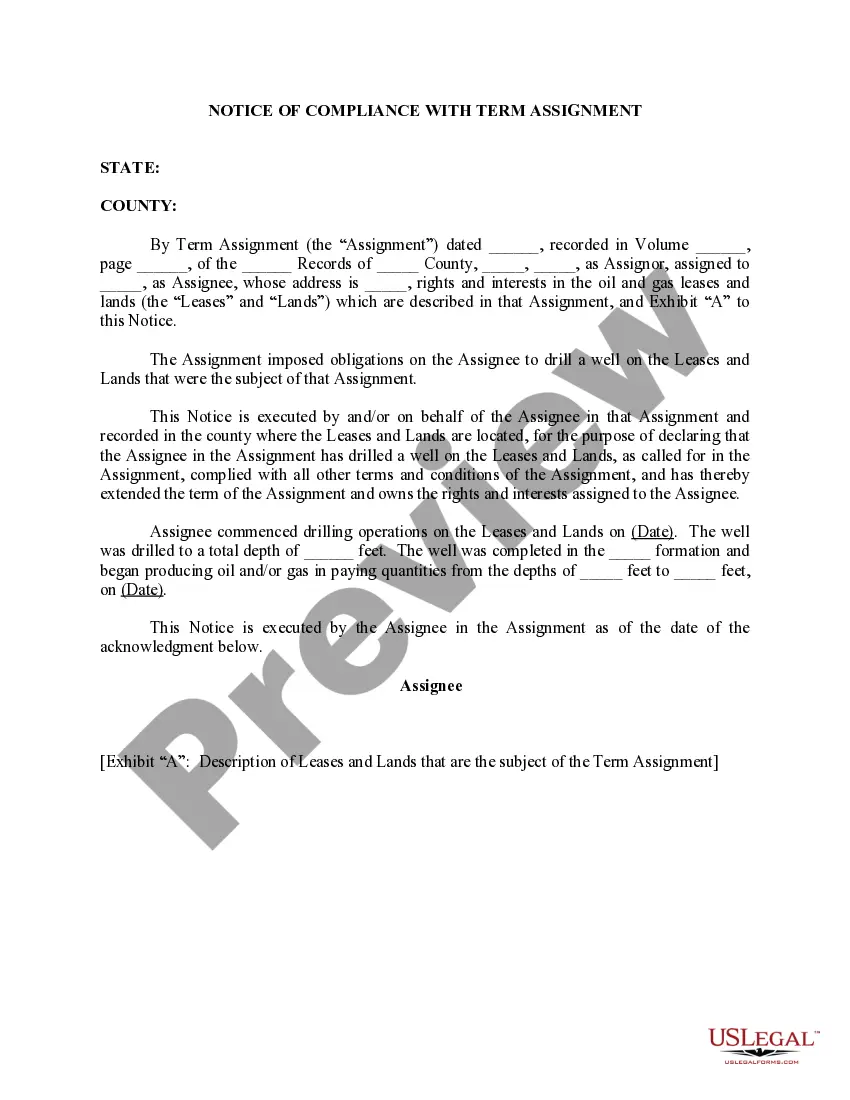

Oklahoma Notice of Compliance With Term Assignment

Description

How to fill out Notice Of Compliance With Term Assignment?

Are you currently inside a placement where you require files for either company or personal functions virtually every day? There are a lot of legitimate file templates available online, but locating types you can depend on isn`t straightforward. US Legal Forms gives 1000s of develop templates, like the Oklahoma Notice of Compliance With Term Assignment, that happen to be composed to fulfill state and federal specifications.

If you are presently informed about US Legal Forms internet site and get a free account, merely log in. Afterward, it is possible to down load the Oklahoma Notice of Compliance With Term Assignment format.

Should you not offer an bank account and would like to begin using US Legal Forms, adopt these measures:

- Get the develop you will need and make sure it is for that appropriate town/region.

- Utilize the Preview switch to examine the form.

- Read the outline to actually have selected the right develop.

- In case the develop isn`t what you are looking for, take advantage of the Research area to find the develop that meets your needs and specifications.

- Whenever you find the appropriate develop, simply click Purchase now.

- Select the rates prepare you would like, fill in the desired information to make your account, and buy the transaction using your PayPal or bank card.

- Pick a practical file format and down load your version.

Locate all the file templates you might have purchased in the My Forms menus. You can aquire a more version of Oklahoma Notice of Compliance With Term Assignment anytime, if needed. Just click the needed develop to down load or printing the file format.

Use US Legal Forms, probably the most substantial selection of legitimate forms, in order to save time as well as avoid blunders. The service gives skillfully created legitimate file templates which you can use for a selection of functions. Create a free account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

Any property left with the landlord for a period of thirty (30) days or longer shall be conclusively determined to be abandoned and as such the landlord may dispose of said property in any manner which he or she deems reasonable and proper without liability to the tenant or any other interested party.

Although courts are not bound to this choice, it may impact which statute of limitations that courts may consider in their decision. The statute of limitations on open-account debt, like credit cards, for Oklahoma is five (5) years.

No seller in any sales transaction may impose a surcharge on a cardholder who elects to use a credit card or debit card in lieu of payment by cash, check or similar means.

The Fair Credit Reporting Act in Oklahoma Oklahoma House Bill 2492 provides that prior to requesting a consumer report for work, you be notified and must be given an option of a copy free of charge. Oklahoma really adds nothing with what they attempted to add with a security freeze on your credit file.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

Reporting of Medical Debt: The three major credit bureaus (Equifax, Transunion, and Experian) will institute a new policy by March 30, 2023, to no longer include medical debt under a dollar threshold (the threshold will be at least $500) on credit reports.

An Assignment of Benefits applies to most-all insurance company contexts; it is a legally binding agreement that you sign with your property insurance or health insurance company asking that they send reimbursements for services rendered (that are covered under your policy) directly to the party who provided the ...

The Fair Credit Reporting Act (FCRA) protects against the misuse and misreporting of your credit information. When creditors, collectors, or credit reporting agencies violate the provisions of the FCRA, it can cause lower credit scores, denials of credit, higher interest rates on loans and credit extensions, and more.

When information has been used against a consumer, such as being used as a basis to deny employment or loan acceptance, the consumer must be notified. The party using the information against the consumer must tell the consumer which agency gave them the information.