Oklahoma Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

Are you currently in the location where you frequently require paperwork for either business or personal purposes nearly every workday.

There are numerous legal document samples accessible online, but finding ones you can rely on is not easy.

US Legal Forms offers a vast array of form templates, including the Oklahoma Self-Employed X-Ray Technician Self-Employed Independent Contractor, which are designed to comply with federal and state regulations.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

Select a convenient file format and download your copy. Retrieve all the document templates you have purchased in the My documents list. You can obtain another copy of the Oklahoma Self-Employed X-Ray Technician Self-Employed Independent Contractor at any time if needed. Just select the desired form to download or print the document template. Utilize US Legal Forms, the most comprehensive selection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Oklahoma Self-Employed X-Ray Technician Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/state.

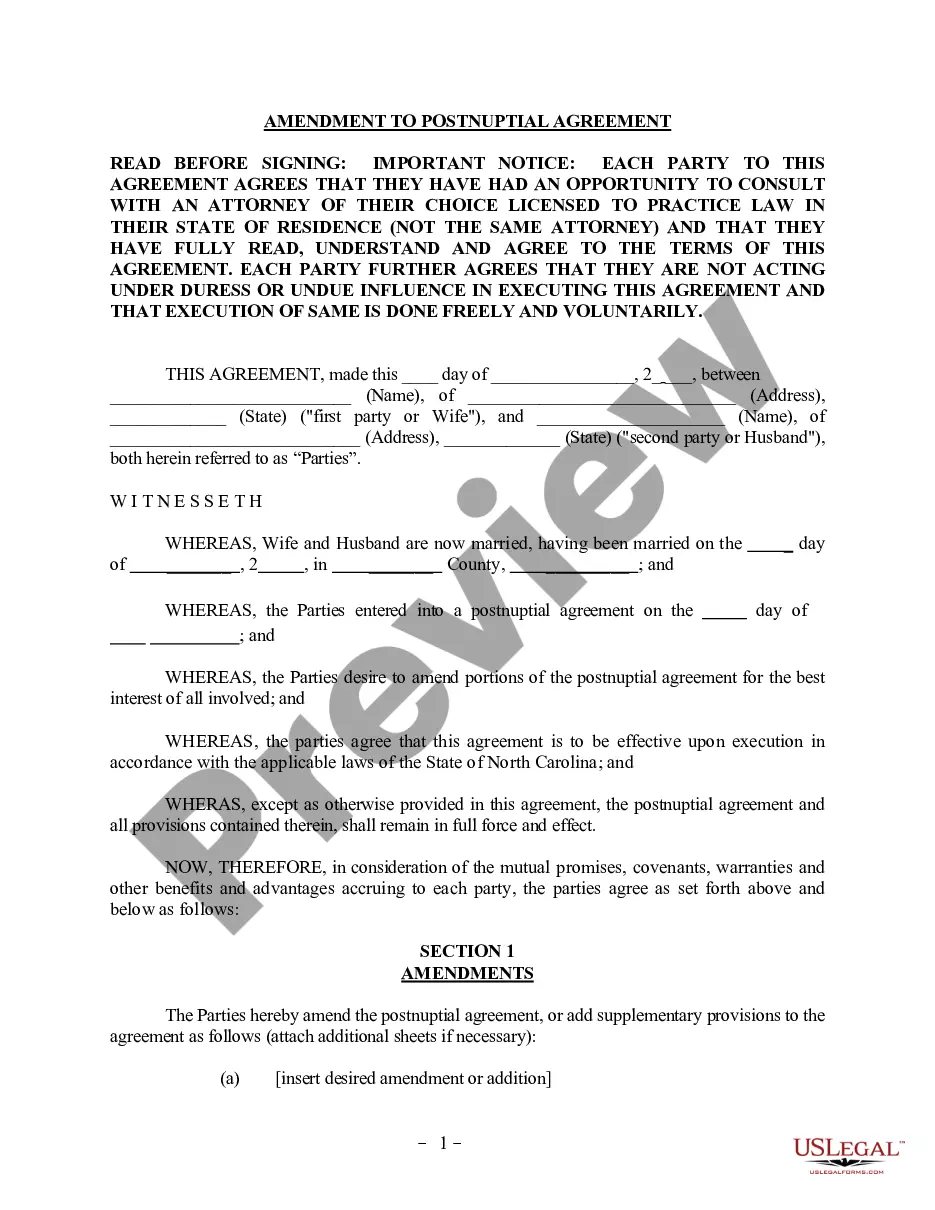

- Use the Review option to examine the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that fits your needs and requirements.

- Once you have the correct form, click on Get now.

Form popularity

FAQ

As an independent contractor, you need to fill out various forms, including a W-9 for your clients and a 1099 when receiving payments. Additionally, maintaining records of income and expenses is crucial for your tax obligations. USLegalForms provides templates and guidance to streamline this process.

To show income as an Oklahoma Self-Employed X-Ray Technician, keep detailed records of all your earnings. This includes invoices, bank statements, and any 1099 forms you receive. Proper documentation ensures you accurately report your income during tax time.

In Oklahoma, if you earn $600 or more as a Self-Employed X-Ray Technician, the client must issue you a 1099 form. This threshold applies to your total earnings from a single client during the tax year. Keep track of your income to ensure accurate reporting.

As an Oklahoma Self-Employed X-Ray Technician Self-Employed Independent Contractor, it's advisable to set aside about 25-30% of your earnings for taxes. This amount covers federal income tax and self-employment tax. You might want to consult a tax professional to determine your exact percentage based on your individual circumstances.

To show proof of income as an Oklahoma Self-Employed X-Ray Technician Self-Employed Independent Contractor, you can provide tax returns, bank statements, invoices, and 1099 forms from your clients. Keeping detailed records of all your transactions throughout the year will make it easier to present your income when needed. If you need assistance with documentation or templates, consider using US Legal Forms to find suitable resources.

Legal requirements for independent contractors in Oklahoma include obtaining any necessary licenses and permits for your work as an Oklahoma Self-Employed X-Ray Technician Self-Employed Independent Contractor. You must also register for state taxes and maintain accurate records of your business activities. Compliance with insurance and safety regulations is also vital. US Legal Forms can help you understand and fulfill these requirements effectively.

As an Oklahoma Self-Employed X-Ray Technician Self-Employed Independent Contractor, you must file taxes if you earn $400 or more in net income. This threshold applies regardless of whether you receive a 1099 form. It's crucial to report all your earnings to avoid potential penalties. For further assistance, you can explore tools available on US Legal Forms to help simplify your filing process.

Yes, you can file your 1099 taxes yourself as an Oklahoma Self-Employed X-Ray Technician Self-Employed Independent Contractor. This process involves filling out the appropriate tax forms, such as Form 1040 and Schedule C, to report your earnings. Be sure to gather all necessary documents and double-check your figures for accuracy. If you need assistance, consider resources like US Legal Forms for templates and guidance.

Yes, Oklahoma requires businesses to file 1099 forms for independent contractors, including Oklahoma Self-Employed X-Ray Technician Self-Employed Independent Contractors, who earn $600 or more in a tax year. This form helps the IRS track income and ensures proper tax reporting. Make sure you receive a 1099 from any client that meets this threshold. To stay compliant, you can find helpful resources on platforms like US Legal Forms.

To file taxes as an Oklahoma Self-Employed X-Ray Technician Self-Employed Independent Contractor, you will need to report your income and expenses on a Schedule C form. Gather all relevant documents, such as 1099 forms and receipts for business expenses. It is essential to keep accurate records throughout the year to simplify this process. Consider using platforms like US Legal Forms to access resources that can help streamline your tax filing.