Oklahoma Lab Worker Employment Contract - Self-Employed

Description

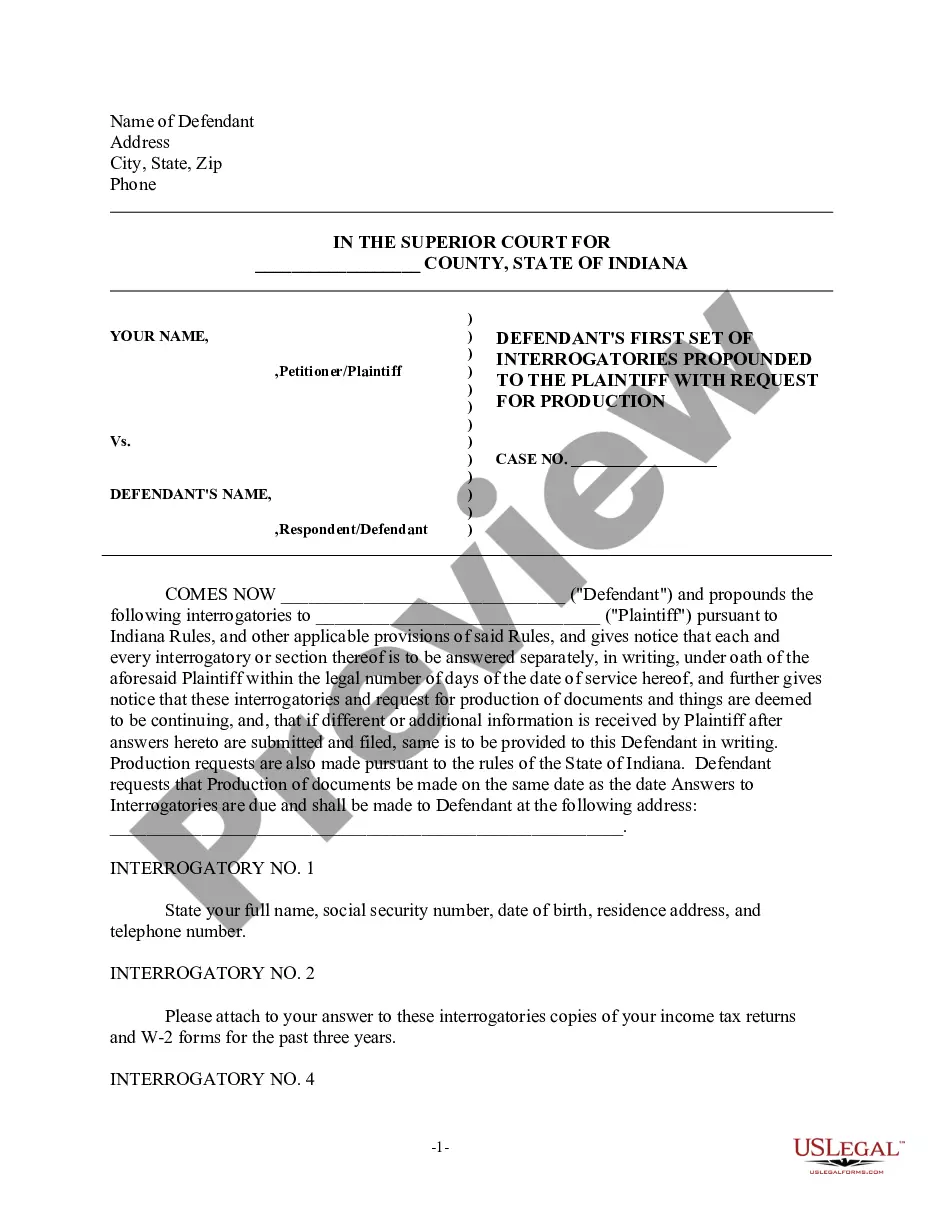

How to fill out Lab Worker Employment Contract - Self-Employed?

Are you currently in a situation where you require documents for various organizations or specific tasks almost daily? There are numerous legal document templates available online, but finding versions you can trust isn't easy. US Legal Forms provides a vast array of form templates, such as the Oklahoma Lab Worker Employment Contract - Self-Employed, designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Oklahoma Lab Worker Employment Contract - Self-Employed template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Find the form you want and ensure it is for the correct city/state. Utilize the Preview button to examine the form. Read the description to confirm that you have selected the right form. If the form isn't what you are looking for, use the Search field to find the form that meets your needs. Once you locate the correct form, click Purchase now. Choose the pricing plan you prefer, fill out the required information to create your account, and complete the purchase using your PayPal or credit card. Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Oklahoma Lab Worker Employment Contract - Self-Employed whenever necessary. Simply select the required form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers well-crafted legal document templates that you can use for a variety of purposes.

- Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

To fill a contract of employment template, read through the document carefully before entering your specific information. Include names, contact details, job descriptions, and payment terms relevant to the Oklahoma Lab Worker Employment Contract - Self-Employed. If you are unsure, consider using customizable templates from USLegalForms, as they are designed to guide you through the necessary fields.

You can show proof of self-employment through various documents such as tax returns, bank statements, or invoices issued to clients. Having a solid Oklahoma Lab Worker Employment Contract - Self-Employed can also help establish your self-employment status. Maintaining organized records will make it easier to substantiate your self-employment during applications or audits.

To write a self-employment contract, start with a title that reflects the agreement type, such as Oklahoma Lab Worker Employment Contract - Self-Employed. Clearly lay out the tasks to be performed, the payment schedule, and the length of the contract. It is wise to use an established template from platforms like USLegalForms to ensure all necessary details are included.

When writing a contract for a 1099 employee, outline the nature of the work, expectations, and the payment structure, as is crucial in an Oklahoma Lab Worker Employment Contract - Self-Employed. Specify that the worker is responsible for taxes and insurance to avoid future complications. USLegalForms provides helpful templates that can assist in crafting a compliant contract.

To write a self-employed contract, begin with a clear definition of the services to be provided. Include payment terms, deadlines, and any specific conditions unique to the Oklahoma Lab Worker Employment Contract - Self-Employed. Ensure all parties sign the document to affirm their agreement. Utilizing resources from USLegalForms can further streamline this process.

Yes, you can write your own legally binding contract by following the essential elements of a contract: offer, acceptance, and consideration. When drafting an Oklahoma Lab Worker Employment Contract - Self-Employed, ensure that all parties involved clearly understand their rights and obligations. You can also use templates available on platforms like USLegalForms to simplify the process and ensure legal compliance.

As a contracted worker with an Oklahoma Lab Worker Employment Contract - Self-Employed, you need to report your income on a Schedule C form with your tax return. Keep track of your earnings and any deductible expenses you incur while performing your work. Using reliable platforms like US Legal Forms can help simplify the process by providing necessary templates and information for self-employed tax requirements. Consult a tax professional for personalized guidance.

In Oklahoma, self-employed individuals generally do not qualify for traditional unemployment benefits. However, during specific circumstances like the COVID-19 pandemic, programs such as the Pandemic Unemployment Assistance were available. If you have an Oklahoma Lab Worker Employment Contract - Self-Employed, it might be beneficial to explore other forms of financial assistance or insurance options for non-traditional workers. Always check with local resources for updates and eligibility.

Yes, a 1099 employee is generally considered self-employed as they operate under a contract rather than a traditional employer-employee relationship. They receive a 1099 form for tax purposes, indicating their income from specific clients. If you are working under an Oklahoma Lab Worker Employment Contract - Self-Employed, you will likely receive a 1099 to report your earnings.

A contract employee is typically not considered self-employed in a traditional sense. Instead, they serve on a contractual basis, allowing clients to hire them for specific tasks. With an Oklahoma Lab Worker Employment Contract - Self-Employed, you can define the terms clearly, stating your independence and responsibilities.