Oklahoma Self-Employed Seasonal Picker Services Contract

Description

How to fill out Self-Employed Seasonal Picker Services Contract?

If you desire to total, acquire, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Utilize the site's simple and convenient search to locate the documents you require. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to obtain the Oklahoma Self-Employed Seasonal Picker Services Contract in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Oklahoma Self-Employed Seasonal Picker Services Contract with US Legal Forms. There are numerous professional and state-specific forms you can utilize for business or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to locate the Oklahoma Self-Employed Seasonal Picker Services Contract.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

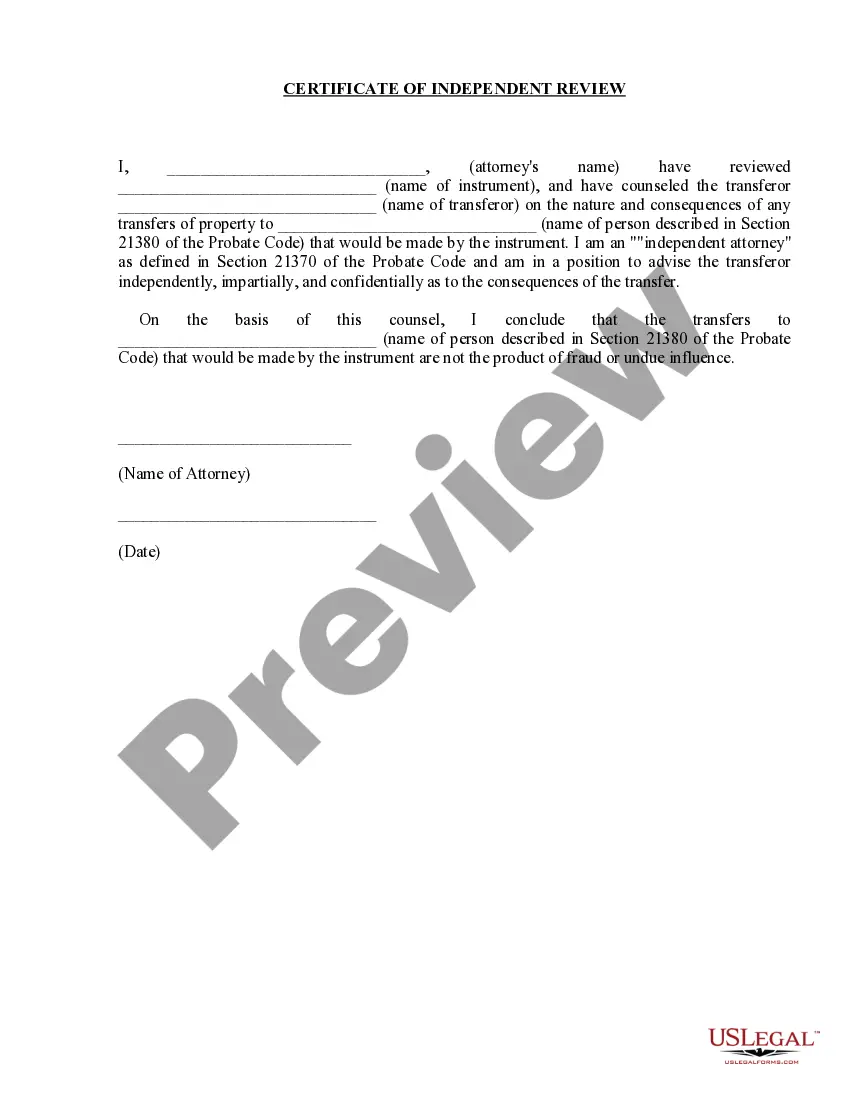

- Step 2. Use the Review option to examine the form's content. Remember to read through the details.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other variations in the legal form template.

- Step 4. Once you have located the form you need, select the Acquire now button. Choose the payment method you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Retrieve the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Oklahoma Self-Employed Seasonal Picker Services Contract.

Form popularity

FAQ

A legally enforceable contract must have an offer, acceptance, consideration, mutual consent, capacity of parties, and legality of purpose. Each party should be aware of their rights and responsibilities under the agreement. By including these six requirements in your Oklahoma Self-Employed Seasonal Picker Services Contract, you create a stronger framework for your professional relationship.

A valid contract must include an offer, acceptance, consideration, mutual consent, and a lawful purpose. Each party must understand and agree to the terms without coercion. When drafting your Oklahoma Self-Employed Seasonal Picker Services Contract, ensure these five elements are present to establish a solid legal foundation.

To qualify as an independent contractor, you must demonstrate control over how you perform your work and typically work for multiple clients. You must also provide your tools and resources for completing tasks. For those in the Oklahoma Self-Employed Seasonal Picker Services, showcasing these attributes in your contract can affirm your status and clarify expectations with clients.

The recent federal rule emphasizes the importance of the relationship between the worker and the employer when determining independent contractor status. It clarifies criteria such as the worker’s control over their tasks and the degree of independence. If you are navigating this landscape for your Oklahoma Self-Employed Seasonal Picker Services Contract, staying informed about these changes is essential to comply with regulations.

In Oklahoma, a contract becomes legally binding when it contains an offer, acceptance, consideration, mutual consent, and legality of purpose. All parties must agree to the terms without coercion. For an Oklahoma Self-Employed Seasonal Picker Services Contract, ensuring these elements are met secures the validity of the agreement and protects your interests.

Yes, having a contract is essential for independent contractors, including those in the Oklahoma Self-Employed Seasonal Picker Services. A contract protects both you and your client by clearly outlining the terms of the work, payment, and responsibilities. It also helps prevent misunderstandings and disputes down the line, making it a valuable tool for any contractor.

In Oklahoma, a contract is considered legal when it includes an offer, acceptance, and consideration. Both parties must have the legal capacity to enter into the agreement. Furthermore, the contract must have a lawful purpose. If you are looking to establish an Oklahoma Self-Employed Seasonal Picker Services Contract, ensuring these elements are present is crucial.

An independent contractor must earn at least $600 in a calendar year from a single client to receive a 1099 form. This threshold applies to various services, including those covered by an Oklahoma Self-Employed Seasonal Picker Services Contract. If you earn below this amount, the client is not required to issue a 1099, but you still need to report your income. Keeping accurate records will help you stay organized and prepared for tax filings.

As a contract worker, you will typically report your income using Schedule C along with your personal tax return. You should keep detailed records of your income and expenses related to your Oklahoma Self-Employed Seasonal Picker Services Contract. Additionally, consider making quarterly estimated tax payments to prevent any surprises during tax season. Utilizing resources from platforms like uslegalforms can simplify the process further.

In Oklahoma, various services are subject to sales tax, including specific types of labor and repair services. However, agricultural services may have different tax rules. It’s essential to consult the Oklahoma Tax Commission or a tax professional for detailed information on your Oklahoma Self-Employed Seasonal Picker Services Contract. Understanding these tax implications can help you stay compliant and avoid penalties.