Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor

Description

How to fill out Electronics Assembly Agreement - Self-Employed Independent Contractor?

If you wish to finalize, acquire, or produce authentic document templates, utilize US Legal Forms, the most extensive collection of lawful documents accessible online.

Leverage the site's straightforward and convenient search feature to discover the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to locate the Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor with just a couple of clicks.

Every legal document template you purchase is yours permanently.

You have access to every document you downloaded in your account. Click the My documents section and choose a document to print or download again. Stay competitive and acquire, and print the Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-specific documents available for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and hit the Obtain button to receive the Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor.

- You can also access documents you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the document for the correct city/state.

- Step 2. Use the Preview option to review the content of the document. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the document, utilize the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the document you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

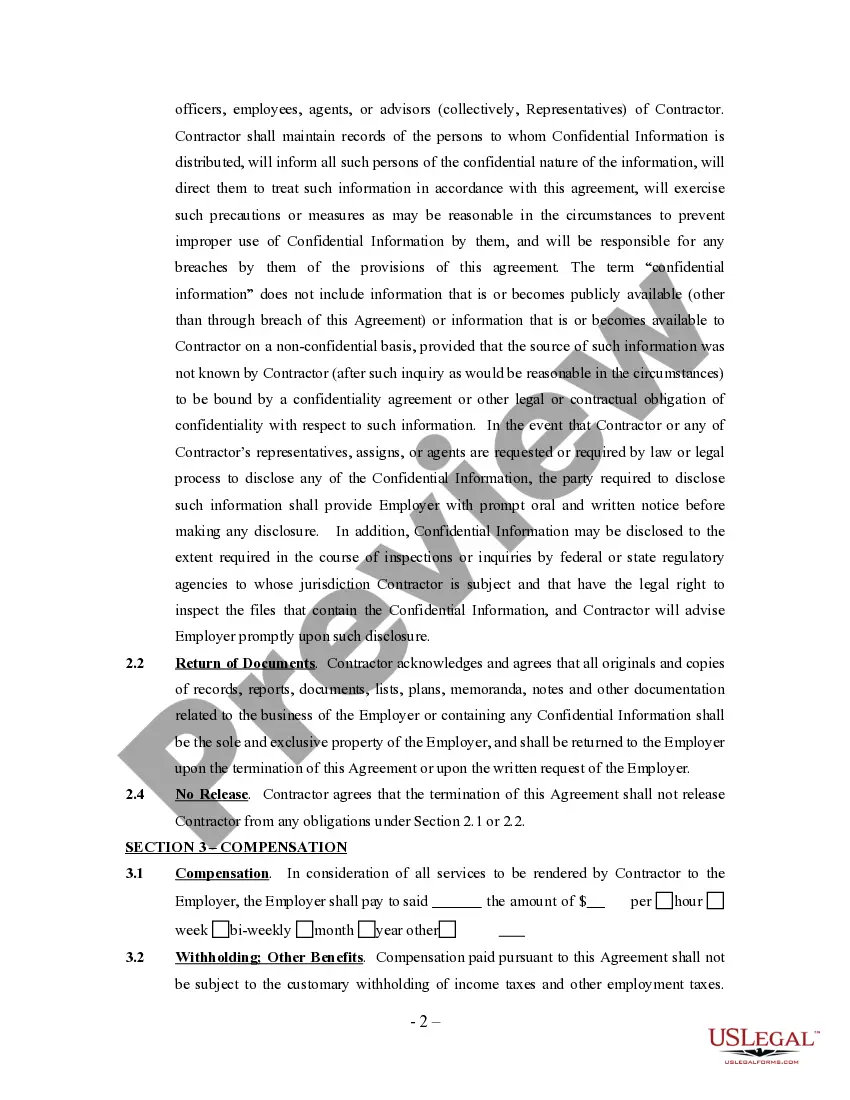

Filling out an independent contractor agreement for an Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor requires attention to detail. Begin with the names and contact information of all parties. Then, describe the services provided, payment details, and deadlines. Ensure both parties sign the document once complete; this agreement is crucial for clarifying expectations and protecting your interests.

Writing an independent contractor agreement for an Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor involves several steps. Start by clearly identifying the parties involved and defining the work to be performed. Include payment terms, timelines, and any confidentiality clauses. Using a template from a reliable platform like USLegalForms can streamline this process and ensure you cover all necessary aspects.

When entering into an Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor, several important documents are involved. You typically need to fill out a W-9 form to provide your Tax Identification Number. Additionally, you should have a detailed contractor agreement that outlines the scope of work, payment terms, and deadlines to protect both parties.

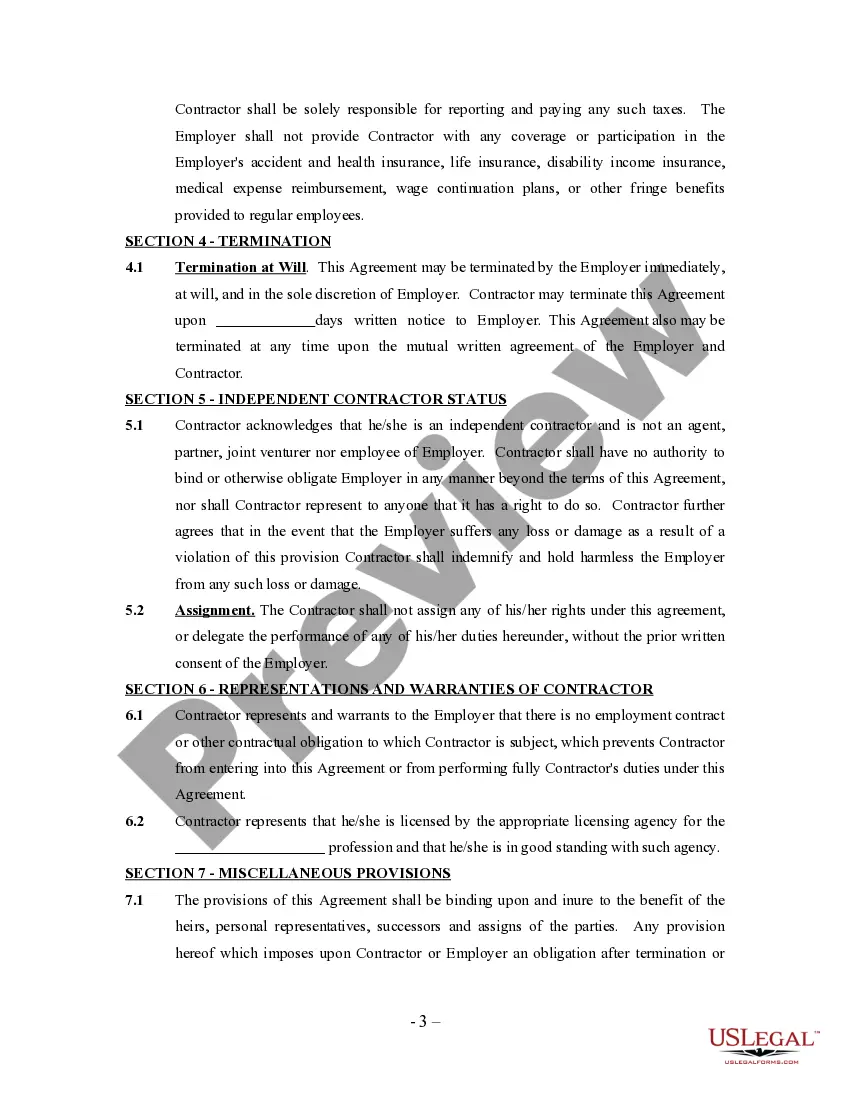

The new federal rule provides a framework for determining whether workers are classified as employees or independent contractors. It focuses on the level of control and independence in the work relationship. Utilizing an Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor can help you demonstrate your status clearly. Staying updated on these rules is vital for protecting your rights as a contractor.

Yes, this situation can happen when the working relationship lacks clarity. Misclassification occurs if the employer exerts too much control over the contractor's work. To avoid this, a clear Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor establishes roles and responsibilities, helping to prevent confusion and ensuring both parties understand their relationship. Being vigilant about your classification protects your rights.

Independent contractors must report all income, but there is a threshold for income tax liability. If you earn below a specific income level, you might not owe federal taxes, but you still need to file a return. An Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor can help you manage your earnings properly and ensure you understand your tax obligations. Keeping excellent records is essential to safeguarding your financial future.

The new federal rule aims to clarify the classification of workers as independent contractors or employees. This is important because misclassification can lead to significant tax implications. Under the federal guidelines, a well-structured Oklahoma Electronics Assembly Agreement - Self-Employed Independent Contractor can help ensure compliance while protecting your status. Being informed about these rules helps you navigate the working landscape confidently.

Oklahoma does not legally require LLCs to have an operating agreement. However, this document provides valuable structure and clarity for your business operations. It is particularly useful for self-employed independent contractors, including those working under an Oklahoma Electronics Assembly Agreement, to outline roles and responsibilities. Consider using uslegalforms to easily create an effective operating agreement.

To file a 1099-NEC as an independent contractor, start by collecting all your income data for services provided under your Oklahoma Electronics Assembly Agreement. Ensure you have your tax identification number and client information ready. You will report your earnings and submit the 1099-NEC form to the IRS and your clients for their records. For a seamless filing experience, tools like uslegalforms can guide you through the process.

While most states do not mandate LLCs to have operating agreements, some, like California and Delaware, strongly encourage their use. An operating agreement can clarify management structure, member roles, and financial arrangements, benefiting all business owners. If you are a self-employed independent contractor operating under an Oklahoma Electronics Assembly Agreement, having such an agreement can help maintain clarity in operations. Uslegalforms provides easy access to useful templates.