Oklahoma Cameraman Services Contract - Self-Employed

Description

How to fill out Cameraman Services Contract - Self-Employed?

If you require to thorough, acquire, or generate official document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Take advantage of the site's straightforward and handy search function to find the documents you need.

A selection of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the Oklahoma Cameraman Services Contract - Self-Employed in just a few clicks.

Every legal document template you obtain is yours permanently. You will have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Be proactive and acquire, and print the Oklahoma Cameraman Services Contract - Self-Employed with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download button to access the Oklahoma Cameraman Services Contract - Self-Employed.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

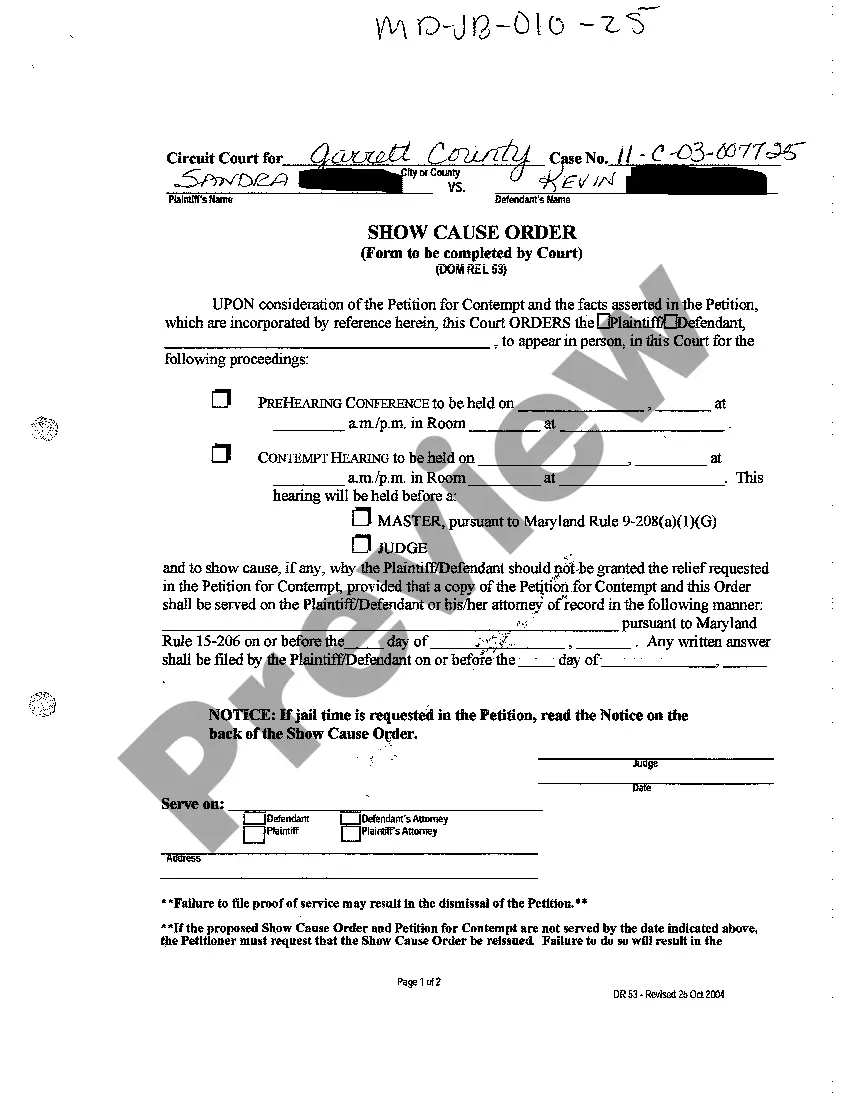

- Step 2. Use the Preview option to review the form's content. Remember to read the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you want, click on the Purchase now button. Choose the payment plan you prefer and enter your information to sign up for an account.

- Step 5. Process the payment. You can utilize your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Oklahoma Cameraman Services Contract - Self-Employed.

Form popularity

FAQ

Yes, a freelance photographer is considered self-employed. This means they operate their own business and generate income through their work, such as an Oklahoma Cameraman Services Contract - Self-Employed. Being self-employed grants flexibility in choosing projects and setting your rates, but it also requires managing your taxes and expenses. Embracing self-employment allows you to pursue your passion independently.

While it is not mandatory, forming an LLC can benefit freelance photographers. An LLC provides personal liability protection and serves as a formal business structure, which can be advantageous for an Oklahoma Cameraman Services Contract - Self-Employed. Establishing an LLC may help build credibility with clients and can simplify tax processes. Overall, consider your circumstances to decide if an LLC suits your work.

Yes, freelance photographers need a contract to clarify the terms of their services. An Oklahoma Cameraman Services Contract - Self-Employed clearly outlines the agreement between the photographer and their clients. This contract defines payment, deliverables, and usage rights, helping to prevent misunderstandings. By having a contract, you protect both your interests and those of your clients.

The $600 rule refers to the requirement that business owners must issue a Form 1099-MISC to any independent contractor who earns $600 or more in a tax year. This form provides necessary information for the contractor to report their income accurately. It is crucial for businesses to understand their reporting obligations to avoid penalties. With an Oklahoma Cameraman Services Contract - Self-Employed, you can clearly outline the services provided, ensuring compliance with this rule.

Filing taxes as a freelance photographer requires you to report your income on Schedule C, detailing both your earnings and deductions. You will also need to calculate self-employment tax, which covers Social Security and Medicare. Staying informed about potential deductions related to equipment and supplies is essential. Using the Oklahoma Cameraman Services Contract - Self-Employed helps establish the professionalism and income of your freelance photography work.

To file your taxes as a freelancer, you will need to complete a Schedule C form along with your regular tax return. Report your income, track your expenses, and keep documentation ready for deductions. It’s helpful to maintain organized records throughout the year. The Oklahoma Cameraman Services Contract - Self-Employed can serve as a foundation for understanding your income and obligations.

As a rule of thumb, you should set aside about 25% to 30% of your income for taxes as a photographer. This percentage should cover both income tax and self-employment tax. Monitoring your earnings carefully is vital, as tax estimates may vary based on your income level and deductions. Utilizing an Oklahoma Cameraman Services Contract - Self-Employed can help you project your earnings and plan your tax contributions more effectively.

Filing taxes as an independent contractor involves reporting your earnings and paying self-employment tax. You will file a Schedule C form with your tax return to report your income and expenses. It's essential to keep accurate records of all your professional activity to maximize deductions. Consider using the Oklahoma Cameraman Services Contract - Self-Employed to clarify your earnings and obligations.

Yes, you can write your own legally binding contract as long as it contains all the essential elements, such as offer, acceptance, and consideration. Make sure that the terms are clear and agreed upon by both parties. For an Oklahoma Cameraman Services Contract - Self-Employed, ensure you cover specifics like rights to footage and payment terms. Platforms like US Legal Forms offer useful templates to help you draft a contract that meets legal standards.

When writing a contract for a 1099 employee, specify that the individual is a contractor and outline the services they will provide. Include details about payment methods, frequency, and terms of termination. An Oklahoma Cameraman Services Contract - Self-Employed should clarify ownership of the work produced. Using a template from US Legal Forms can ensure you include all necessary elements for legal compliance.