Oklahoma Foundation Contractor Agreement - Self-Employed

Description

How to fill out Foundation Contractor Agreement - Self-Employed?

You can dedicate hours online searching for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that can be examined by professionals.

You can easily download or print the Oklahoma Foundation Contractor Agreement - Self-Employed from the service.

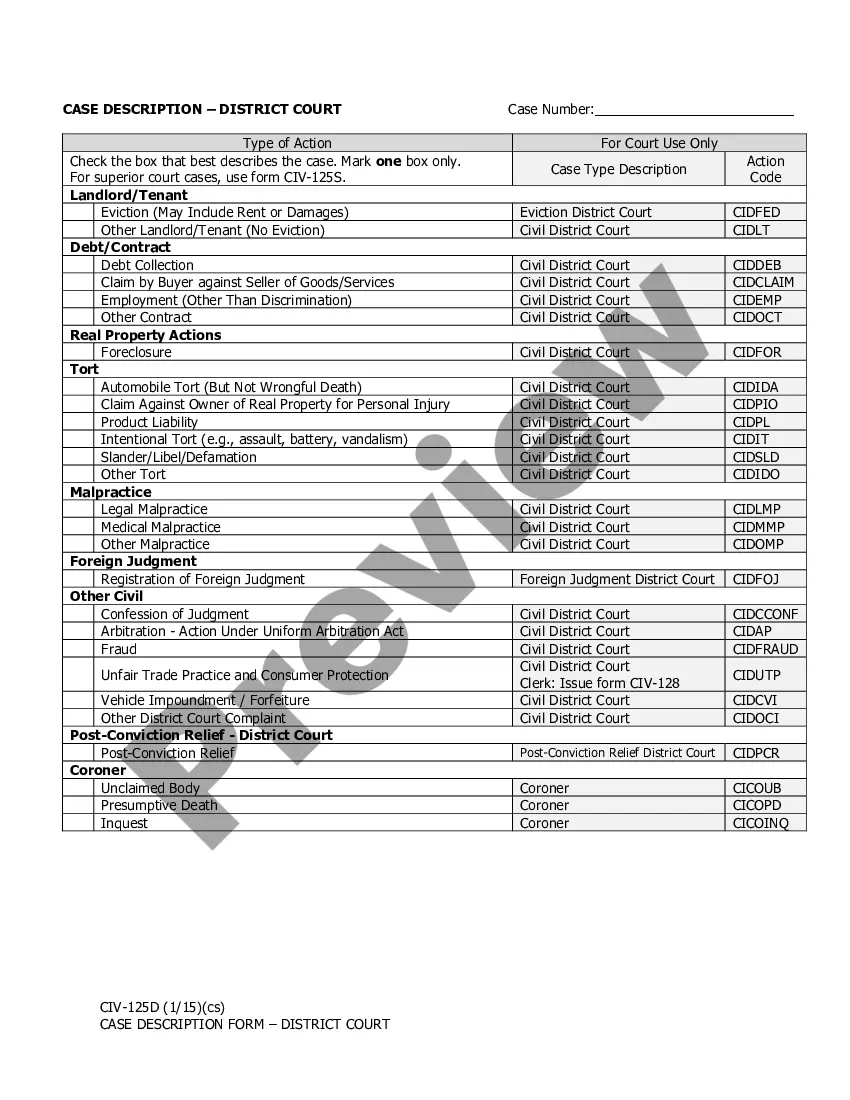

Read the form summary to confirm you have selected the appropriate form. If available, utilize the Review button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, edit, print, or sign the Oklahoma Foundation Contractor Agreement - Self-Employed.

- Every legal document template you purchase is yours for years.

- To obtain another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple directions provided below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

Form popularity

FAQ

Typically, the hiring party or business owner drafts the independent contractor agreement. However, both parties can collaborate to ensure mutual understanding and agreement on terms. It's essential that the final document reflects clear and concise language to avoid any potential disputes. For ease, consider using a platform like US Legal Forms to create your Oklahoma Foundation Contractor Agreement - Self-Employed.

When filling out an independent contractor agreement, be sure to include details such as the project scope, payment structure, and duration of the contract. Clearly outline the expectations for both parties to avoid confusion later. You should also ensure that both parties sign and date the agreement. Using templates specific to your field, like an Oklahoma Foundation Contractor Agreement - Self-Employed, helps maintain professionalism.

To set up as a self-employed contractor, start by choosing a business name and registering it if necessary. Next, obtain any required licenses or permits specific to your industry. Consider establishing a business bank account to track your earnings and expenses accurately. Lastly, an Oklahoma Foundation Contractor Agreement - Self-Employed is crucial for outlining your roles and responsibilities.

Filling out an independent contractor form involves providing essential information about the contractor and the nature of the work. Start with personal details, followed by job descriptions and payment arrangements. You may also want to highlight any relevant licenses or qualifications. Utilizing a pre-formatted document, like an Oklahoma Foundation Contractor Agreement - Self-Employed, can simplify this process.

To write an effective independent contractor agreement, begin by clearly defining the scope of work. Ensure you specify payment terms, deadlines, and any confidentiality requirements. Including a section on dispute resolution can also be beneficial. This Oklahoma Foundation Contractor Agreement - Self-Employed should reflect the specific needs of your project and protect all parties involved.

Yes, a self-employed person can and should have a contract. An Oklahoma Foundation Contractor Agreement - Self-Employed provides a legal framework for outlining the terms of employment and responsibilities. This contract not only clarifies what is expected from both parties, but it also protects the self-employed individual in case disputes arise. Using such a contract ensures fair business practices and strengthens professional relationships.

To create an independent contractor agreement, start by defining the scope of work clearly. Include details such as payment terms, deadlines, and responsibilities. By using an Oklahoma Foundation Contractor Agreement - Self-Employed template, you can simplify this process and ensure you cover essential legal elements. This approach helps both parties understand their commitments and protects their interests.