Oklahoma Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

Are you situated in a location where you require documents for business or personal reasons almost every day.

There is a wide selection of legal document templates accessible online, yet finding reliable ones can be challenging.

US Legal Forms offers a vast array of template documents, such as the Oklahoma Door Contractor Agreement - Self-Employed, which can be tailored to comply with federal and state regulations.

Once you locate the suitable form, simply click Get now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Oklahoma Door Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/region.

- Use the Review button to inspect the form.

- Read the description to confirm that you have chosen the correct document.

- If the form is not what you're looking for, use the Research field to find a document that suits your requirements.

Form popularity

FAQ

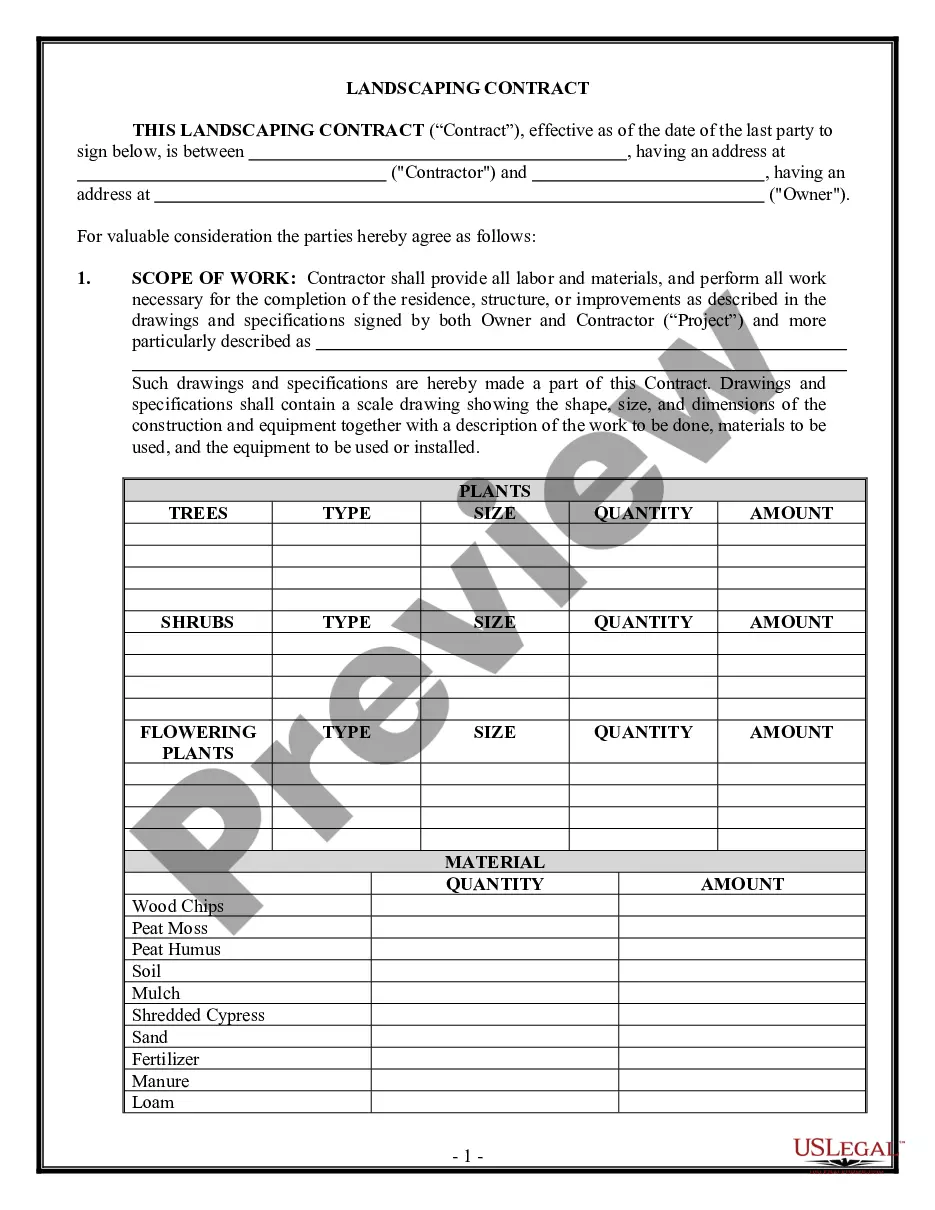

Writing an independent contractor agreement is straightforward when you include essential elements. Start with clearly defining the roles, services provided, and payment terms. For an Oklahoma Door Contractor Agreement - Self-Employed, it is crucial to specify the scope of work and any deadlines. You can use uslegalforms to access expertly crafted templates that simplify the process while ensuring legal compliance.

In Oklahoma, a contract is legally binding when it includes an offer, acceptance, and consideration. Both parties must be competent, meaning they understand the agreement and its implications. Furthermore, an Oklahoma Door Contractor Agreement - Self-Employed needs to comply with state laws and regulations to ensure enforceability. Always review your contract thoroughly to confirm it meets all legal requirements.

Creating an Oklahoma Door Contractor Agreement - Self-Employed requires a few essential steps. First, both you and the contractor should outline the scope of work, including specific tasks and deadlines. Next, include payment terms and any necessary legal clauses that protect both parties. For a streamlined process, consider using the tools provided by USLegalForms, which can help you draft a comprehensive and compliant agreement.

To fill out an independent contractor agreement, begin by entering the date and the parties’ contact information. Clearly define the work scope and timeline. Specify compensation details, including payment frequency. Ultimately, ensure both parties sign the document and keep copies for reference, reinforcing the terms of your Oklahoma Door Contractor Agreement - Self-Employed.

Typically, the hiring party writes the independent contractor agreement. However, it’s beneficial for the contractor to review and suggest changes. Using platforms like USLegalForms can streamline this process, ensuring the Oklahoma Door Contractor Agreement - Self-Employed meets legal standards. Both parties should agree on the final document to avoid misunderstandings.

To write an independent contractor agreement, begin with a clear title that reflects the nature of the contract, such as Oklahoma Door Contractor Agreement - Self-Employed. Outline the parties involved, the scope of work, duration, and payment terms. Don’t forget to include confidentiality clauses if needed and specify how disputes will be resolved. This clarity helps protect both parties.

Filling out an independent contractor form is straightforward. Start by providing your personal information, such as your name and address. Next, include the details of the services you will provide. Finally, ensure you highlight the payment terms, so everyone understands the financial agreement, which is crucial for an Oklahoma Door Contractor Agreement - Self-Employed.