Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor

Description

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

It is feasible to dedicate several hours online attempting to locate the sanctioned document template that meets the federal and state requirements you desire.

US Legal Forms offers an extensive collection of legal templates that can be examined by experts.

You can easily download or print the Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor from the service.

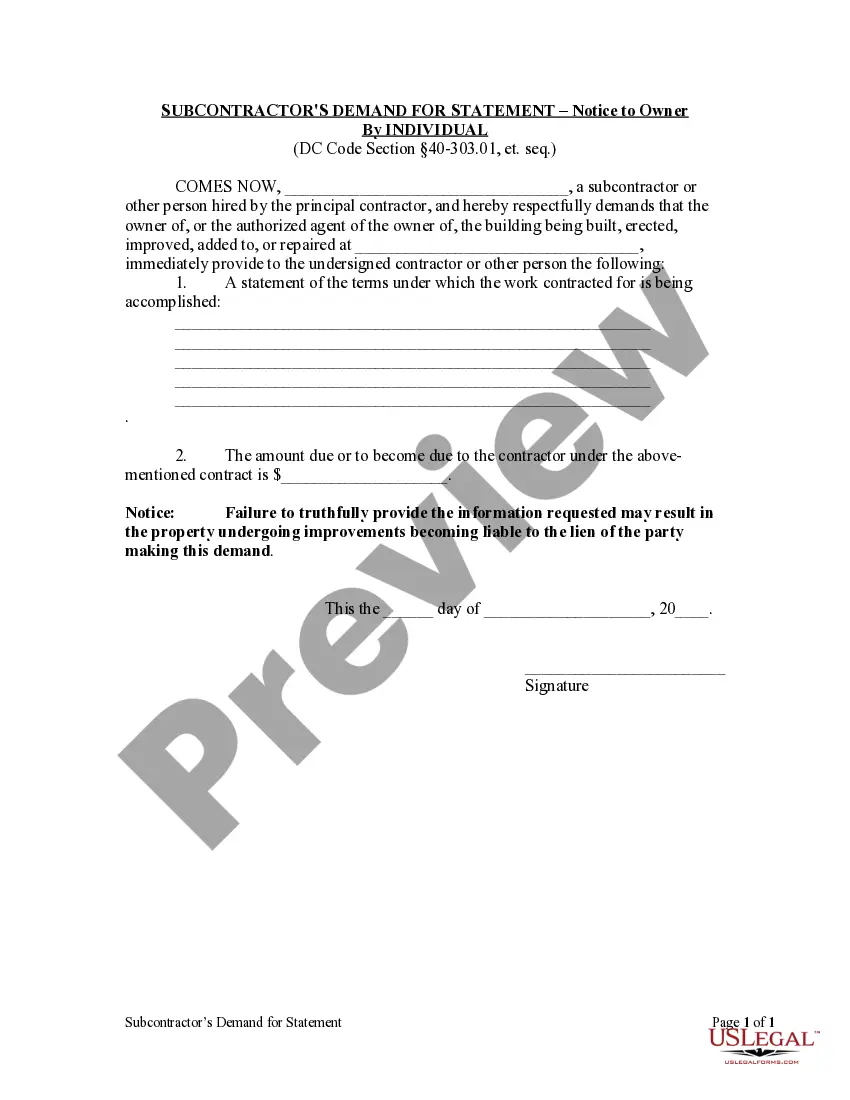

If available, utilize the Review button to view the document template as well. If you wish to obtain another version of the form, use the Search field to find the template that meets your needs and specifications.

- If you have an existing US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the region/state you choose.

- Review the form information to confirm you have selected the appropriate template.

Form popularity

FAQ

Yes, employment contracts are legally binding documents when they meet the essential criteria of contract law. They outline the rights and duties of both parties and provide a framework for resolving disputes. An Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor serves as a crucial tool for freelancers, ensuring clarity in agreements with clients. Utilizing a comprehensive contract can protect your interests and clarify what is expected from both sides.

A contract becomes legally binding in Oklahoma when it contains an offer, acceptance, consideration, and the intention to create a legal relationship. Both parties must understand the terms and agree voluntarily to prevent disputes later. For an Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor, including clear roles and responsibilities can strengthen your agreement. Ensuring these elements are present promotes a smoother working relationship.

Quiet firing, which involves passive-aggressive tactics to encourage an employee to resign, can create legal complications, particularly if it violates any existing employment contracts. In Oklahoma, a clear and concise Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor can outline the terms of engagement and protect you against such tactics. If you feel that quiet firing is occurring, it may be beneficial to consult with a legal expert familiar with Oklahoma labor laws. Knowing your rights can empower you as a contractor.

An Oklahoma employment contract is a legal document that outlines the terms of employment between an employer and an employee. In the context of freelance work, an Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor specifies the responsibilities, payment terms, and duration of work. This contract helps both parties understand their obligations and rights. Having a well-drafted contract is essential for freelancers navigating the legal landscape of independent work.

Yes, employment contracts are enforceable in Oklahoma as long as they meet certain legal requirements. When both parties agree to the terms and conditions, they create a binding agreement that outlines the expectations of the job. It is crucial to ensure that the Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor includes clear terms to avoid misunderstandings. Legal protection can provide peace of mind for both freelancers and clients alike.

Freelance data entry jobs involve entering information into various systems or databases, often for businesses that require accurate record-keeping. As a self-employed independent contractor in this field, you have the flexibility to choose your projects and work on your own schedule. Many opportunities come from clients needing assistance with tasks that require precision and attention to detail. Considering an Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor can help you formalize these arrangements.

Legal requirements for independent contractors in Oklahoma include obtaining any necessary licenses and permits for your specific profession. Furthermore, you must comply with tax obligations, especially when filing as a 1099 user. While it is not mandatory to have a written agreement, an Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor is recommended to define your work terms and protect your rights. For assistance, consider using platforms like uslegalforms that can help you navigate contract requirements.

Having a contract as an independent contractor is important for various reasons. An Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor allows you to define your role, expectations, and compensation clearly. This legal safeguard protects your interests and ensures both parties are on the same page, reducing the likelihood of misunderstandings or conflicts. Always strive for clarity with a well-drafted contract.

Yes, you can work as a 1099 contractor without a formal contract, but it's not recommended. Without an Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor, you risk missing out on important provisions like payment terms and responsibilities. A contract clarifies expectations and helps avoid disputes, which can be crucial for your financial security. To mitigate these risks, always aim for a written agreement.

While you don't legally need a contract as a self-employed individual, having one is highly advisable. An Oklahoma Data Entry Employment Contract - Self-Employed Independent Contractor clarifies the terms of your work relationship, protects your interests, and outlines payment structures. Without a contract, misunderstandings may arise, which could jeopardize your income and business relationships. Therefore, consider drafting a contract to secure your freelance position.