Oklahoma Construction Loan Financing Term Sheet

Description

How to fill out Construction Loan Financing Term Sheet?

If you want to full, download, or printing lawful record themes, use US Legal Forms, the biggest selection of lawful types, which can be found on the Internet. Use the site`s basic and convenient lookup to discover the paperwork you need. Numerous themes for company and personal reasons are sorted by categories and suggests, or search phrases. Use US Legal Forms to discover the Oklahoma Construction Loan Financing Term Sheet with a couple of mouse clicks.

If you are previously a US Legal Forms customer, log in to the profile and then click the Download option to find the Oklahoma Construction Loan Financing Term Sheet. You can even gain access to types you earlier saved from the My Forms tab of the profile.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have chosen the form for your right area/nation.

- Step 2. Take advantage of the Review solution to check out the form`s information. Never overlook to learn the outline.

- Step 3. If you are not happy with all the type, use the Look for field towards the top of the display to get other versions of your lawful type design.

- Step 4. Once you have identified the form you need, go through the Purchase now option. Select the pricing plan you like and put your accreditations to register to have an profile.

- Step 5. Approach the purchase. You can use your bank card or PayPal profile to accomplish the purchase.

- Step 6. Select the structure of your lawful type and download it in your gadget.

- Step 7. Complete, revise and printing or indication the Oklahoma Construction Loan Financing Term Sheet.

Each and every lawful record design you buy is yours permanently. You might have acces to each type you saved inside your acccount. Click on the My Forms segment and select a type to printing or download once again.

Compete and download, and printing the Oklahoma Construction Loan Financing Term Sheet with US Legal Forms. There are thousands of expert and condition-particular types you can use for your personal company or personal requirements.

Form popularity

FAQ

As mentioned, construction loans are short-term loans, usually no longer than a year in length. On the other hand, traditional mortgages are long-term loans, with terms typically ranging from 15 ? 30 years. With a mortgage, the borrower receives the money in one lump sum.

With a construction loan, the lender typically agrees to loan a certain percentage (95%, for example) of the future home's appraised value. Then, they'll suggest a down payment equal to the difference between the approved loan amount and the construction costs.

Loan terms refer to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

Loan Term Example Let's say you have a 15-year fixed-rate mortgage. The loan term will then be 15 years. During this time, the loan must be paid off or refinanced during the term. Your loan can last for any length of time ? it just needs to be agreed upon by the lender and you as the borrower.

Student loans: 10-year terms are most common, although they can range up to 30 years in some cases, like consolidation loans. Mortgages: 30-year mortgages are most common, but 15-year mortgages are also available.

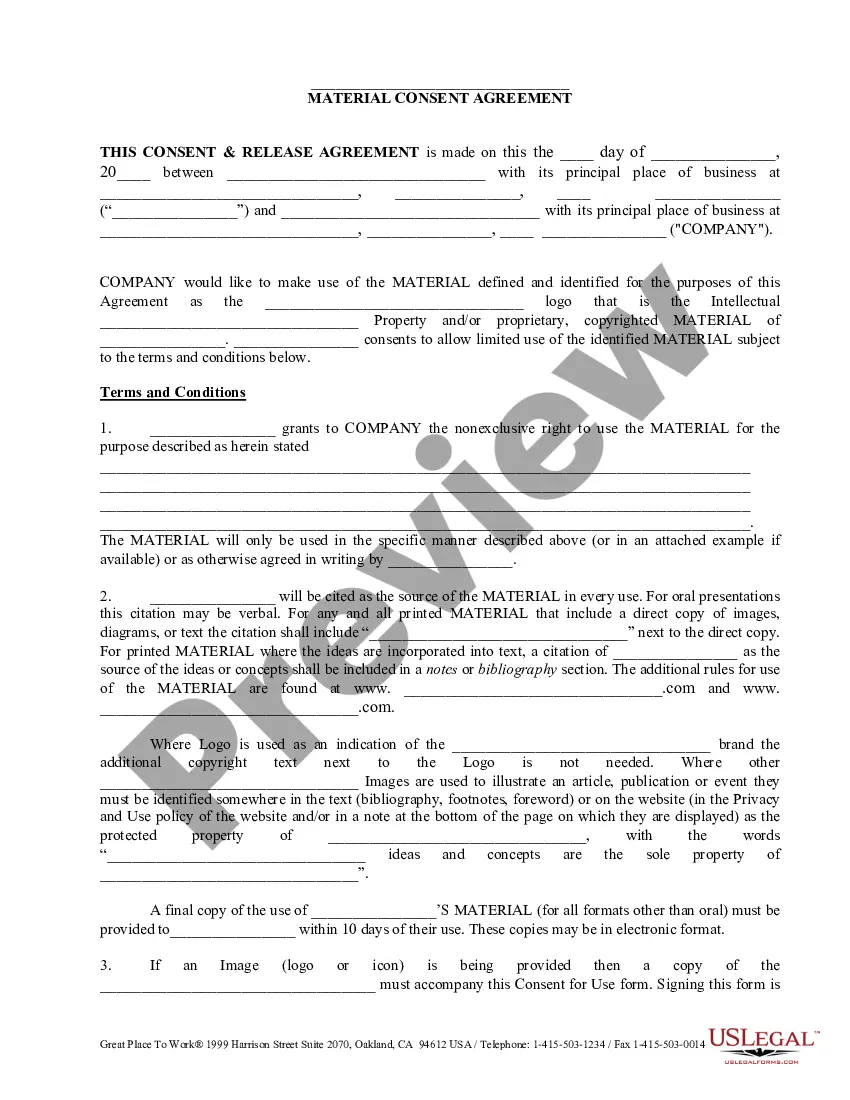

A term sheet is designed to help the parties to the loan to set out clearly and in advance, the terms on which the loan will be made. It serves as a non-binding letter of intent which summarises all the important financial and legal terms as well as quantifying the amount of the loan and its repayment.