This due diligence form is used to summarize data for each partnership entity associated with the company in business transactions.

Oklahoma Partnership Data Summary

Description

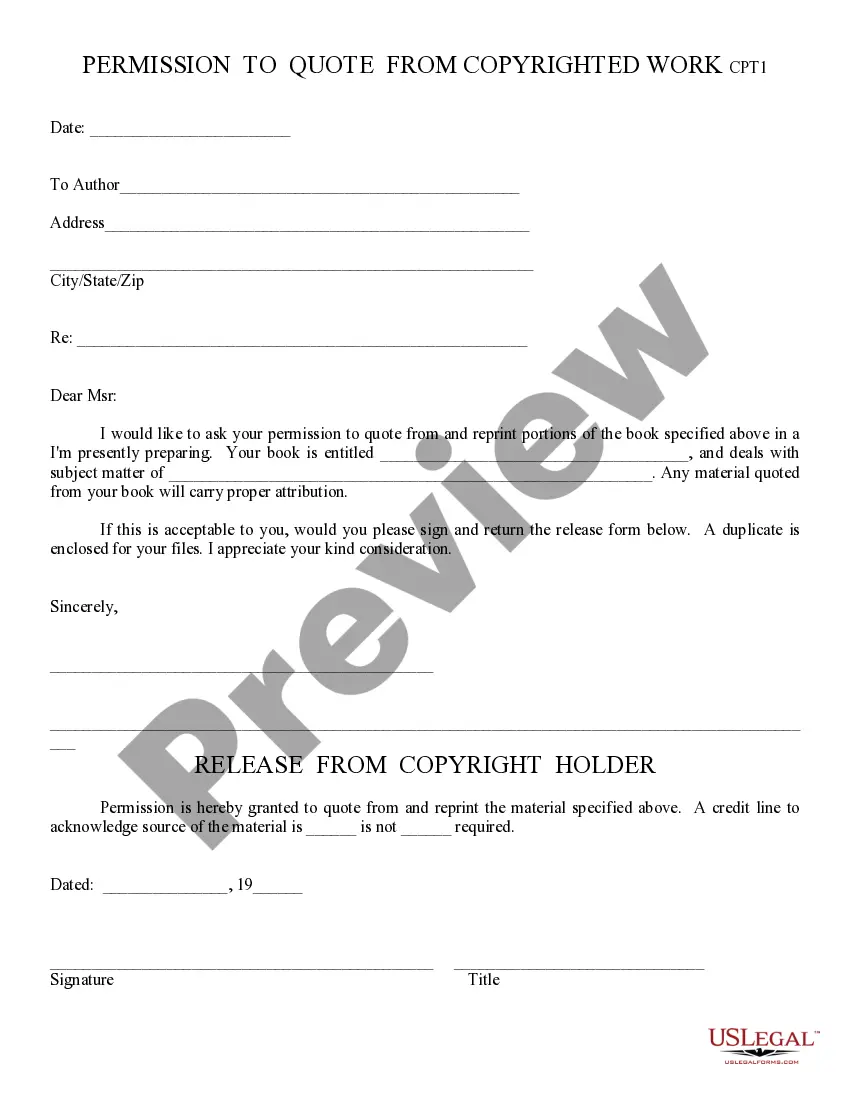

How to fill out Partnership Data Summary?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates you can download or create.

While navigating the site, you can discover thousands of documents for business and personal needs, organized by categories, states, or keywords. You can quickly access the latest documents such as the Oklahoma Partnership Data Summary in a matter of minutes.

If you already have a subscription, Log In and download the Oklahoma Partnership Data Summary from the US Legal Forms library. The Download option will appear on every form you view. You have access to all previously downloaded documents in the My documents section of your account.

Edit. Fill out, modify, print, and sign the downloaded Oklahoma Partnership Data Summary.

Each template you acquire is valid indefinitely and belongs to you forever. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Oklahoma Partnership Data Summary with US Legal Forms, one of the largest repositories of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you’re using US Legal Forms for the first time, here are simple steps to help you start.

- Ensure you have selected the correct form for your city/state. Click the Review option to examine the form's details. Read the form description to verify you have selected the correct one.

- If the form does not fit your needs, utilize the Search bar at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy Now button. Afterwards, choose the payment plan you prefer and provide your credentials to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

- Obtain the format and download the form onto your device.

Form popularity

FAQ

The 183 day rule in Oklahoma refers to a guideline for determining residency status based on the number of days spent in the state during a year. Surpassing this threshold can classify you as a resident, impacting your tax responsibilities. This rule is particularly relevant for partnerships and how they manage their statewide operational footprint. Resources like the Oklahoma Partnership Data Summary can clarify these residency rules and their implications for your partnership.

The greatest expense for the state of Oklahoma often involves education funding and healthcare services. These sectors require significant budgeting to meet the needs of residents. For partnerships operating within the state, understanding how state funding works can be essential to gauge economic conditions. The Oklahoma Partnership Data Summary can provide additional context for these financial aspects.

Yes, partnerships are required to file Schedule K-1 forms for each partner to report their share of income, deductions, and credits. These forms break down how income is distributed among partners, and they are essential for tax reporting. For partnerships in Oklahoma, understanding K-1 requirements is part of sound financial management. The Oklahoma Partnership Data Summary can be a helpful resource for navigating these obligations.

The 183 day rule assesses whether you qualify as a resident or non-resident based on your physical presence in Oklahoma. If you spend 183 days or more in the state during a calendar year, you may be considered a resident for tax purposes. This rule has implications for income taxation, especially for partnerships. Utilizing the Oklahoma Partnership Data Summary provides valuable information for understanding these residency nuances.

To be considered a resident of Oklahoma, you generally need to live in the state for at least six months. This duration establishes your residential status for various legal and tax purposes. For partnerships operating in Oklahoma, knowing the residency requirements is crucial for compliance. The Oklahoma Partnership Data Summary offers insights that can help partnerships navigate these rules.

A 511 NR, or non-resident income tax return, is a form required for individuals earning income in Oklahoma while residing in another state. It ensures that those who conduct business or earn income in Oklahoma comply with local tax laws. Understanding the implications of a 511 NR is important for managing your finances, especially for partnerships. The Oklahoma Partnership Data Summary can guide you in organizing your tax reporting effectively.

Partnership distributions should typically be entered on the lines specified in the individual tax return forms, most commonly on Schedule E. This schedule details various types of income, including partnership income. For best practices, utilize the insights from the Oklahoma Partnership Data Summary to ensure you're entering the right information in the right sections.

The 511 NR form is the Oklahoma Nonresident Individual Income Tax Return. This form is used by nonresidents to report income earned in Oklahoma, including income from partnerships. Properly filling out this form is essential to align with your obligations under the Oklahoma Partnership Data Summary and to avoid potential tax issues.

Partnership distributions themselves are not reported on Form 1099; instead, they are documented through a Schedule K-1. However, these distributions can be taxable depending on the taxable income allocated to the partner. For clarity and detailed guidance, refer to the Oklahoma Partnership Data Summary and consult with a tax professional.

To report partnership distributions, you will often use the information provided on your Schedule K-1. Report your distributions in the appropriate section of your tax return, depending on how they are categorized. Using the Oklahoma Partnership Data Summary can help ensure you're capturing all necessary details for accurate reporting.